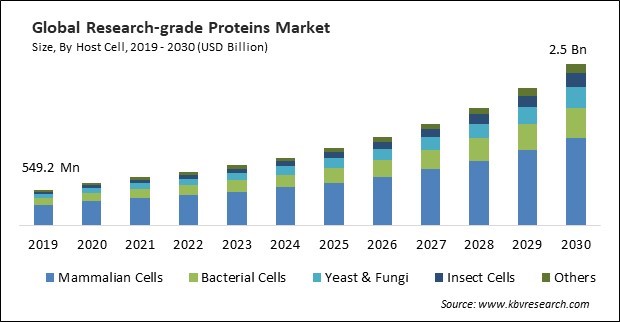

The Global Research-grade Proteins Market size is expected to reach $2.5 Billion by 2030, rising at a market growth of 15.2% CAGR during the forecast period.

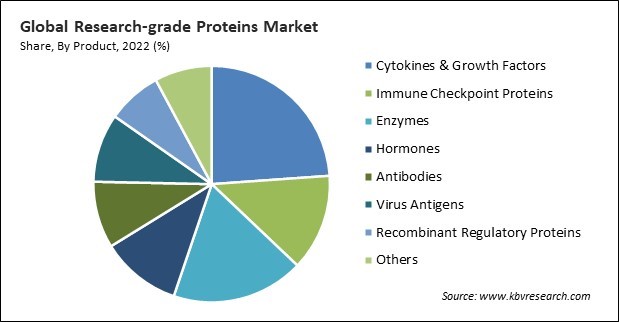

Immune checkpoint proteins, also known as immune checkpoint molecules or inhibitors, are critical regulators of the immune system's response to antigens, including pathogens and cancer cells. Consequently, the Immune checkpoint proteins segment registered $109.9 million revenue of the market in 2022. These proteins balance the immune system's ability to attack foreign invaders while avoiding excessive damage to healthy tissues. Dysregulation of immune checkpoint proteins can lead to immune system dysfunction and contribute to various diseases, including cancer and autoimmune disorders. These therapies have shown remarkable success in treating various types of cancer and are a promising area of research in oncology. Some of the factors Impacting on the market are use of these proteins in industrial applications, growing research activities for drug discovery and precision medicine and regulatory and safety concerns regarding protein production.

The versatility of research-grade proteins is a positive aspect. They serve as essential tools in various industrial applications, ranging from food quality control to bioprocess optimization. Their adaptability to different contexts and their role in supporting quality assurance, process efficiency, and product innovation make them invaluable in diverse industrial settings. Proteins play a critical role in ensuring the quality and safety of food products, and as consumer demands for better food quality increase, so does the need for high-quality research-grade proteins for testing and analysis. These drives sustained demand for these proteins within the food and beverage industry. These are crucial for identifying and validating potential drug targets. Researchers use these proteins to study the biological functions of specific proteins and determine if they are suitable targets for drug development. In drug discovery, high-throughput screening assays are used to test thousands of compounds for their potential as drug candidates. These are employed in these assays to assess the compounds' interactions with target proteins. After identifying initial hits in drug screening, researchers use these proteins to optimize lead compounds and enhance their binding affinity and selectivity for the target.

However, Regulatory agencies, like the European Medicines Agency (EMA) and the US Food and Drug Administration (FDA), have established strict guidelines and requirements for producing, quality control, and characterizing proteins, including research-grade proteins. Meeting regulatory standards can be complex and resource-intensive, requiring adherence to Good Manufacturing Practices (GMP) and Good Laboratory Practices (GLP) standards. Ensuring the purity and quality of these proteins is essential to prevent contamination and ensure reliable research results. Contaminants such as endotoxins, host cell proteins, and adventitious agents must be monitored rigorously. Accurate record-keeping and data integrity are essential for regulatory compliance and quality control. Ensuring the integrity of research data is a critical consideration. These challenges may hamper the market’s growth.

Moreover, the COVID-19 had a moderate impact on the market. The COVID-19 pandemic disrupted supply chains worldwide due to lockdowns, travel restrictions, and labor shortages. This disruption affected the production and distribution of research-grade proteins, potentially leading to delays in product availability. Research institutions and biotechnology companies redirected their resources and efforts toward COVID-19-related research and vaccine development. This shift in research priorities temporarily reduced demand for other research-grade proteins in non-COVID research areas. Economic challenges and uncertainties resulting from the pandemic influenced research budgets and funding availability. Collaborative research efforts and partnerships between academia, industry, and government agencies influenced the demand and use of research-grade proteins. Therefore, the market will grow significantly after the pandemic.

On the basis of product, the market is segmented into cytokines & growth factors, antibodies, immune checkpoint proteins, virus antigens, enzymes, recombinant regulatory proteins, hormones, and others. The enzymes segment projected a remarkable revenue share in the market in 2022. Enzymes are biological molecules that perform as catalysts in living organisms. They play a fundamental role in speeding up chemical reactions, allowing them to occur at a rate compatible with life. Enzymes are essential for functioning in various biological processes, including metabolism, digestion, cellular respiration, and DNA replication.

Based on host cell, the market is fragmented into mammalian cells, bacterial cells, fungi & yeast, insect cells, and others. In 2022, the mammalian cells segment witnessed the largest revenue share in the market. Due to the similar biological makeup to human cells, mammalian cells are widely used in the production of biopharmaceuticals, including monoclonal antibodies, vaccines, therapeutic proteins, and growth factors, among others. In a clinical study conducted by researchers of Karolinska Institute and Karolinska University Hospital and published in March 2023, a possible basic mechanism for the enhancement of cardiac pump function using ghrelin was identified by scientists by studying isolated mouse heart cells in the laboratory.

By end-use, the market is classified into pharmaceutical & biotechnology companies, academic & research institute, and others. In 2022, the pharmaceutical & biotechnology companies segment generated the highest revenue share in the market. The growing drug discoveries & development, rising need for personalized medicines, and growing number of clinical trials are expected to drive the segment's expansion over the forecast period. Moreover, continuous investments by governments to support rising R&D activities are further expected to accelerate the segment's growth.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 831.2 Million |

| Market size forecast in 2030 | USD 2.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 15.2% from 2023 to 2030 |

| Number of Pages | 289 |

| Number of Table | 420 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Host Cell, Product, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the research-grade proteins market is analysed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region garnered a significant revenue share in the market in 2022. Due to the increasing awareness of novel technologies, developing healthcare infrastructure, and surging demand for advanced diagnostics & efficient therapeutic solutions, the market is expected to have a lucrative growth rate. Furthermore, regional emerging economies are establishing research facilities and infrastructure for the biotechnology sector. With the rising number of clinical studies on cancer research and drug development, the Asia Pacific market is anticipated to grow over the years.

Free Valuable Insights: Global Research-grade Proteins Market size to reach USD 2.5 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Thermo Fisher Scientific, Inc., Abcam Plc, Miltenyi Biotech B.V. & Co. KG, Genscript Biotech Corporation, Bio-Techne Corporation, Proteintech Group, Inc., AcroBiosystems INC., Sino Biologicals, Inc. and ProSpec-Tany TechnoGene Ltd. and New England Biolabs, Inc.

By Host Cell

By Product

By End-use

By Geography

This Market size is expected to reach $2.5 Billion by 2030.

Use of research-grade proteins in industrial applications are driving the Market in coming years, however, Regulatory and safety concerns regarding protein production restraints the growth of the Market.

Thermo Fisher Scientific, Inc., Abcam Plc, Miltenyi Biotech B.V. & Co. KG, Genscript Biotech Corporation, Bio-Techne Corporation, Proteintech Group, Inc., AcroBiosystems INC., Sino Biologicals, Inc. and ProSpec-Tany TechnoGene Ltd. and New England Biolabs, Inc.

The expected CAGR of this Market is 15.2% from 2023 to 2030.

The Cytokines & Growth Factors segment is generating the highest revenue share in the Market, by Product in 2022; thereby, achieving a market value of $513.9 million by 2030.

The North America region dominated the Market, by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $1.0 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.