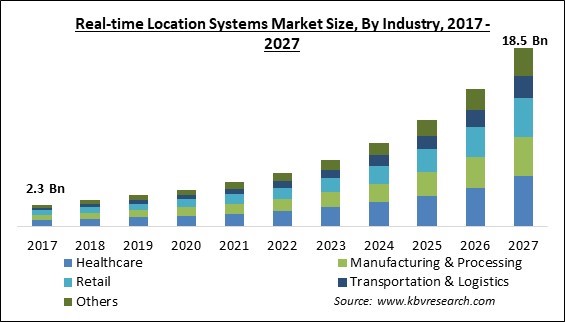

The Global Real-time Location Systems Market size is expected to reach $18.5 billion by 2027, rising at a market growth of 26.2% CAGR during the forecast period.

A real-time location system (RTLS) tracks the location of objects, assets, vehicles, and items in real-time. The system consists of physical tags or beacons affixed to the object, signal detection receivers, gateways, as well as a software location engine.

A real-time location system uses real-time information acquired over a wireless connection to establish an object's present location. It also aids in the indoor tracking of the object. The healthcare sector is adopting indoor tracking as a result of its availability, and it is likely to support the growth of the real-time location systems market for the healthcare vertical. Furthermore, enterprises are turning to real-time location system to reduce the risk of workplace accidents. A real-time location system allows for accurate tracking of vehicles, forklifts, and operators at all times. In addition, these systems analyses traffic based on the obtained data, allowing it to detect and reduce workplace accidents, as well as saving money and time, workflow bottlenecks.

Hospitals can use real-time location systems to check their operations as a form of insurance against prospective lawsuits. The majority of hospitals have patient guarantees. These are especially common in circumstances where the patient is in a serious state or has a mental disease. Along with that, these systems can be used as a form of insurance in the event of a lawsuit.

Furthermore, the Bluetooth standard is widely used around the world. Other technologies are more expensive and difficult to integrate with current systems and devices than Bluetooth Low-Energy (BLE) solutions. Additionally, real-time location system that use Bluetooth tags has a detection accuracy of up to 1.5 meters (about 5 feet), making them appropriate for a wide range of healthcare applications. Due to this, there is a greater need for services and assistance, which may necessitate a redesign of existing resources and procedures. As a result, hospital management teams are turning to real-time location systems (RTLS) to help them overcome some of their problems. Furthermore, the growing popularity of connected devices is fuelling the market growth.

The impact of the COVID-19 pandemic has highlighted the necessity of excellent hand cleanliness, but ensuring adherence in hospitals can also protect patients from other illnesses. RTLS systems can be used to ensure that doctors and nurses wash their hands after treating several patients, preventing the spread of diseases that are especially harmful to patients whose immune systems have already been weakened by their illness.

The spread of COVID-19 has had a positive impact on the market for real-time positioning systems, raising requirements for digital freight solutions. Pharmaceutical logistics gear and software were in high demand as a result of the innovative coronavirus vaccine shipment. The vast scale of this travel may motivate freight-tech companies to reshape the goods movement markets in response to the pandemic.

With an expanding quantity of players entering the market with unique RTLS features for clients, the market for RTLS technology has seen significant expansion. In the RTLS market, there are more than 150 competitors, with the top five accounting for over half of the market share. These top companies have developed industry-specific solutions for the retail, and manufacturing, healthcare industries. Start-ups & smaller companies in the industry, on the other hand, provide customized solutions and develop their customer base in fresh industries such as agriculture, livestock, sports, education, and aerospace & defense, resulting in increased growth and market share year after year. As a result of the intense rivalry in the RTLS market, RTLS companies are compelled to provide their clients with application-specific tailored goods at reasonable prices.

Asset tracking is gaining interest in a variety of industries, including healthcare, defense, and manufacturing, to track assets. Medical equipment, tools, containers and trailers, and containers are among these assets. Furthermore, as per the Stockholm International Peace Research Institute (SIPRI), global military spending has reached an all-time high. The United States, China, Saudi Arabia, India, and France were the top five spending countries in 2020, accounting for more than half of worldwide military spending. As a result, the global real-time location systems market is expected to grow even faster as military spending rises.

At the time of installation, the cost of an RTLS system can be very costly, ranging between USD 2 and 5 million. This varies by industry and is determined by the installation area. Wi-Fi-based RTLS is less expensive to deploy than UWB-permitted systems, but the hardware costs are the opposite. Wi-Fi and RFID-based solutions are more expensive to maintain than systems based on other technologies like UWB and BLE. Many RTLS organizations are experiencing deployment and technological challenges, with many projects faltering due to extensive engineering efforts and on-site preferences. As in the case of RTLS, the company cannot just ship the hardware and expect the customer to install it; they must be there on the installation site.

Based on Technology, the market is segmented into RFID, Ultra-Wideband, Wi-Fi, ZigBee, Infrared and Others. The Ultra-Wideband segment garnered a substantial revenue share in the real-time location systems market in 2020. The increase in technological improvement and rise in the market competition are two significant factors driving the growth of UWB technology. Furthermore, UWB is a major technology in the real-time location systems market due to its high accuracy position identification, low interference with other signals, applicability in both outdoor and indoor contexts, and an acceptable operating range.

Based on Industry, the market is segmented into Healthcare, Manufacturing & Processing, Retail, Transportation & Logistics and Others. The Healthcare segment acquired the highest revenue share in the real-time location systems market in 2020. With the ongoing pandemic, hospitals are currently experiencing unprecedented hurdles. Other severe issues confronting the healthcare sector include aging populations and personnel shortages, both of which put tremendous strain on institutions, workers, doctors, communities, and patients. Many are seeking methods to reduce expenses and increase efficiency while still providing the high-quality treatment that their patients require. The early implementation of RTLS-based solutions for a broad array of applications in healthcare, particularly in the United States, can be credited with the expansion of the healthcare vertical.

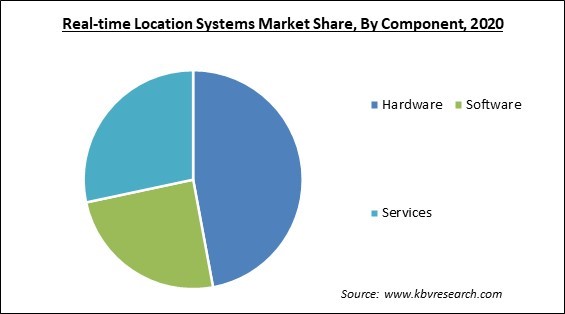

Based on Component, the market is segmented into Hardware, Software and Services. The software segment garnered a substantial revenue share in the real-time location systems market in 2020. The Real-Time Location System (RTLS) Tracking Software is used in a variety of industries, which include manufacturing, healthcare, hospitality, smart warehouses, and education. It manages a variety of purposes, including maximizing workflow efficiency, way finding, safety, and asset & inventory control.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 3.8 Billion |

| Market size forecast in 2027 | USD 18.5 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 26.2% from 2021 to 2027 |

| Number of Pages | 248 |

| Number of Tables | 404 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Technology, Industry, Component, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America emerged as the prominent region in the real-time location systems market with the maximum revenue share in 2020. The market's expansion in this region can be ascribed to several reasons, including technological advancements and the adoption of real-time location systems in industries like healthcare and hospitality. Furthermore, the expansion of the real-time location systems (RTLS) market is aided by smartphone adoption and 5G evolution.

Free Valuable Insights: Global Real-time location systems Market size to reach USD 18.5 Billion by 2027

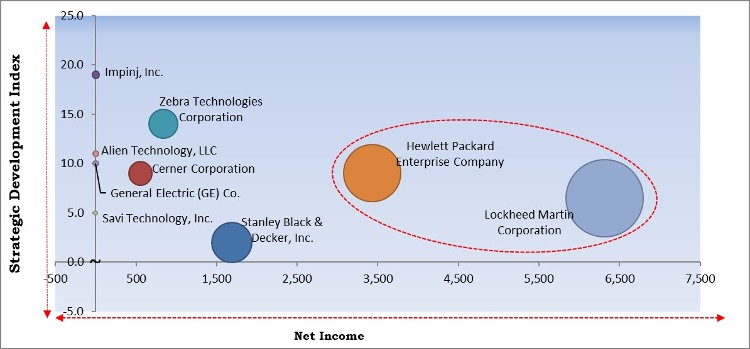

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Lockheed Martin Corporation and Hewlett Packard Enterprise Company are the forerunners in the Real-time location systems Market. Companies such as Impinj, Inc., Zebra Technologies Corporation, Stanley Black & Decker, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Impinj, Inc., Zebra Technologies Corporation, Stanley Black & Decker, Inc., Cerner Corporation, Lockheed Martin Corporation, Hewlett Packard Enterprise Company, General Electric (GE) Co., Alien Technology, LLC, Tracktio, and Savi Technology, Inc.

By Technology

By Industry

By Component

By Geography

The real-time location systems market size is projected to reach USD 18.5 billion by 2027.

Rising availability of low-cost RTLS solutions are driving the market in coming years, however, the high cost of installation and maintenance limited the growth of the market.

Impinj, Inc., Zebra Technologies Corporation, Stanley Black & Decker, Inc., Cerner Corporation, Lockheed Martin Corporation, Hewlett Packard Enterprise Company, General Electric (GE) Co., Alien Technology, LLC, Tracktio, and Savi Technology, Inc.

COVID-19 has had a positive impact on the market for real-time positioning systems, raising requirements for digital freight solutions. Pharmaceutical logistics gear and software were in high demand as a result of the innovative coronavirus vaccine shipment.

The RFID segment dominated the Global Real-time Location Systems Market by Technology in 2020, thereby, achieving a market value of $4.0 billion by 2027.

The North America is the fastest growing region in the Global Real-time Location Systems Market by Region in 2020.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.