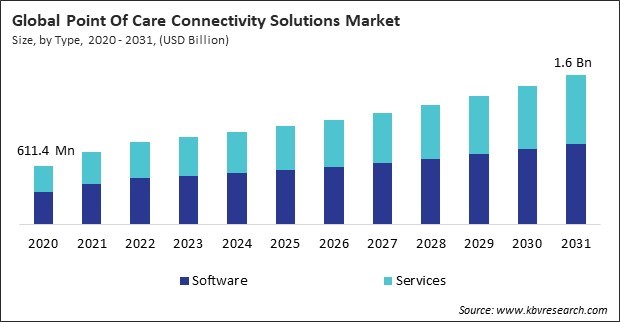

“Global Point Of Care Connectivity Solutions Market to reach a market value of 1.6 Billion by 2031 growing at a CAGR of 7.1%”

The Global Point Of Care Connectivity Solutions Market size is expected to reach $1.6 billion by 2031, rising at a market growth of 7.1% CAGR during the forecast period.

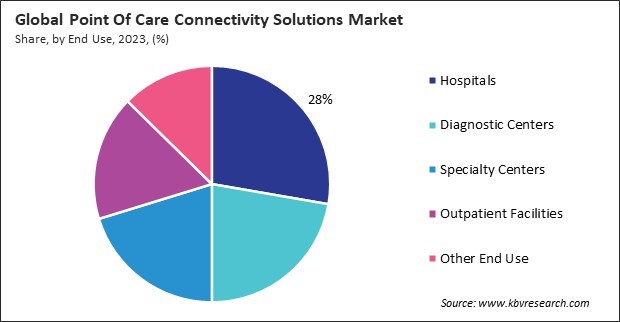

Diagnostic centers are critical in providing timely and accurate diagnostic services, and the adoption of connectivity solutions enhances their operational efficiency and diagnostic capabilities. Hence, the diagnostic centers segment procured 22% revenue share in the market in 2023. These solutions enable seamless data transfer and communication between diagnostic equipment and healthcare professionals, ensuring accurate and swift diagnostic results. The rising demand for diagnostic services and the ongoing advancements in diagnostic technologies drive the notable revenue share of the diagnostic centers segment.

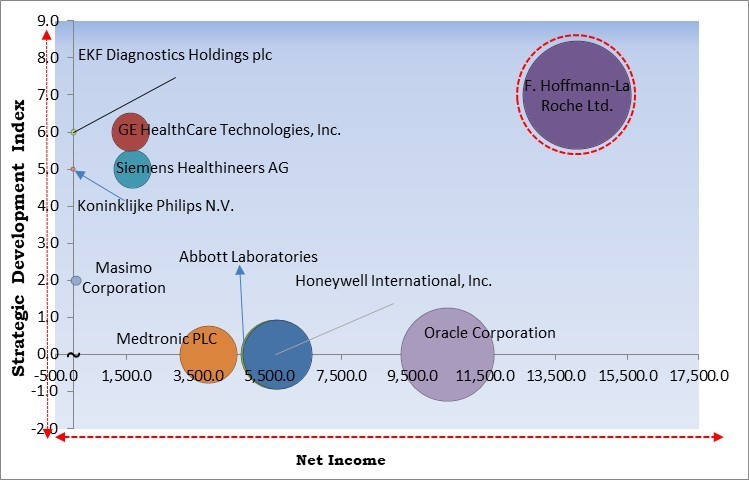

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In July, 2024, Siemens Healthineers AG unveiled the next-generation Atellica DCA Analyser, which enhances diabetes care by enabling rapid HbA1c and ACR testing at the point of care. Additionally, In November, 2023, Masimo Corporation teamed up with GE HealthCare, a health technology and consumer electronics company to integrate Masimo Signal Extraction Technology into GE’s Portrait Mobile patient monitoring solution.

Based on the Analysis presented in the KBV Cardinal matrix; F. Hoffmann-La Roche Ltd. is the forerunner in the Point Of Care Connectivity Solutions Market. In June, 2022, F. Hoffmann-La Roche Ltd. unveiled the BenchMark ULTRA PLUS, an advanced tissue staining platform that delivers quick, accurate test results for cancer diagnostics. Companies such as Siemens Healthineers AG (Siemens AG), and GE HealthCare Technologies, Inc. are some of the key innovators in Point Of Care Connectivity Solutions Market.

The pandemic led to the postponement of non-essential medical procedures and routine check-ups, resulting in a reduced demand for Point of Care (POC) connectivity solutions during the peak of the crisis. There were significant disruptions in global supply chains, affecting the production and distribution of medical devices and connectivity solutions. This resulted in delays and shortages in available products. Many healthcare facilities faced budget constraints due to increased expenses related to pandemic response efforts. As a result, investments in new technologies, including POC connectivity solutions, were deprioritized. Thus, the COVID-19 pandemic had a positive impact on the market.

RPM allows healthcare providers to continuously monitor patients’ vital signs and health conditions. This ongoing oversight can lead to quicker diagnoses and timely interventions, ultimately improving patient outcomes. As healthcare systems focus on quality of care, the demand for connectivity solutions that support RPM is expected to rise. RPM fosters patient engagement by enabling individuals to track their health metrics, such as blood glucose levels, heart rates, and physical activity. This integration enhances the overall patient experience and further accelerates demand. In conclusion, increasing demand for remote patient monitoring drives the market's growth.

The patient-centric approach emphasizes active patient participation in their own healthcare decisions. Point of care connectivity solutions enable this engagement by providing patients with access to medical data, treatment plans, and educational resources. As patients become more informed and involved in their care, the demand for solutions that support this engagement rises. Patient-centric care tailors healthcare services to individual needs, preferences, and circumstances. This capability is particularly valuable for managing chronic diseases, driving demand for robust connectivity solutions. Thus, an enhanced focus on patient-centric care propels the market's growth.

Implementing point of care connectivity solutions often requires substantial upfront capital investment. Healthcare facilities must purchase hardware, software, and network infrastructure, which can be prohibitively expensive, especially for smaller institutions or practices. The high initial costs can deter potential adopters from investing in these technologies, slowing market penetration. Organizations must allocate additional resources for change management to ensure staff adoption, which can strain budgets and extend timelines for implementation. In conclusion, high initial investment and implementation costs drive the market's growth.

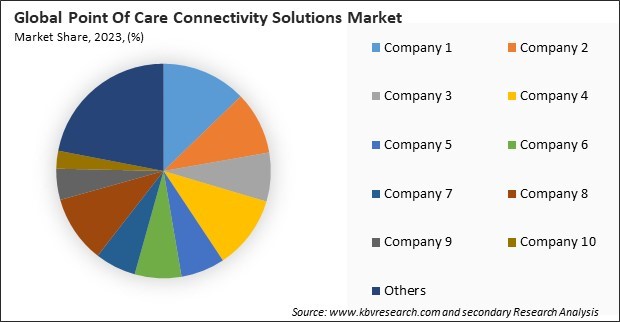

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

On the basis of application, the market is segmented into glucose monitoring, coagulation monitoring, electrolyte and blood gas analysis, infectious disease devices, cardio metabolic monitoring, hematology, and others. The hematology segment recorded 26% revenue share in the market in 2023. This dominance can be attributed to the high demand for connectivity solutions in hematology to manage and analyze blood-related diagnostics, which are critical in various medical conditions and treatments.

By end use, the market is divided into hospitals, diagnostic centers, specialty centers, outpatient facilities, and others. In 2023, the specialty centers segment held 20% revenue share in the market. Specialty centers, which focus on specific areas of healthcare such as oncology, cardiology, and orthopaedics, require advanced connectivity solutions to manage complex patient data and provide specialized care. Implementing point-of-care connectivity solutions in these centers enables precise and efficient data administration, improving patient outcomes and increasing operational efficiency.

Based on type, the market is bifurcated into services and software. In 2023, the software segment garnered 56% revenue share in the market. The software segment emerged as the dominant force in the market, garnering the highest revenue share. This can be attributed to the increasing demand for advanced software solutions that enhance the efficiency and effectiveness of point of care services.

Free Valuable Insights: Global Point Of Care Connectivity Solutions Market size to reach USD 1.6 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 36% revenue share in the market in 2023. This dominance can be attributed to the advanced healthcare infrastructure, high adoption rate of new technologies, and significant investments in healthcare IT solutions in North America. The presence of major market players and the growing demand for efficient and integrated healthcare systems further drive the revenue share in this region.

The Point of Care (PoC) Connectivity Solutions market is highly competitive, fueled by growing demand for real-time patient data access and seamless integration across healthcare systems. Key drivers include advancements in IoT, cloud-based platforms, and wireless technologies, which enhance connectivity and data sharing. Regulatory compliance is a critical factor, pushing providers to develop secure and efficient solutions. Companies are competing to offer scalable, innovative systems that improve patient care and operational efficiency in hospitals, clinics, and other healthcare settings.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 913.2 Million |

| Market size forecast in 2031 | USD 1.6 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 7.1% from 2024 to 2031 |

| Number of Pages | 289 |

| Tables | 403 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, End Use, Application, Region |

| Country scope |

|

| Companies Included | F. Hoffmann-La Roche Ltd., Siemens Healthineers AG (Siemens AG), Abbott Laboratories, GE HealthCare Technologies, Inc., Masimo Corporation, Medtronic PLC, Oracle Corporation, Koninklijke Philips N.V., Honeywell International, Inc., EKF Diagnostics Holdings plc |

By Type

By End Use

By Application

By Geography

This Market size is expected to reach $1.6 billion by 2031.

Increasing Demand for Remote Patient Monitoring are driving the Market in coming years, however, High Initial Investment and Implementation Costs restraints the growth of the Market.

F. Hoffmann-La Roche Ltd., Siemens Healthineers AG (Siemens AG), Abbott Laboratories, GE HealthCare Technologies, Inc., Masimo Corporation, Medtronic PLC, Oracle Corporation, Koninklijke Philips N.V., Honeywell International, Inc., EKF Diagnostics Holdings plc

The expected CAGR of this Market is 7.1% from 2024 to 2031.

The Hospitals segment is leading the Market by End Use in 2023; thereby, achieving a market value of $402.9 million by 2031.

The North America region dominated the Market by Region in 2023; thereby, achieving a market value of $542.5 million by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges