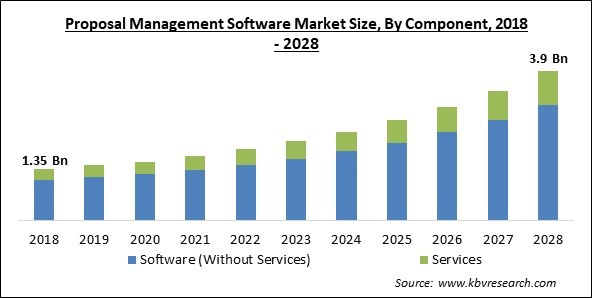

The Global Proposal Management Software Market size is expected to reach $3.9 billion by 2028, rising at a market growth of 13.2% CAGR during the forecast period.

The proposal management software refers to a technical program that enables real-time organizing, creating, and archiving of business proposal contracts. The software allows businesses to maintain contracts, track progress, identify potential roadblocks and collaborate in real time, which may prevent proposal finalization.

This software may help businesses or organizations store, build and manage proposals efficiently in an organized manner. Proposal management software serves a broad range of features & tools which allow businesses to conveniently set up a document in various document formats like MS Word.

Integration of proposal management software with novel technologies like AI (artificial intelligence) improves the capabilities of the software to support auto-suggest functionality and respond quickly to queries. Proposal management software further allows users to personalize their proposals which is helpful in communicating an enterprise’s identity to their cloud all over the world.

In addition, with the proposal management software, a single document could easily be shared with many team members, irrespective of their location or time zone, in a coordinated manner. The software help users in automating time-consuming tasks and thus save both money & time. This software works as the personal assistant of the user.

The software is designed with the aim to support the sales team and the businesses to enhance sales efficiency by automating the contract and proposal process. By using proposal management software tools like sales content repository, document generation, and merging content, the software automates the primary proposal management operations for better sales results.

The widespread novel corona virus has created a crisis in social & economic areas and medical life worldwide, which has directly or indirectly affected almost all industries. The travel bans, lockdowns, temporary business shutdowns, and other restrictions imposed by the governments of affected nations have caused severe disruptions in businesses. Despite this, the outbreak of the COVID-19 pandemic has significantly benefited the proposal management software market. With the increased number of smartphone users, growing e-commerce sector, and rising adoption of connected devices, the proposal management software market witnessed lucrative growth opportunities.

A significant benefit of proposal management software is the ability to share information with already existing programs. This allows seamless data sharing and coordination between the employees. The proposal management software allows passing the client’s information over two platforms which may add value to the proposal easily. Moreover, by the integration, users would be able to monitor the proposal’s growth without launching the proposal software. As a result of these benefits of proposal management software, the market is expected to grow substantially in the upcoming years.

Nowadays, proposals are not only given more frequently, but they are also hard to gather than they were in the past. As it expands and refines the operations, proposal & capture teams are becoming more competent, and the quality of proposals has significantly increased. Because of this, customers today expect greater understanding and personalization than they did in the past. In the past year, the average number of contributors to a proposal has increased. This may result in the rising adoption of proposal management software, thereby supporting market expansion.

The proposal management software is employed on the cloud because of the expanded SaaS-based application. However, this comes up with security concerns as the data stored on the cloud is prone to cyber threats. Cyber security threats, including vulnerabilities and malware attacks in cloud-based software, could have a severe impact on proposal management software. As a result of all this, the market for proposal management software may restrict the market growth during the projection period.

Based on component, the proposal management software market is divided into software and services. In 2021, the software segment dominated the proposal management software market with maximum revenue share. The market growth in this segment is attributed from the increased innovations in different sectors including BFSI, IT & Telecom and others. The continuous digitalization has resulted in grown adoption of the cloud-based software.

On the basis of deployment model, the proposal management software market is segmented into on-premise, and cloud. The cloud segment garnered a considerable revenue share in the proposal management software market. The growth of this segment is the result of factors, including an increased shift towards cloud-based technologies. Further, the need for cloud-based proposal management software is growing as a result of the widening integration of AI-enabled tools within the software.

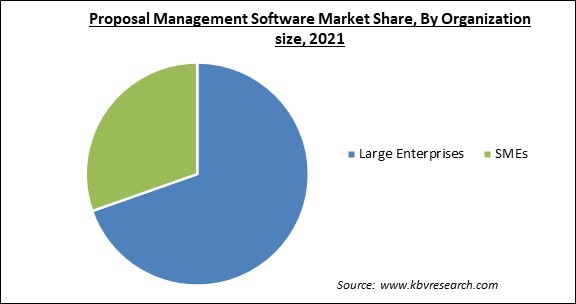

By enterprise size, the proposal management software market is fragmented into large enterprise and SMEs. In 2021, the large enterprise segment registered the highest revenue share in the proposal management software market. As a result of the high affordability of large enterprises, proposal management software is widely preferred them. Efficient collaboration between large teams of large businesses is a difficult task; proposal management supports the collaboration within the team by allowing the whole team working on a project to access the documents at the same time but in a secure way.

Based on industry vertical, the proposal management software market is classified into government, transportation & logistics, healthcare & life science, BFSI, retail & e-commerce, manufacturing, IT & telecom and others. The retail segment garnered a considerable growth rate in the proposal management software market in 2021. The rising competition in the market, declining margins, and reduced brand loyalty are a few issues due to which the retailers are looking for innovative ways to gain profit. In addition, retailers are widely shifting towards procurement teams to reduce supply risks and lessen the cost to be spent.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.7 Billion |

| Market size forecast in 2028 | USD 3.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 13.2% from 2022 to 2028 |

| Number of Pages | 264 |

| Number of Tables | 459 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Organization size, Deployment Mode, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the proposal management software market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the North America region led the proposal management software market by generating the largest revenue share. The region’s developed nations, such as Canada and the United States, are open to adopting emerging innovative technologies. Besides this, the region’s well-established financial position allows people to invest in the adoption of innovative and leading technologies to ensure effectiveness in operations.

Free Valuable Insights: Global Proposal Management Software Market size to reach USD 3.9 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Microsoft Corporation, Icertis, Inc., Deltek, Inc. (Roper Technologies, Inc.), WeSuite, LLC, GetAccept, Inc., Nusii Proposals S.L., iQuoteXpress, Inc., Sofon B.V. (Revalize, Inc.), Aarav Solutions Pvt. Ltd., and Practice Ignition Pty Ltd. (Ignition)

By Component

By Vertical

By Organization size

By Deployment Mode

By Geography

The global Proposal Management Software Market size is expected to reach $3.9 billion by 2028.

Incorporation With Existing Tools are driving the market in coming years, however, Risk Of Cyber-Security And Integration Capabilities restraints the growth of the market.

Microsoft Corporation, Icertis, Inc., Deltek, Inc. (Roper Technologies, Inc.), WeSuite, LLC, GetAccept, Inc., Nusii Proposals S.L., iQuoteXpress, Inc., Sofon B.V. (Revalize, Inc.), Aarav Solutions Pvt. Ltd., and Practice Ignition Pty Ltd. (Ignition)

The expected CAGR of the Proposal Management Software Market is 13.2% from 2022 to 2028.

The Government segment acquired maximum revenue share in the Global Proposal Management Software Market by Vertical in 2021 thereby, achieving a market value of $829.1 million by 2028.

The North America market dominated the Global Proposal Management Software Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $1.5 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.