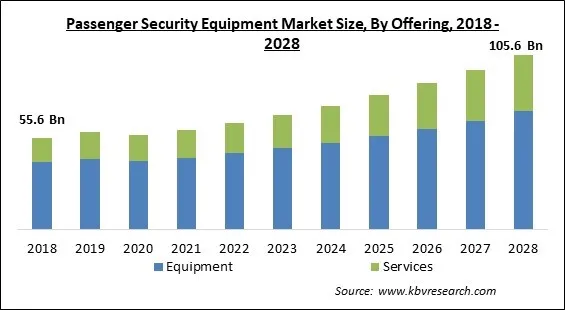

The Global Passenger Security Equipment Market size is expected to reach $105.9 billion by 2028, rising at a market growth of 8.6% CAGR during the forecast period.

Passenger security is a system that helps protect people and assets against inadvertent injuries, thefts, and other risks. Such protocols aid governments in safely regulating passenger travel from one location to another. Furthermore, security screening systems are built to detect any potentially dangerous chemicals.

Passenger security is an important part of reducing the risk of terrorism and other illegal actions across the world. Passenger screening has become increasingly crucial in national and international transportation infrastructure to prevent bags containing unlawful items such as sharp objects, firearms, and ammunition from being carried on planes, trains, and ships. The screening systems improve service quality while also protecting employees from potential risks.

Public transportation plays an increasingly essential role in people's lives, and this importance would only grow as the population ages. However, the transportation industry is extremely vulnerable to security threats in recent years. One of the most difficult tasks is protecting railway stations, where the rail sector protects passengers, personnel, cargo, equipment, and assets from potential threats. These establishments, in particular, have become as susceptible as airports. They must consequently meet stringent safety, security, communications, and building automation requirements in order to maintain their reputation as reliable suppliers of safe, well-organized services for travellers and freight forwarders.

Passengers are primarily protected by security devices from disasters, crimes, and other risks. Illegal items such as sharp objects, firearms, and explosives are prevented using people screening devices at transportation infrastructure. Advance technologies, such as the use of robotics to screen passengers and video analytics, would also contribute to market growth during the projection period.

Security and screening systems, particularly x-ray screening equipment, offer interior pictures of suitcases, bags, luggage, and other goods. Luggage maintains optimal, hazardous trace scanners, portable scanners, walk-through detection systems, and full-body scanners are also included. Security screening systems are deployed in a variety of transportation infrastructures, including airports, bus stops, railway stations, and others, to improve passenger safety.

As a result of the outbreak of COVID-19, most countries implemented a temporary lockdown, causing economic slowdowns in numerous business sectors, including travel and tourism. COVID-19 limitations made travel impossible for ordinary people. However, strict travel policies and regulations implemented by many governments during this time facilitated an upsurge for passenger security solutions from critical sectors such as law regulatory oversight and public connectivity authorities, which were responsible for enforcing new safety and security standards such as temperature and mask checks. During the COVID-19 pandemic, such patterns presented significant growth potential for the passenger security equipment market. COVID-19 has emerged as a major player in the economic crises, particularly in the aviation industry.

For intra-city and inter-city travel, more than 80% of the world's population uses public transportation such as metros, trams, local trains, and buses. Individuals are encouraged to use public transit more as a result of accessible travel, reduced travel, and a campaign to reduce carbon emissions. For example, before the COVID-19 pandemic, more than 7 million people in Singapore utilized public transportation every day. As a response, governments around the world are spending more resources on passenger security technology including security screening systems and surveillance systems to provide safer public transportation options.

Upgrades to dining rooms and airport lounges aren't enough to improve the customer experience. However, digital integrations that improve efficiency and traveller movement at every step can immediately transform airport facilities' safety and security while also keeping passengers better informed throughout their travels in real-time. For example, incorporating touch less and mobile alerts that can reach participants via SMS and mobile devices can convey pre-boarding and essential security information to passengers, while trying to execute mobile conversations at key airport security offers hands-free methods to increase passenger movement and limit unnecessary contact.

Due to tight regulatory regimes and government regulations for safety measures, OEM companies precisely construct security systems all over the nation. For a long time, the security device is installed in ports, railways, and other infrastructure. These are used to keep track of a large number of travellers. To limit the danger of operational failure, OEM businesses are required to build protection products with high-quality components and hardware. The cost of manufacturing and components for security systems are both high, resulting in higher-end product prices. The fixed costs of ownership are the expenses incurred regardless of whether the machine is stored or utilized every day.

Based on Offering, the market is segmented into Equipment and Services. The equipment segment acquired the largest revenue share in the passenger security equipment market in 2021. Due to the utilization of the Ionizing radiation in some screening equipment, Ionizing radiation has enough energy to knock electrons from atoms, which is what ionization is all about. Ionizing radiation is used to scan travellers and cargo at airports. Ionizing radiation is used to identify goods that may be hidden by travellers and to make photographs of what is in luggage, depending on the type of machine.

Based on Transport Infrastructure, the market is segmented into Airport, Train Stations, Bus Stations, and Seaports. The train stations segment recorded a substantial revenue share in the passenger security equipment market in 2021. Protecting railway stations from terrorism entails dealing with anonymous bomb threats, explosive devices hidden in cars parked, waste bins along with stations, luggage, or lockers, among many other things. It is critical to be able to control these security and safety issues. Early detection of evidence is possible with Bosch Advanced Intelligent Video Analysis (IVA). Bosch's Video Management System allows full control of all surveillance camera components such as Suspicious activity and the discovery of discarded luggage and bags that were left unattended inadvertently.

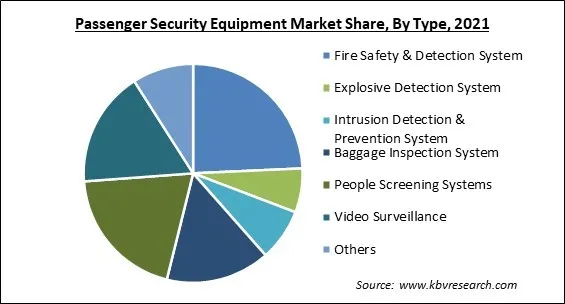

Based on Type, the market is segmented into Fire Safety & Detection System, Explosive Detection System, Intrusion Detection & Prevention System, Baggage Inspection System, People Screening Systems, Video Surveillance, and Others. The fire safety & detection system segment procured the largest revenue share in the passenger security equipment market in 2021. This is due to the growing demand for higher passenger safety regulations in public spaces, as well as the growing dread of terrorist attacks. The people screening system segment, on the other hand, is predicted to expand the most, owing to increased terrorist activity at numerous airports and other stations, as well as increased government measures to improve security at various transportation stations.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 60.3 Billion |

| Market size forecast in 2028 | USD 105.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 8.6% from 2022 to 2028 |

| Number of Pages | 254 |

| Number of Tables | 387 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Offering, Transport Infrastructure, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The Asia Pacific segment garnered the largest revenue share in the passenger security equipment market in 2021. Emerging government expenditure on enhanced passenger security devices by developing areas in the region, such as China, India, and other countries, to provide greater protection for their inhabitants, is expected to boost regional market expansion. Increase in air passengers and foreign travellers, in these regions to build additional international airports in the coming years.

Free Valuable Insights: Global Passenger Security Equipment Market size to reach USD 105.9 Billion by 2028

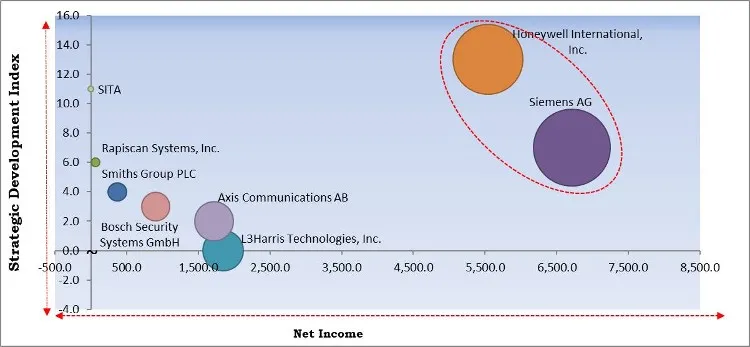

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Siemens AG and Honeywell International, Inc. are the forerunners in the Passenger Security Equipment Market. Companies such as Rapiscan Systems, Inc., SITA and Smiths Group PLC are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Siemens AG, L3Harris Technologies, Inc., Smiths Group PLC, Autoclear LLC, Kapsch TrafficCom AG, Honeywell International, Inc., Axis Communications AB, Bosch Security Systems GmbH, Rapiscan Systems, Inc., and SITA.

By Offering

By Transport Infrastructure

By Type

By Geography

The global passenger security equipment market size is expected to reach $105.9 billion by 2028.

Growing population of utilizing public transportation and aviation are increasing are driving the market in coming years, however, a major stumbling block is the high cost of equipment and installation growth of the market.

Siemens AG, L3Harris Technologies, Inc., Smiths Group PLC, Autoclear LLC, Kapsch TrafficCom AG, Honeywell International, Inc., Axis Communications AB, Bosch Security Systems GmbH, Rapiscan Systems, Inc., and SITA.

The Airport segment acquired maximum revenue share in the Global Passenger Security Equipment Market by Transport Infrastructure in 2021, thereby, achieving a market value of $40,654.5 million by 2028.

The Services segment has shown growth rate of 10.8% during (2022 - 2028).

The Asia Pacific market dominated the Global Passenger Security Equipment Market by Region in 2021, and would continue to be a dominant market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.