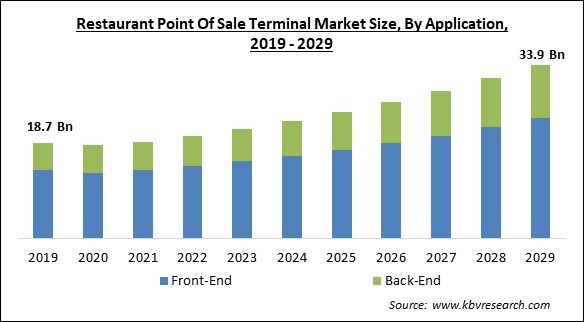

The Global Restaurant Point Of Sale Terminal Market size is expected to reach $33.9 billion by 2029, rising at a market growth of 7.9% CAGR during the forecast period.

The fixed POS terminal is the largest contributor to the market and captured more than 80% share of the market in 2022 as the trend to eat out and the working population are expected to increase the number of people visiting restaurants. The fixed POS are substantially deployed by the Quick service restaurants as tourism industry is growing and people prefers fast food, which in turn, offers opportunities to brands to expand their business. For example, Yum! Brands have more than 53,000 stores across the world. Thus, Quick Service Restaurants generated approximately $5,950.9 million in 2022. Some of the factors impacting the market are adoption of cashless transactions, increasingly adopting point-of-sale (POS) terminals to improve business operations, and Point of sale security issues.

Customers are less likely to carry cash on hand as transactions become more cashless and prefer to use a debit or credit card instead. Hence, the market is expanding as a result of the growing inclination for cashless transactions. To ensure that business operations run smoothly, the duties of the restaurant POS terminal include billing customers, documenting sales data, managing payroll, and controlling inventory. As a result, the additional benefit of implementing a POS system to get insights related to customer choice and sales patterns is anticipated to contribute to the expansion of the market in the projected period. On the Contrary, Cybercriminals steal sensitive and private data from unsuspecting clients through point-of-sale apps, including information on their credit or debit cards, which damages their credit scores and causes financial losses. Hence, the market is predicted to grow slower due to POS terminal security issues.

Based on product, the market is segmented into fixed and mobile. The fixed segment dominated the market with maximum revenue share in 2022. This is because the adoption of point-of-sale terminals in more notable restaurants that serve a large number of customers and have several locations to manage is primarily responsible for the increase in the adoption of fixed POS terminals.

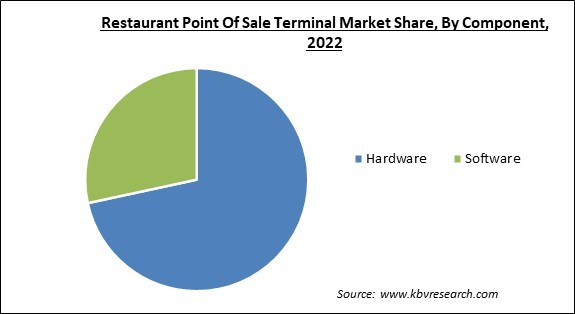

On the basis of component, the market is divided into hardware and software. The hardware segment held the highest revenue share in the market in 2022. This is because touchscreen monitors or tablet, cash drawer, EFTPOS, and receipt printer must be added to the restaurant POS system. In addition, the availability of OLED displays and touch screens, thermal receipt printers, and touch payment EFTPOS systems, among many other innovations, are expected to aid the market segment's expansion in the projected period.

By deployment, the market is classified into cloud and on-premise. The cloud segment garnered a prominent revenue share in the market in 2022. This is because cloud-based deployment increases data visibility, gives enterprises greater mobility, improves data security, reduces downtime for upgrades, and streamlines information across several locations. For quick-service restaurateurs offering upscale culinary experiences, the security, financial, and operational advantages of POS cloud implementation have become clear, aiding the segment's growth in the forecasted period.

Based on the application, the market is bifurcated into front-end and back-end. The front-end segment registered the highest revenue share in the market in 2022. This is owing to the restaurant POS terminal's primary job being to manage front-end activities such as placing orders, billing, keeping track of sales, accepting payments, managing orders, corresponding with customers, reporting, and marketing. A POS system to prepare orders accurately and promptly is essential for managing restaurants' front ends.

On the basis of end-user, the market is divided into full-service restaurant (FSR), quick service restaurant (QSR), institutional and others. The quick service restaurant (QSR) segment acquired a substantial revenue share in the market in 2022. This is because QSRs must frequently attend to a large number of customers in a short period of time, necessitating the assistance of POS systems to determine customer needs, quickly take orders, shorten order turnaround times, and offer quicker customer service. Hence the benefits provided by the POS terminals to the QSR are expected to boost the segment's growth.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 20 Billion |

| Market size forecast in 2029 | USD 33.9 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 7.9% from 2023 to 2029 |

| Number of Pages | 317 |

| Number of Table | 590 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Deployment, Product, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region generated the highest revenue share in the market in 2022. This is because of the region's quickly expanding and changing food service business, driven by favorable demographic trends, and rising disposable income in nations. Many small-scale eateries in Asian nations have begun utilizing tablet-based POS systems and digital kiosks to show menus, take orders, improve operational efficiency, and improve customer experience, boosting the market growth in the region.

Free Valuable Insights: Global Restaurant Point Of Sale Terminal Market size to reach USD 33.9 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Oracle Corporation, Aireus Inc. (CaTech systems Ltd), DCR Point of Sale Systems, Alchemy Web Private Limited, Lightspeed Commerce Inc., PAX Global Technology Limited, VeriFone Holdings, Inc. (Francisco Partners), NCR Corporation, Revel Systems (Welsh, Carson, Anderson & Stowe) and TouchBistro, Inc.

By Application

By End User

By Component

By Deployment

By Product

By Geography

The Market size is projected to reach USD 33.9 billion by 2029.

More people are choosing cashless transactions are driving the Market in coming years, however, Point of sale security issues restraints the growth of the Market.

Oracle Corporation, Aireus Inc. (CaTech systems Ltd), DCR Point of Sale Systems, Alchemy Web Private Limited, Lightspeed Commerce Inc., PAX Global Technology Limited, VeriFone Holdings, Inc. (Francisco Partners), NCR Corporation, Revel Systems (Welsh, Carson, Anderson & Stowe) and TouchBistro, Inc.

The Full-Service Restaurant (FSR) segment is leading the Market by End-user in 2022 thereby, achieving a market value of $14.1 billion by 2029.

The On-premise segment is generating highest revenue share in the Market by Deployment in 2022 thereby, achieving a market value of $23.9 billion by 2029.

The Asia Pacific market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $12.5 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.