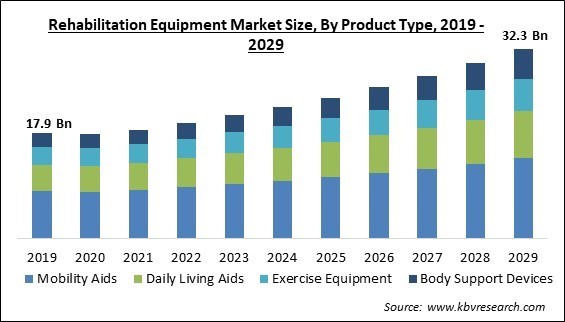

The Global Rehabilitation Equipment Market size is expected to reach $32.3 billion by 2029, rising at a market growth of 7.4% CAGR during the forecast period.

Rehabilitation equipment refers to any medical gadget used to aid in physical rehabilitation. These items include therapeutic machines, workout machines, and assistive devices. This apparatus is intended to assist those with physical limitations, injuries, or chronic illnesses in regaining coordination, strength, and mobility. Moreover, they can be utilized to alleviate discomfort and promote independence.

As chronic diseases like rheumatoid arthritis, Parkinson's disease, multiple sclerosis, and a number of others are becoming more common, the need for rehabilitation equipment has grown around the world. This is the main thing that makes the market grow. Chronic diseases can result in physical impairments and disabilities that can only be treated through rehabilitation services. In addition, the increase in the senior population affected by osteoarthritis is a major contributor to the expansion of the rehabilitation equipment market.

The manual handling of impaired people may cause caretakers to sustain significant musculoskeletal injuries. As caregivers must reach over the stretcher to the bed and manually lift the patient onto the stretcher during lateral transfer, the risk of back injuries increases. This movement pulls caregivers into a difficult spot, which might result in musculoskeletal pain.

Direct costs include money related to the treatment of injury and the total number of man-days lost from work. In contrast, indirect costs are difficult to quantify and include the impaired function of caregivers.

Even months after sustaining a work-related injury, workers in healthcare institutions continue to experience considerable discomfort. In addition, there are typically no measures for replacing wounded staff immediately, which negatively impacts patient care. Hence, fewer caregivers must move and carry the same number of patients, which affects the quality of care, particularly for patients with mobility issues. This, in turn, leads to a rise in the length of hospital stays, which increases the entire cost of healthcare.

The demand and production of rehabilitation equipment rise under the post-COVID scenario, boosting the total net income of businesses manufacturing and supplying rehabilitation equipment. Also, the market can expand due to the spike in demand for elderly and disabled assistance services. Thus, the market experienced a slowdown during the early stages of the pandemic due to the lockdown, which reduced the number of traffic accidents and sporting events. With the lifting of the restrictions and the growing geriatric population, the market is anticipated to grow during the post-pandemic period.

Non-communicable diseases (NCDs) account for 41 million annual fatalities or 74% of all fatalities globally. According to estimates, 86% of these cases take place in low- and middle-income nations. Children, adults, and seniors are susceptible to NCD risk factors, including poor diets, inactivity, exposure to tobacco smoke, and problematic alcohol use. Hence, the prevalence of chronic disease, especially in low or middle-income countries, is expected to increase the usage of various rehabilitation equipment due to their usage for assisting patients in recovering or suppressing the difficulties faced due to chronic disease and propel the market growth.

The importance of rehabilitation in healthcare has grown to retain the residual activities of those suffering from diseases. Rehabilitation or rehab centers offer facilities and services that include possibilities for education and training, rehabilitation for people with disabilities, and patient monitoring and evaluation. Additionally, they empower the disabled by assisting them in generating micro and macro earnings. Rehabilitations are person-oriented, meaning the interventions and methods chosen for each patient are determined by their preferences and goals. Rehabilitation facilities offer treatments that can aid patients in recovering from their chronic ailments.

The expansion of the rehabilitation equipment market is anticipated to be constrained by a general lack of knowledge regarding the efficient use of these equipment. For instance, failing to receive the right care and rehabilitation after a stroke can seriously impact the body's functioning. Patients may completely ignore the symptoms of serious diseases due to this lack of awareness, which impacts how rehabilitation is used. This is a major issue in nations when a shortage of infrastructure and human resources worsens the consequences of this factor. As a result, the expansion of this market is being restricted due to the lack of accessibility to rehabilitation treatments.

Based on product type, the rehabilitation equipment market is segmented into mobility aids, daily living aids, exercise equipment and body support devices. The daily living aids segment acquired a substantial revenue share in the rehabilitation equipment market in 2022. This is due to the products used by physically challenged individuals, patients with physical restrictions, and patients recovering from surgery to help them complete everyday duties and activities. In addition, the need for daily living assistance is anticipated to rise in the upcoming years due to an increase in the number of patients with chronic diseases or Parkinson's disease.

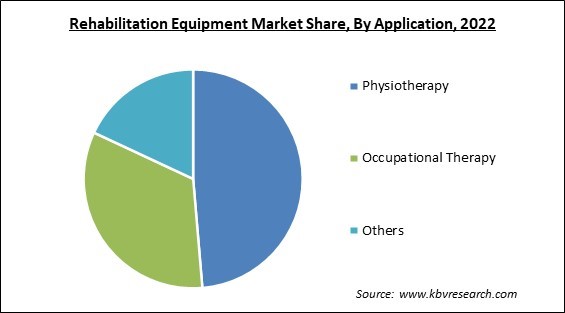

On the basis of application, the rehabilitation equipment market is divided into physiotherapy, occupational therapy and others. The physiotherapy segment held the highest revenue share in the rehabilitation equipment market in 2022. The growth is attributed to the factors like an aging population, changing lifestyles, an increase in the number of physiotherapy centers, and favorable healthcare reforms. Robotics, exoskeletons, implanted tech for pain treatment, and other technological advances are also big drivers of the rehabilitation equipment market in physiotherapy, as is a rising demand in emerging economies.

By end user, the rehabilitation equipment market is classified into hospitals and clinics, rehabilitation centers and homecare settings. The hospitals & clinics segment witnessed the largest revenue share in the rehabilitation equipment market in 2022. This is owing to the fact that patients frequently need to stay in hospitals for longer periods of time before making a full recovery. Also, due to hospitals' huge patient populations, this segment is anticipated to increase significantly over the projected period.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 19.7 Billion |

| Market size forecast in 2029 | USD 32.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 7.4% from 2023 to 2029 |

| Number of Pages | 373 |

| Number of Table | 690 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product Type, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the rehabilitation equipment market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region registered the highest revenue share in the rehabilitation equipment market in 2022. The sharp increase in the number of sports-related injuries among the younger population in this region primarily drives the market. Also, the rise in the elderly population raises the need for rehabilitation tools such as mobility aids to regain stability and movement. Thus, the market for rehabilitative equipment is expected to grow in the North America region.

Free Valuable Insights: Global Rehabilitation Equipment Market size to reach USD 32.3 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Invacare Corporation, Ekso Bionics Holdings, Inc., ReWalk Robotics Ltd., Baxter International, Inc., Medline Industries, Inc., GF Health Products, Inc., Drive DeVilbiss Healthcare (Medical Depot, Inc.), Roma Medical Aids Limited, Hospital Equipment Mfg. Co. and Caremax Rehabilitation Equipment Co. Ltd.

By Application

By Product Type

By End User

By Geography

The Market size is projected to reach USD 32.3 billion by 2029.

Surging prevalence of chronic diseases are driving the Market in coming years, however, Limited access and awareness regarding rehabilitation restraints the growth of the Market.

Invacare Corporation, Ekso Bionics Holdings, Inc., ReWalk Robotics Ltd., Baxter International, Inc., Medline Industries, Inc., GF Health Products, Inc., Drive DeVilbiss Healthcare (Medical Depot, Inc.), Roma Medical Aids Limited, Hospital Equipment Mfg. Co. and Caremax Rehabilitation Equipment Co. Ltd.

The expected CAGR of this Market is 7.4% from 2023 to 2029.

The Mobility Aids segment is leading the Market by Product Type in 2022 thereby, achieving a market value of $13.7 billion by 2029.

The North America market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $11 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.