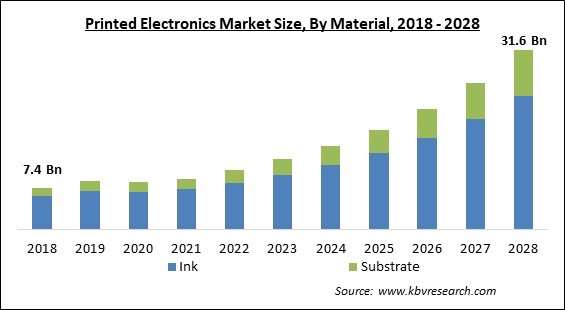

The Global Printed Electronics Market size is expected to reach $31.6 billion by 2028, rising at a market growth of 20.1% CAGR during the forecast period.

Printed electronics refers to a group of printing techniques for producing electrical devices on a variety of substrates. Screen printing, offset lithography, flexography, gravure, and inkjet are examples of common printing equipment appropriate for defining patterns on the material. These are low-cost processes by electronic-industry standards. Passive or active devices, like thin-film transistors, capacitors, coils, and resistors, are created by depositing electrically functioning optical or electronic inks on the substrate. According to some academics, printed electronics would enable widespread, low-cost, low-performance electronics for low-performance applications like flexible displays, smart labeling, colorful and animated posters, and active clothing.

Plastic or organic electronics, in which one or more inks are made of carbon-based chemicals, are sometimes associated with the term printed electronics. These other words refer to the ink material, which can be applied via solution, suction, or other methods. Printed electronics, on the other hand, specify the technique and can use any solution-based material, subject to the particular criteria of the printing process employed. Organic semiconductors, metallic conductors, inorganic semiconductors, nanoparticles, and nanotubes are all examples of this.

Almost all industrial printing technologies are used in the preparation of printed electronics. Printed electronics, like traditional printing, lays ink layers one on top of the other. The field's most important tasks are the coordinated development of printing processes and ink supplies. The most significant advantage of printing is low-cost mass production. Because of the cheaper cost, it may be used in more applications. RFID technology, for example, provides contactless identification in transportation and trade. Printing has little effect on performance in some areas, such as light-emitting diodes. Electronics can be printed on curved surfaces using flexible substrates, for example, solar cells on vehicle roofs. Conventional semiconductors often justify their substantially higher costs by giving far better performance.

The COVID-19 pandemic caused severe harm to businesses all over the world, which eventually resulted in a major downfall of the worldwide economy. During the spread of the COVID-19 pandemic, governments all over the world imposed stringent lockdown in their countries. The lockdown scenario caused a temporary shutdown of various companies as well as manufacturing units, which posed a challenge of low production of goods and services. Moreover, the worldwide supply chain was also demolished due to rigorous travel restrictions enforced by governments. These regulations critically devastated various industries all over the world.

The main end-user of printed electronics are transportation and automobile industries. The thinness, resilience, and flexibility of printed electronic goods make them popular in the automotive industry. Touch control technology along with smart surfaces have also become commonplace in car interior interfacing. As a result, market players are incorporating technology and design improvements into their offerings. In addition, the conductive ink sensor is used in vehicle HMI applications, such as HVAC controls, steering wheel controls, and overhead panels. Automobile manufacturers can reap various benefits from printed electronics.

With flexible displays, smart sensors, smart labeling, and active clothing, printed electronics have aided the creation of readily available, low-performance, as well as cost-effective electronic products. They have also made it easier to incorporate new features into current electronic products. Printed electronic technologies, such as sensors, inks, batteries, and Radio frequency identification are utilized in the healthcare business for a variety of applications, including remote surveillance of patients for important functions. As a result, there has been a spike in the development of novel remote monitoring products. Screen-printing technology is used to distribute stretchable conductive inks on thin films, which are subsequently transferred to the garment and made washable.

When it comes to novel technologies, cost-cutting is frequently a driving force behind R&D. New equipment and materials for printed electronics research, on the other hand, are extremely expensive. Manufacturers must spend significant resources on research and development in order to provide value beyond cost reduction, like thinner, lighter, more resilient, and flexible goods. The material qualities of certain technologies would determine investment decisions. Precision machinery and qualified employees are also required for the development of new technologies, which adds to the overall expenditures. The substantial expenditure required is thus a barrier to the market for printed electronics.

Based on Material, the market is segmented into Ink and Substrate. In 2021, the ink materials segment acquired the largest revenue share of the printed electronics market. The constantly rising growth of this segment is owing to the rapid adoption of this material across the market. The widespread use of printed electronics technology has facilitated the widespread use of inks in a variety of applications across numerous industries. In addition, inks are more widely available in the market, which is making them more accessible to customers. This factor is augmenting the growth of this segment.

Based on Technology, the market is segmented into Screen, Inkjet, Flexographic, and Gravure. In 2021, the inkjet segment witnessed a substantial revenue share of the printed electronics market. The increasing growth of this segment is owing to the rapidly increasing utilization of this novel and advanced technology. Inkjet printers are adaptable and versatile, and they can be set up quickly. Inkjets also have a lower throughput of approximately 100 m2/h and a poorer resolution (around 50 m). It's ideal for soluble, low-viscosity materials such as organic semiconductors. nozzle clogging is a problem with high-viscosity materials like organic dielectrics and scattered particles like inorganic metal inks. Because the ink is applied in droplets, the thickness and uniformity of the dispersion are diminished. Productivity and resolution can be improved by using multiple nozzles at the same time and pre-structuring the substrate.

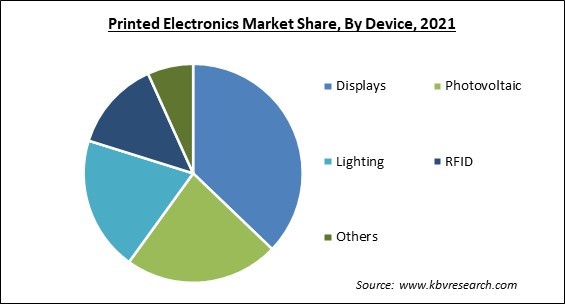

Based on Device, the market is segmented into Displays, Photovoltaic, Lighting, RFID, and Others. In 2021, the display segment registered the largest revenue share of the printed electronics market. The rising growth of the segment is owing to the wide availability of displays at affordable rates. By leveraging functional printed electronics, manufacturers can produce various distinct types of displays. It provides a significant growth prospect to market players operating in the printed electronics industry. This factor is anticipated to augment the growth of this segment in the coming years.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 9 Billion |

| Market size forecast in 2028 | USD 31.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 20.1% from 2022 to 2028 |

| Number of Pages | 204 |

| Number of Tables | 370 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Material, Technology, Device, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, Asia-pacific accounted for the largest revenue share of the printed electronics market. The high market share is mainly attributed to the increasing adoption of printed electronics technology in consumer electronics applications. The regional market of APAC is anticipated to retain its leading position growing at the fastest CAGR during the forecast period. This growth can be attributed to the rapidly growing electronics manufacturing sector in the region. Emerging countries, such as China, South Korea, and Japan, are significant contributors to the target market. In addition, the Asia Pacific region, especially China, is a hub of electronics manufacturing.

Free Valuable Insights: Global Printed Electronics Market size to reach USD 31.6 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Samsung Electronics Co., Ltd., BASF SE, DuPont de Nemours, Inc., LG Display Co., Ltd., Xerox Corporation, Koch Industries, Inc., E Ink Holdings, Inc., Enfucell Oy, GSI Technology, Inc., and NovaCentrix.

By Material

By Technology

By Device

By Geography

The printed electronics market size is projected to reach USD 31.6 billion by 2028.

Increasing adoption of printed electronics in the automotive & transportation sector are increasing are driving the market in coming years, however, the high initial cost of the technology growth of the market.

Samsung Electronics Co., Ltd., BASF SE, DuPont de Nemours, Inc., LG Display Co., Ltd., Xerox Corporation, Koch Industries, Inc., E Ink Holdings, Inc., Enfucell Oy, GSI Technology, Inc., and NovaCentrix.

The Screen segment acquired maximum revenue share in the Global Printed Electronics Market by Technology in 2021, thereby, achieving a market value of $17.5 billion by 2028.

The Photovoltaic segment has shown growth rate of 20.8% during (2022 - 2028).

The Asia Pacific market dominated the Global Printed Electronics Market by Region in 2021, and would continue to be a dominant market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.