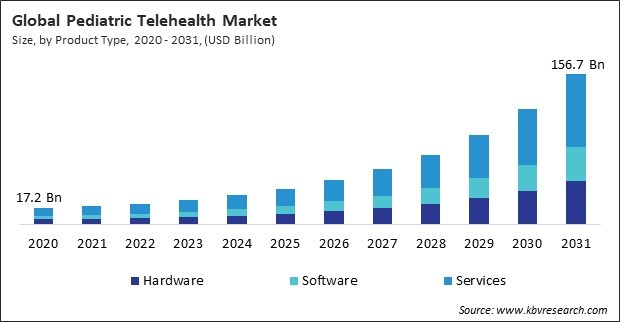

“Global Pediatric Telehealth Market to reach a market value of 156.7 Billion by 2031 growing at a CAGR of 26.1%”

The Global Pediatric Telehealth Market size is expected to reach $156.7 billion by 2031, rising at a market growth of 26.1% CAGR during the forecast period.

Segment expansion is being propelled by the growing investments in telehealth platforms, electronic health record (EHR) integration, and mobile health (mHealth) applications. To enhance the overall efficiency and accessibility of pediatric telehealth services, these software solutions have become essential for facilitating seamless communication between healthcare providers and patients. Thus, the software segment acquired 21% revenue share in the pediatric telehealth market in 2023.

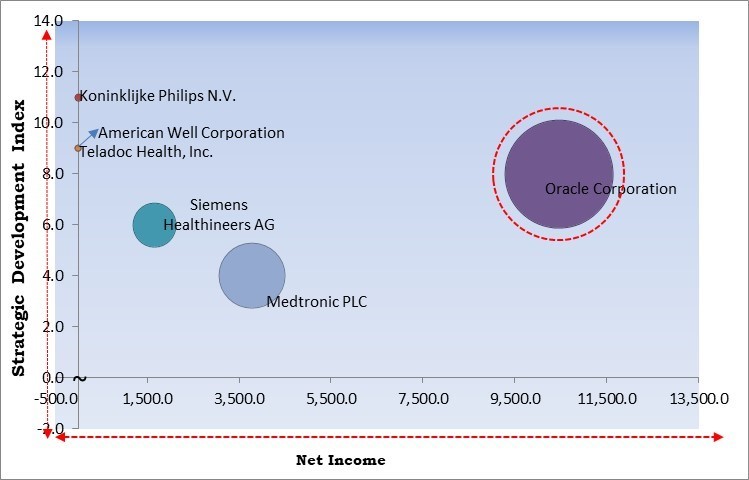

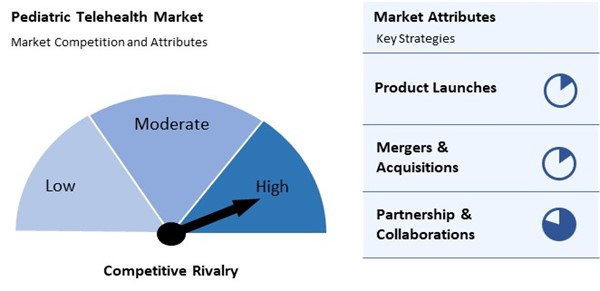

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In April, 2024, Philips announced joined hands with SmartQare, a company specializing in wearable health monitoring devices, to automate and simplify continuous patient monitoring both in and out of hospital settings. This collaboration integrates SmartQare’s advanced patient monitoring technology with Philips’ extensive healthcare solutions, aiming to enhance the efficiency and accuracy of continuous monitoring. The integration seeks to provide a seamless experience for healthcare providers and improve patient outcomes through advanced automation and simplified processes. Additionally, In December, Siemens Healthineers has teamed up with OU Health, a major healthcare provider, to enhance medical technology deployment across healthcare facilities. This collaboration focuses on integrating Siemens’ advanced diagnostic technologies to improve patient care and expand access to remote health solutions.

Based on the Analysis presented in the KBV Cardinal matrix; Oracle Corporation is the forerunner in the Pediatric Telehealth Market. In February, 2024, Oracle expanded its partnership with ObvioHealth, a digital clinical trial company, to enhance their global presence in the life sciences sector. This extended collaboration focuses on integrating ObvioHealth’s digital trial solutions with Oracle’s comprehensive health data management platforms, aiming to streamline clinical trials and improve patient monitoring on a global scale.

Telehealth was instrumental in addressing the mental health requirements of children during the pandemic by providing virtual therapy and support to those who were experiencing anxiety, depression, and other challenges associated with isolation. The pandemic ultimately accelerated the adoption of pediatric telehealth, establishing it as a key component of healthcare delivery that will likely continue to grow in importance. Thus, the pandemic had an overall positive impact on the market.

Obesity in children can lead to numerous long-term health complications, including cardiovascular diseases and type 2 diabetes. Telehealth programs focused on managing pediatric obesity offer parents and caregivers the tools to address their children’s weight management through virtual consultations with nutritionists, exercise plans, and regular check-ins. Hence, the rising incidence of chronic disease among children is a key factor propelling the market's growth.

Additionally, this level of clarity is essential in pediatric care, where early detection of potential health issues can make a critical difference in outcomes. These advancements have enhanced the efficiency of telehealth consultations and improved access to pediatric specialists who may not be available locally, ensuring timely and expert care for children without needing in-person visits. Thus, these factors will aid in the growth of the market.

