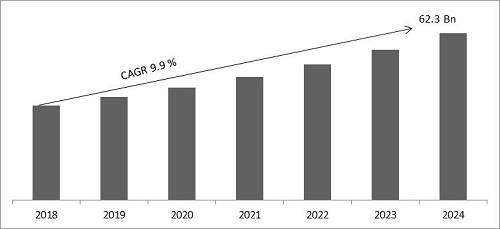

The Global Payment Processing Solutions Market size is expected to reach $62.3 billion by 2024, rising at a market growth of 9.9% CAGR during the forecast period. Payment processing is a particular word that relates to how operations between the customer and the merchant are automated. A third-party service, generally a computer-based system such as eMerchant Gateway, processes the customer's payment information and is set up to accept or decline payments on behalf of the merchant oriented on pre-set parameters. A merchant account is a business and financial arrangement with a credit card processor that enables a dealer to accept payment cards — in this case, online. An internet merchant account allows operating web-initiated transactions online in the real time. The three-party scheme includes three main parties wherein the issuer (having the relationship with the cardholder) and the acquirer (having relationship with the merchant) is the same entity. The three parties involved are the consumer, the merchant and the scheme.

Global Payment Processing Solutions Market Size

Based on Payment method, the market is segmented into Credit Card, Debit card and Ewallet. Credit cards are payment cards issued to users, which enables the cardholder to pay merchants for goods and services, and make payments for the amounts along with the other agreed charges. The card issuer, usually a bank, creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money to make payment to a merchant or as a cash advance. A credit card allows customers to build a continuous balance of debt, subject to interest charges. The credit card segment is anticipated to have the largest market size in the market for payment processing solutions. Credit card remains to be the favored way to pay in department shops, most probably due to people who prefer credit card for purchases in higher value.

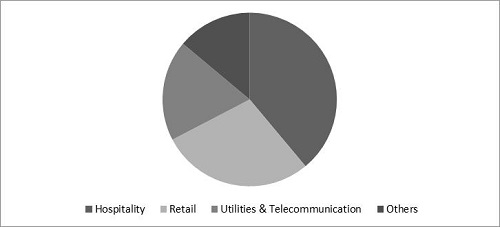

Global Payment Processing Solutions Market Share

Based on End User, the market is segmented into Hospitality, Retail, Utilities & Telecommunication, and Others. Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East and Africa.

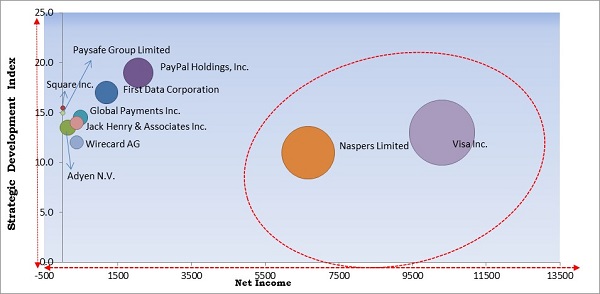

KBV Cardinal Matrix

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include PayPal Holdings, Inc., Global Payments Inc., First Data Corporation, Square Inc., Wirecard AG, Naspers Limited, Visa Inc., Jack Henry & Associates Inc., Adyen N.V., and Paysafe Group Limited. . The major strategies followed by the market participants are Product launches and Partnerships & Collaborations. Based on the Analysis presented in the Cardinal matrix, Naspers Limited, and Visa Inc. are some of the forerunners in the Payment Processing Solutions market.

Market Segmentation:

By Payment Method

By End User

By Geography

Companies Profiled

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.