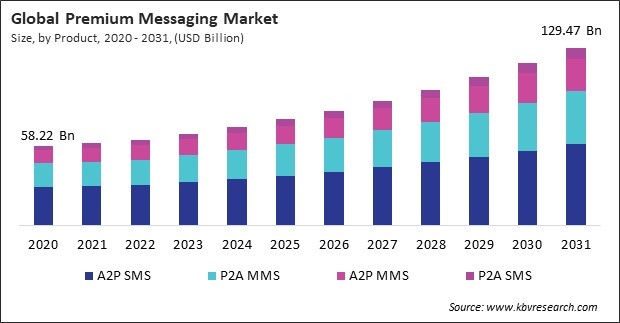

“Global Premium Messaging Market to reach a market value of USD 129.47 Billion by 2031 growing at a CAGR of 8.8%”

The Global Premium Messaging Market size is expected to reach $129.47 billion by 2031, rising at a market growth of 8.8% CAGR during the forecast period.

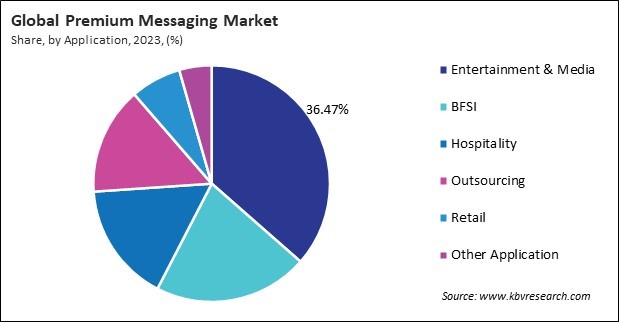

With the growing popularity of mobile streaming, gaming, and social media platforms, entertainment companies rely on premium messaging for subscription updates, promotional offers, event notifications, and interactive campaigns like voting and contests. Therefore, the entertainment & media segment acquired 36% revenue share in the market in 2023. Additionally, personalized content recommendations and pay-per-view services are boosting the adoption of A2P SMS and MMS to enhance user engagement and drive monetization. The rise of mobile advertising and influencer marketing also contributes to the growing importance of premium messaging in the media sector.

Improved network infrastructure under 5G ensures greater stability and security in messaging services, reducing the risk of message delays, failures, or fraud. This is particularly beneficial for mission-critical sectors like emergency response systems, remote healthcare, and industrial IoT, where instant and reliable communication can make a significant difference. Furthermore, the integration of AI and edge computation in 5G networks further enhances real-time analytics, enabling businesses to optimize message delivery based on user preferences and behavior. Moreover, the rise in cross-border e-commerce, which UNCTAD estimated at $440 billion in 2019, underscores the importance of reliable communication channels. Premium messaging facilitates seamless interactions between retailers and international customers, providing real-time updates on order confirmations, shipping statuses, and delivery schedules. This level of transparency and immediacy is essential for fostering trust and guaranteeing a positive consumer experience. Therefore, the growth of e-commerce is beneficial for the premium messaging market.

However, for businesses, premium messaging can increase operational expenses, particularly for industries that rely on bulk messaging for customer engagement, transactional alerts, and marketing campaigns. Subscription-based premium messaging services add to these costs, making it difficult for companies to justify their investment in SMS-based communication when cheaper alternatives are readily available. Businesses often hesitate to allocate budgets to premium messaging when they can achieve similar or better engagement through cost-effective digital channels. As a result, many customers and businesses are shifting to more economical alternatives such as push notifications, email marketing, and AI-driven chatbots. Thus, the demand for premium messaging services continues to decline, given the availability of more affordable and feature-rich communication channels.

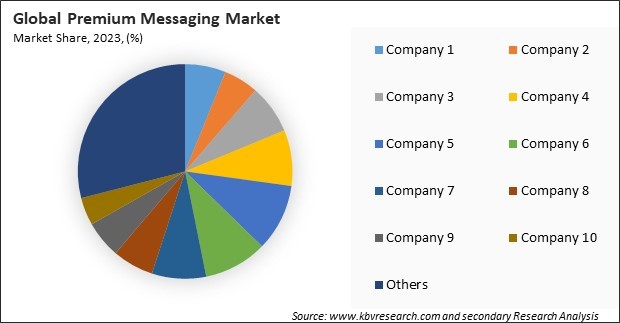

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

On the basis of application, the market is divided into BFSI, entertainment & media, hospitality, outsourcing, retail, and others. The BFSI segment recorded 21% revenue share in the market in 2023. Financial institutions depend on premium messaging for transaction alerts, OTP-based authentication, fraud prevention, and customer service interactions. With the rapid expansion of digital banking, mobile wallets, and fintech solutions, premium SMS is crucial in ensuring secure financial transactions and regulatory compliance. Growing concerns about cybersecurity and identity verification have also strengthened the demand for A2P SMS in multi-factor authentication (MFA) and fraud detection systems.

Based on product, the market is classified into A2P SMS, A2P MMS, P2A SMS, and P2A MMS. The P2A SMS segment procured 6% revenue share in the market in 2023. The P2A SMS (Person-to-Application SMS) segment is experiencing growth due to the rising adoption of interactive messaging, AI-driven chatbots, and automated customer service solutions. Consumers increasingly use shortcodes, surveys, and SMS-based inquiries to interact with businesses, request information, or provide feedback. Industries such as telecom, travel, healthcare, and entertainment leverage P2A SMS to enable seamless two-way communication between users and service providers.

Free Valuable Insights: Global Premium Messaging Market size to reach USD 129.47 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment garnered 35% revenue share in the market in 2023. The North America segment is primarily driven by high mobile penetration, advanced digital infrastructure, and strong enterprise adoption of premium messaging. The region's well-established BFSI, e-commerce, and media industries heavily rely on A2P SMS for secure transactions, customer engagement, and fraud prevention.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 66.61 Billion |

| Market size forecast in 2031 | USD 129.47 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 8.8% from 2024 to 2031 |

| Number of Pages | 212 |

| Number of Tables | 300 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Market Share Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Product, Application, Region |

| Country scope |

|

| Companies Included | Deutsche Telekom AG, Orange S.A., Vodafone Group Plc, China Telecom Corporation Limited, Twilio, Inc., AT&T Inc., Sinch AB, SoftBank Group Corporation, Vonage Holdings Corp. (Ericsson AB), NTT Docomo, Inc. (NTT Data Corporation) |

By Product

By Application

By Geography

This Market size is expected to reach $129.47 billion by 2031.

Rising Demand for Mobile Payments and OTPs are driving the Market in coming years, however, Rapid Shift to OTT Messaging Apps restraints the growth of the Market.

Deutsche Telekom AG, Orange S.A., Vodafone Group Plc, China Telecom Corporation Limited, Twilio, Inc., AT&T Inc., Sinch AB, SoftBank Group Corporation, Vonage Holdings Corp. (Ericsson AB), NTT Docomo, Inc. (NTT Data Corporation)

The expected CAGR of this Market is 8.8% from 2023 to 2031.

The A2P SMS segment is leading the Market by Product in 2023; thereby, achieving a market value of $59.13 billion by 2031.

The North America region dominated the Market by Region in 2023; thereby, achieving a market value of $43.31 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges