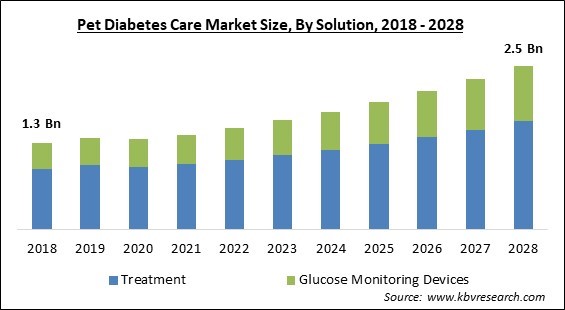

The Global Pet Diabetes Care Market size is expected to reach $2.5 billion by 2028, rising at a market growth of 8.3% CAGR during the forecast period.

Diabetes in animals is brought on by a complete lack of relevant insulin or a poor biological reaction to it. The pancreas secretes insulin, which regulates blood glucose levels. The food that is consumed is broken down into several different substances, including glucose, which is subsequently transported by insulin to the cells and used as energy. Restricted glucose transport to the cells is caused by a lack of insulin synthesis. This causes the cells to operate improperly, and the tissue becomes energy-starved. As a result of this metabolic famine, the liver begins to metabolise extra sugar that has been accumulated in the liver, muscles, and fat cells.

Diabetes is a metabolic condition that frequently affects elderly pets, though it can also occur in younger animals. Unlike humans, some pets are genetically predisposed to acquiring diabetes; yet, obesity raises the risk of diabetes in animals. Since pet diabetes cannot be treated, growing efforts are being made to manage it as best as possible by pet owners and major players in the market for pet diabetic care equipment. The quality of life for pets with diabetes is unaffected by proper management and care. Diabetes in pets typically requires lifelong management, including a healthy exercise programme, a special diet, and, notably in dogs, daily insulin injections.

The incidence and increasing health conditions of the disease, supportive awareness campaigns launched by governments, tactics adopted by significant companies, and an increase in the number of companion animals and pet adoptions are all contributing causes. For example, Boehringer Ingelheim International overcame the pandemic hurdles by taking extensive measures and successfully maintaining its animal health business. The rising adoption of pet insurance, increasing costs for veterinary care, the return to normalcy following the pandemic, R&D initiatives by important corporations, and advancements in pet diabetic care devices are a few of the major factors fueling the expansion.

The COVID-19 pandemic's advent has sharply raised public healthcare concerns that have an effect on the world economy. Numerous local and national regulatory organizations were identified to place limitations on the movement of products and individuals as the cases were reported to increase. Supply chain difficulties were found to have an impact on the total sales of the devices for treating pet diabetes with the arrival of the COVID-19 pandemic. Nevertheless, this was largely offset by the rise in demand from pet owners who wanted to stock up on important pet care items like diabetic devices for pets. Revenue in the pet diabetes care industry have decreased as a result of the COVID-19 pandemic, particularly in 2020.

The amount spent on pet care has dramatically grown as a result of an increase in pet adoption for companionship and safety-related reasons. The majority of pet owners are known to treat their animals with the highest care and regard them to be family members, which drives up the cost of pet care. The population of pet is constantly increasing across various nations of the world, which is creating opportunities for the pet care companies.

Ketoacidosis, cataracts, and kidney failure can develop in dogs with diabetes if it is not addressed. Chronic pancreatitis, nerve deterioration and ketoacidosis can all occur in diabetic cats. Early detection and treatment are so crucial. As per Vetsource, the lifetime prevalence of diabetes is currently 1 in 300 dogs and 1 in 230 cats, and these numbers are steadily rising. According to the 2016 State of Pet Health Report, over a ten-year period, the disease's prevalence increased by over 80% in dogs and 18% in cats.

Although diabetes in pets is a serious disease that could be treated with medication, it could be effectively recognized early and controlled with a veterinarian's advice, correct care, food, and exercise, assuring a long and healthy life. But, routine medication in animals has a number of undesirable side effects. Also, it has been noted that diabetic pets are more susceptible to various infections. High sugar levels may result in cataract, which may impair a pet's ability to smell, hear, and see. Urinary tract infections are also at risk due to elevated blood sugar levels.

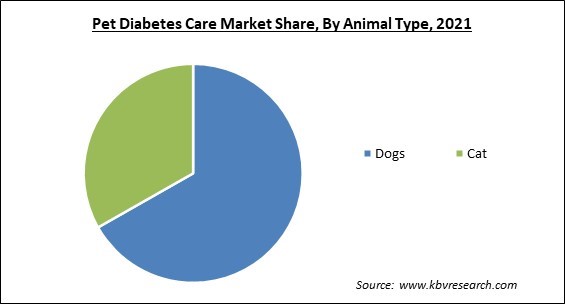

On the basis of animal type, the pet diabetes care market is segmented into Dogs and Cats. The cats segment procured a significant revenue share in the pet diabetes care market in 2021. It is because more pet owners are becoming aware of the signs of diabetes in their cats. Another element driving expansion is the rising incidence of diabetes among cats. For example, relative to dogs, cats are three times more likely to develop diabetes, as per Boehringer Ingelheim International GmbH.

On the basis of animal type, the pet diabetes care market is segmented into Dogs and Cats. The cats segment procured a significant revenue share in the pet diabetes care market in 2021. It is because more pet owners are becoming aware of the signs of diabetes in their cats. Another element driving expansion is the rising incidence of diabetes among cats. For example, relative to dogs, cats are three times more likely to develop diabetes, as per Boehringer Ingelheim International GmbH.

Based on solution, the pet diabetes care market is divided into Treatment (Insulin Therapy, Insulin Delivery Devices and Other Treatments) and Glucose Monitoring Devices. Under treatment segment, the insulin therapy segment witnessed the largest revenue share in the pet diabetes care market in 2021. Since insulin therapy helps the body transport glucose from eaten food to other parts, it is preferred by veterinarians as that of the gold standard treatment for diabetes in pets. Given that needles could not be reused, veterinary clinics and homes have a high need for insulin delivery devices such needles, syringes, and delivery pens.

By distribution channel, the pet diabetes care market is fragmented into Veterinary Hospitals & Clinics, Retail Pharmacies and E-commerce. E-commerce segment recorded a significant revenue share in pet diabetes care market in 2021. Pet glucometers & insulin products are becoming more and more in demand as the number of families with companion animals rises. In retail vet pharmacies, a variety of brands of glucose monitors and insulin delivery pens are offered for the treatment of diabetes in companion animals. During the COVID-19 pandemic, pet diabetes products have seen significant growth in online sales.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.4 Billion |

| Market size forecast in 2028 | USD 2.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 8.3% from 2022 to 2028 |

| Number of Pages | 227 |

| Number of Tables | 420 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Animal Type, Distribution Channel, Solution, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the pet diabetes care market is analyzed across North America, Europe, Asia Pacific and LAMEA. North America emerged as the leading region with the maximum revenue share in the pet diabetes care market in 2021. The large presence of key businesses, the adoption of various methods developed by key corporations to expand market penetration, the rising accessibility of treatment, the increasing diagnostic rates, and the growing pet population and spending all contribute to the region's high share. Another factor boosting the market's growth is the rise in the number of veterinary clinics with qualified veterinarians across the globe.

Free Valuable Insights: Global Pet Diabetes Care Market size to reach USD 2.5 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Boehringer Ingelheim International GmbH, Becton, Dickinson and Company, Merck & Co., Inc., Zoetis, Inc., ACON Laboratories, Inc., Allison Medical, Inc., i-SENS, Inc., Trividia Health, Inc., UltiMed, Inc., and Taidoc Technology Corporation.

By Animal Type

By Distribution Channel

By Solution

By Geography

The Pet Diabetes Care Market size is projected to reach USD 2.5 billion by 2028.

Growing Adoption Of Pets Among Population are driving the market in coming years, however, Low Awareness Among People About Proper Pet Diabetes Management restraints the growth of the market.

Boehringer Ingelheim International GmbH, Becton, Dickinson and Company, Merck & Co., Inc., Zoetis, Inc., ACON Laboratories, Inc., Allison Medical, Inc., i-SENS, Inc., Trividia Health, Inc., UltiMed, Inc., and Taidoc Technology Corporation.

The Treatment segment acquired maximum revenue share in the Global Pet Diabetes Care Market by Solution in 2021 thereby, achieving a market value of $1.6 billion by 2028.

The Dogs segment is leading the Global Pet Diabetes Care Market by Animal Type in 2021 thereby, achieving a market value of $1.5 billion by 2028.

The North America market dominated the Global Pet Diabetes Care Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $879.5 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.