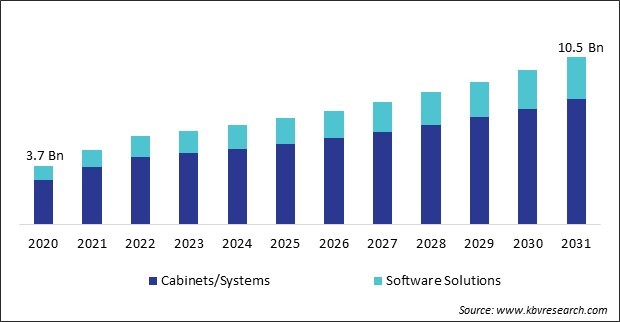

“Global Pharmacy Inventory Management Software Solutions and Cabinets Market to reach a market value of 10.5 Billion by 2031 growing at a CAGR of 7.7%”

The Global Pharmacy Inventory Management Software Solutions And Cabinets Market size is expected to reach $10.5 billion by 2031, rising at a market growth of 7.7% CAGR during the forecast period.

Governments throughout the Asia Pacific region is investing in healthcare IT infrastructure, and pharmacies are implementing cutting-edge technologies to accommodate the evolving needs of their populations. As healthcare demands grow, the need for advanced pharmacy inventory management solutions and cabinets has become more apparent to ensure efficiency, minimize wastage, and maintain adequate medication stock levels. Thus, the Asia Pacific region acquired 25% revenue share in the market 2023.

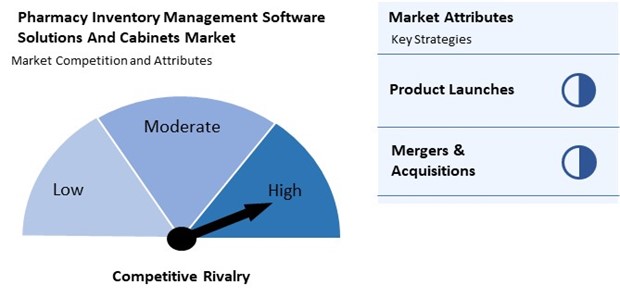

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In August, 2024, Omnicell, Inc. unveiled Central Med Automation Service, a subscription-based solution designed to optimize centralized medication management for health systems. It integrates robotics, smart devices, and intelligent software to streamline medication dispensing across care sites, enhancing inventory visibility, scalability, and patient safety while supporting centralized pharmacy operations. Additionally, In April, 2024, Cardinal Health, Inc. unveiled the KL1Plus pharmacy prescription filling device with its innovative Aura platform, boosting efficiency in prescription fulfillment. This upgraded device features a new user interface and intuitive prompts for faster operation, alongside OTA software updates to maintain optimal performance for retail and hospital outpatient pharmacies.

Based on the Analysis presented in the KBV Cardinal matrix; Oracle Corporation is the forerunner in the Pharmacy Inventory Management Software Solutions And Cabinets Market. In September, 2024, Oracle Corporation unveiled a new replenishment solution in its Fusion Cloud SCM to enhance inventory management for healthcare customers. The RFID for Replenishment solution, integrating technologies from Avery Dennison, Terso Solutions, and Zebra Technologies, automates stock tracking and replenishment, improving productivity and ensuring supplies are readily available for clinicians. Companies such as Becton, Dickinson and Company, McKesson Corporation, and Cardinal Health, Inc. are some of the key innovators in Pharmacy Inventory Management Software Solutions And Cabinets Market.

Pharmacies began to recognize the value of automation for managing inventory efficiently, forecasting demand, and maintaining adequate stock levels during times of uncertainty. The shift towards contactless healthcare also contributed to the market's growth, as pharmacies needed systems that could manage inventory for both in-store and online channels. Automated cabinets enabled secure, contactless medication dispensing, reducing the risk of virus transmission and improving operational efficiency. Thus, the pandemic had an overall negative impact on the market.

Inventory management software helps pharmacies stay compliant by maintaining accurate records of drug transactions, including details about dispensing, returns, and disposal. This ensures that pharmacies meet regulatory requirements related to drug traceability and reporting. For example, in the United States, compliance with the Drug Supply Chain Security Act (DSCSA) mandates that pharmacies must have traceability systems. Automated inventory solutions help meet such regulatory requirements, reducing the risk of penalties and improving patient safety.

Additionally, these systems enable better coordination between retail pharmacies and their suppliers, ensuring that medications are delivered on time and that any supply chain disruptions are minimized. Thus, expanding retail pharmacy chains has driven the need for pharmacy inventory management software solutions and cabinets.

With rapid technological advancements, inventory management software needs regular updates to keep up with new features, improve efficiency, and address emerging security threats. However, these upgrades often come at an additional cost through subscription fees or as a one-time payment. Hence, these financial limitations prevent pharmacies from embracing inventory management solutions, ultimately restricting the market's growth.

Based on type, the market is bifurcated into cabinets/systems and software solutions. The cabinets/systems segment garnered 77% revenue share in the market in 2023. This can be attributed to the greater use of mechanized cabinets in pharmacies, particularly hospitals, to ensure the secure storage and management of medications.

By end use, the market is divided into independent pharmacies, LTC, and hospital pharmacies. The independent pharmacies segment witnessed 39% revenue share in the market in 2023. Independent pharmacies, often community-based and operating on smaller scales than hospital pharmacies, increasingly adopt inventory management solutions to optimize their operations.

On the basis of mode of operations, the market is classified into centralized and decentralized. The decentralized segment acquired 54% revenue share in the market in 2023. Decentralized systems are designed to manage inventory at multiple points of care, such as hospital wards, satellite pharmacies, or individual clinics, rather than relying on a single central pharmacy.

Free Valuable Insights: Global Pharmacy Inventory Management Software Solutions and Cabinets Market size to reach USD 10.5 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment acquired 29% revenue share in the market in 2023. This growth is driven by factors such as the increasing emphasis on patient safety, rising healthcare expenditure, and supportive government initiatives promoting digital transformation in healthcare.

The Pharmacy Inventory Management Software Solutions and Cabinets Market is highly competitive, driven by technological advancements and rising demand for automation in healthcare. Key market players focus on enhancing software functionality and integrating cloud-based solutions for real-time inventory tracking and medication dispensing. Companies also emphasize data security, interoperability, and compliance with healthcare regulations. The market attributes include scalability, ease of use, and integration capabilities with existing systems. Major players like Omnicell and McKesson lead the market with innovative and customizable solutions.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 5.9 Billion |

| Market size forecast in 2031 | USD 10.5 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 7.7% from 2024 to 2031 |

| Number of Pages | 229 |

| Tables | 332 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, End Use, Mode of Operations, Region |

| Country scope |

|

| Companies Included | ARxIUM, Inc., Epicor Software Corporation, Omnicell, Inc., McKesson Corporation, Becton, Dickinson and Company, Cardinal Health, Inc., Oracle Corporation (Cerner Corporation), Capsa Healthcare LLC, Accu-Chart Plus Healthcare Systems, Inc., and ScriptPro, LLC |

By Type

By End Use

By Mode of Operations

By Geography

This Market size is expected to reach $10.5 billion by 2031.

Rising demand for automated solutions are driving the Market in coming years, however, High initial costs and maintenance expenses restraints the growth of the Market.

ARxIUM, Inc., Epicor Software Corporation, Omnicell, Inc., McKesson Corporation, Becton, Dickinson and Company, Cardinal Health, Inc., Oracle Corporation (Cerner Corporation), Capsa Healthcare LLC, Accu-Chart Plus Healthcare Systems, Inc., and ScriptPro, LLC

The expected CAGR of this Market is 7.7% from 2024 to 2031.

The Decentralized segment is leading the Market by Mode of Operations in 2023; thereby, achieving a market value of $5.5 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $4.2 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges