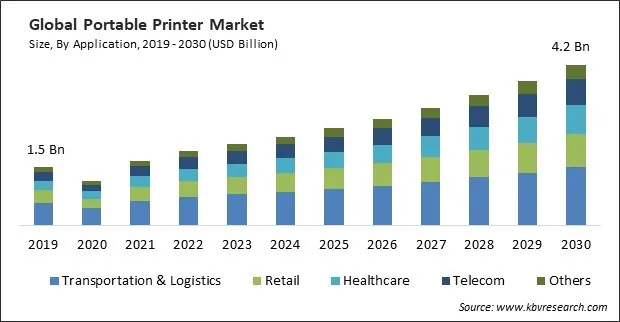

The Global Portable Printer Market size is expected to reach $4.2 billion by 2030, rising at a market growth of 10.3% CAGR during the forecast period. In the year 2022, the market attained a volume of 8264.9 thousand units, experiencing a growth of 8.8% (2019-2022).

Portable printers offer a practical solution in the logistics and supply chain industry, where real-time tracking and documentation are crucial. Therefore, the Transportation & Logistics segment acquired $733.8 million in 2022. They allow for on-the-go printing of shipping labels, invoices, packing slips, and barcodes directly at the point of action. This enhances the speed and accuracy of order processing and contributes to a more streamlined supply chain. Field service professionals, including technicians, maintenance workers, and utility personnel, benefit from the mobility provided by these printers. On-site printing of work orders, service reports, and invoices improves the efficiency of field operations. It eliminates the need for returning to a central location for documentation, reducing downtime and improving overall service delivery.

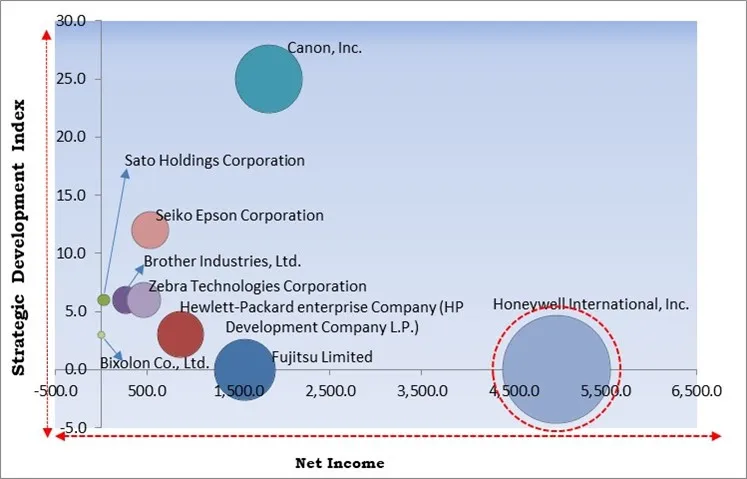

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In, June, 2023, BIXOLON Europe GmbH, a subsidiary of Bixolon Co., Ltd. unveiled next-generation SRP-350V and SRP-350plusV 3-inch (80 mm) Direct Thermal POS printers to the European market to enable the use of printing blue receipts, print speeds would have been increased and be faster and they would use the latest connectivity technologies. Additionally, In, March, 2023, Sato Holdings Corporation unveiled PW4NX 4-inch mobile label printer for mobility, speed, durability, and minimal downtime to lower total cost of ownership (TCO).

Based on the Analysis presented in the KBV Cardinal matrix; Honeywell International, Inc. is the major forerunner in the Portable Printer Market. Companies such as Canon, Inc., Seiko Epson Corporation and Zebra Technologies Corporation are some of the key innovators in Portable Printer Market. In, February, 2023, Seiko Epson Corporation launched I3200(8)-S1HD and S800-S1, the two new models of inkjet printheads that support solvent inks. The launched product would be compatible with a range of inks used for industrial applications.

Mobile professionals often require the ability to print documents, receipts, and labels while moving. It provides a solution that aligns with the dynamic nature of the mobile workforce, enabling them to produce essential paperwork directly from their mobile devices. Remote workers, including telecommuters and employees working from home, benefit from these printers to create a dedicated printing environment wherever they are. This flexibility enhances productivity by eliminating commuting or finding alternative printing facilities. This independence from centralized printing facilities contributes to more efficient workflows and reduces the need for workers to return to the office solely for printing purposes. Thus, these aspects will pose lucrative growth prospects for the market.

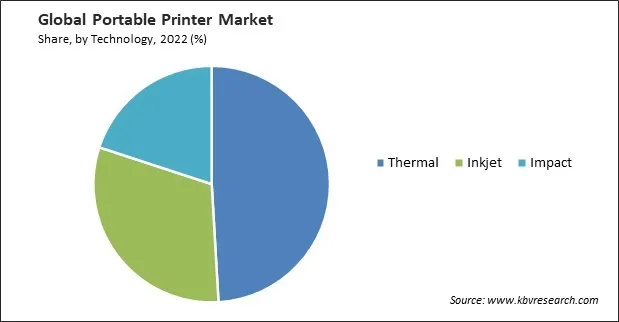

Advances in battery technology have led to significant improvements in the battery life of these printers. Longer battery life allows mobile workers to use these devices for extended periods without frequent recharging, enhancing their productivity and reducing downtime. The integration of multiple connectivity options has been a key driver in the adoption of these printers. Bluetooth and Wi-Fi enable seamless communication between mobile devices (smartphones, tablets, and laptops) and portable printers, eliminating physical connections. This wireless capability enhances mobility and convenience for users. This technology is reliable, cost-effective, and contributes to the compact design of these printers. Thermal printing is well-suited for applications such as receipt printing and label creation. These aspects will fuel the growth of the market.

Portable printers are generally designed for mobility and compactness, often resulting in a trade-off with printing speed and capacity. In industries or applications requiring high-volume printing, such as large-scale manufacturing, distribution centers, or busy retail environments, the slower printing speed of portable printers may lead to reduced operational efficiency. Certain industries, including logistics, healthcare, and field services, often involve time-sensitive tasks that require quick document generation. The limited printing speed of portable printers may pose challenges in scenarios where rapid printing is essential, potentially impacting time-critical processes. Slower printing speeds may extend the time spent on-site, affecting the overall efficiency of field service operations and potentially delaying subsequent tasks. These factors can reduce demand for portable printers in the coming years.

By technology, the market is segmented into thermal, inkjet, and impact. The thermal segment held the largest revenue share in the market in 2022. Thermal printing provides businesses with a financially efficient alternative by eliminating the requirement for ink cartridges and filaments. The absence of consumables simplifies maintenance and reduces operational costs, appealing to budget-conscious consumers and businesses. This cost-effectiveness has been a driving factor in the widespread adoption of thermal printing technology in these printers. These factors will boost the demand in the segment.

On the basis of application, the market is divided into retail, healthcare, transportation & logistics, telecom, and others. In 2022, the healthcare segment witnessed a substantial revenue share in the market. In healthcare settings, accurate and detailed labeling is essential for patient safety. These printers are commonly used for on-demand printing of labels for medications, specimen containers, and patient wristbands. This ensures that each item is appropriately labeled with accurate information, contributing to patient care's overall quality and safety. These factors will boost the demand in the segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 1.9 Billion |

| Market size forecast in 2030 | USD 4.2 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 10.3% from 2023 to 2030 |

| Number of Pages | 302 |

| Number of Table | 552 |

| Quantitative Data | Volume in Thousand Units, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Technology, Application, Region |

| Country scope |

|

| Companies Included | BIXOLON, Brother Industries, Ltd., Canon, Inc., Fujitsu Limited, Hewlett Packard Enterprise (HPE) Company, Honeywell International, Inc., Polaroid Corporation, Toshiba Corporation (Toshiaba TEC Corporation), Zebra Technologies Corporation, and Printek, LLC. |

| Growth Drivers |

|

| Restraints |

|

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured the highest revenue share in the market in 2022. The Asia-Pacific region has traditionally led technological advancements. Countries like China, Japan, South Korea, and Singapore have vibrant technology ecosystems that foster innovation. The continuous evolution of mobile technologies, wireless connectivity, and portable computing devices has created a conducive environment for adopting portable printers. As these advancements become more accessible, businesses and consumers in the region are incorporating portable printing solutions into their workflows. These aspects will propel the expansion of the segment.

Free Valuable Insights: Global Portable Printer Market size to reach USD 4.2 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Brother Industries, Ltd., Canon, Inc., Fujitsu Limited, Hewlett-Packard enterprise Company (HP Development Company L.P.), Honeywell International, Inc., Toshiba TEC Corporation (Toshiba Corporation), Zebra Technologies Corporation, Seiko Epson Corporation, Sato Holdings Corporation, and Bixolon Co., Ltd.

By Application (Volume, Thousand Units, USD Billion, 2019-2030)

By Technology (Volume, Thousand Units, USD Billion, 2019-2030)

By Geography (Volume, Thousand Units, USD Billion, 2019-2030)

This Market size is expected to reach $4.2 billion by 2030.

Growth of the mobile workforce worldwide are driving the Market in coming years, however, Restricted printing speed and capacity restraints the growth of the Market.

Brother Industries, Ltd., Canon, Inc., Fujitsu Limited, Hewlett-Packard enterprise Company (HP Development Company L.P.), Honeywell International, Inc., Toshiba TEC Corporation (Toshiba Corporation), Zebra Technologies Corporation, Seiko Epson Corporation, Sato Holdings Corporation, and Bixolon Co., Ltd.

In the year 2022, the market attained a volume of 8264.9 thousand units, experiencing a growth of 8.8% (2019-2022).

The Transportation & Logistics segment is leading the Market, by Application in 2022; thereby, achieving a market value of $1.5 billion by 2030.

The Asia Pacific region dominated the Market, by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $1.6 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.