The Global Peripheral Vascular Stents Market size is expected to reach $2.7 billion by 2030, rising at a market growth of 7.4% CAGR during the forecast period. In the year 2022, the market attained a volume of 2,468.7 thousand units, experiencing a growth of 6.8% (2019-2022).

Increase in the prevalence of disorders like PAD can be ascribed to several factors, including sedentary lifestyles, unhealthful eating patterns, and an aging population. Therefore, the Asia Pacific region would generate 1/4th share in the market by the year 2030. The expansion of the peripheral vascular stents industry is also fueled by growing government initiatives and supportive policies in the region, such as public awareness campaigns, disease prevention programs, and favorable reimbursement policies, which encourage cutting-edge medical technology and promote cardiovascular health. Some of the factors impacting the market are rising global aging population, increasing awareness and diagnosis, and increasing need for healthcare cost containment.

The global aging population is more susceptible to vascular diseases. The demand for peripheral vascular stents develops as the elderly population grows. For example, peripheral artery disease (PAD) is more likely to occur in older adults. These conditions often involve the narrowing or blockage of arteries in the legs and other peripheral areas of the body. With age, the risk of atherosclerosis and plaque buildup in the arteries increases, necessitating interventions like stent placement. An increased prevalence of risk factors for vascular diseases, including hypertension, diabetes, and high cholesterol, often accompanies aging. These factors can accelerate the progression of vascular diseases, leading to a greater need for treatment, including using vascular stents. Additionally, Efforts to increase awareness of peripheral vascular diseases and the importance of early diagnosis contribute to the market's growth. As more people are diagnosed with vascular conditions, there is a greater need for treatment options, including stents. Early detection and diagnosis can result from a greater awareness of peripheral vascular disorders, their risk factors, and symptoms. Awareness campaigns can help reduce health disparities by ensuring that individuals from underserved communities are informed about the risks and symptoms of peripheral vascular diseases. This can result in earlier diagnosis and treatment for populations at increased risk. Increased awareness and diagnosis of peripheral vascular disorders significantly influence market growth.

However, Healthcare systems around the world are under pressure to contain costs. This pressure leads to increased scrutiny of the cost-effectiveness of stent procedures, potentially limiting their use. Healthcare providers and payers often pressure medical device manufacturers to lower the prices of peripheral vascular stents. This reduces manufacturer profit margins and limits their ability to invest in research and development for innovative stent technologies. The reimbursement rates set by government healthcare programs, private insurers, and other payers play a crucial role in determining the economic viability of stent procedures. Healthcare cost containment is a significant challenge in the market, as it affects the adoption and utilization of stent procedures.

Furthermore, during the initial phases of the pandemic, many non-urgent medical procedures, including elective vascular procedures, were postponed or canceled to conserve healthcare resources and reduce the risk of infection. This led to a decline in the number of peripheral vascular stent placements. Healthcare facilities implemented strict infection control measures, which influenced how procedures were conducted. These measures included enhanced sterilization protocols and personal protective equipment (PPE) requirements. Factors such as changes in patient behavior, healthcare delivery models, and healthcare policies continue to influence the market. Consequently, the market is expected to experience stable growth during the forecast period, considering the subsiding effects of the pandemic.

Based on mode of delivery, the market is classified into self-expanding stents and balloon-expandable stents. The self-expanding stents segment acquired a substantial revenue share in the market in 2022. Self-expanding stents comprise shape-memory materials, such as nitinol, that can expand to conform to the vessel walls. This flexibility enables the stent to conform to challenging lesions or narrow arteries, restoring blood flow and providing effective support.

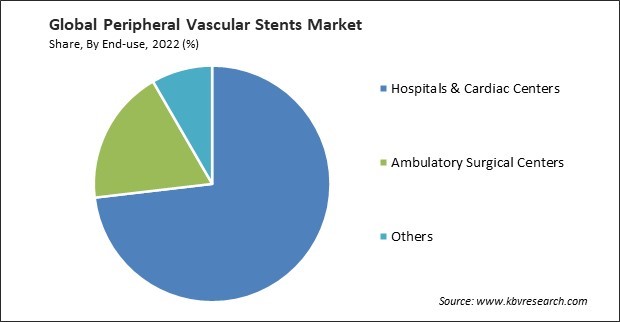

By end-use, the market is segmented into hospitals & cardiac centers, ambulatory surgical centers, and others. In 2022, the hospitals & cardiac centers segment registered the maximum revenue share in the market. General hospitals are significant players in the market. It provides a wide range of medical services and has specialized departments and interventional suites where peripheral vascular procedures, including stent placement, are performed. With the growth of telemedicine, healthcare facilities, including hospitals and cardiac centers, have incorporated telehealth services for consultations, follow-ups, and remote monitoring of patients who have undergone peripheral vascular stent procedures.

On the basis of product, the market is divided into iliac artery stents, femoral artery stents, carotid artery stents, renal artery stents, and other. The femoral artery stents segment garnered a significant revenue share in the market in 2022. The prevalence of PAD and other vascular diseases affecting the femoral arteries is on the rise, driven by factors such as an aging population and the increasing incidence of risk factors like diabetes and obesity. This growing patient population creates a higher demand for femoral artery stents. Femoral artery stent placement is a minimally invasive procedure that can be performed through a small incision. As patients and healthcare providers increasingly prefer minimally invasive treatments over open surgery, the demand for femoral artery stents grows.

By stents type, the market is categorized into drug eluting stents (DES), bare metal stents (BMS), and bioabsorbable stents. In 2022, the drug eluting stents (DES) segment held the highest revenue share in the market. Compared to bare metal stents (BMS), drug-eluting stents (DES) can reduce restenosis rates. The capability of DES to reduce the incidence of major adverse cardiac events (MACE) is a critical factor in their widespread adoption. The stent's medication coating lowers the risk of clot formation by preventing stent thrombosis. This improves patient safety and overall survival rates by reducing the frequency of heart attacks, strokes, and other cardiovascular events.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 1.5 Billion |

| Market size forecast in 2030 | USD 2.7 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 7.4% from 2023 to 2030 |

| Number of Pages | 469 |

| Number of Table | 890 |

| Quantitative Data | Volume in Thousand Units, Revenue in USD Million, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Stents Type, End Use, Product, Mode of Delivery, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. North America has a well-established healthcare infrastructure, including cutting-edge medical facilities and competent healthcare professionals. This infrastructure facilitates diagnosing and treating cardiovascular diseases, making peripheral vascular stents accessible to regional patients.

Free Valuable Insights: Global Peripheral Vascular Stents Market size to reach USD 2.7 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Boston Scientific Corporation, Medtronic PLC, Terumo Corporation, Abbott Laboratories, Biotronik SE & Co. KG, Stryker Corporation, Cook Medical, Inc. (Cook Group), MicroPort Scientific Corporation, LifeTech Scientific Corporation and iVascular S.L.U.

By Mode of Delivery (Volume, Thousand Units, USD Million, 2019-2030)

By End-use (Volume, Thousand Units, USD Million, 2019-2030)

By Product (Volume, Thousand Units, USD Million, 2019-2030)

By Stents Type (Volume, Thousand Units, USD Million, 2019-2030)

By Geography (Volume, Thousand Units, USD Million, 2019-2030)

This Market size is expected to reach $2.7 billion by 2030.

Rising global aging population are driving the Market in coming years, however, Increasing need for healthcare cost containment restraints the growth of the Market.

Boston Scientific Corporation, Medtronic PLC, Terumo Corporation, Abbott Laboratories, Biotronik SE & Co. KG, Stryker Corporation, Cook Medical, Inc. (Cook Group), MicroPort Scientific Corporation, LifeTech Scientific Corporation and iVascular S.L.U.

In the year 2022, the market attained a volume of 2,468.7 thousand units, experiencing a growth of 6.8% (2019-2022).

The Iliac Artery Stents segment is leading the Market by Product in 2022; thereby, achieving a market value of $896.8 million by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $1.0 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.