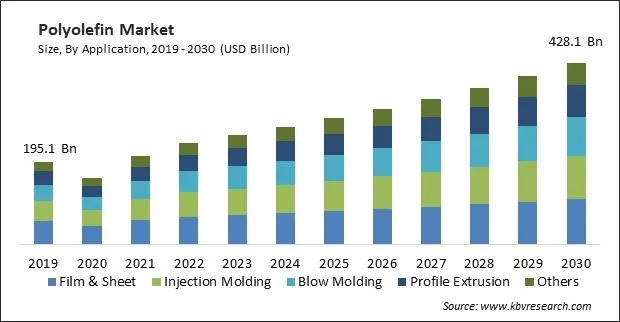

The Global Polyolefin Market size is expected to reach $428.1 billion by 2030, rising at a market growth of 7.5% CAGR during the forecast period. In the year 2022, the market attained a volume of 1,45,614.4 Kilo Tonnes, experiencing a growth of 5.2% (2019-2022).

Blow molding is a highly efficient procedure that can produce many parts in a relatively short time. This high productivity is valuable for meeting increased demand and maintaining production efficiency. Therefore, the blow molding segment contributed $49,084.6 million revenue in the market in 2022. Blow molding is a cost-effective manufacturing process, especially for high-volume production. It requires relatively low initial tooling and equipment costs, and the production cycle times are typically short, contributing to lower production expenses. Lightweight blow-molded products reduce transportation costs, as they are lighter than alternatives like glass or metal, saving on fuel and logistics expenses. Blow molding can produce clear and transparent plastic containers, which are often desirable for showcasing products, especially in the food and beverage industry.

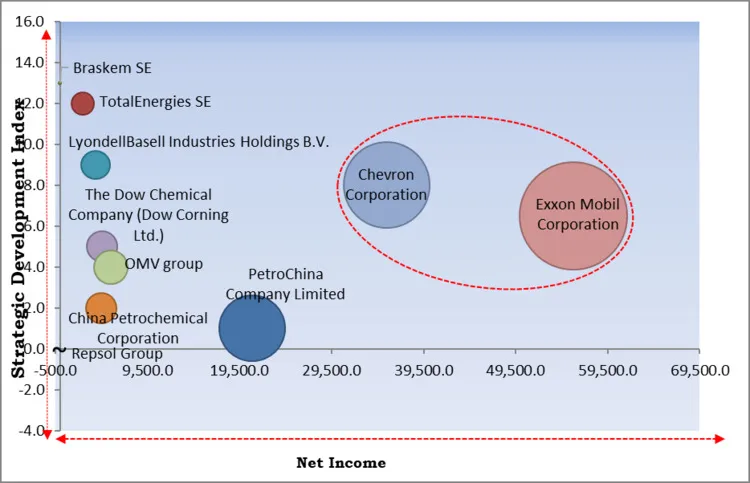

The major strategies followed by the market participants are Mergers & Acquisition as the key developmental strategy to keep pace with the changing demands of end users. For instance, In July, 2023, TotalEnergies SE enhanced its presence in the renewable energy sector by acquiring the remaining shares of Total Eren, increasing its ownership from nearly 30% to 100%. The Total Eren teams will be fully integrated into TotalEnergies SE's Renewables business unit. The acquisition of 70.8% represents a net investment of approximately €1.5 billion for TotalEnergies SE. Additionally, In July, 2023, LyondellBasell Industries Holdings B.V. successfully acquired Mepol Group to seize opportunities in APS business growth, leveraging circularity trends for sustainable living solutions.

Based on the Analysis presented in the KBV Cardinal matrix; Chevron Corporation and Exxon Mobil Corporation are the forerunners in the Market. In August, 2023, Chevron Corporation completed its acquisition of PDC Energy, Inc., an independent exploration and production company. The acquired assets consist of 275,000 net acres in the Denver-Julesburg (DJ) Basin, adjacent to Chevron's current operations, contributing over 1 billion barrels of oil equivalent proved reserves. Additionally, the acquisition includes 25,000 net acres in the Permian Basin withheld-by-production status. Companies such as LyondellBasell Industries Holdings B.V., PetroChina Company Limited and TotalEnergies SE are some of the key innovators in the Market.

Industrial sectors, such as aerospace, automotive, and construction, require high-performance materials to meet demanding specifications. Polyolefins are being modified and enhanced to offer improved strength, impact resistance, and other properties needed for these applications. As the automotive sector seeks to reduce vehicle weight to enhance fuel efficiency and reduce emissions, polyolefins play a vital role. Lightweight components made from polyolefins are used in vehicle interiors, exteriors, and under-the-hood applications. Industrial advancements in the renewable energy sector have increased the demand for polyolefins in applications like photovoltaic modules, which require durable and weather-resistant materials. The market's growth in industrial applications is closely tied to ongoing technological advancements and industry-specific requirements.

As the global population continues to grow, there is a higher demand for products made from polyolefins. These products include everyday essentials such as packaging materials, containers, consumer goods, and construction materials. Urbanization leads to the construction of housing, commercial buildings, and infrastructure in urban areas. Polyolefins are used in various construction applications, including pipes, insulation, roofing materials, and geomembranes. The rise of urban living has resulted in a surge in the demand for packaged goods. Urbanization is closely linked to the rise of e-commerce, which relies heavily on packaging materials. Polyolefins are used for shipping materials, such as polyethylene bags and protective packaging. These factors will drive the market growth in the coming years.

Meeting stringent regulations often requires investments in equipment, processes, and materials to ensure compliance. Manufacturers face increasing costs associated with upgrading facilities, implementing new technologies, and conducting testing to meet regulatory standards. Regulations require the use of recycled materials or the incorporation of sustainability practices in the production of polyolefins. Adhering to these requirements can be challenging, mainly when sourcing recycled materials or implementing sustainable practices. Regulatory changes necessitate adjustments to the formulation of polyolefin products. The above factors will decline market growth in the coming years.

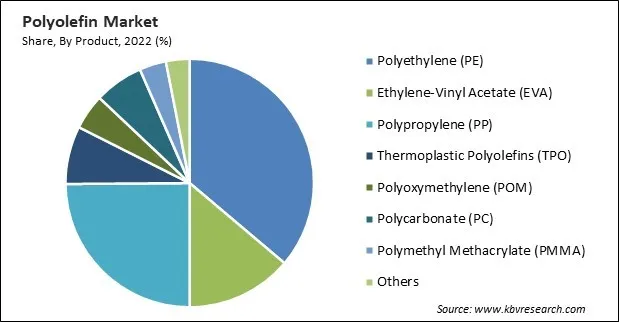

On the basis of product, the market is segmented into polyethylene (PE), polypropylene (PP), ethylene-vinyl acetate (EVA), thermoplastic polyolefins (TPO), polyoxymethylene (POM), polycarbonate (PC), polymethyl methacrylate (PMMA), and others. In 2022, the polyethylene (PE) segment dominated the market with the maximum revenue share. Polyethylene is incredibly versatile and can be used in various industries. It can be manufactured in different forms, such as films, sheets, pipes, and molded parts, making it suitable for multiple uses. PE is a lightweight material, advantageous in applications where weight is a vital factor, such as automotive and aerospace industries. Its low density contributes to fuel efficiency and reduces transportation costs. PE exhibits excellent resistance to various chemicals, acids, and bases, making it ideal for use in containers and piping systems that transport or store corrosive substances.

Based on application, the market is fragmented into film & sheet, injection molding, blow molding, profile extrusion, and others. The injection molding segment recorded a remarkable revenue share in the market in 2022. Injection molding is used for producing custom polyolefin materials. As polyolefin parts are made in molds and must be cooled before removal, the process is discontinuous. Injection molding necessitates utilizing a machine, plastic materials, and molds. In order to make the final product, molten plastic is pumped into the mold cavity and cooled. It is commonly used in producing automobile parts, medical devices, containers, and others. Growing demand for polyolefin injection molding from various end-use sectors, combined with increased manufacturer awareness about the benefits of polyolefin injection molding, is expected to fuel the demand for polyolefin injection molding.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 240.4 Billion |

| Market size forecast in 2030 | USD 428.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 7.5% from 2023 to 2030 |

| Number of Pages | 395 |

| Number of Table | 656 |

| Quantitative Data | Volume in Kilo Tonnes, Revenue in USD million, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region registered the highest revenue share in the market. The Asia Pacific region stands out for its abundance of skilled labor available at a low cost, as well as easily accessible land. This shift in production focus toward emerging economies, particularly China and India, is poised to have a favorable impact on market growth throughout the forecast period. The region is a significant hub for rapidly expanding industries like construction, automotive, and electronics, offering substantial potential for polyolefin manufacturers. Continuing infrastructural investments are expected to sustain economic growth in China, and the automotive, aerospace, and construction sectors are expected to benefit from reforms, including regulatory changes, policy adjustments, or structural enhancements.

Free Valuable Insights: Global Polyolefin Market size to reach USD 428.1 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include China Petrochemical Corporation, LyondellBasell Industries Holdings B.V., PetroChina Company Limited, TotalEnergies SE, Chevron Corporation, Repsol Group, The Dow Chemical Company (Dow Corning Ltd.), Exxon Mobil Corporation, Braskem SE, and OMV group.

By Application (Volume, Kilo Tonnes, USD Million, 2019-2030)

By Product (Volume, Kilo Tonnes, USD Million, 2019-2030)

By Geography (Volume, Kilo Tonnes, USD Million, 2019-2030)

This Market size is expected to reach $428.1 billion by 2030.

Increasing industrial advancements are driving the Market in coming years, however, Stringent rules & regulations regarding polyolefin restraints the growth of the Market.

China Petrochemical Corporation, LyondellBasell Industries Holdings B.V., PetroChina Company Limited, TotalEnergies SE, Chevron Corporation, Repsol Group, The Dow Chemical Company (Dow Corning Ltd.), Exxon Mobil Corporation, Braskem SE, and OMV group.

In the year 2022, the market attained a volume of 1,45,614.4 Kilo Tonnes, experiencing a growth of 5.2% (2019-2022).

The Film & Sheet segment is leading the Market by Application in 2022 thereby, achieving a market value of $107.9 billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $205.1 Billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.