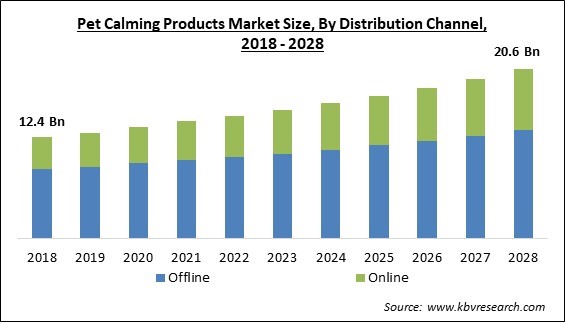

The Global Pet Calming Products Market size is expected to reach $20.6 billion by 2028, rising at a market growth of 5.6% CAGR during the forecast period.

Awareness that dogs, like people, may feel stress, anxiety, and behavioral disorders has increased the number of pet owners seeking remedies to assist their pets in managing these conditions. In turn, this increases the need for pet-calming products. Lifestyle changes, the humanization of pets, the influence of the pandemic on human-animal relationships, and the efficacy of the products are all significant market drivers.

Pets get anxious, just like people do. Even though it’s not fun, anxiety is a normal and healthy feeling. All dog breeds can get nervous, but each dog may feel it differently. Even though all dogs sometimes worry, a dog with too much worry could develop an anxiety disorder if it isn’t treated. If one doesn’t deal with a dog’s anxiety, it can lead to behavioral and other problems.

Pets can be anxious for several different reasons. Anxiety in dogs is usually caused by fear, being alone, or getting older. Loud noises, strange people or animals, visual cues like hats or umbrellas, new or strange places, specific situations like going to the vet or riding in a car, and surfaces like grass and wood floors can all cause fear-based anxiety. Although certain pets may react briefly to these things, they may have a bigger effect on already nervous dogs.

It is believed that some dogs suffer from separation anxiety. Dogs suffering from separation anxiety cannot find solace when left alone or separated from their family. This anxiousness frequently shows as unwanted behaviors, such as peeing and defecating in the home, trashing furniture and furnishings, and barking.

During the COVID-19, the outbreak impacted nearly every business significantly. The economy around the world was negatively impacted by the pandemic, which interrupted the majority of veterinary medicine production businesses. COVID-19 has reduced veterinary activities such as continuous immunization and routine health checks. The reduced checkups and availability of veterinaries and the professional diagnosis of anxiety in pets, combined with the minimal production of these pet calming products, declined the market growth in the initial phase of the pandemic.

Cats and dogs are among the most prevalent domesticated animals for human companionship, and their relationships with humans often confer mental health advantages on both parties. In response to the spread of COVID-19, social distancing measures such as the working-from-home policy have been strengthened globally. Coupled with a rise in unemployment, the average number of hours spent at home per day by the general population has grown significantly, which has given a rise in dog and cat adoptions from animal shelters. Hence, this is boosting the market growth.

In recent decades, as the "humanization" of pets has expanded, so has the amount spent by consumers on their pets' healthcare. This rise in pet ownership gives the pet-care ecosystem, which involves retail chains, food and services for pets, and pet care services, the boost it needs. Also, more and more people think of their pets as a member of the family and choose products based on what their dogs need. Thus, with the usage of organic and high-quality pet care products, the market for pet calming products is expected to surge.

Small and medium-sized livestock enterprises frequently lack the financial resources to pay for veterinary treatment, which reduces demand and makes it difficult for veterinary clinics to stay profitable. The low demand for veterinary services shows that it is difficult or impossible for rural veterinarians to earn a living owing to the volume of business. Thus, professionals hesitate to purchase or develop new enterprises in these industries. The scarcity of veterinarians from the aforementioned factors prominently in remote regions, will limit the market's growth as there will be no proper diagnosis or treatment for issues like anxiety.

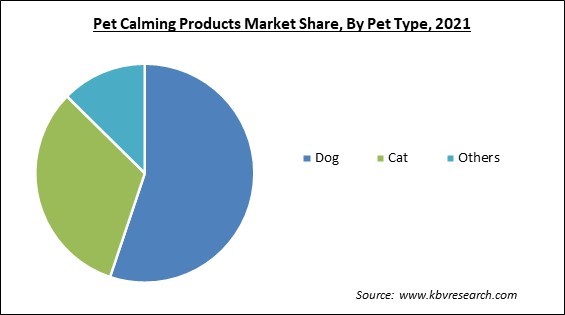

Based on pet type, the pet calming products market is segmented into dog, cat and others. This is because dogs are the most common pet in the world, with one in three families having one. The combination of more excellent knowledge of pet anxiety, increasing pet ownership, lifestyle changes, and a desire for natural therapies has increased the demand for pet calming solutions for dogs. Since individuals have become more active and busier, they are increasingly bringing their dogs to work, vacations, and social activities, which can be the cause for increased anxiety attacks in dogs and high demand for these products, thereby surging the segment's growth.

On the basis of Type, the pet calming products market is divided into food & supplements, snacks & treats, gel & ointment, spray & mist and others. The snacks & treats segment held the highest revenue share in the pet calming market in 2021. This is because these items are simple to administer to pets and may be added to their usual diet. These may be given to pets as a reward or a means to calm them down in stressful situations without specific equipment or training. In addition, several pet-soothing snacks and treats contain natural substances with relaxing characteristics, such as herbs, vitamins, and minerals.

By distribution channel, the pet calming products market is classified into offline and online. The online segment garnered a prominent revenue share in the pet calming market in 2021. This is because internet retailers provide ease of shopping at any time and from any location. This is particularly useful for consumers who reside in remote places or are too busy to visit physical establishments during business hours. Also, many online stores provide lucrative discounts and offers, which attracts many people to this distribution channel.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 14.3 Billion |

| Market size forecast in 2028 | USD 20.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.6% from 2022 to 2028 |

| Number of Pages | 199 |

| Number of Table | 359 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Distribution Channel, Type, Pet Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the pet calming products market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region registered the highest revenue share in the pet calming market in 2021. This is owing to the increasing pet ownership rates, which have raised demands for such products. In addition, pet owners in this region are spending a huge sum of money on non-veterinary services, like grooming, insurance, boarding, and training. Increasing urbanization, demanding schedules, and increased knowledge and education regarding calming pet solutions are significant drivers boosting the market growth in this region.

Free Valuable Insights: Global Pet Calming Products Market size to reach USD 20.6 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Virbac, Zoetis, Inc., Ceva Santé Animale, NOW Foods, Inc., PetHonesty (Vestar Capital Partners), Nestlé Purina Petcare Company (Nestle S.A), PetIQ, Inc., Swedencare (Garmon Corporation) and Health & Happiness (H&H) Group International Holdings Ltd. (Zesty Paws)

By Pet Type

By Distribution Channel

By Type

By Geography

The global Pet Calming Products Market size is expected to reach $20.6 billion by 2028.

The usage of organic and premium products are driving the market in coming years, however, Lack of professional veterinarians especially in remote areas restraints the growth of the market.

Virbac, Zoetis, Inc., Ceva Santé Animale, NOW Foods, Inc., PetHonesty (Vestar Capital Partners), Nestlé Purina Petcare Company (Nestle S.A), PetIQ, Inc., Swedencare (Garmon Corporation) and Health & Happiness (H&H) Group International Holdings Ltd. (Zesty Paws)

The Offline segment acquired maximum revenue share in the Global Pet Calming Products Market by Distribution Channel in 2021 thereby, achieving a market value of $13.2 billion by 2028.

The North America market dominated the Global Pet Calming Products Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $7.9 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.