The Global Patient Access Solutions Market size is expected to reach $3.3 billion by 2028, rising at a market growth of 9.1% CAGR during the forecast period.

By utilizing patient access technologies, healthcare professionals can provide better purchasing experiences to their customers. The systems allow customers to search for, schedule and subscribe to the online services that are supplied. The patient access solutions, which connect hospitals with their clients up until the billing stage, address the medical claim processing system. The solution allows hospital staff members more patient interaction freedom and financial responsibility. These techniques reduce manual work in general and claim rejections, improving the patients’ financial experiences.

"Patient access" is a key idea in contemporary healthcare and life science developments, and it's one that businessmen are likely to hear about frequently. However, different people's interpretations of the phrase vary. The term "patient access" is most simply defined as "access to patients." It speaks to the accessibility of healthcare and the accessibility of care and treatment for customers.

The Affordable Healthcare Act includes patient access as a crucial component. Several elements for "improving access to inexpensive care" and "affordable health insurance options" are included in the program's four-year rollout. Beyond this currently required minimum, however, the idea of patient access has additional connotations and poses new problems for both consumers and providers. Patient access is a notion that has a significant impact on all significant players and many aspects of healthcare.

The COVID-19 outbreak has made doctors and other health care providers more socially isolated, which has increased the demand for patient access solutions as well as the necessity for comprehensive and quick exchange of patient health information and damage policies for chronically ill patients. Software and systems may offer a platform for more secure transmission, access, and retrieval of electronic health records. Due to these technologies that enable the exchange and analysis of patient data, patients and healthcare professionals can both make wise operational and financial decisions.

Insurance organizations are increasingly refusing claims and coverage to individuals who are being treated for chronic or persistent illnesses to save costs and increase profits. Healthcare providers now have additional responsibility for controlling operating expenses. In order to correctly examine denied claims, healthcare providers can employ healthcare IT solutions like patient access solutions due to these characteristics. The presence of regulatory compliances and governmental directives that promote the expansion of the patient access solutions market in the next years are anticipated to provide the market pace.

Due to several government efforts aimed at HCIT solution adoption, increased government healthcare spending, and technology improvements in the healthcare industry. The emerging market offers tremendous opportunities for the development and application of patient access solutions, including systems for managing claims denials and necessity. The emerging government's HCIT efforts are aiding in the adoption of these HCIT solutions on a state and national level. One of the global industries with the fastest growth is healthcare. Medical care is provided to individuals globally by professionals working in these fields.

Software solutions for patient access are generally quite expensive. These tools may cost more to maintain and upgrade their software than the program itself. Software updates are part of the support and maintenance services that make up a recurrent cost that accounts for over 30% of the total cost of ownership. Additionally, a lack of internal IT competence needs end-user training, which raises the cost of ownership. New technological platforms now enable patients to obtain the care they require at a cost they can afford by providing a complete perspective of prescription fees, limitations, and availability.

Based on the Offering, the Patient Access Solutions Market is segmented into Software and Services. The service segment acquired the highest revenue share in the patient access solutions market in 2021. Services that form the face of a healthcare provider's office are represented by the front-end healthcare revenue cycle. Patient scheduling, qualification and authorization checks, registration of patients, and, where practical, the best upfront collection of patient dues are all tasks performed in the front office.

On the basis of Software type, the Patient Access Solutions Market is divided into Eligibility verification software, Medical necessity management software, Precertification & authorization software, Claims denial & appeal management, Payment estimation software, Claims payment assessment & processing software, and Other Software. The eligibility verification software segment procured the largest revenue share in the patient access solutions market in 2021. To guarantee correct and prompt receipt of info concerning insurance coverage, eligibility and insurance confirmation are essential. A healthcare institution may be losing money if there aren't adequate balances and checks in place. If eligibility is not verified and prior authorization is not obtained, payments may be delayed or denied, which lowers collections and income.

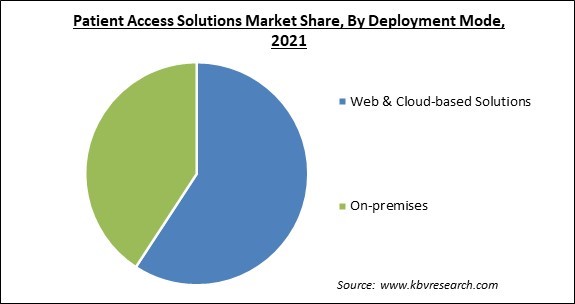

By Deployment Mode, the Patient Access Solutions Market is classified into Web & Cloud-based solutions and On-premise solutions. The on-premise segment registered a significant revenue share in the patient access solutions market in 2021. Due to the on-premise solutions, the business purchases a server and takes full control of its management. This means that it is the responsibility of the company to guarantee that the server has the necessary security technologies and that it is routinely updated and maintained.

On the basis of End Users, the Patient Access Solutions Market is segmented into Healthcare Providers, HCIT Outsourcing Companies, and Others. The healthcare providers segment acquired the largest revenue share in the patient access solutions market in 2021. Due to the growing need to standardize patient data, the demand for patient access solutions services is likely to increase in the coming years. Healthcare data generation has increased dramatically, patient safety has increased, healthcare spending has increased significantly, medical errors have increased, insurance denials have increased, and healthcare costs have increased.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.8 Billion |

| Market size forecast in 2028 | USD 3.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9.1% from 2022 to 2028 |

| Number of Pages | 296 |

| Number of Tables | 453 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Offering, Deployment Mode, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the Patient Access Solutions Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment procured a significant revenue share in the patient access solutions market in 2021. It is due to factors such as the availability of a high-quality healthcare system, the availability of innovative medical technology, and increasing government funding. Due to factors like improved healthcare infrastructure and attractive reimbursement practices, among others, the European region is expected to grow its market share.

Free Valuable Insights: Global Patient Access Solutions Market size to reach USD 3.3 Billion by 2028

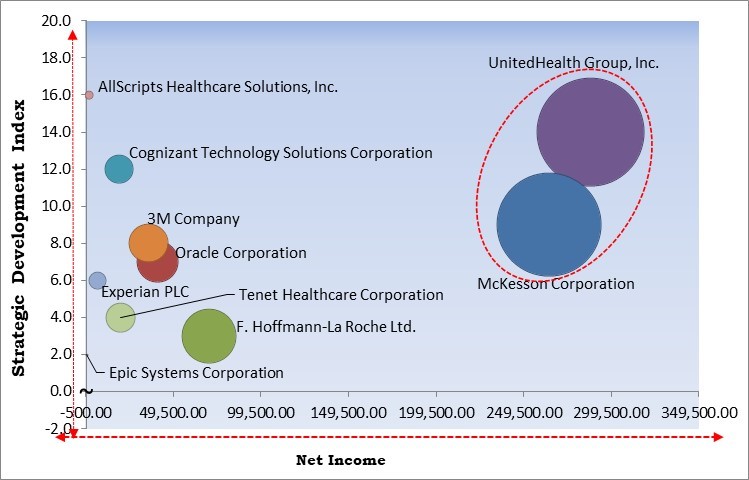

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; UnitedHealth Group, Inc. and McKesson Corporation are the forerunners in the Patient Access Solutions Market. Companies such as Cognizant Technology Solutions Corporation, Oracle Corporation and 3M Company are some of the key innovators in Patient Access Solutions Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include UnitedHealth Group, Inc. (Optum, Inc.), Cognizant Technology Solutions Corporation, McKesson Corporation, Oracle Corporation (Cerner Corporation), Experian PLC, 3M Company, Epic Systems Corporation, AllScripts Healthcare Solutions, Inc., F. Hoffmann-La Roche Ltd. (Genentech, Inc.), and Tenet Healthcare Corporation (Conifer Health Solutions, LLC).

By Offering

By Deployment Mode

By End User

By Geography

The global Patient Access Solutions Market size is expected to reach $3.3 billion by 2028.

The increasing significance of managing rejection are driving the market in coming years, however, High expenses for the deployment of patient access solutions restraints the growth of the market.

UnitedHealth Group, Inc. (Optum, Inc.), Cognizant Technology Solutions Corporation, McKesson Corporation, Oracle Corporation (Cerner Corporation), Experian PLC, 3M Company, Epic Systems Corporation, AllScripts Healthcare Solutions, Inc., F. Hoffmann-La Roche Ltd. (Genentech, Inc.), and Tenet Healthcare Corporation (Conifer Health Solutions, LLC).

The Web & Cloud-based Solutions market acquired the highest revenue share in the Global Patient Access Solutions Market by Deployment Mode in 2021, thereby, achieving a market value of $2.1 billion by 2028.

The HCIT Outsourcing Companies market has shown the high growth rate of 9.8% during (2022 - 2028).

The North America market dominated the Global Patient Access Solutions Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $1.2 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.