Global Pea Protein Market By Application (Dietary Supplements, Bakery Goods, Meat Substitutes, Beverage and Other Applications), By Product (Isolates, Concentrates, Textured and Hydrolysate), By Regional Outlook, Industry Analysis Report and Forecast, 2020 - 2026

Published Date : 21-Apr-2021 |

Pages: 164 |

Formats: PDF |

COVID-19 Impact on the Pea Protein Market

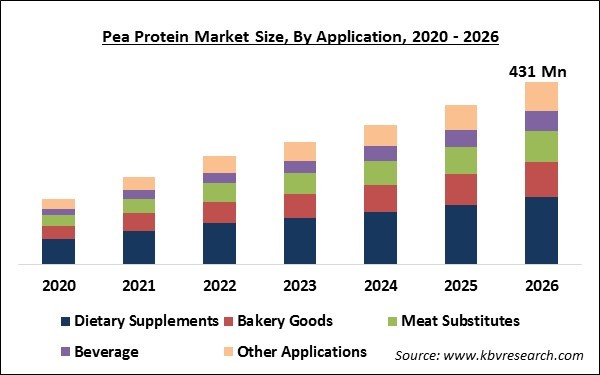

The Global Pea Protein Market size is expected to reach $431 Million by 2026, rising at a market growth of 18.6% CAGR during the forecast period. Pea protein refers to the protein obtained from split peas which is extensively utilized in a broad range of food items like fast foods, cereals, meal replacements shakes, and energy bars.

Meat is regarded as the major source of protein for years. Though, in past few years, plant-based proteins are highly popular in the thriving food & beverage sector, owing to the increasing health and environmental issues. Though, assuring the meat-free ‘meat’ was a long dream among customers - lack quality and variety - currently, the feasible options to environmentally hazardous meat are gaining massive traction. In addition, the ‘fake meat’ revolution is taking place in the global food industry, and pea protein is gaining massive prominence among makers of meat, dairy food, and seafood alternatives.

Increasing demand for the product due to the rising consumer awareness with respect to the consumption of a healthy diet and living healthy lifestyles is expected to the growth of the global pea protein market. Moreover, the market would witness bright growth prospects due to many factors including rising product development regarding manufacturing that carries out particular functions such as energy balance, weight loss, and repairing of muscle. The protein is obtained from several kinds of pea varieties, such as green, chickpeas, and dry, available in textured, concentrates, and isolate forms.

Rising cases of COVID-19 in North America, Europe, and the Asia Pacific combined with severe government lockdown norms would slow down the food & beverage industry. The supply chain can be disrupted and raw materials can witness shortage due to the stringent norms and limitations on trade, shipping, and social distancing guidelines.

Application Outlook

Based on Application, the market is segmented into Dietary Supplements, Bakery Goods, Meat Substitutes, Beverage and Other Applications. The meat substitutes segment would exhibit a higher growth rate over the forecast years. Increasing health issues, like obesity and diabetes, have encouraged many individuals to adopt vegan dietary habits. Animal rearing has a remarkable impact on the natural resources of the world and is the reason behind global warming to a certain extent. Though, this factor has not been measured, increasing awareness about this factor is expected to switch food habits to a more vegetarian diet, hence boosting the growth of the meat substitutes market. This trend would support the integration of pea protein as meat analogs.

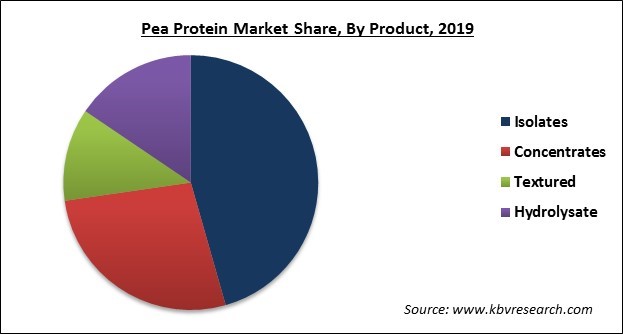

Product Outlook

Based on Product, the market is segmented into Isolates, Concentrates, Textured and Hydrolysate. In 2019, the global pea protein market was dominated by the isolates product segment. Isolates are extensively utilized as nutritional supplements in meat items, fruit mixes, energy drinks, and bakery products as they have good emulsification and non-allergic properties. Growth of the sports nutrition sector in the established nations such as the US, the UK, and Germany, on account of the introduction of new products by Amway and Cadbury in the energy mix segment, would fuel the demand for the product.

| Report Attribute | Details |

|---|---|

| Market size value in 2019 | USD 168.9 Million |

| Market size forecast in 2026 | USD 431 Million |

| Base Year | 2019 |

| Historical Period | 2016 to 2018 |

| Forecast Period | 2020 to 2026 |

| Revenue Growth Rate | CAGR of 18.6% from 2020 to 2026 |

| Number of Pages | 164 |

| Number of Tables | 294 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling, Competitive Landscape |

| Segments covered | Application, Product, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

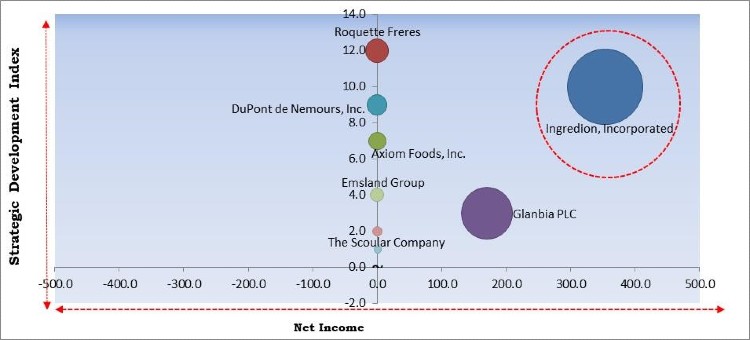

KBV Cardinal Matrix - Pea Protein Market Competition Analysis

Free Valuable Insights: Global Pea Protein Market to reach a market size of $431 Million by 2026

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2019, North America emerged as the leading region of the global pea protein market. The pea protein market in the North American region is anticipated to propel by the increasing demand for gluten-free items, growing concerns in terms of Cardiovascular Diseases (CVDs) caused by red meat consumption, and strong development of the sports nutrition sector in the region.

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Ingredion, Incorporated is the major forerunner in the Pea Protein Market. Companies such as Roquette Freres, DuPont de Nemours, Inc., Axiom Foods, Inc., Emsland Group, and Glanbia PLC are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Glanbia PLC, DuPont de Nemours, Inc., Ingredion, Incorporated, Roquette Freres, The Green Labs LLC, Fenchem Biotek Ltd., A&B Ingredients, Inc., The Scoular Company, Axiom Foods, Inc., and Emsland Group.

Recent Strategies Deployed in Pea Protein Market

» Partnerships, Collaborations, and Agreements:

- Jun-2020: Emsland Group extended its partnership with Brenntag Food & Nutrition in Russia. The partnership broadened the company's portfolio with pea and potato products.

- Jun-2020: The Scoular Company signed an exclusive licensing agreement with Montana Microbial Products, a Research and Development Company. The agreement aims to manufacture and distribute barley protein concentrate (BPC) for pet food and aquaculture feed in the North American and Asian markets. These BPC products are sustainable and are plant-based protein substitutes made from non-GMO barley.

- May-2020: Emsland Group came into partnership with JUST. The partnership would offer the range required to fulfill the growing global demand for plant-based products marketed as JUST Egg in the United States.

- May-2020: Axiom Foods formed a partnership with Brenntag Food & Nutrition business unit in North America. The partnership aims to distribute plant proteins in the United States and Canada. The ingredient portfolio consists of a pea, hemp, pumpkin rice & sacha inchi proteins, oat & rice dairy-replacement powders and Axiom’s recently introduced texturized pea proteins.

- Feb-2020: Roquette signed a multi-year agreement with Beyond Meat, a prominent plant-based meat producer. The agreement substantially raises the amount of pea protein to be supplied by Roquette to Beyond Meat in the next three years in comparison to the amount supplied in 2019. This agreement with Roquette indicated Beyond Meat's commitment to further ranging the plant protein supply chain.

- Apr-2019: Axiom Foods entered into an agreement with Univar, a global chemical and ingredient distributor, and provider of value-added services. Under this agreement, Axiom Foods selected Univar Solutions as its sole distributor for the United States. This agreement also includes the whole portfolio of Axiom Foods rice & pea proteins and other plant-based ingredients that are generally found in bars, snacks, nutritional beverages, and meat analogs or extenders.

» Acquisition and Mergers:

- Nov-2020: Ingredion entered into an agreement with James Cameron and Suzy Amis Cameron to acquire the remaining portion of ownership in Verdient Foods. The acquisition of Verdient Foods allows Ingredion to escalate the net sales growth, further expand their manufacturing capability and co-create with their customers to deliver the rising consumer demand for plant-based foods.

» Product Launches and Product Expansion:

- Mar-2021: Ingredion introduced Vitessense Pulse 1853 pea protein isolate and Purity P 1002 pea starch. These products are manufactured at its latest pea protein manufacturing unit in South Sioux City, Neb. They are 100% sustainably extracted from North American Farms. The pea protein isolate provides 85% protein on a dry basis and can be utilized to raise protein content over a range of applications.

- Jul-2020: DuPont introduced its Danisco Planit ingredient portfolio, Birgitte Borch. The latest portfolio features hydrocolloids, plant proteins, cultures, probiotics, food protection, fibers, antioxidants, emulsifiers, natural extracts, and enzymes, and also tailor-made systems.

- Feb-2020: Roquette introduced NUTRALYS L85M, a new ingredient to its range of NUTRALYS plant proteins. It is a specialty ingredient that further expanded the prevailing range of NUTRALYS pea protein from Roquette, the largest available in the market.

- Dec-2019: Roquette released two new plant-based textured proteins, NUTRALYS TP-C and NUTRALYS TF-C. These products aimed to better meet the increasing users' demand for sensory, diversity, and sustainable nutritional advancements. Roquette added two plant-based textured proteins, one is from peas and another is from fava beans.

- Dec-2019: Ingredion unveiled its first-ever protein isolate. VITESSENCE Pulse 1803 pea protein allows food and beverage manufacturers in EMEA to fulfill the growing consumer demand for protein-rich products, in a wide range of on-trend categories.

- Mar-2019: DuPont released a solution for manufacturers of snacks, nutrition bars, cereals, toppings, and more. These six new plant protein nuggets from its SUPRO and TRUPRO product variety provide options that have more protein or less sodium than the earlier range in a wider array of formats and textures. Plant protein nuggets or crisps are extruded ingredients that are generally utilized in nutrition bars, snacks, and cereals to raise the protein content and also provide crispy & crunchy texture.

Scope of the Study

Market Segments Covered in the Report:

By Application

- Dietary Supplements

- Bakery Goods

- Meat Substitutes

- Beverage

- Other Applications

By Product

- Isolates

- Concentrates

- Textured

- Hydrolysate

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Glanbia PLC

- DuPont de Nemours, Inc.

- Ingredion, Incorporated

- Roquette Freres

- The Green Labs LLC

- Fenchem Biotek Ltd.

- A&B Ingredients, Inc.

- The Scoular Company

- Axiom Foods, Inc.

- Emsland Group

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Pea Protein Market, by Application

1.4.2 Global Pea Protein Market, by Product

1.4.3 Global Pea Protein Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.2 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Geographical Expansions

3.2.4 Acquisition and Mergers

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2016-2020)

Chapter 4. Global Pea Protein Market by Application

4.1 Global Dietary Supplements Market by Region

4.2 Global Bakery Goods Market by Region

4.3 Global Meat Substitutes Market by Region

4.4 Global Beverage Market by Region

4.5 Global Other Application Market by Region

Chapter 5. Global Pea Protein Market by Product

5.1 Global Isolates Market by Region

5.2 Global Concentrates Market by Region

5.3 Global Textured Market by Region

5.4 Global Hydrolysate Market by Region

Chapter 6. Global Pea Protein Market by Region

6.1 North America Pea Protein Market

6.1.1 North America Pea Protein Market by Application

6.1.1.1 North America Dietary Supplements Market by Country

6.1.1.2 North America Bakery Goods Market by Country

6.1.1.3 North America Meat Substitutes Market by Country

6.1.1.4 North America Beverage Market by Country

6.1.1.5 North America Other Application Market by Country

6.1.2 North America Pea Protein Market by Product

6.1.2.1 North America Isolates Market by Country

6.1.2.2 North America Concentrates Market by Country

6.1.2.3 North America Textured Market by Country

6.1.2.4 North America Hydrolysate Market by Country

6.1.3 North America Pea Protein Market by Country

6.1.3.1 US Pea Protein Market

6.1.3.1.1 US Pea Protein Market by Application

6.1.3.1.2 US Pea Protein Market by Product

6.1.3.2 Canada Pea Protein Market

6.1.3.2.1 Canada Pea Protein Market by Application

6.1.3.2.2 Canada Pea Protein Market by Product

6.1.3.3 Mexico Pea Protein Market

6.1.3.3.1 Mexico Pea Protein Market by Application

6.1.3.3.2 Mexico Pea Protein Market by Product

6.1.3.4 Rest of North America Pea Protein Market

6.1.3.4.1 Rest of North America Pea Protein Market by Application

6.1.3.4.2 Rest of North America Pea Protein Market by Product

6.2 Europe Pea Protein Market

6.2.1 Europe Pea Protein Market by Application

6.2.1.1 Europe Dietary Supplements Market by Country

6.2.1.2 Europe Bakery Goods Market by Country

6.2.1.3 Europe Meat Substitutes Market by Country

6.2.1.4 Europe Beverage Market by Country

6.2.1.5 Europe Other Application Market by Country

6.2.2 Europe Pea Protein Market by Product

6.2.2.1 Europe Isolates Market by Country

6.2.2.2 Europe Concentrates Market by Country

6.2.2.3 Europe Textured Market by Country

6.2.2.4 Europe Hydrolysate Market by Country

6.2.3 Europe Pea Protein Market by Country

6.2.3.1 Germany Pea Protein Market

6.2.3.1.1 Germany Pea Protein Market by Application

6.2.3.1.2 Germany Pea Protein Market by Product

6.2.3.2 UK Pea Protein Market

6.2.3.2.1 UK Pea Protein Market by Application

6.2.3.2.2 UK Pea Protein Market by Product

6.2.3.3 France Pea Protein Market

6.2.3.3.1 France Pea Protein Market by Application

6.2.3.3.2 France Pea Protein Market by Product

6.2.3.4 Russia Pea Protein Market

6.2.3.4.1 Russia Pea Protein Market by Application

6.2.3.4.2 Russia Pea Protein Market by Product

6.2.3.5 Spain Pea Protein Market

6.2.3.5.1 Spain Pea Protein Market by Application

6.2.3.5.2 Spain Pea Protein Market by Product

6.2.3.6 Italy Pea Protein Market

6.2.3.6.1 Italy Pea Protein Market by Application

6.2.3.6.2 Italy Pea Protein Market by Product

6.2.3.7 Rest of Europe Pea Protein Market

6.2.3.7.1 Rest of Europe Pea Protein Market by Application

6.2.3.7.2 Rest of Europe Pea Protein Market by Product

6.3 Asia Pacific Pea Protein Market

6.3.1 Asia Pacific Pea Protein Market by Application

6.3.1.1 Asia Pacific Dietary Supplements Market by Country

6.3.1.2 Asia Pacific Bakery Goods Market by Country

6.3.1.3 Asia Pacific Meat Substitutes Market by Country

6.3.1.4 Asia Pacific Beverage Market by Country

6.3.1.5 Asia Pacific Other Application Market by Country

6.3.2 Asia Pacific Pea Protein Market by Product

6.3.2.1 Asia Pacific Isolates Market by Country

6.3.2.2 Asia Pacific Concentrates Market by Country

6.3.2.3 Asia Pacific Textured Market by Country

6.3.2.4 Asia Pacific Hydrolysate Market by Country

6.3.3 Asia Pacific Pea Protein Market by Country

6.3.3.1 China Pea Protein Market

6.3.3.1.1 China Pea Protein Market by Application

6.3.3.1.2 China Pea Protein Market by Product

6.3.3.2 India Pea Protein Market

6.3.3.2.1 India Pea Protein Market by Application

6.3.3.2.2 India Pea Protein Market by Product

6.3.3.3 Japan Pea Protein Market

6.3.3.3.1 Japan Pea Protein Market by Application

6.3.3.3.2 Japan Pea Protein Market by Product

6.3.3.4 South Korea Pea Protein Market

6.3.3.4.1 South Korea Pea Protein Market by Application

6.3.3.4.2 South Korea Pea Protein Market by Product

6.3.3.5 Singapore Pea Protein Market

6.3.3.5.1 Singapore Pea Protein Market by Application

6.3.3.5.2 Singapore Pea Protein Market by Product

6.3.3.6 Malaysia Pea Protein Market

6.3.3.6.1 Malaysia Pea Protein Market by Application

6.3.3.6.2 Malaysia Pea Protein Market by Product

6.3.3.7 Rest of Asia Pacific Pea Protein Market

6.3.3.7.1 Rest of Asia Pacific Pea Protein Market by Application

6.3.3.7.2 Rest of Asia Pacific Pea Protein Market by Product

6.4 LAMEA Pea Protein Market

6.4.1 LAMEA Pea Protein Market by Application

6.4.1.1 LAMEA Dietary Supplements Market by Country

6.4.1.2 LAMEA Bakery Goods Market by Country

6.4.1.3 LAMEA Meat Substitutes Market by Country

6.4.1.4 LAMEA Beverage Market by Country

6.4.1.5 LAMEA Other Application Market by Country

6.4.2 LAMEA Pea Protein Market by Product

6.4.2.1 LAMEA Isolates Market by Country

6.4.2.2 LAMEA Concentrates Market by Country

6.4.2.3 LAMEA Textured Market by Country

6.4.2.4 LAMEA Hydrolysate Market by Country

6.4.3 LAMEA Pea Protein Market by Country

6.4.3.1 Brazil Pea Protein Market

6.4.3.1.1 Brazil Pea Protein Market by Application

6.4.3.1.2 Brazil Pea Protein Market by Product

6.4.3.2 Argentina Pea Protein Market

6.4.3.2.1 Argentina Pea Protein Market by Application

6.4.3.2.2 Argentina Pea Protein Market by Product

6.4.3.3 UAE Pea Protein Market

6.4.3.3.1 UAE Pea Protein Market by Application

6.4.3.3.2 UAE Pea Protein Market by Product

6.4.3.4 Saudi Arabia Pea Protein Market

6.4.3.4.1 Saudi Arabia Pea Protein Market by Application

6.4.3.4.2 Saudi Arabia Pea Protein Market by Product

6.4.3.5 South Africa Pea Protein Market

6.4.3.5.1 South Africa Pea Protein Market by Application

6.4.3.5.2 South Africa Pea Protein Market by Product

6.4.3.6 Nigeria Pea Protein Market

6.4.3.6.1 Nigeria Pea Protein Market by Application

6.4.3.6.2 Nigeria Pea Protein Market by Product

6.4.3.7 Rest of LAMEA Pea Protein Market

6.4.3.7.1 Rest of LAMEA Pea Protein Market by Application

6.4.3.7.2 Rest of LAMEA Pea Protein Market by Product

Chapter 7. Company Profiles

7.1 Glanbia PLC

7.1.1 Company Overview

7.1.2 Financial Analysis

7.1.3 Segmental and Regional Analysis

7.1.4 Research & Development Expense

7.1.5 Recent strategies and developments:

7.1.5.1 Product Launches and Product Expansions:

7.2 DuPont de Nemours, Inc.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Segmental and Regional Analysis

7.2.4 Research & Development Expense

7.2.5 Recent strategies and developments:

7.2.5.1 Product Launches and Product Expansions:

7.3 Ingredion, Incorporated

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Regional Analysis

7.3.4 Research & Development Expense

7.3.5 Recent strategies and developments:

7.3.5.1 Product Launches and Product Expansions:

7.3.5.2 Acquisition and Mergers:

7.4 Roquette Freres

7.4.1 Company Overview

7.4.2 Recent strategies and developments:

7.4.2.1 Product Launches and Product Expansions:

7.4.2.2 Partnerships, Collaborations, and Agreements:

7.4.2.3 Geographical Expansions:

7.5 The Green Labs LLC

7.5.1 Company Overview

7.6 Fenchem Biotek Ltd.

7.6.1 Company Overview

7.7 A&B Ingredients, Inc.

7.7.1 Company Overview

7.8 The Scoular Company

7.8.1 Company Overview

7.8.2 Recent strategies and developments:

7.8.2.1 Partnerships, Collaborations, and Agreements:

7.9 Axiom Foods, Inc.

7.9.1 Company Overview

7.9.2 Recent strategies and developments:

7.9.2.1 Partnerships, Collaborations, and Agreements:

7.9.2.2 Product Launches and Product Expansions:

7.10. Emsland Group

7.10.1 Company Overview

7.10.2 Recent strategies and developments:

7.10.2.1 Partnerships, Collaborations, and Agreements:

TABLE 2 Global Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 3 Partnerships, Collaborations and Agreements– Pea Protein Market

TABLE 4 Product Launches And Product Expansions– Pea Protein Market

TABLE 5 Geographical Expansions– Pea Protein Market

TABLE 6 Acquisition and Mergers– Pea Protein Market

TABLE 7 Global Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 8 Global Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 9 Global Dietary Supplements Market by Region, 2016 - 2019, USD Thousands

TABLE 10 Global Dietary Supplements Market by Region, 2020 - 2026, USD Thousands

TABLE 11 Global Bakery Goods Market by Region, 2016 - 2019, USD Thousands

TABLE 12 Global Bakery Goods Market by Region, 2020 - 2026, USD Thousands

TABLE 13 Global Meat Substitutes Market by Region, 2016 - 2019, USD Thousands

TABLE 14 Global Meat Substitutes Market by Region, 2020 - 2026, USD Thousands

TABLE 15 Global Beverage Market by Region, 2016 - 2019, USD Thousands

TABLE 16 Global Beverage Market by Region, 2020 - 2026, USD Thousands

TABLE 17 Global Other Application Market by Region, 2016 - 2019, USD Thousands

TABLE 18 Global Other Application Market by Region, 2020 - 2026, USD Thousands

TABLE 19 Global Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 20 Global Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 21 Global Isolates Market by Region, 2016 - 2019, USD Thousands

TABLE 22 Global Isolates Market by Region, 2020 - 2026, USD Thousands

TABLE 23 Global Concentrates Market by Region, 2016 - 2019, USD Thousands

TABLE 24 Global Concentrates Market by Region, 2020 - 2026, USD Thousands

TABLE 25 Global Textured Market by Region, 2016 - 2019, USD Thousands

TABLE 26 Global Textured Market by Region, 2020 - 2026, USD Thousands

TABLE 27 Global Hydrolysate Market by Region, 2016 - 2019, USD Thousands

TABLE 28 Global Hydrolysate Market by Region, 2020 - 2026, USD Thousands

TABLE 29 Global Pea Protein Market by Region, 2016 - 2019, USD Thousands

TABLE 30 Global Pea Protein Market by Region, 2020 - 2026, USD Thousands

TABLE 31 North America Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 32 North America Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 33 North America Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 34 North America Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 35 North America Dietary Supplements Market by Country, 2016 - 2019, USD Thousands

TABLE 36 North America Dietary Supplements Market by Country, 2020 - 2026, USD Thousands

TABLE 37 North America Bakery Goods Market by Country, 2016 - 2019, USD Thousands

TABLE 38 North America Bakery Goods Market by Country, 2020 - 2026, USD Thousands

TABLE 39 North America Meat Substitutes Market by Country, 2016 - 2019, USD Thousands

TABLE 40 North America Meat Substitutes Market by Country, 2020 - 2026, USD Thousands

TABLE 41 North America Beverage Market by Country, 2016 - 2019, USD Thousands

TABLE 42 North America Beverage Market by Country, 2020 - 2026, USD Thousands

TABLE 43 North America Other Application Market by Country, 2016 - 2019, USD Thousands

TABLE 44 North America Other Application Market by Country, 2020 - 2026, USD Thousands

TABLE 45 North America Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 46 North America Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 47 North America Isolates Market by Country, 2016 - 2019, USD Thousands

TABLE 48 North America Isolates Market by Country, 2020 - 2026, USD Thousands

TABLE 49 North America Concentrates Market by Country, 2016 - 2019, USD Thousands

TABLE 50 North America Concentrates Market by Country, 2020 - 2026, USD Thousands

TABLE 51 North America Textured Market by Country, 2016 - 2019, USD Thousands

TABLE 52 North America Textured Market by Country, 2020 - 2026, USD Thousands

TABLE 53 North America Hydrolysate Market by Country, 2016 - 2019, USD Thousands

TABLE 54 North America Hydrolysate Market by Country, 2020 - 2026, USD Thousands

TABLE 55 North America Pea Protein Market by Country, 2016 - 2019, USD Thousands

TABLE 56 North America Pea Protein Market by Country, 2020 - 2026, USD Thousands

TABLE 57 US Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 58 US Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 59 US Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 60 US Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 61 US Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 62 US Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 63 Canada Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 64 Canada Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 65 Canada Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 66 Canada Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 67 Canada Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 68 Canada Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 69 Mexico Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 70 Mexico Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 71 Mexico Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 72 Mexico Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 73 Mexico Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 74 Mexico Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 75 Rest of North America Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 76 Rest of North America Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 77 Rest of North America Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 78 Rest of North America Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 79 Rest of North America Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 80 Rest of North America Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 81 Europe Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 82 Europe Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 83 Europe Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 84 Europe Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 85 Europe Dietary Supplements Market by Country, 2016 - 2019, USD Thousands

TABLE 86 Europe Dietary Supplements Market by Country, 2020 - 2026, USD Thousands

TABLE 87 Europe Bakery Goods Market by Country, 2016 - 2019, USD Thousands

TABLE 88 Europe Bakery Goods Market by Country, 2020 - 2026, USD Thousands

TABLE 89 Europe Meat Substitutes Market by Country, 2016 - 2019, USD Thousands

TABLE 90 Europe Meat Substitutes Market by Country, 2020 - 2026, USD Thousands

TABLE 91 Europe Beverage Market by Country, 2016 - 2019, USD Thousands

TABLE 92 Europe Beverage Market by Country, 2020 - 2026, USD Thousands

TABLE 93 Europe Other Application Market by Country, 2016 - 2019, USD Thousands

TABLE 94 Europe Other Application Market by Country, 2020 - 2026, USD Thousands

TABLE 95 Europe Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 96 Europe Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 97 Europe Isolates Market by Country, 2016 - 2019, USD Thousands

TABLE 98 Europe Isolates Market by Country, 2020 - 2026, USD Thousands

TABLE 99 Europe Concentrates Market by Country, 2016 - 2019, USD Thousands

TABLE 100 Europe Concentrates Market by Country, 2020 - 2026, USD Thousands

TABLE 101 Europe Textured Market by Country, 2016 - 2019, USD Thousands

TABLE 102 Europe Textured Market by Country, 2020 - 2026, USD Thousands

TABLE 103 Europe Hydrolysate Market by Country, 2016 - 2019, USD Thousands

TABLE 104 Europe Hydrolysate Market by Country, 2020 - 2026, USD Thousands

TABLE 105 Europe Pea Protein Market by Country, 2016 - 2019, USD Thousands

TABLE 106 Europe Pea Protein Market by Country, 2020 - 2026, USD Thousands

TABLE 107 Germany Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 108 Germany Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 109 Germany Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 110 Germany Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 111 Germany Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 112 Germany Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 113 UK Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 114 UK Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 115 UK Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 116 UK Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 117 UK Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 118 UK Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 119 France Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 120 France Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 121 France Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 122 France Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 123 France Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 124 France Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 125 Russia Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 126 Russia Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 127 Russia Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 128 Russia Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 129 Russia Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 130 Russia Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 131 Spain Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 132 Spain Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 133 Spain Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 134 Spain Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 135 Spain Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 136 Spain Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 137 Italy Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 138 Italy Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 139 Italy Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 140 Italy Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 141 Italy Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 142 Italy Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 143 Rest of Europe Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 144 Rest of Europe Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 145 Rest of Europe Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 146 Rest of Europe Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 147 Rest of Europe Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 148 Rest of Europe Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 149 Asia Pacific Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 150 Asia Pacific Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 151 Asia Pacific Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 152 Asia Pacific Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 153 Asia Pacific Dietary Supplements Market by Country, 2016 - 2019, USD Thousands

TABLE 154 Asia Pacific Dietary Supplements Market by Country, 2020 - 2026, USD Thousands

TABLE 155 Asia Pacific Bakery Goods Market by Country, 2016 - 2019, USD Thousands

TABLE 156 Asia Pacific Bakery Goods Market by Country, 2020 - 2026, USD Thousands

TABLE 157 Asia Pacific Meat Substitutes Market by Country, 2016 - 2019, USD Thousands

TABLE 158 Asia Pacific Meat Substitutes Market by Country, 2020 - 2026, USD Thousands

TABLE 159 Asia Pacific Beverage Market by Country, 2016 - 2019, USD Thousands

TABLE 160 Asia Pacific Beverage Market by Country, 2020 - 2026, USD Thousands

TABLE 161 Asia Pacific Other Application Market by Country, 2016 - 2019, USD Thousands

TABLE 162 Asia Pacific Other Application Market by Country, 2020 - 2026, USD Thousands

TABLE 163 Asia Pacific Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 164 Asia Pacific Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 165 Asia Pacific Isolates Market by Country, 2016 - 2019, USD Thousands

TABLE 166 Asia Pacific Isolates Market by Country, 2020 - 2026, USD Thousands

TABLE 167 Asia Pacific Concentrates Market by Country, 2016 - 2019, USD Thousands

TABLE 168 Asia Pacific Concentrates Market by Country, 2020 - 2026, USD Thousands

TABLE 169 Asia Pacific Textured Market by Country, 2016 - 2019, USD Thousands

TABLE 170 Asia Pacific Textured Market by Country, 2020 - 2026, USD Thousands

TABLE 171 Asia Pacific Hydrolysate Market by Country, 2016 - 2019, USD Thousands

TABLE 172 Asia Pacific Hydrolysate Market by Country, 2020 - 2026, USD Thousands

TABLE 173 Asia Pacific Pea Protein Market by Country, 2016 - 2019, USD Thousands

TABLE 174 Asia Pacific Pea Protein Market by Country, 2020 - 2026, USD Thousands

TABLE 175 China Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 176 China Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 177 China Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 178 China Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 179 China Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 180 China Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 181 India Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 182 India Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 183 India Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 184 India Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 185 India Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 186 India Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 187 Japan Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 188 Japan Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 189 Japan Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 190 Japan Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 191 Japan Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 192 Japan Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 193 South Korea Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 194 South Korea Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 195 South Korea Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 196 South Korea Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 197 South Korea Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 198 South Korea Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 199 Singapore Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 200 Singapore Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 201 Singapore Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 202 Singapore Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 203 Singapore Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 204 Singapore Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 205 Malaysia Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 206 Malaysia Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 207 Malaysia Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 208 Malaysia Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 209 Malaysia Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 210 Malaysia Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 211 Rest of Asia Pacific Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 212 Rest of Asia Pacific Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 213 Rest of Asia Pacific Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 214 Rest of Asia Pacific Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 215 Rest of Asia Pacific Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 216 Rest of Asia Pacific Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 217 LAMEA Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 218 LAMEA Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 219 LAMEA Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 220 LAMEA Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 221 LAMEA Dietary Supplements Market by Country, 2016 - 2019, USD Thousands

TABLE 222 LAMEA Dietary Supplements Market by Country, 2020 - 2026, USD Thousands

TABLE 223 LAMEA Bakery Goods Market by Country, 2016 - 2019, USD Thousands

TABLE 224 LAMEA Bakery Goods Market by Country, 2020 - 2026, USD Thousands

TABLE 225 LAMEA Meat Substitutes Market by Country, 2016 - 2019, USD Thousands

TABLE 226 LAMEA Meat Substitutes Market by Country, 2020 - 2026, USD Thousands

TABLE 227 LAMEA Beverage Market by Country, 2016 - 2019, USD Thousands

TABLE 228 LAMEA Beverage Market by Country, 2020 - 2026, USD Thousands

TABLE 229 LAMEA Other Application Market by Country, 2016 - 2019, USD Thousands

TABLE 230 LAMEA Other Application Market by Country, 2020 - 2026, USD Thousands

TABLE 231 LAMEA Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 232 LAMEA Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 233 LAMEA Isolates Market by Country, 2016 - 2019, USD Thousands

TABLE 234 LAMEA Isolates Market by Country, 2020 - 2026, USD Thousands

TABLE 235 LAMEA Concentrates Market by Country, 2016 - 2019, USD Thousands

TABLE 236 LAMEA Concentrates Market by Country, 2020 - 2026, USD Thousands

TABLE 237 LAMEA Textured Market by Country, 2016 - 2019, USD Thousands

TABLE 238 LAMEA Textured Market by Country, 2020 - 2026, USD Thousands

TABLE 239 LAMEA Hydrolysate Market by Country, 2016 - 2019, USD Thousands

TABLE 240 LAMEA Hydrolysate Market by Country, 2020 - 2026, USD Thousands

TABLE 241 LAMEA Pea Protein Market by Country, 2016 - 2019, USD Thousands

TABLE 242 LAMEA Pea Protein Market by Country, 2020 - 2026, USD Thousands

TABLE 243 Brazil Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 244 Brazil Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 245 Brazil Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 246 Brazil Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 247 Brazil Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 248 Brazil Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 249 Argentina Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 250 Argentina Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 251 Argentina Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 252 Argentina Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 253 Argentina Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 254 Argentina Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 255 UAE Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 256 UAE Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 257 UAE Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 258 UAE Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 259 UAE Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 260 UAE Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 261 Saudi Arabia Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 262 Saudi Arabia Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 263 Saudi Arabia Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 264 Saudi Arabia Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 265 Saudi Arabia Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 266 Saudi Arabia Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 267 South Africa Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 268 South Africa Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 269 South Africa Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 270 South Africa Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 271 South Africa Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 272 South Africa Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 273 Nigeria Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 274 Nigeria Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 275 Nigeria Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 276 Nigeria Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 277 Nigeria Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 278 Nigeria Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 279 Rest of LAMEA Pea Protein Market, 2016 - 2019, USD Thousands

TABLE 280 Rest of LAMEA Pea Protein Market, 2020 - 2026, USD Thousands

TABLE 281 Rest of LAMEA Pea Protein Market by Application, 2016 - 2019, USD Thousands

TABLE 282 Rest of LAMEA Pea Protein Market by Application, 2020 - 2026, USD Thousands

TABLE 283 Rest of LAMEA Pea Protein Market by Product, 2016 - 2019, USD Thousands

TABLE 284 Rest of LAMEA Pea Protein Market by Product, 2020 - 2026, USD Thousands

TABLE 285 Key Information – Glanbia PLC

TABLE 286 Key Information –DuPont de Nemours, Inc.

TABLE 287 Key Information – Ingredion, Incorporated

TABLE 288 key information – Roquette Freres

TABLE 289 Key Information – The Green Labs LLC

TABLE 290 Key Information – Fenchem Biotek Ltd.

TABLE 291 key Information – A&B Ingredients, Inc.

TABLE 292 Key Information – The Scoular Company

TABLE 293 key information – Axiom Foods, Inc.

TABLE 294 Key Information – Emsland Group

List of Figures

FIG 1 Methodology for the research

FIG 2 KBV Cardinal Matrix

FIG 3 Key Leading Strategies: Percentage Distribution (2016-2020)

FIG 4 Recent strategies and developments: Ingredion, Incorporated

FIG 5 Recent strategies and developments: Roquette Freres

FIG 6 Recent strategies and developments: Axiom Foods, Inc.