According to a new report, published by KBV research, The Global Big Data Analytics in Smart Manufacturing Market size is expected to reach $356.9 billion by 2031, rising at a market growth of 19.7% CAGR during the forecast period.

The Software segment is generating the highest revenue in the Global Big Data Analytics in Smart Manufacturing Market by Component in 2023; thereby, achieving a market value of $206.7 billion by 2031. This dominance reflects manufacturers' increasing reliance on advanced analytics tools to optimize their operations, enhance efficiency, and drive decision-making processes. The demand for sophisticated software solutions is fuelled by the need for real-time data insights and the ability to leverage large volumes of data generated in smart manufacturing environments.

The On-premises segment is expected to witness a CAGR of 19.3% during (2024 - 2031). Some manufacturers prefer on-premises solutions due to specific operational needs, regulatory compliance, or concerns over data security. By maintaining their data and analytics infrastructure in-house, these organizations can control their systems completely, ensuring that sensitive information remains protected. This enduring preference for on-premises solutions underscores the diverse landscape of deployment modes in the market, where manufacturers choose the model that best aligns with their operational strategies and security requirements.

The Large Enterprises market dominated the Global Big Data Analytics in Smart Manufacturing Market by Organization Size in 2023; thereby, achieving a market value of $194.6 billion by 2031. Large enterprises often have extensive resources and the ability to invest heavily in advanced technologies. These organizations operate on a global scale and manage complex manufacturing processes, which generate vast amounts of data. The sheer volume and variety of data produced by large enterprises necessitate robust big data analytics solutions to optimize operations, enhance productivity, and reduce costs.

The Internet of Things (IoT) segment exhibits a CAGR of 19.4% during (2024 - 2031). This connectivity lets manufacturers gain insights into equipment performance, production workflows, and supply chain dynamics. The growing adoption of IoT solutions is driven by the need for increased visibility and control over manufacturing operations, enabling organizations to respond swiftly to changes in demand and optimize their processes accordingly.

The Automotive segment is leading the Global Big Data Analytics in Smart Manufacturing Market by Industry Vertical in 2023; thereby, achieving a market value of $73.1 billion by 2031. As the automotive industry faces rising production costs and the need for enhanced safety measures, manufacturers are turning to data analytics to gain insights into vehicle performance, consumer preferences, and operational efficiencies. The use of big data allows automotive manufacturers to optimize production lines, improve vehicle quality, and enhance the overall customer experience, thus driving demand for analytics solutions within the sector.

The Supply Chain Optimization segment is registering a CAGR of 20.4% during (2024 - 2031). As global supply chains become more complex, manufacturers use data analytics to gain insights into their supply chain processes. By analyzing vast amounts of data, companies can optimize inventory management, streamline logistics, and enhance overall supply chain efficiency. This trend highlights the critical role of data-driven decision-making in navigating supply chain challenges and improving responsiveness to market demands.

Full Report: https://www.kbvresearch.com/big-data-analytics-in-smart-manufacturing-market/

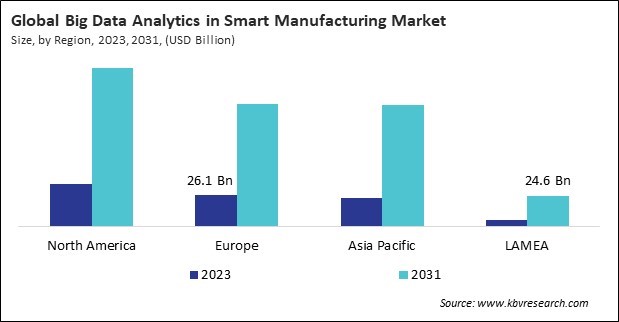

The North America region dominated the Global Big Data Analytics in Smart Manufacturing Market by Region in 2023; thereby, achieving a market value of $130.9 billion by 2031. The Europe region is expected to witness a CAGR of 19.2% during (2024 - 2031). Additionally, The Asia Pacific region would witness a CAGR of 20.6% during (2024 - 2031).

By Component

By Deployment Mode

By Organization Size

By Technology

By Industry Vertical

By Application

By Geography

Unique Offerings

Unique Offerings