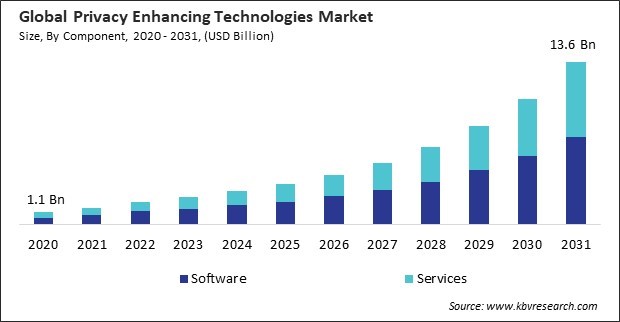

“Global Privacy Enhancing Technologies Market to reach a market value of USD 13.6 Billion by 2031 growing at a CAGR of 25%”

The Global Privacy Enhancing Technologies Market size is expected to reach $13.6 billion by 2031, rising at a market growth of 25% CAGR during the forecast period.

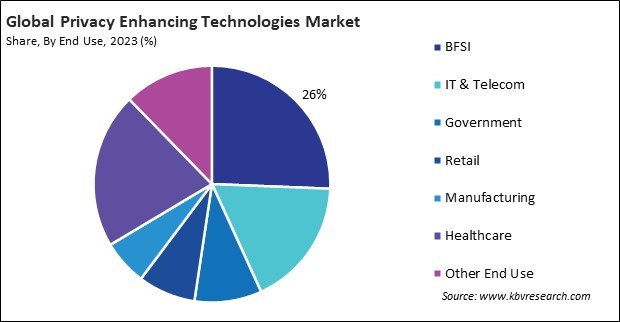

The healthcare industry handles extensive amounts of personal health information (PHI), making it critical to implement strong privacy measures to protect patient data. Privacy-enhancing technologies in healthcare include encryption, secure data storage, and access controls that comply with regulations. Adopting electronic health records (EHRs), telemedicine, and other digital health solutions further emphasizes the need for robust privacy practices to prevent data breaches and ensure patient confidentiality. Additionally, medical research and data analytics advancements require privacy-preserving techniques to balance data utility with privacy protection. Thus, the healthcare segment registered 21% revenue share in the privacy enhancing technologies market.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In December, 2023, SAP SE teamed up with Bosch, a German multinational engineering and technology company to leverage secure multi-party computation (MPC) for privacy-preserving data analysis across industries. MPC is an advanced cryptographic method enabling multiple organizations to compute collaboratively while keeping their sensitive data confidential, benefiting SAP's customers and partners who handle diverse, sensitive information. Additionally, In September, Oracle Corporation announced the partnership with Informatica, an American software development company with an Oracle Cloud Infrastructure point of delivery for joint customers in North America. New integrations between Informatica’s Intelligent Data Management Cloud (IDMC) and Oracle’s Modern Data Platform aim to deliver secure, trusted data, advancing AI/ML use and modernization efforts.

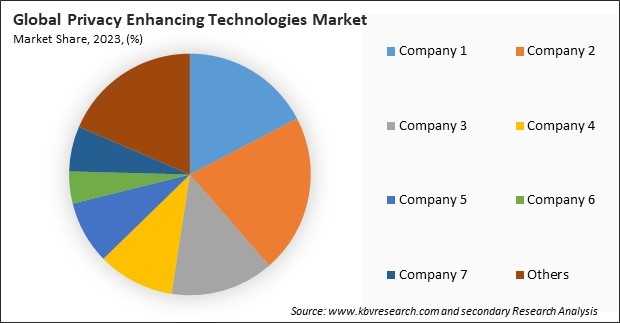

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the Privacy Enhancing Technologies Market. Companies such as IBM Corporation, Oracle Corporation, and SAP SE are some of the key innovators in Privacy Enhancing Technologies Market. In June, 2023, Microsoft Corporation teamed up with Moody's Corporation, an American business and financial services company to create advanced data, analytics, and risk solutions for financial services and global knowledge workers. Combining Moody's data expertise with Microsoft Azure OpenAI Service's AI power, the collaboration aims to enhance corporate intelligence and risk assessment.

The rise of privacy-focused alternatives to mainstream services (e.g., search engines and email providers) has led to greater consumer interest in technologies prioritizing privacy. The popularity of these privacy-first solutions encourages the development and adoption of PET. Thus, the growing consumer awareness and demand for data privacy is driving the market's growth.

Additionally, Organizations often rely on third-party vendors for cloud services, analytics, and customer engagement. This reliance raises concerns about data privacy and security, as sensitive information may be shared across platforms. PET can facilitate secure data sharing and minimize risks when collaborating with external partners. Thus, rapid digital transformation across industries is driving the market's growth.

Due to budget constraints, many organizations prioritize other IT and business initiatives over privacy and security measures. When resources are limited, organizations may allocate funds to more immediate business needs rather than investing in PET, which can be perceived as a lower priority. Therefore, high implementation costs associated with privacy-enhancing technologies impede the market's growth.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies to cater to demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations & Agreements.

By application, the market is divided into compliance management, risk management, reporting & analytics, and others. The reporting & analytics segment procured 20% revenue share in the privacy enhancing technologies market in 2023. This segment's growth can be attributed to the increasing need for organizations to gain insights from data while maintaining privacy.

Based on end use, the market is categorized into BFSI, healthcare, IT & telecommunication, government, retail, manufacturing, and others. In 2023, the manufacturing segment procured 6% revenue share in the market. The rise of Industry 4.0, characterized by integrating digital technologies into manufacturing processes, has led to increased data generation and connectivity across manufacturing operations.

Based on component, the market is divided into software and service. The service segment attained 42% revenue share in the market in 2023. Services in this market typically include consulting, implementation, and maintenance services, which are essential for organizations to integrate and manage privacy-enhancing technologies effectively.

On the basis of type, the market is segmented into cryptographic technique, anonymization technique, and pseudonymization techniques. The cryptographic technique segment recorded 46% revenue share in the market in 2023. The growing demand for robust data protection mechanisms across various industries largely fuels this predominance.

Free Valuable Insights: Global Privacy Enhancing Technologies Market size to reach USD 13.6 Billion by 2031

The Privacy Enhancing Technologies market is characterized by intense competition driven by increasing concerns over data privacy. Key attributes include robust encryption methods, anonymization techniques, and secure communication protocols. Innovations focus on enhancing user anonymity and protecting sensitive information across digital platforms. Market players differentiate through advanced cryptographic solutions and adherence to regulatory standards, catering to growing demands for privacy-centric technologies in sectors ranging from finance to healthcare and beyond.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region generated 26% revenue share in the market in2023. The rapid digital transformation across countries like China, India, Japan, and South Korea has led to an exponential increase in data generation and the need for robust privacy solutions.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 2.4 Billion |

| Market size forecast in 2031 | USD 13.6 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 25% from 2024 to 2031 |

| Number of Pages | 309 |

| Number of Tables | 483 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Component, Type, Application, End Use, Region |

| Country scope |

|

| Companies Included | IBM Corporation, Microsoft Corporation, Google LLC (Alphabet Inc.), Intel Corporation, SAP SE, Inpher, Thales Group S.A., OneTrust, LLC, TrustArc Inc. and Oracle Corporation |

By Component

By Type

By Application

By End Use

By Geography

This Market size is expected to reach $13.6 billion by 2031.

Growing consumer awareness and demand for data privacy are driving the Market in coming years, however, Concerns over data utility and performance trade-offs restraints the growth of the Market.

IBM Corporation, Microsoft Corporation, Google LLC (Alphabet Inc.), Intel Corporation, SAP SE, Inpher, Thales Group S.A., OneTrust, LLC, TrustArc Inc. and Oracle Corporation

The expected CAGR of this Market is 25% from 2024 to 2031.

The Software Segment is leading the Market by Component in 2023; thereby, achieving a market value of $7.4 billion by 2031.

The North America region dominated the Market by Region in 2023 and would continue to be a dominant market till 2031; thereby, achieving a market value of $5.1 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges