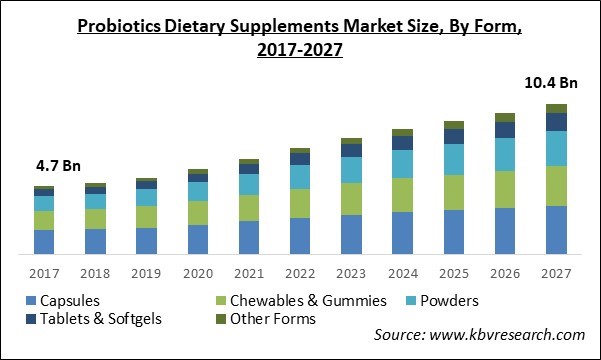

The Global Probiotics Dietary Supplements Market size is expected to reach $ 10,454.9 million by 2027, rising at a market growth of 7.8% CAGR during the forecast period.

Probiotics refer to the live bacteria that help to facilitate functions of digestive systems in the human body. The majority of the bacteria fall under probiotics; however, in technical terms, Lactobacillus is most common bacteria found across fermented food and beverages. In addition, probiotics help to treat conditions like inflammatory bowel disease, irritable bowel syndrome, and diarrhea which are caused by antibiotics, hence increasing their popularity among the masses.

Some of the common symptoms witnessed among the patients of COVID-19 are vomiting, diarrhea, and nausea. In addition, many renowned organizations conducted different types of studies to determine the effectiveness of utilizing probiotics against COVID-19 infection since its onset. For example, in May 2020, BIOITHAS, a Spanish company conducted a clinical trial that involves giving capsules to young people who are suffering from coronavirus and need hospitalization.

Due to the COVID-19 pandemic, a shift has been witnessed in the consumption and dietary patterns among the masses. In addition, the majority of the consumers preferred to choose products with a high nutritional value rather than junk or processed foods. The demand and sales of probiotics drastically increased across the US as individuals were in hurry to purchase nutrient boosters with an aim to develop higher immunity.

The rise in demand for probiotics has displayed that consumers are more likely to purchase products that have health advantages. The expectations of the customers related to probiotics have been increased with the proven health advantages of probiotics in health restoration. In addition, this preference toward a secure, affordable, and natural alternative for drugs has resulted in the utilization of probiotics as pharmaceutical agents.

A growing number of consumers prefer to consume probiotic products, particularly supplements with an aim to maintain their well-being and reduce their spending on healthcare. In addition, many key players are attempting to attract the possible customers by creating products on the basis of customer preferences. Moreover, technological developments have allowed the addition of particular beneficial bacteria to every type of food and beverage including cereals and baked goods.

Functional food products are associated with complicated, costly, and uncertain development and commercial aspects. Factors such as high consumer demand, supportive regulatory landscape, and technological development are driving the demand for functional food products. On the other hand, the rise in awareness among the consumers about the health effects of some ingredients can negatively impact the adoption of some functional foods.

Based on Form, the Probiotics Dietary Supplements market is segmented into Capsules, Chewables & Gummies, Powders, Tablets & Softgels, and Others. The chewables & gummies segment would showcase the fastest growth rate during the forecasting period. This is attributed to the fact that these products are sweet and can be conveniently consumed. In addition, the growth of the chewable & gummies segment would be driven by the attractive shapes, colors like teddy bears, and many flavors of gummies.

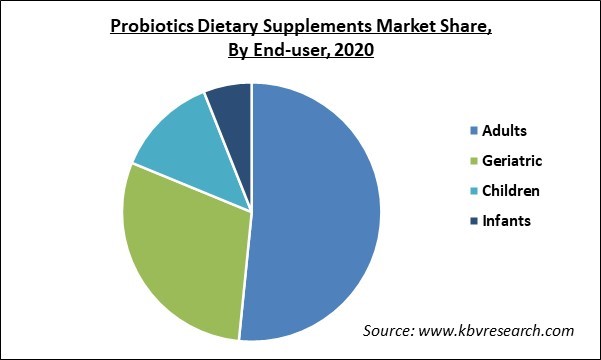

Based on End User, the market is segmented into Adults, Geriatric, Children, and Infants. Probiotics supplements for infants are generally provided in powder or liquid forms, where the products do not have their own taste. Hence, it is very simple to mix these products with pumped breast milk, infant formulas, and other liquids that are given to the baby.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 5.9 Billion |

| Market size forecast in 2027 | USD 10.4 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 7.8% from 2021 to 2027 |

| Number of Pages | 177 |

| Number of Tables | 290 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Form, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Europe would showcase a promising growth rate in the probiotics dietary supplements market. This is credited to the surge in acceptance of supplement products among the regional population. For example, according to the survey of Synadiet in 2020, around 1/3rd of the studied population in France were willing to or consume food supplements and natural health products in order to fuel immunity after the outbreak of the COVID-19 pandemic.

Free Valuable Insights: Global Probiotics Dietary Supplements Market size to reach USD 120.38 billion by 2027

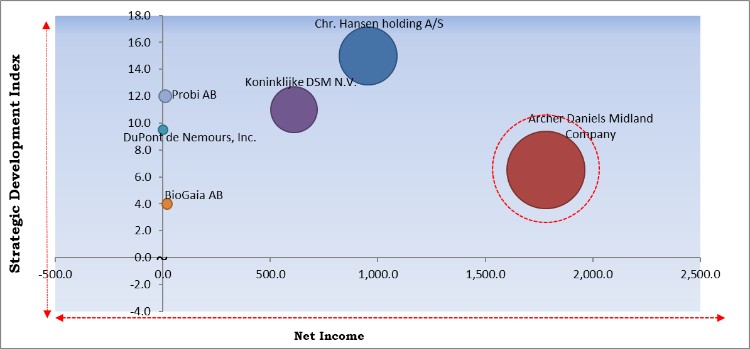

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Archer Daniels Midland Company is the major forerunner in the Probiotics Dietary Supplements Market. Companies such as Chr. Hansen holding A/S, Koninklijke DSM N.V., BioGaia AB are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Koninklijke DSM N.V., DuPont de Nemours, Inc., Chr. Hansen holding A/S, Archer Daniels Midland Company, Probi AB, BioGaia AB, Vitakem Nutraceutical, Inc., and ProbioFerm.

By Form

By End User

By Geography

The probiotics dietary supplements market size is projected to reach USD 10,454.9 million by 2027.

Pharmaceutical agents can be substituted by probiotics are driving the market in coming years, however, difficulties while incorporating probiotics in functional foods limited the growth of the market.

Koninklijke DSM N.V., DuPont de Nemours, Inc., Chr. Hansen holding A/S, Archer Daniels Midland Company, Probi AB, BioGaia AB, Vitakem Nutraceutical, Inc., and ProbioFerm.

Yes, The majority of the consumers preferred to choose products with a high nutritional value rather than junk or processed foods. The demand and sales of probiotics drastically increased across the US as individuals were in hurry to purchase nutrient boosters with an aim to develop higher immunity.

The Adults market dominated the Global Probiotics Dietary Supplements Market by End-user in 2020, and would continue to be a dominant market till 2027 growing at a CAGR of 7% during the forecast period.

The North America market dominated the Global Probiotics Dietary Supplements Market by Region in 2020, and would continue to be a dominant market till 2027; thereby, achieving a market value of $3,948.8 million by 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.