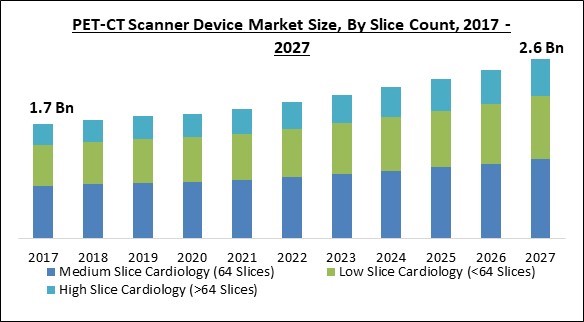

The Global PET-CT Scanner Device Market size is expected to reach $2.6 billion by 2027, rising at a market growth of 5.5% CAGR during the forecast period.

PET imaging or a PET scan is another name for positron emission tomography, which is a sort of nuclear medicine imaging. It evaluates organ and tissue functions using small amounts of radioactive materials called radiotracers or radiopharmaceuticals, a special camera, and a computer. In addition, by detecting changes at the cellular level, it can detect the early onset of disease before other imaging tests. Moreover, it can detect heart illness, cancer, gastrointestinal, endocrine, and neurological issues, among other conditions. The radiotracers utilized in it tend to accumulate in tumors or inflammatory areas and bind to certain proteins in the body.

PET-CT, which is regarded as a high-end technique, has gained widespread adoption because of its excellent quality, accuracy, precision, and versatility in diagnosis. Additionally, the integration of PET and CT in a single system is seen as an advancement in imaging technology, as the combination of two well-established modalities provides greater benefits than the sum of their parts. Moreover, CT scanners provide high-resolution images of the anatomy.

Also, malignant disorders can only be detected with this technique, starting with observing changes in lymph node size or the existence of aberrant masses. On the other hand, for a lymph node that is normal in size, PET can completely identify a functional anomaly. As a result, combining PET/CT systems allows for a better functional assessment of anatomical scan abnormalities as well as improved spatial localization of functional abnormalities.

PET imaging allows researchers to track COVID-19's key pathophysiological changes at the molecular level, providing crucial information for the disease's subsequent diagnosis, evaluation, and treatment. The most widely employed PET imaging agent in COVID-19 patients is F-labeled fluorodeoxyglucose (18F-FDG), a radiolabeled glucose analog, and the integrated PET/CT system can be used to evaluate the functional and structural alterations of COVID-19 at the same time. In addition, the adoption of devices in the diagnosis and evaluation of the COVID-19 fueled the demand for these devices during the pandemic period. Moreover, cancer patients who receive radiation therapy have a higher risk of developing a more serious condition.

In the last couple of years, there has been a rising prevalence of infectious and chronic diseases such as cancer and heart disease around the world, as well as increased demand for better diagnostic technologies. Globally, an estimated 14.1 million new cancer cases were recorded in 2012, according to the International Agency for Research on Cancer (IARC). Among these, Lung cancer (13%) was the most prevalent type, followed by breast cancer (11.9%) and colorectal cancer (11.9%). (9.7 percent). In addition, increased cases of brain diseases including Alzheimer's and traumatic brain injury are fueling market expansion. Moreover, the number of newly diagnosed cancer cases and cancer fatalities across the world would increase significantly. Furthermore, Scanner advancements now allow for better localization of activity to normal vs. aberrant structures, as well as faster scan times than earlier versions.

PET-only scanners had an equivalent of extremely crude built-in CT scanners that used PET detectors such as crude CT detectors prior to the advent of PET/CT systems. The pictures produced by these CT-equivalent systems were non-diagnostic and highly sluggish. Furthermore, they exposed patients to more radiation. Hence, Correction images exposure was introduced into PET/CT systems. Moreover, PET/CT scanners are also quicker, which helps to eliminate motion artifacts. Because of the unique combination of functional information received with PET and anatomic information gathered with CT, PET/CT systems have seen an increase in usage since their introduction into clinical practice.

One of the biggest challenges faced by the industry players is high maintenance and installation costs of these systems. Due to the considerable capital necessary for the latest technology, and with a huge and controlled refurbished systems business, especially in developing nations has hampered the adoption of new and innovative systems. In addition, major global and domestic players have entered this profitable industry, offering refurbished equipment to healthcare facilities around the world at inexpensive pricing. Moreover, Healthcare institutions prefer low-cost reconditioned equipment over new products. Further, there are unsupportive healthcare reimbursement scenarios in many countries. Globally, decreased payer reimbursement for PET and SPECT procedures has resulted in a drop in outpatient volumes, limiting patient access to high-quality, low-cost imaging and diagnostic services.

Based on Slice Count, the market is segmented into Medium Slice Cardiology (64 Slices), Low Slice Cardiology (<64 Slices), and High Slice Cardiology (>64 Slices). The Low Slice Cardiology (<64 Slices) segment obtained a significant revenue share of the PET-CT Scanner Device Market. This is due to the high occurrence of medical implants, shifting food habits, and acceptance of sedentary lifestyles. Moreover, constant developments in imaging devices with the help of R&D efforts would drive the growth of the segment during the forecasting period.

Based on Isotope/Detector Type, the market is segmented into Flurodeoxyglucose (FDG), 62Cu ATSM, 18 F Sodium Fluoride, FMISO, Gallium, Thallium, and Others. In 2020, the Flurodeoxyglucose (FDG) segment obtained the highest revenue share of the PET-CT Scanner Devices Market. F-18 fluorodeoxyglucose (FDG), for example, is a common radiotracer that is absorbed by cancer cells. This is because of the increasing number of FDG applications, a decrease in the number of FDG adverse effects, and an increase in the incidence of chronic diseases. Moreover, it provides a number of advantages, including the ability to provide more detail with a higher level of accuracy.

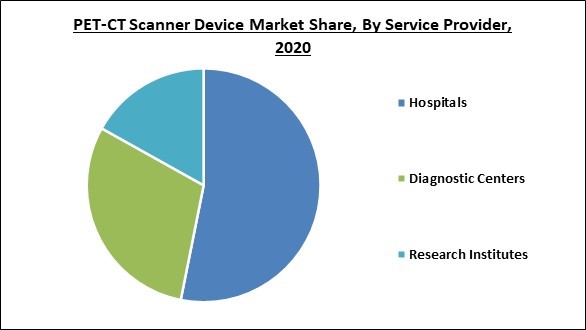

Based on Service Provider, the market is segmented into Hospitals, Diagnostic Centers, and Research Institutes. In 2020, the Hospitals segment collected the maximum revenue share of the PET-CT Scanner Device Market. This is due to an increase in the number of hospitals, a surge in patient awareness toward treatment in hospitals, increased healthcare infrastructure, and increased adoption of PET-CT scanner devices.

Based on Type, the market is segmented into Stationary Scanners and Portable Scanners/Mobile Scanners. The Portable Scanners/Mobile Scanners segment held a significant revenue share of the PET-CT Scanner Device Market. This is because small and medium-sized healthcare organizations are increasingly turning to mobile devices. Moreover, lower expenses, faster installation time, cheap initial investment, and reduced patient travel are some of the advantages of the mobile device category. Leading manufacturers such as GE, Philips, and Siemens provide a variety of portable PET-CT scanners.

Based on Application, the market is segmented into Oncology, Cardiology, Neurology, and Others. In 2020, the Cardiology segment obtained a significant revenue share of the PET-CT Scanner Device Market. A cardiac positron emission tomography (PET) scan uses a small quantity of radioactivity to examine the heart muscle. When compared to conventional nuclear stress testing methods, cardiac PET/CT provides higher accuracy, reduced radiation, and increased efficiency in the diagnosis of coronary artery disease (SPECT). Patients with a high body mass index, or BMI, or a considerable amount of breast/chest wall tissue, breast implants, or pleural or pericardial effusions may benefit from cardiac PET/CT.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 1.8 Billion |

| Market size forecast in 2027 | USD 2.6 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 5.5% from 2021 to 2027 |

| Number of Pages | 328 |

| Number of Tables | 573 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Slice Count, Isotope/Detector Type, Service Provider, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2020, the North America emerged as the leading region in the overall PET-CT Scanner Device Market. This is due to an increase in the number of chronic disease patients, an increase in the demand for PET-CT scan devices, the availability of advanced healthcare facilities with trained medical professionals, an increase in the number of R&D activities with a large presence of key players, and an increase in government investment in the healthcare system.

Free Valuable Insights: Global PET-CT Scanner Device Market size to reach USD 2.6 Billion by 2027

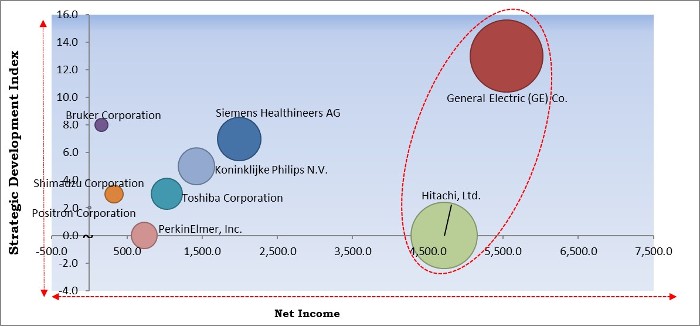

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; General Electric (GE) Co. and Hitachi, Ltd. are the forerunners in the PET-CT Scanner Device Market. Companies such as Bruker Corporation, Toshiba Corporation, and Siemens Healthineers AG are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Bruker Corporation, Toshiba Corporation, Siemens Healthineers AG (Siemens AG), General Electric (GE) Co. (GE Healthcare), Koninklijke Philips N.V., Shimadzu Corporation, Positron Corporation, PerkinElmer, Inc., Mediso Ltd., and Hitachi, Ltd. (Hitachi Healthcare).

By Slice Count

By Isotope/Detector Type

By Service Provider

By Type

By Application

By Geography

The global PET-CT scanner device market size is expected to reach $2.6 billion by 2027.

The rise in deployment of PET/CT systems in clinical applications are driving the market in coming years, however, high Installation & Maintenance Costs limited the growth of the market.

Bruker Corporation, Toshiba Corporation, Siemens Healthineers AG (Siemens AG), General Electric (GE) Co. (GE Healthcare), Koninklijke Philips N.V., Shimadzu Corporation, Positron Corporation, PerkinElmer, Inc., Mediso Ltd., and Hitachi, Ltd. (Hitachi Healthcare).

The Oncology segment has acquired high revenue in the Global PET-CT Scanner Device Market by Application in 2020, thereby, achieving a market value of $1.1 billion by 2027.

The North America is the fastest growing region in the Global PET-CT Scanner Device Market by Region in 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.