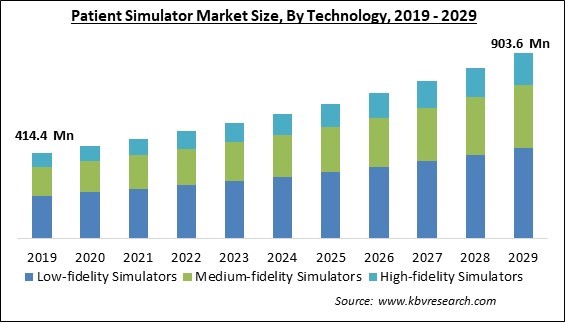

The Global Patient Simulator Market size is expected to reach $903.6 million by 2029, rising at a market growth of 8.3% CAGR during the forecast period.

Asia Pacific is one of the developing regions that focuses more on advanced and innovative technologies thereby patient simulators companies are expecting tremendous development prospects from emerging countries like India, China, and Japan. Thus, APAC is expected to generate 2/5th share of the market by 2029. India and China have the largest patient bases and more than half the world's population. The main factors influencing the market growth in these nations are the expanding economies, increasing private investments, the untapped rural sector, the rising prevalence of non-communicable lifestyle-related diseases, the growing emphasis on medical education, training, and research, and the rising number of academic medical institutions. Some of the factors impacting the market are the rapid increase in patient simulator technology, increased attention to patient safety, and medical simulators with poor design.

With the emergence of technologies like virtual reality, artificial intelligence, robotics, augmented reality, 3D printing, and nanotechnology over the past few decades, healthcare technology has advanced quickly. These technologies will continue to shape the future of healthcare in the years to come. Manikins can now incorporate computer software because of the advancements in technology. The expanded use of simulation-based training and certification of healthcare personnel can improve patient safety and outcomes. Patient safety as a medical subspecialty came into being as a response to the increasing complication of healthcare systems and the subsequent rise in patient injuries in healthcare facilities. It prevents and minimizes risks, mistakes, and patient harm during healthcare delivery.

The COVID-19 outbreak contributed to the expansion of the market. This is attributable to the incorporation of simulators in medical training, which has created new simulators that permit more flexible and remote training. In addition, according to a National Library of Medicine article, medical school administrators and various government organizations invested in simulation-based educational management technologies and products in 2020 to maintain clinical education and competency assessment throughout the COVID-19 pandemic. Therefore, COVID-19 had a positive impact on the market.

However, models and instruments cannot accurately reflect human functioning because of how complicated human systems are. Facilitators and simulation engineers must build and modify the simulation models to accurately represent a physiological response sought under particular conditions. It can be difficult to manipulate these systems to achieve the necessary simulation aims. These elements are expected to limit the market growth.

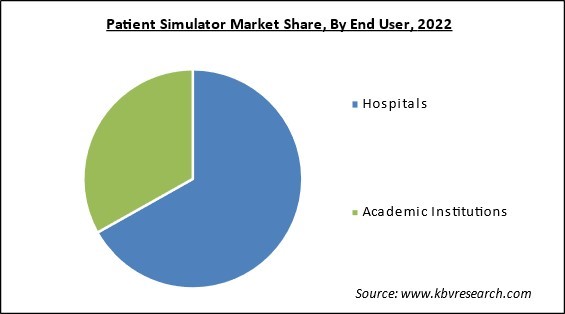

By end user, the market is fragmented into hospital, and academic institutions. The academic institutions segment procured a significant revenue share in the market in 2022. This is due to the presence of several academic research groups engaged in studying complex biological systems utilizing computer models; the academic research institutions segment is expected to continue to expand. Medical simulation enables the acquisition of clinical skills through deliberate practice instead of apprenticeship-style instruction. Simulation tools substitute for actual patients while providing them with real-life settings to study and practice, which will fuel the segment's growth.

On the basis of product type, the market is bifurcated into adult patient simulator, infant simulator, and childbirth simulator. The adult patient simulator segment witnessed the largest revenue share in the market in 2022. This is due to the fact that an adult patient simulator (APS) is a sophisticated medical simulation system created to give healthcare practitioners a realistic, interactive healthcare experience. It allows students to develop their clinical abilities in a secure setting by simulating a variety of medical settings and patient circumstances. APS is a crucial tool for medical education because it enables practitioners to obtain experience in various clinical settings, including ERs, ORs, and outpatient clinics, propelling the segment's growth.

Based on technology, the market is segmented into high-fidelity simulators, medium-fidelity simulators, and low-fidelity simulators. The low-fidelity simulators segment dominated the market with maximum revenue share in 2022. This is because simulators with low fidelity are used to develop knowledge. These may comprise two-dimensional displays and static models. In addition, there are task trainers like IV arms or CPR manikins that are created for particular tasks or procedures. Students have the chance to practice lung, heart, and stomach auscultation using low-fidelity simulation, which is anticipated to propel the segment's expansion in the projected period.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 521.1 Million |

| Market size forecast in 2029 | USD 903.6 Million |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 8.3% from 2023 to 2029 |

| Number of Pages | 192 |

| Number of Table | 340 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Technology, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analyzed across North America, Europe, Asia Pacific and LAMEA. The North America region registered the highest revenue share in the market in 2022. This growth is due to several factors, including the rising demand for healthcare services, growing recognition of the use of simulation in healthcare education, and the expansion of high-tech patient simulators. The region's rising need for healthcare services will fuel market expansion. Increased demand for patient simulators and healthcare services results from the rising prevalence of chronic diseases like cardiovascular and respiratory illnesses.

Free Valuable Insights: Global Patient Simulator Market size to reach USD 903.6 Million by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Laerdal Medical Limited, CAE Inc., Gaumard Scientific Company, Inc., Kyoto Kagaku Co., Ltd., Medical-X, K.K. MedVision, Simulab Corporation, Limbs & Things Limited, Surgical Science Sweden AB, and Mentice AB.

By Type

By End User

By Technology

By Geography

The Market size is projected to reach USD 903.6 million by 2029.

Increased attention to patient safety are driving the Market in coming years, however, Medical simulators with poor design restraints the growth of the Market.

Laerdal Medical Limited, CAE Inc., Gaumard Scientific Company, Inc., Kyoto Kagaku Co., Ltd., Medical-X, K.K. MedVision, Simulab Corporation, Limbs & Things Limited, Surgical Science Sweden AB, and Mentice AB.

The Medium-fidelity Simulators market has shown the high growth rate of 8.4% during (2023 - 2029).

The Hospitals market is leading the Market by End User in 2022 thereby, achieving a market value of $592.8 Million by 2029.

The North America market dominated the Market by Region in 2022 thereby, achieving a market value of $337.8 Million by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.