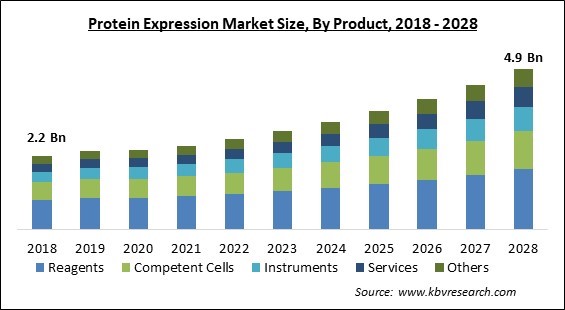

The Global Protein Expression Market size is expected to reach $4.9 billion by 2028, rising at a market growth of 10.1% CAGR during the forecast period.

Protein expression is a biotechnological technique that produces a particular protein. It is commonly accomplished by manipulating an organism's gene expression so that it expresses a recombinant gene in high quantities. Numerous opportunities for the generation and separation of heterologous proteins for scientific, medical, and industrial uses have been made possible by the advancement of genetic engineering and recombinant technology. Due to important developments in biotechnology, massive recombinant protein production (or expression) and isolation are feasible.

According to the functional requirements in the cell, proteins are generated and controlled. DNA contains the instructions for proteins, which are then decoded by tightly controlled transcriptional mechanisms to make messenger RNA (mRNA). A protein is then produced after an mRNA's message has been translated. The translation is the process of making protein based on a sequence dictated by mRNA, while transcription is the process of moving information from DNA to mRNA.

Transcription and translation happen simultaneously in prokaryotes. Even before a full mRNA transcript is entirely produced, mRNA translation begins. Coupled translation and transcription refer to the simultaneous translation and transcription of a gene. In eukaryotes, the steps are spatially distinct and take place in a particular order, with protein synthesis, or translation taking place in the cytoplasm and transcription taking place in the nucleus.

Protein expression systems, commonly referred to as production systems, are employed in the biotechnology, medical, and life sciences fields. Particularly reverse transcriptase for RNA analysis, DNA polymerase for PCR, and restriction endonucleases for cloning. These are also implemented to make proteins that are scanned in drug development as biological targets or as potential drugs themselves.

The pandemic has had a marginally beneficial effect on the protein expression market. Accurate knowledge of the part proteins perform in the SARS-CoV-2 infection process and COVID-19 progression expedited the development of therapeutic and preventative treatments. The enormous field of proteomics had all the necessary tools to aid with this challenge. Researchers noted that advances in proteome technology would not only speed up progress in combating the coronavirus pandemic but may also prove invaluable in resolving the current COVID-19 problem.

Biologics have been essential in the process of treating a variety of medical conditions. The success of Humira, a medication used to treat rheumatoid arthritis, has inspired numerous pharmaceutical companies to continue developing biologic medicines. The probability that biologicals will be produced utilizing protein expression systems is increased by the rising demand for them. Concurrent bioprocessing has also become a cutting-edge method that has been applied to the production of therapeutic proteins as well as the creation of upstream and downstream processes. As a result of the growing use of genetic engineering and biotechnology in the pharmaceutical business and in the field of medicine, the protein expression market is currently very lucrative.

Due to consumer acceptance, cell-free protein expression is carried out without the use of living cells. Compared to other protein expression methods, this technology has a number of advantages, and as a result, it is frequently employed. Cell-free expression usage is expanding as a result of the benefits of cell-free protein approaches, such as improved speed, the capacity to express hazardous proteins, and the simplicity of amino acids from selective labeling, among others. Therefore, the novel technique can accelerate the development of the cell-free expression industry, which is expected to expand the protein expression market.

The increase in infectious diseases necessitates the availability of excellent diagnostic and therapeutic alternatives like CFPE. For instance, by adding water, CFPE-based systems can be activated more quickly. The mobile diagnosis of communicable diseases is made easier by this capability. The use of CFPS in therapy and diagnosis may increase as infectious diseases become more prevalent. Though this technique is garnering major attention from many institutes, not many are interested in producing them because of some underlying factors. As a result, the cost of producing CFPE on a big scale makes it risky for the expansion of the protein expression market.

Based on system, the protein expression market is segmented into prokaryotic, mammalian cell, insect cell, yeast, and others. The mammalian cell expression system acquired a significant revenue share in the protein expression market in 2021. Mammalian expression systems have been used by numerous pharmaceutical businesses to create and generate proteins either temporarily or through stable cell lines. When certain expression constructs combine with the genomic host, this occurs. Mammalian cells are preferred by businesses for the manufacture of proteins, medicines, and vaccinations.

On the basis of product, the protein expression market is divided into reagents, competent cells, expression vectors, services, and instruments. The reagents segment dominated the protein expression market with the largest revenue share in 2021. Thermo Fisher Scientific and Agilent Technologies, Inc. are examples of established market participants working to develop advanced reagents. To meet the unique requirements of transfection and optimize the circumstances of cell culture, the firms provide a wide selection of transfection reagents.

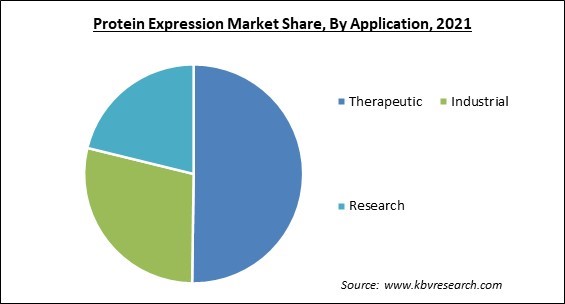

Based on application, the protein expression market is categorized into therapeutic, industrial, and research. The research segment garnered a promising revenue share in the protein expression market in 2021. Protein expression is most frequently used in fundamental research, where it is crucial to the majority of ongoing projects in the biomedical and biological sciences. rDNA probes are used to examine how genes are expressed both inside and across the tissues of entire organisms.

On the basis of end-user, the protein expression market is classified as pharmaceutical & biotechnological companies, academic research, contract research organizations, and others. The pharmaceutical and biotechnological companies recorded the highest revenue share in the protein expression market in 2021. This is because cultured cells are widely used in the creation of treatments and individualized medications. Together they use more than 170 recombinant proteins in medicine around the world. The market is fueled by the pharmaceutical industry's expanding inventive usage of proteins.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 2.5 Billion |

| Market size forecast in 2028 | USD 4.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 10.1% from 2022 to 2028 |

| Number of Pages | 276 |

| Number of Tables | 490 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | System, Product, Application, End-user, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the protein expression market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North American region garnered the largest revenue share in the protein expression market in 2021. This sizeable portion of the market share can be attributed to the existence of important competitors in the area, rising R&D funding, and robust biosimilar pipelines. It has been noted that one of the most important techniques used in the region is a partnership between businesses and academic institutions.

Free Valuable Insights: Global Protein Expression Market size to reach USD 4.9 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc., Merck Group, New England BioLabs, Inc., Promega Corporation, Qiagen N.V., Takara Bio, Inc. (Takara Holdings Inc.), Oxford Expression Technologies Ltd., and LGC Biosearch Technologies.

By System

By Product

By Application

By End User

By Geography

The global Protein Expression Market size is expected to reach $4.9 billion by 2028.

Widespread Application Of Protein Expression In Biologics are driving the market in coming years, however, High Cost Of Cell Free Protein Expression Techniques restraints the growth of the market.

Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc., Merck Group, New England BioLabs, Inc., Promega Corporation, Qiagen N.V., Takara Bio, Inc. (Takara Holdings Inc.), Oxford Expression Technologies Ltd., and LGC Biosearch Technologies.

The Prokaryotic market has acquired the maximum revenue share in the Global Protein Expression Market by System in 2021, thereby, achieving a market value of $1.9 billion by 2028.

The North America market dominated the Global Protein Expression Market by Region in 2021, thereby, achieving a market value of $1.8 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.