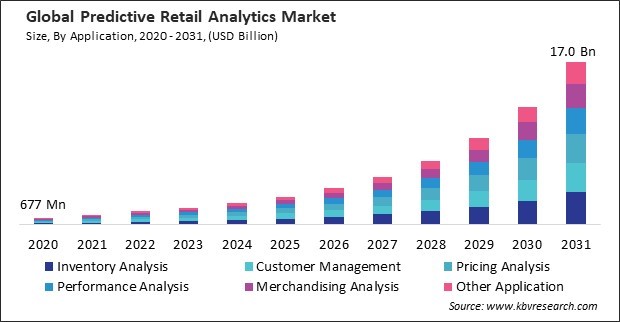

“Global Predictive Retail Analytics Market to reach a market value of 17 billion by 2031 growing at a CAGR of 33.2%”

The Global Predictive Retail Analytics Market size is expected to reach $17 billion by 2031, rising at a market growth of 33.2% CAGR during the forecast period.

Retailers are increasingly focused on optimizing in-store and online performance to improve customer satisfaction and reduce operational costs. Performance analysis tools allow businesses to monitor metrics such as sales trends, staff productivity, and inventory turnover, helping them adapt quickly to market changes. The rise in e-commerce and omnichannel strategies has further amplified the need for performance analysis, as retailers strive to maintain consistent service quality and seamless customer experiences across platforms. Thus, the performance analysis segment procured 15% revenue share in the predictive retail analytics market in 2023.

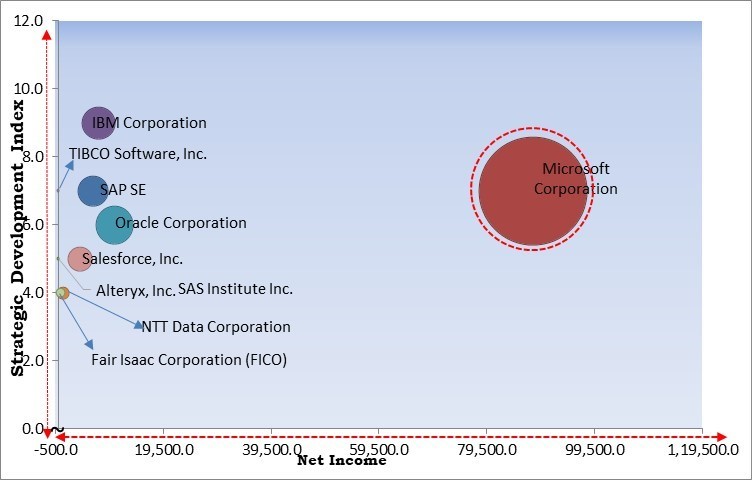

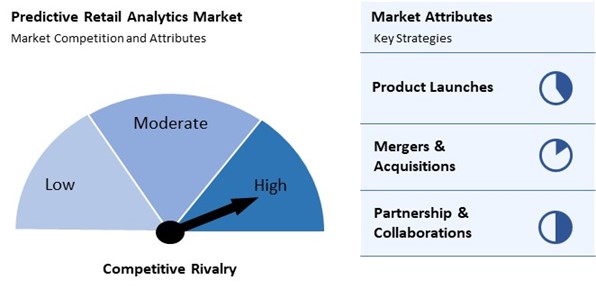

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In August, 2024, Alteryx partnered with Udacity, an American educational company, to launch a comprehensive data preparation course using Alteryx Designer. This partnership aimed to expand AI and data literacy, offering hands-on training to equip learners with essential skills for predictive analytics, supporting the growing demand for data-savvy professionals in modern organizations. Additionally, In June, 2024, IBM Corporation partnered with Telefónica Tech, a Spanish telecommunications company, to enhance AI, analytics, and data governance solutions in Spain. This partnership would develop an open, hybrid, multi-cloud platform, SHARK.X, featuring IBM's watsonx AI and Data platform.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation are the forerunners in the Predictive Retail Analytics Market. In June, 2023, Microsoft Corporation signed a partnership with Moody’s, a financial services company. The partnership aimed to develop advanced data, analytics, and risk solutions using Microsoft Azure OpenAI Service. Companies such as Oracle Corporation, IBM Corporation, SAP SE are some of the key innovators in Predictive Retail Analytics Market.

Retailers are integrating AI and ML algorithms into their operations to gain deeper insights into customer behavior. This allows them to anticipate needs and tailor strategies accordingly. For example, machine learning models can analyze customer purchase histories, browsing patterns, and preferences to create personalized shopping experiences. This enhances customer satisfaction and drives loyalty as shoppers return to brands that understand their needs.

Additionally, the retail landscape has been further complicated by the emergence of omnichannel retailing, which involves the integration of multiple sales channels, including online platforms, physical stores, and mobile applications, to deliver a seamless customer experience. Consequently, retailers that implement predictive analytics are more effectively positioned to satisfy the growing demand and preserve their market position as e-commerce expands.

As predictive analytics becomes more integral to retail, concerns about data privacy have grown significantly. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States have set stringent standards for how businesses collect, store, and use consumer data. These laws aim to protect consumer privacy, granting individuals greater control over their personal information and ensuring transparency in data usage. Hence, such factors may impede the growth of the market.

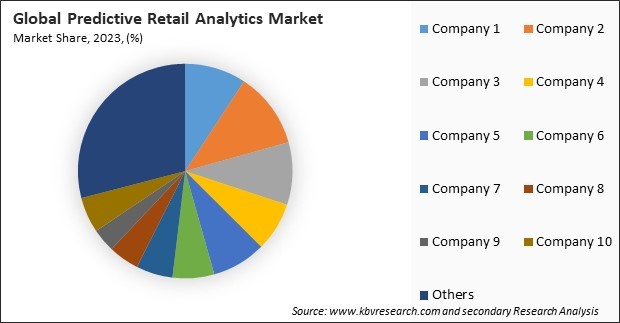

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations & Agreements.

Based on application, the market is segmented into inventory analysis, customer management, pricing analysis, performance analysis, merchandising analysis, and others. The inventory analysis segment witnessed 23% revenue share in the market in 2023. This segment's growth is fueled by retailers' need to optimize stock levels, reduce costs, and enhance supply chain efficiency.

By business function, the market is divided into supply chain management, sales & marketing, strategy & planning, in-store operations, human resource, and others. supply chain management segment procured 25% revenue share in the market in 2023. This segment's growth is driven by retailers' need to optimize inventory levels, enhance demand forecasting, and improve logistics efficiency.

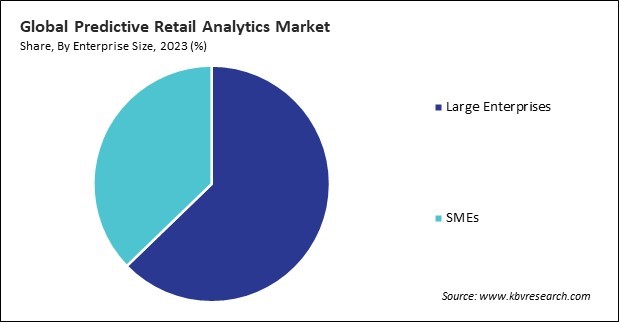

On the basis of enterprise size, the market is bifurcated into large enterprises and SMEs. The SMEs segment recorded 37% revenue share in the market in 2023. While Small & medium enterprises (SMEs) may have smaller budgets, the growing availability of scalable, cloud-based analytics solutions has made it easier for them to adopt predictive analytics.

The services segment is further segmented into consulting services, deployment & integration services, support & maintenance services, and training & education services. The support & maintenance services segment garnered 19% revenue share in the market in 2023. As predictive analytics solutions become more complex and integral to retail operations, ongoing support and maintenance are essential to ensure optimal performance.

On the basis of component, the market is bifurcated into software and services. The software segment acquired 63% revenue share in the market in 2023. This dominance results from the growing demand for sophisticated analytics tools that allow retailers to analyze large volumes of data, predict trends, and make data-driven decisions.

Based on deployment type, the market is classified into cloud-based, on-premise, and hybrid. The on-premise segment procured 29% revenue share in the market in 2023. The need for enhanced data security, control, and compliance with industry regulations primarily drives this segment.

Free Valuable Insights: Global Predictive Retail Analytics Market size to reach USD 17 billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment garnered 29% revenue share in the market in 2023. The region's mature retail sector, coupled with a high adoption rate of advanced digital technologies, has led to strong demand for predictive analytics solutions.

The predictive retail analytics market is highly competitive, driven by demand for data-driven insights in consumer behavior, personalized experiences, and inventory optimization. Key attributes include advanced AI, machine learning, and real-time data processing, enabling retailers to forecast demand, optimize pricing, and enhance customer loyalty. High accuracy, scalability, and integration capabilities are essential for effective deployment. As customer expectations evolve, the competition intensifies, with players focusing on innovation, ease of use, and analytics depth to stand out in a rapidly advancing landscape.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 1.8 Billion |

| Market size forecast in 2031 | USD 16.9 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 33.2% from 2024 to 2031 |

| Number of Pages | 405 |

| Number of Tables | 673 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Application, Enterprise Size, Component, Deployment Type, Business Function, Region |

| Country scope |

|

| Companies Included | IBM Corporation, Oracle Corporation, SAP SE, Microsoft Corporation, SAS Institute Inc., NTT Data Corporation, TIBCO Software, Inc. (Vista Equity Partners Management, LLC), Salesforce, Inc., Alteryx, Inc., and Fair Isaac Corporation (FICO) |

By Application

By Enterprise Size

By Component

By Deployment Type

By Business Function

By Geography

The Market size is projected to reach USD 17 billion by 2031.

Increasing adoption of AI and machine learning are driving the Market in coming years, however, Risk of data breaches and misuse of customer data restraints the growth of the Market.

IBM Corporation, Oracle Corporation, SAP SE, Microsoft Corporation, SAS Institute Inc., NTT Data Corporation, TIBCO Software, Inc. (Vista Equity Partners Management, LLC), Salesforce, Inc., Alteryx, Inc., and Fair Isaac Corporation (FICO)

The expected CAGR of this Market is 33.2% from 2024 to 2031.

The Large Enterprises segment is leading the Market by Enterprise Size in 2023; thereby, achieving a market value of $10.3 billion by 2031.

The North America region dominated the Market by Region in 2023 and would continue to be a dominant market till 2031; thereby, achieving a market value of $6.1 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges