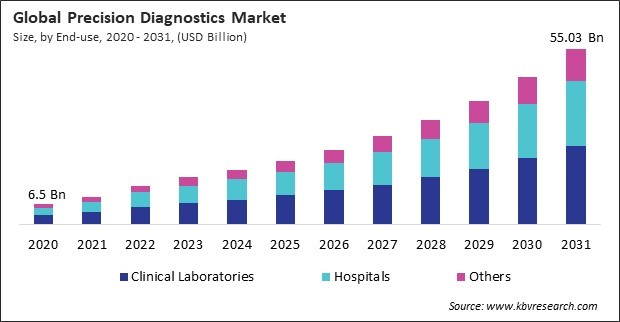

“Global Precision Diagnostics Market to reach a market value of USD 55.03 Billion by 2031 growing at a CAGR of 18%”

The Global Precision Diagnostics Market size is expected to reach $55.3 billion by 2031, rising at a market growth of 18% CAGR during the forecast period.

Precision diagnostics play a crucial role in early detection of cancer by identifying genetic predispositions and biomarkers associated with different cancer types. Early diagnosis allows for timely intervention, potentially improving patient outcomes through earlier initiation of treatment and monitoring of disease progression. The rising rates of cancer are increasing the demand for precision diagnostics in oncology. For instance, as per the New York State, each year, nearly 115,000 New Yorkers are diagnosed with cancer. Thus, the oncology segment acquired 23% revenue share in the market 2023.

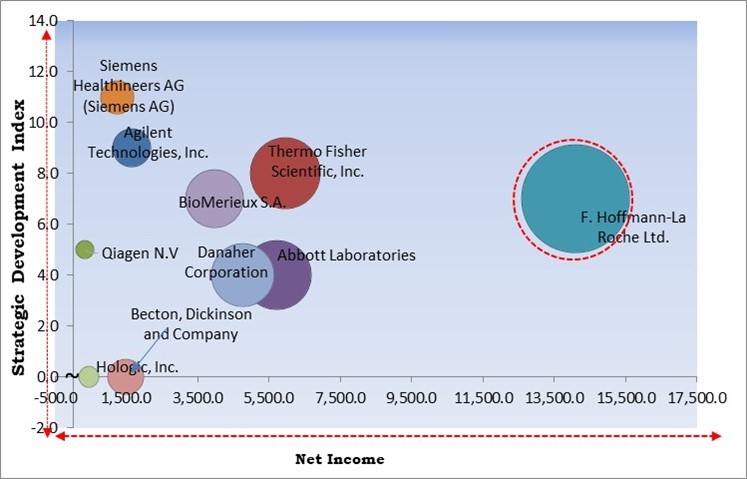

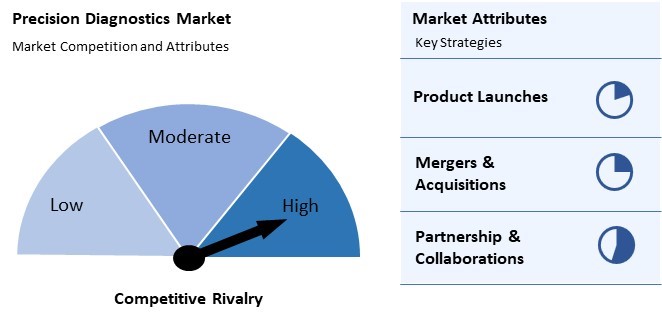

The major strategies followed by the market participants is Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In February, 2024, F. Hoffmann-La Roche Ltd. and PathAI entered an exclusive agreement to develop AI-enabled digital pathology algorithms for companion diagnostics. This collaboration aims to accelerate innovations in personalized healthcare and enhance digital pathology integration for improved diagnostics and precision therapeutics. Additionally, In May, 2024, bioMérieux partnered with AnaBioTec to enhance Mycoplasma testing in biopharmaceutical and Cell & Gene Therapy industries in Europe. Their collaboration aims to streamline testing with BIOFIRE® Mycoplasma, offering rapid, automated PCR detection to improve manufacturing efficiency and regulatory compliance.

Based on the Analysis presented in the KBV Cardinal matrix; F. Hoffmann-La Roche Ltd. is the forerunners in the Precision Diagnostics Market. Companies such as Thermo Fisher Scientific, Inc., Abbott Laboratories, and Danaher Corporation are some of the key innovators in Precision Diagnostics Market. In March, 2024, Thermo Fisher Scientific and Bayer AG have entered into a partnership to develop next-generation sequencing-based companion diagnostic assays for Bayer’s precision cancer therapies. This partnership aims to improve patient access through decentralized genomic testing, utilizing Thermo Fisher’s Ion Torrent Genexus Dx System with rapid turnaround times.

Economic uncertainties caused by the pandemic led to budget constraints in healthcare systems and reduced spending on non-essential healthcare services, including precision diagnostics. Clinical trials for new diagnostic technologies and products were delayed or halted due to restrictions on non-essential research activities and challenges in patient recruitment during the pandemic. Thus, the COVID-19 pandemic had a negative impact on the market.

Precision diagnostics enable healthcare providers to tailor treatment strategies based on individual genetic profiles, biomarker patterns, and disease characteristics. This shift towards personalized medicine improves treatment efficacy, minimizes adverse effects, and optimizes healthcare resource allocation. Also, as the global population ages, the incidence of chronic diseases increases. Hence, the rising prevalence of chronic diseases worldwide is driving the growth of the market.

As healthcare infrastructure expands, more facilities are equipped with state-of-the-art diagnostic technologies. This increases the accessibility of precision diagnostics to a larger population, including those in rural and underserved areas.

Developing precision diagnostic technologies involves substantial R&D expenditures to innovate and refine technologies such as genomic sequencing, digital imaging, and molecular diagnostics. Prototyping and testing phases require specialized equipment and expertise, contributing to high upfront costs. Therefore, high initial investment and operational costs hinder the market's growth.

By end-use, the market is categorized into hospitals, clinical laboratories, and others. In 2023, the clinical laboratories segment registered 46% revenue share in the market. Clinical laboratories possess the infrastructure, equipment, and expertise required to perform a wide range of diagnostic tests, including molecular testing, genetic analysis, biochemical assays, and imaging studies.

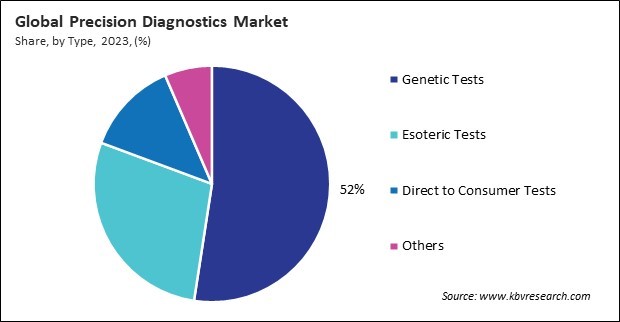

Based on type, the market is divided into genetic tests, direct to consumer tests, esoteric tests, and others. In 2023 the DTC segment acquired 12% revenue share in the market 2023. DTC tests offer convenience by allowing consumers to order diagnostic tests online or through retail outlets without needing a healthcare provider's referral.

On the basis of application, the market is segmented into oncology, respiratory diseases, skin diseases, CNS disorders, immunology, genetic diseases, and others. The skin diseases segment attained 8% revenue share in the market in 2023.

Free Valuable Insights: Global Precision Diagnostics Market size to reach USD 55.03 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific region generated 23% revenue share in the market. Rising incidences of chronic diseases such as diabetes, cardiovascular diseases, and cancer are prevalent in the Asia-Pacific region.

The Precision Diagnostic Treatment market is highly competitive, driven by rapid technological advancements in AI, molecular diagnostics, and genomics. Key players focus on enhancing diagnostic accuracy and personalized medicine, optimizing treatments based on individual genetic profiles. Attributes such as high precision, early disease detection, and rapid treatment adjustments are paramount. The market sees significant investments in R&D, with collaborations between biotech firms, healthcare providers, and tech companies to innovate and improve patient outcomes in a fast-evolving landscape.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 14.9 Billion |

| Market size forecast in 2031 | USD 55.03 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 18.0% from 2024 to 2031 |

| Number of Pages | 280 |

| Number of Tables | 403 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | End-use, Type, Application, Region |

| Country scope |

|

| Companies Included | Abbott Laboratories, F. Hoffmann-La Roche Ltd., Siemens Healthineers AG (Siemens AG), Thermo Fisher Scientific, Inc., Danaher Corporation, Agilent Technologies, Inc., BioMerieux S.A., Becton, Dickinson and Company, Qiagen N.V, and Hologic, Inc. |

By End-use

By Type

By Application

By Geography

This Market size is expected to reach $55.3 billion by 2031.

Rising demand for non-invasive diagnostics are driving the Market in coming years, however, High initial investment and operational costs restraints the growth of the Market.

Abbott Laboratories, F. Hoffmann-La Roche Ltd., Siemens Healthineers AG (Siemens AG), Thermo Fisher Scientific, Inc., Danaher Corporation, Agilent Technologies, Inc., BioMerieux S.A., Becton, Dickinson and Company, Qiagen N.V, and Hologic, Inc.

The expected CAGR of this Market is 18% from 2024 to 2031.

The Genetic Tests segment is leading the Market by Type in 2023; thereby, achieving a market value of $26.9 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $22.7 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges