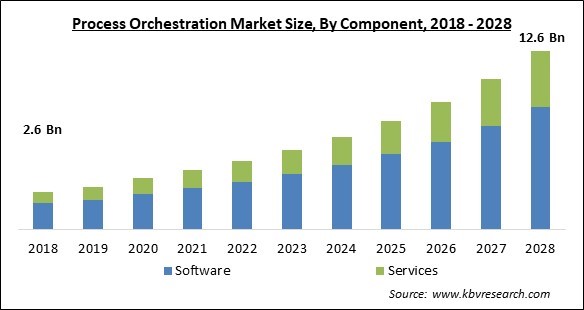

The Global Process Orchestration Market size is expected to reach $12.6 billion by 2028, rising at a market growth of 17.2% CAGR during the forecast period.

Process orchestration is a framework used for creating unique workflow operations that enable the orchestration of various business activities across people, processes, and technology. It offers a platform that enables business and IT specialists to collaborate, track business process applications, and securely communicate data. This platform supports business operations in an efficient manner. Additionally, it is well known to improve corporate operations' efficiency. The choice of such platforms has decreased production costs, improved the value chain, and improved an organization's overall operations.

Using web-based services to manage business processes is known as business process orchestration. This procedure helps to shape the direction of business process management and has the potential to alter how companies and information technology interact. Business process orchestration is often referred as workflow orchestration or service instrumentation. It gives comprehensive information on the limitations as well as the occurrence process and a structure for the company's internal control flow.

Some of the factors driving the growth of the process orchestration market include the rise in the adoption of business process automation technologies by companies to enhance the efficiency and quality of operational processes and interactions with other companies & customers as they engage in e-business transactions. The market is expanding due to the increased deployment of adequate business solutions by enterprises to save operational costs and effectively use their IT resources.

IT can automate specific activities with traditional automation technologies. Native task schedulers, custom scripting, RPA tools, and business process management tools are typical examples. Automated processes can be planned, carried out on-demand, or started by a relevant business or IT events. Although many process orchestration tools are actually automation tools, they offer the same functionality with a few key distinctions.

Lockdown protocols were put in place in numerous nations as a result of the Covid-19 outbreak. This in turn encouraged companies and organizations to adopt a culture of remote, or work from home, employment. This increased the use of process orchestration tools to increase company agility. Every corporation and business have been forced by the pandemic to move their business operations toward a virtual and remote work environment. Due to the critical circumstances, businesses started implementing process orchestration solutions for increased productivity and business agility. Every corporation and business were compelled by the pandemic to move their business operations toward a remote work environment.

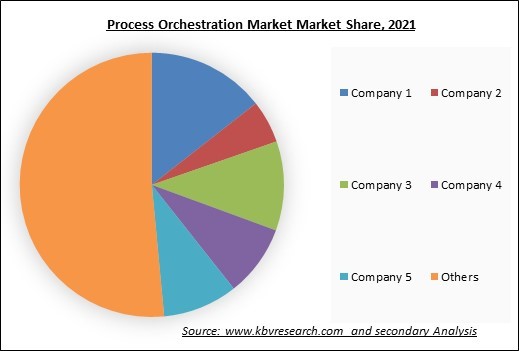

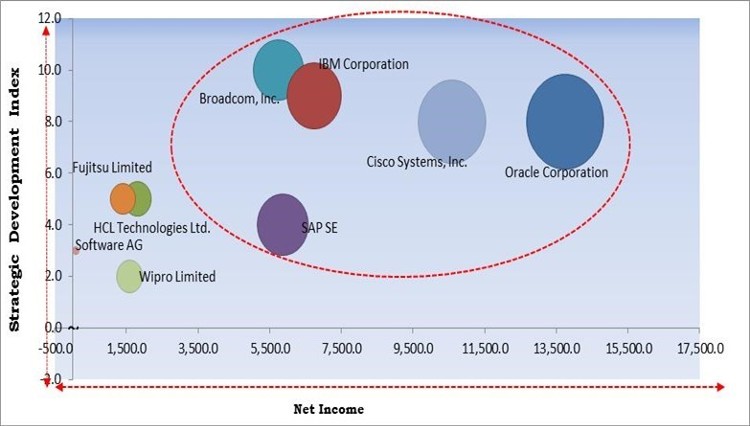

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product launches, Partnerships and Acquisitions.

In the modern era, there is a rapid spread of digitalization all over the world. Businesses are increasingly transforming their manual processes into advanced and automated processes. In order to comply with the widespread digitalization, various companies are rapidly undergoing digital transformation. Businesses are significantly investing in digital transformation as an effort to meet the rapidly evolving and increasing customer requirements because developing technologies are continually changing those expectations. Adopting automation technology to better corporate operations and decision-making is the core of digital transformation.

Businesses are focusing on making the best use of their available resources, including storage, processing power, and technical resources. Process orchestration offers managed and professional services, as well as cloud orchestration services, allowing businesses to work on diverse processes, such as other real-time projects, simultaneously. Process orchestration thereby provides optimal use of resources of a company. Additionally, pay-per-use flexibility and streamlined optimization make organizations more productive. Additionally, knowing what resources are available and completing them when necessary for the project is essential for controlling expenses and ensuring the success of project operations. It has substantial advantages for all businesses and organizations.

When complex logic is implemented via orchestration tools, the procedure sometimes results in poor and reduced performance of the datastore. These tools frequently add a large number of objects to the data store, and displays frequently involve a large number of function calls. For example, to mask data, lookup or entitlement tables, expressions, and other things. Therefore, these procedures might also eliminate some datastore optimizations in addition to requiring more processing. When more objects, such as roles, views, and entitlement tables, are added, complications are frequently created in addition to potential performance effects.

By industrial vertical, the process orchestration market is segmented into Government and Defense, Energy and utilities, Transportation and Logistics, BFSI, Manufacturing, Healthcare and Pharmaceuticals, IT and Telecommunications, Retail and consumer goods, and Others. In 2021, the healthcare and pharmaceuticals segment garnered a significant revenue share of the process orchestration market. Personalized healthcare is currently being promoted by self-care, which is being supported by the digitization of services, more affordable and effective care models, and the healthcare sector as a whole. The demand for process orchestration to be adopted for cost-effectiveness and better efficiency of healthcare systems has been brought on by rising expenses and the promise of connected health technologies.

Based on component, the process orchestration market is classified into Software and Services. In 2021, the software segment procured the highest revenue share of the process orchestration market. Standard procedures for business processes in complicated contexts can be standardized, consolidated, and automated with the use of process orchestration software. This is bolstering the demand for process orchestration software all over the world. Owing to this, the growth of this segment is rapidly rising.

On the basis of deployment model, the process orchestration market is categorized into On-Premises and Cloud. In 2021, the cloud segment registered a significant revenue share of the process orchestration market. The rapid growth of the segment is a result of the increasing number of cloud providers operating in the field. It also eliminates the requirement for owning a separate system to leverage these solutions. Moreover, mid-sized financial institutions favor cloud-based Process Orchestration software because it requires little initial investment and less ongoing maintenance.

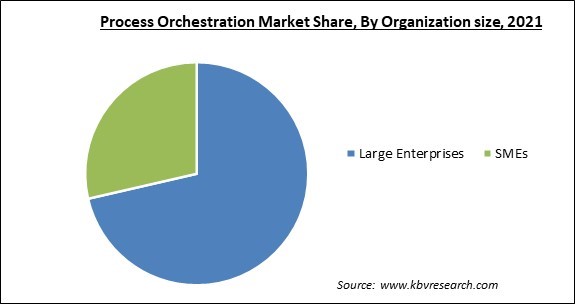

By enterprise size, the process orchestration market is fragmented into Large Enterprises and Small and Medium Enterprises. In 2021, the large enterprises segment acquired the largest revenue share of the process orchestration market. One of the major factors driving the expansion of this segment is that large enterprises are expanding their IT budgets to adopt cutting-edge technologies and solutions. The products aid in fostering better teamwork within huge organizations and boost worker productivity by enhancing the speed, effectiveness, and efficiency of business operations.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 4.2 Billion |

| Market size forecast in 2028 | USD 12.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 17.2% from 2022 to 2028 |

| Number of Pages | 293 |

| Number of Tables | 473 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Market Share Analysis, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Vertical, Organization size, Deployment Model, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the process orchestration market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, North America held the largest revenue share of the process orchestration market. Several factors, including the rise in digitization and the use of process orchestration tools by several end-users across the region, including BFSI and retail, are responsible for the market's expansion in this region. Furthermore, the existence of major players offers a significant number of growth prospects for market expansion.

Free Valuable Insights: Global Process Orchestration Market size to reach USD 12.6 Billion by 2028

The major strategies followed by the market participants are Acquisitions, Partnerships and Product Launches. Based on the Analysis presented in the Cardinal matrix; Oracle Corporation, IBM Corporation, Broadcom, Inc., Cisco Systems, Inc., SAP SE, are the forerunners in the Process Orchestration Market. Companies such as HCL Technologies Ltd., Wipro Limited and Fujitsu Limited are some of the key innovators in Process Orchestration Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include SAP SE, International Business Machines Corporation, Oracle Corporation, Broadcom, Inc., Cisco Systems Inc, Fujitsu Limited, TIBCO Software Inc., Software AG, HCL Technologies Ltd., and Wipro Limited.

By Component

By Vertical

By Organization size

By Deployment Model

By Geography

The global Process Orchestration Market size is expected to reach $12.6 billion by 2028.

The Rapid Spread Of Digital Transformation are driving the market in coming years, however, Degrade Performance And Quality In Certain Cases restraints the growth of the market.

SAP SE, International Business Machines Corporation, Oracle Corporation, Broadcom, Inc., Cisco Systems Inc, Fujitsu Limited, TIBCO Software Inc., Software AG, HCL Technologies Ltd., and Wipro Limited.

The expected CAGR of the Process Orchestration Market is 17.2% from 2022 to 2028.

The BFSI segment acquired maximum revenue share in the Global Process Orchestration Market by Vertical in 2021 thereby, achieving a market value of $3.2 billion by 2028.

The North America market dominated the Global Process Orchestration Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $4.3 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.