The Global Payment Orchestration Platform Market size is expected to reach $3.7 billion by 2028, rising at a market growth of 22.4% CAGR during the forecast period.

A payment orchestration platform is a third-party platform that integrates and manages the entire payment procedure from starting to the end. A payment orchestration platform helps in streamlining processes including transaction routing, payment authorization, and settlement. This procedure entails connecting to various banks, acquirers, and payment service providers via a special software layer. The generally complex payment process can be simplified and optimized with the use of a payment orchestration platform.

As a result, rather than juggling dozens of connectors across several payment service providers, this payment solution can assist merchants in building a more effective payment stack throughout a single platform. A payment orchestration platform can also be referred as a set of services and tools that aid users in coordinating and managing several elements of payment. Connections to different payment service providers, transaction routing, cascade, fraud protection, vaulting, automatic reconciliation and settlements, tokenization, compliance, and thorough analytics and reporting are often the essential components.

Payment orchestration uses these tools to streamline the management of the payment infrastructure and optimize the payment process. Finding the appropriate payment option for specific goals and requirements is crucial if any business accepts, both card-present and card-not-present transactions. Payment orchestration and payment processing can be confusing. However, they differ in terms of the services they offer or their connectivity, flexibility, and usefulness.

To assist users in identifying the appropriate solution for their business, there is a considerable number of payment orchestration platforms by different market players. In addition to making it easier to access an unlimited number of payment providers and methods (such as PSPs, acquirers, gateways, processors, and security vendors) through single API integration, a payment orchestration platform also enables the company to expand more quickly into new markets while maintaining the necessary flexibility.

The backbone of technology providers, small and medium-sized businesses, has witnessed a sharp decline in revenue as a result of the pandemic. As a result of the supply chain disruptions, market players encountered several difficulties. However, the payment orchestration platform market witnessed several growth prospects owing to the emergence of the pandemic. Due to the social distancing norms, people were more tend to avoid cash payments owing to the risk of infection. Therefore, the growth of the trend of cashless payments was observed. Moreover, the COVID-19 pandemic has accelerated the trend toward more digital financial transactions.

If a business is compelled to rely on a single PSP or buyer, it has less control over how a transaction would proceed. This factor indicates a higher risk of payment failures, and the usage of inefficient payment routing, which results in reduced sales and business, a diminished competitive advantage, and disgruntled consumers. Multiple payment methods are supported by Payment Orchestration Platforms utilizing a single API. Because Payment Orchestration Platforms are flexible and dynamic, a transaction can be routed to maximize its benefits for both the customer experience and the business.

In recent years, E-commerce has significantly gained popularity all over the world, which increased the competition in the market. Since payments are very important to the customer experience, retailers must pay close attention to how simple, quick, and safe it is for customers to make payments. It would determine whether the buyer would finish the payment procedure or stop it midway due to the challenges. The payment orchestration platform plays a crucial role in offering high-quality payment software. Research indicates that there will be an increase in POP demand in the near future.

Lack of agility is a serious issue with a payment orchestration platform because integrating new payment choices is frequently quite difficult. Payment orchestration, which offers numerous payment options through single API integration, resolves this issue by reducing time-to-market and increasing competitiveness. However, if the transactional data is dispersed among numerous PSPs and gateways, the company can lack relevant and informative data. This complicates the analysis of any kind and makes it more challenging to spot fraud.

By the Type, the payment orchestration platform market is segregated into B2B, B2C, and C2C. In 2021, the B2C segment garnered a significant revenue share of the payment orchestration market. The rapidly surging growth of the segment is attributed to the growing utilization of digital payment methods, such as mobile banking, digital wallets, and cashless trends. The expansion of online payment systems is also linked to the expansion of the e-commerce sector.

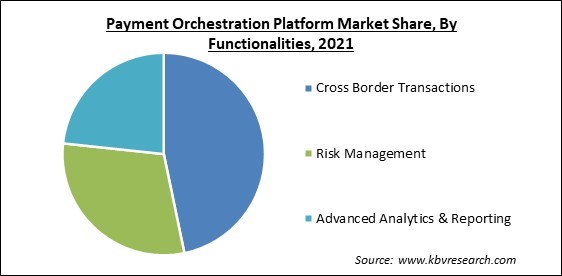

On the basis of Functionalities, the payment orchestration platform market is segmented into Cross Border Transactions, Risk Management, and Advanced Analytics & Reporting. In 2021, the advanced analytics & reporting segment recorded a substantial revenue share of the payment orchestration platform market. The demand for centralized dashboards powered by AI to improve corporate efficiency is substantially driving the growth of this segment of the market. Many companies all over the world are deploying AI-enabled POPs to handle financial transactions.

Based on the End-use, the payment orchestration platform market is categorized into BFSI, E-commerce, Healthcare, Travel & Hospitality, and Others. In 2021, the BFSI segment witnessed the highest revenue share of the payment orchestration platform market. The rise in the growth of the segment is a result of the continuously increasing workload on the BFSI sector all over the world. In addition, instant, online, and simpler payments are considered as the future of banking. These trends have developed as a result of the creation of more modern business models with POP features, such as improved financial services connectivity, responsiveness, dependability, and security.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 904.6 Million |

| Market size forecast in 2028 | USD 3.7 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 22.4% from 2022 to 2028 |

| Number of Pages | 211 |

| Number of Tables | 373 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Functionalities, End Use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the payment orchestration platform market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America held the biggest revenue share of the payment orchestration platform market. The growth of the regional market can be ascribed to the prevalence of numerous prominent players throughout North America as well as the growing necessity to stop fraudulent operations because of the rise in cybercrime. For instance, in June 2022, Spreedly, a provider of payment orchestration, introduced its Network Tokenization payment program in partnership with Mastercard for suppliers across North America. This program was made possible by Mastercard's MDES.

Free Valuable Insights: Global Payment Orchestration Platform Market size to reach USD 3.7 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include CellPoint Digital Ltd., IXOLIT Group, Payoneer, Inc., APEXX Fintech Ltd., Rebilly, Spreedly, Inc., Modo Payments, LLC, Akurateco BV, BNT SOF, and aye4fin GmbH.

By Type

By End Use

By Functionalities

By Geography

The Payment Orchestration Platform Market size is projected to reach USD 3.7 billion by 2028.

Increased Redundancy Along With Reduced Friction are driving the market in coming years, however, Lack Of Agility And Control Of Transaction Flow restraints the growth of the market.

CellPoint Digital Ltd., IXOLIT Group, Payoneer, Inc., APEXX Fintech Ltd., Rebilly, Spreedly, Inc., Modo Payments, LLC, Akurateco BV, BNT SOF, and aye4fin GmbH.

The Cross-Border Transactions segment acquired maximum revenue share in the Global Payment Orchestration Platform Market by Functionalities in 2021 thereby, achieving a market value of $1.7 billion by 2028.

The B2B segment is leading the Global Payment Orchestration Platform Market by Type in 2021 thereby, achieving a market value of $2.3 billion by 2028.

The North America market dominated the Global Payment Orchestration Platform Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $1.3 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.