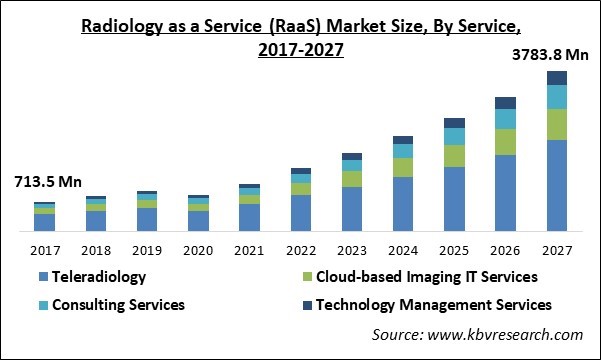

The Global Radiology as a Service Market size is expected to reach $3,783.8 million by 2027, rising at a market growth of 22.5% CAGR during the forecast period.

Radiology services refer to the medical imaging services that can be utilized for treating and diagnosing different kinds of diseases. Radiology services are considered as minimally invasive medical procedures which include magnetic resonance imaging (MRI), positron emission tomography (PET), and computed tomography (CT).

Factors such as the rise in rates of age-associated disorders like Parkinson’s disease, Alzheimer’s disease, and dementia, the deployment of cutting-edge healthcare technologies, and higher focus on R&D activities are acting as growth catalysts for the market during the forecasting period. In addition, the growth of the market would be driven by the increasing aging population and massive spending to develop advanced healthcare infrastructure, particularly in emerging countries.

Aging is the most common factor which increases the risks of developing diseases. As per the Centers for Disease Control and Prevention (CDC), around 4/5th of the aging population in the US experience minimum of one chronic disease. In addition, the American Medical Association (AMA) predicts that around 3/5th of the people aged 65 years or above will experience above one chronic condition by the end of 2030.

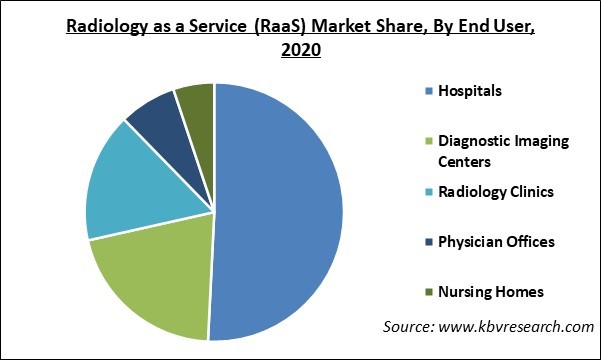

Based on Service, the market is segmented into Teleradiology, Cloud-based Imaging IT Services, Consulting Services, and Technology Management Services. Based on End User, the market is segmented into Hospitals, Diagnostic Imaging Centers, Radiology Clinics, Physician Offices, and Nursing Homes. Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa.

The medical imaging procedures have been drastically declined due to the outbreak of the COVID-19 pandemic, thereby restricting the growth of radiology as a service market during the pandemic period. In addition, doctors, nurses, and other staff were occupied in managing the increased number of COVID-19 patients, which decreased the medical imaging procedures.

In addition, the higher fear of corona virus among the patients has decreased the visits to hospitals regarding radiology imaging. Additionally, the outbreak of the COVID-19 pandemic has increased the demand for remote healthcare services, like telemedicine, telehealth, and teleradiology. Moreover, the growth of the market would be driven by the surge in the adoption of radiology as a service that includes cloud-based imaging IT services, teleradiology, technology management services, and consulting services.

Radiology consists of imaging procedures that help to diagnose and treat different types of diseases. In addition, as various imaging techniques have emerged in the medical field, radiology services have achieved a high popularity in the last couple of years due to their high efficiency in accurately detecting diseases. These days, doctors are highly dependent on radiographers. Radiographers perform these tests as well as provide physical & emotional support throughout these imaging procedures. This factor plays a vital role in boosting the adoption of radiology services among patients.

The demand for radiology services is driven by the growing cases of diseases due to the shifting lifestyle patterns and consumption of unhealthy foods. In addition, imaging techniques are utilized to view structures of the human body with an aim to diagnose, observe, or treat different kinds of diseases. Chronic diseases such as cardiovascular diseases, respiratory diseases, cancer, and others need imaging procedures to decide the future course of treatment, hence boosting the demand for radiology services in the market.

The growth of the market would be hampered by the absence of well-trained professionals in some of the developing and underdeveloped countries. These countries are unwilling to pay the standard income to the trained professionals due to the sluggish economic growth and low healthcare budget, which further contributes to the low penetration of skilled professionals in such countries. In addition, these countries do not have well-developed healthcare infrastructure, which poses a significant challenge to the growth of the overall radiology as a service market.

Based on Service, the Radiology as a service market is segregated into Teleradiology, Cloud-based Imaging IT Services, Consulting Services, and Technology Management Services. The teleradiology service type segment obtained the maximum revenue share of the overall market. In addition, factors such as growing cases of various chronic diseases like tumor, cancer, and cardiac diseases, which generate more diagnostic radiology images, are responsible for the growth of this segment.

Based on End-user, the Radiology as a service market is segmented into Hospitals, Diagnostic Imaging Centers, Radiology Clinics, Physician Offices, and Nursing Homes. In 2020, the hospitals segment garnered the maximum revenue share of the overall radiology as a service market. In addition, factors such as high preferences of patients for treating and diagnosing with the help of varied imaging modalities in the hospitals are anticipated to fuel the growth of this segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 857.1 Million |

| Market size forecast in 2027 | USD 3,783.8 Million |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 22.5% from 2021 to 2027 |

| Number of Pages | 189 |

| Number of Tables | 294 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Service, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on the Region, the Radiology as a service market is analyzed across North America, Europe, APAC, and LAMEA. North America emerged as the leading region in overall radiology as a service market in 2020. This is attributed to the large consumer base for radiology procedures, and the rise in the number of teleradiology service vendors in the region. Additionally, the growth of the regional market would be driven by the less availability of radiologists in the U.S. over the number of patients.

Free Valuable Insights: Global Radiology as a Service Market size to reach USD 3,783.8 Million by 2027

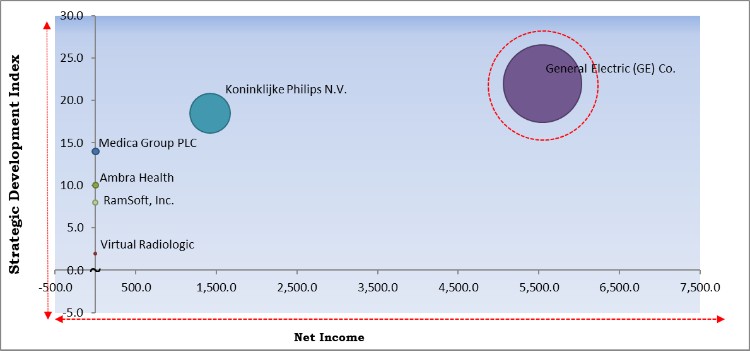

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; General Electric (GE) Co. is the major forerunner in the Radiology as a Service Market. Companies such as Koninklijke Philips N.V., Medica Group PLC, Ambra Health are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include General Electric (GE) Co. (GE Healthcare), Koninklijke Philips N.V., Medica Group PLC, Virtual Radiologic (Radiology Partners, Inc.), Teleconsult Europe, Vesta Teleradiology, Teleradiology Solutions, Inc., ONRAD, Inc., Ambra Health, and RamSoft, Inc.

By Service

By End User

By Geography

The radiology as a service market size is projected to reach USD 3,783.8 million by 2027.

The rise in demand for radiology services are driving the market in coming years, however, lack of well-trained professionals limited the growth of the market.

General Electric (GE) Co. (GE Healthcare), Koninklijke Philips N.V., Medica Group PLC, Virtual Radiologic (Radiology Partners, Inc.), Teleconsult Europe, Vesta Teleradiology, Teleradiology Solutions, Inc., ONRAD, Inc., Ambra Health, and RamSoft, Inc.

Yes, the higher fear of corona virus among the patients has decreased the visits to hospitals regarding radiology imaging. Additionally, the outbreak of the COVID-19 pandemic has increased the demand for remote healthcare services, like telemedicine, telehealth, and teleradiology.

The Technology Management Services market is expected to witness highest CAGR of 24% during (2021 - 2027). The growth of the segment would be fuelled by the rise in demand for remote management of technology in the healthcare centers, especially in the radiology departments.

The North America market dominated the Global Radiology as a Service (RaaS) Market by Region in 2020, and would continue to be a dominant market till 2027; thereby, achieving a market value of $1,656.2 million by 2027, growing at a CAGR of 21.8 % during the forecast period.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.