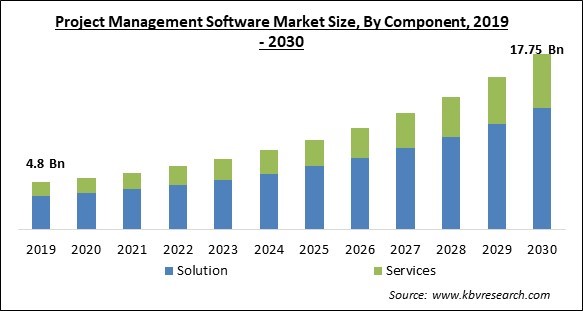

The Global Project Management Software Market size is expected to reach $17.75 billion by 2030, rising at a market growth of 13.8% CAGR during the forecast period.

Telecom & IT sector requires Project Management Software for the accomplishment of their day-to-day work efficiently. Therefore, Telecom & IT acquired $1,566.7 million revenue in the market in 2022. An important development in artificial intelligence is the speed at which data-based AI replaces rule-based AI. Machines are starting to comprehend and use procedures independently rather than employing if/then logic. ICT corporations are the most visible actors in AI innovations (patents, trademarks, and publications). Large corporations headquartered in China, Japan, Korea, or the United States make up most of these. According to the Organization for Economic Co-operation and Development (OECD), the United States, the European Union, and Japan account for 75% of the top performers in AI technology.

The Singaporean government has also made a framework for moral AI models available to enterprises to develop moral AI models. The European Commission has produced a framework that details how to respect ethical standards in AI while boosting user confidence. This has aided AI technology applications and led to unbiased analyses of human resources in businesses. Thus, the market is expanding due to the ongoing development of AI technology and related technologies.

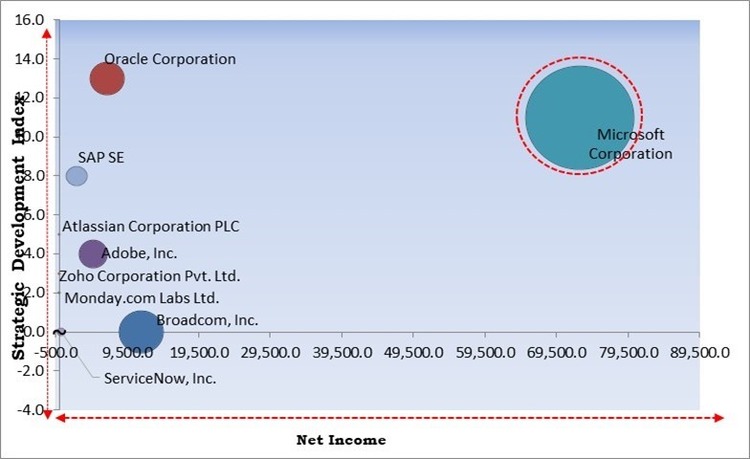

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In April, 2022, Microsoft formed a partnership with Bharat Petroleum Corporation Ltd to offer various services including platform as a service (PAAS), infrastructure as a service (IAAS), network and security services on the cloud, including Azure native services on Azure Datafactory, API, IoT, and analytics. This would help Bharat Petroleum Corporation Ltd. to transform operations, build smarter supply chains and increase customer engagement. Additionally, In July, 2022, Oracle announced a collaboration with Constru to integrate with Oracle Primavera Cloud, the industry-leading solution for project management scheduling, planning, risk, and resource. With this integration, Constru tracks a job's schedule and progress on the go, finding discrepancies and resolving issues more quickly, which increases efficiency and streamlines building project management using AI.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation is the forerunner in the Market. In January, 2023, Microsoft partnered with HDFC Bank to provide Microsoft Azure to the HDFC Bank for consolidating and modernizing its enterprise data landscape through a Federated Data Lake to scale its information management capabilities across enterprise reporting, and advanced analytics using artificial intelligence. Companies such as Broadcom, Inc., Oracle Corporation, Adobe, Inc. are some of the key innovators in the Market.

Gantt charts, critical path analysis, as well as risk management techniques, are just a few of the project management tools and procedures that are frequently used in organizations. Projects for numerous firms have been effectively managed using these techniques and tools, which have been refined over time. Less than half of all projects reportedly reach production and are completed on time, under budget, and according to plan, according to project management specialists. A lack of resources mostly causes project failure, inadequate project management, and planning, poor stakeholder involvement and communication, as well as shifting project requirements. These factors will propel the growth of the market in the upcoming years.

Businesses worldwide implement the idea and train each employee to manage projects more effectively. The increasing sophistication of project management software has led to the development of project management strategies that are now readily available, immensely flexible to any department, and may help make finishing tasks much more manageable. The extensive capabilities of modern automated information systems have also increased end-user awareness because they can provide the most precise and timely information necessary for the enterprise's decision-makers to help them overcome challenges and support the accomplishment of organizational goals.

Data is generally considered the most crucial business asset, necessitating protection against cyber threats. Utilizing cutting-edge digital technologies exposes businesses' corporate data to risk. No matter how well-equipped a business is to handle cybercrimes, fending against these dangers will never be simple. Every innovation that seeks to streamline company processes simultaneously increases the points of access to IT systems for burglars and hackers. The largest obstacle preventing businesses from embracing project management solutions is this. Small and medium-sized businesses can use public cloud services right away at a fair price. This could then impede the development of the market.

Based on component, the market is characterized into solution and services. The solution segment garnered the highest revenue share in the market in 2022. Including planning, resource management, scheduling, document management, and task management, this system provides tools and methodologies for managing organizational projects and tasks. Through the management of resources, budget, and quality, as well as the monitoring of their output, it enables them to keep expenses under control. As a result, it guarantees that projects are delivered on schedule while reducing risks and difficulties.

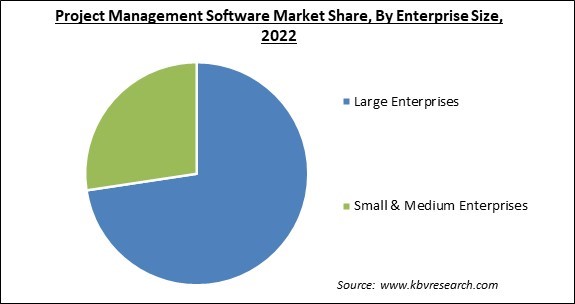

Based on enterprise size, the market is segmented into large enterprises and small & medium enterprises (SMEs). The small & medium enterprises (SMEs) segment recorded a substantial revenue share in the market in 2022. Using the sophisticated features and tools provided by this software, SMEs may efficiently plan, schedule, and use resources. By replacing them with a single digital platform powered by technology, this software also reduces the time and expense of manually managing and maintaining operational activities. Therefore, during the forecast period, these factors are anticipated to fuel demand for project software management in the SME sector.

On the basis of solution, the market is classified into activity scheduling, project portfolio management, resource management, issue tracking, document management, and others. The activity scheduling segment acquired the largest revenue share in the market in 2022. Using this software, businesses may efficiently establish project plans, strategies, budgets, delivery schedules, and project deadlines. These solutions ca also provide real-time project updates and an easy way to track project performance and specify comparisons between defined and realized plans. As a result, in the coming years, there will be an increasing demand for activity scheduling project management software.

On the basis of deployment type, the market is bifurcated into on-premise and cloud. The on-premise segment garnered a considerable growth rate in the market in 2022. With the help of in-house hosted solutions provided by on-premises project management software, a company can carry out activities and maintain operations inside its walls. Greater data security and privacy are ensured, and clients have complete control over the use and maintenance of the software. These aspects are therefore anticipated to assist segment expansion.

By end-use, the market is fragmented into manufacturing, BFSI, IT & telecom, healthcare & life sciences, engineering & construction, government, and others. The manufacturing segment recorded a promising growth rate in the market in 2022. Project management software is increasingly used in the manufacturing sector to ensure efficient planning, scheduling, job management, document management, and budgeting operations. It does away with the conventional method of manually maintaining workbooks and collecting data, which reduces errors, costs, and time while running efficient production operations.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 6.4 Billion |

| Market size forecast in 2030 | USD 17.75 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 13.8% from 2023 to 2030 |

| Number of Pages | 351 |

| Number of Table | 573 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Enterprise Size, Deployment Type, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment witnessed the highest revenue share in the market in 2022. Due to the growing demand for software for business among key end-use industries, including IT and Telecom, healthcare, and BFSI, which is anticipated to propel market expansion in this region, the industry is predicted to experience good momentum in North America. The major regional players are also making several strategic moves to improve and expand their offerings. These elements will propel market expansion in the region.

Free Valuable Insights: Global Project Management Software Market size to reach USD 17.75 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Adobe, Inc., Microsoft Corporation, Broadcom, Inc., Oracle Corporation, SAP SE, Zoho Corporation Pvt. Ltd., ServiceNow, Inc., Atlassian Corporation PLC, Monday.com Labs Ltd. and Smartsheet, Inc.

Sep-2021: SAP took over SwoopTalent, a platform that automatically connects companies' talent systems. This acquisition aimed to enable SAP to embed SwoopTalent’s data and machine learning technology within SAP SuccessFactors solutions.

Mar-2021: SAP completed the acquisition of Signavio, a business process management company specializing in business process analysis, modeling tools, and decision management. This combination of SAP's business process intelligence and Signavio enables SAP to better serve its customers by providing an end-to-end business process transformation suite.

By Component

By Enterprise Size

By Deployment Type

By Vertical

By Geography

The Market size is projected to reach USD 17.75 billion by 2030.

An increased requirement to boost project success rates are driving the Market in coming years, however, Increased concern over privacy and data security restraints the growth of the Market.

Adobe, Inc., Microsoft Corporation, Broadcom, Inc., Oracle Corporation, SAP SE, Zoho Corporation Pvt. Ltd., ServiceNow, Inc., Atlassian Corporation PLC, Monday.com Labs Ltd. and Smartsheet, Inc.

The Large Enterprises segment acquired maximum revenue share in the Global Project Management Software Market by Enterprise Size in 2022 thereby, achieving a market value of $12.2 billion by 2030.

The Cloud segment is leading the Global Project Management Software Market by Deployment Type in 2022 thereby, achieving a market value of $11.4 billion by 2030.

The North America market dominated the Global Project Management Software Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $6.7 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.