Many families cannot afford the required technology, such as smartphones or computers, making it difficult for children to use telehealth services. Even in households with such devices, multiple children or family members may lead to competition for limited resources, such as shared computers, further reducing their ability to participate in telehealth visits. This digital divide disproportionately impacts children who need specialized care but live far from major pediatric healthcare centers. Hence, these issues are hampering the widespread adoption of pediatric telehealth services.

The software segment is further segmented into standalone software and integrated software. The standalone software segment recorded 39% revenue share in the market in 2023. Standalone telehealth applications allow healthcare providers to independently manage consultations, scheduling, and patient data.

The medical peripheral devices subsegment is further divided into blood pressure meters, blood glucose meters, weighing scales, pulse oximeters, peak flow meters, ECG monitors, and others. The weighing scales segment acquired 13% revenue share in the market in 2023. Weighing scales are vital for tracking growth and development, especially for newborns and children with conditions that affect weight gain or loss.

The services segment is divided into remote patient monitoring, real-time interactions, store & forward, and others. The remote patient monitoring segment garnered 25% revenue share in the market in 2023. The increasing demand for continuous monitoring of chronic pediatric conditions such as diabetes, asthma, and obesity drive the segment's growth.

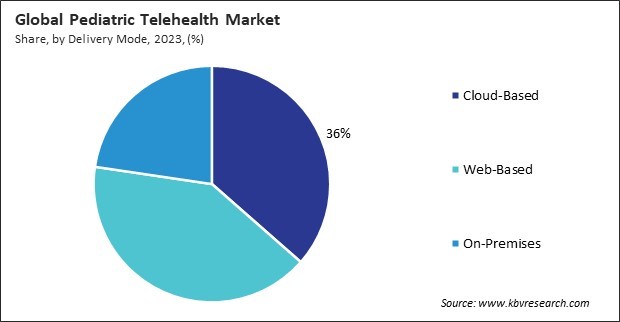

On the basis of delivery mode, the market is classified into on-premises, web-based, and cloud-based. The web-based segment acquired 41% revenue share in the market in 2023. Web-based platforms are highly popular due to their ease of access, as they allow both healthcare providers and patients to use telehealth services through a simple web browser without requiring extensive software installations.

Based on product type, the market is divided into hardware, software, and services. The services segment garnered 47% revenue share in the pediatric telehealth market in 2023. The increasing demand for virtual consultations, remote monitoring, and mental health services drives the segment's growth. Government policies and insurance coverage support the expansion of telehealth infrastructure.

The hardware segment is further bifurcated into monitors and medical peripheral devices. The medical peripheral devices segment witnessed 46% revenue share in the market in 2023. These peripherals have become essential in pediatric telehealth, as they allow healthcare providers to conduct more detailed assessments remotely, addressing some of the concerns about virtual care's limitations.

By end-use, the market is divided into payers, providers, and patients. The payers segment garnered 32% revenue share in the market in 2023. This growing segment reflects the increasing role of insurance companies and government programs in supporting telehealth adoption.

Based on disease area, the market is segmented into psychiatry, substance use, radiology, dermatology, neurological medicine, ENT (ear, nose, and throat), dental, and others. The substance use segment acquired 5% revenue share in the market in 2023. While substance use disorders are less common in pediatric populations compared to adults, the growing need for early intervention and support for adolescents struggling with addiction or substance abuse has contributed to the rise of telehealth services in this area.

Free Valuable Insights: Global Pediatric Telehealth Market size to reach USD 156.7 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured 26% revenue share in the market in 2023. Countries like China, India, and Japan have made substantial strides in expanding access to telehealth, especially in pediatric care.

The Pediatric Telehealth Market is characterized by intense competition driven by technological advancements and increasing demand for remote healthcare services. Key attributes include user-friendly platforms, high-quality video consultations, and integration with electronic health records. Providers focus on expanding service offerings, enhancing patient engagement, and ensuring compliance with healthcare regulations. Additionally, the market benefits from growing acceptance among parents for virtual consultations and preventive care, creating opportunities for innovative solutions tailored to pediatric needs. Continuous investment in technology is vital for maintaining competitive advantage.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 25.7 Billion |

| Market size forecast in 2031 | USD 156.7 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 26.1% from 2024 to 2031 |

| Number of Pages | 501 |

| Tables | 833 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Product Type, Delivery Mode, End-use, Disease Area, Region |

| Country scope |

|

| Companies Included | Oracle Corporation, Siemens Healthineers AG (Siemens AG), American Well Corporation (Amwell), Koninklijke Philips N.V., Medtronic PLC, Teladoc Health, Inc., Kiddo Health Inc., Pediatric Partners, Brave Care Technologies, Inc. and Anytime Pediatrics |

By Product Type

By Delivery Mode

By End-use

By Disease Area

Other Disease Area

By Geography

This Market size is expected to reach $156.7 billion by 2031.

Rising incidence of pediatric chronic diseases are driving the Market in coming years, however, Limited access to technology in rural areas restraints the growth of the Market.

Oracle Corporation, Siemens Healthineers AG (Siemens AG), American Well Corporation (Amwell), Koninklijke Philips N.V., Medtronic PLC, Teladoc Health, Inc., Kiddo Health Inc., Pediatric Partners, Brave Care Technologies, Inc. and Anytime Pediatrics

The expected CAGR of this Market is 26.1% from 2024 to 2031.

The Providers segment is leading the Market by End-use in 2023; thereby, achieving a market value of $77.5 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $57,490.4 million by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges