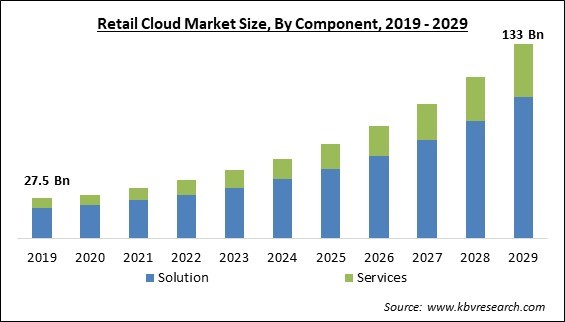

The Global Retail Cloud Market size is expected to reach $133 billion by 2029, rising at a market growth of 19.2% CAGR during the forecast period.

Solutions segment is the major component of the market. Hence, it is anticipated to capture more than 72% share of the market by 2029. Many of these essential elements of the customer experience, including the lack of fitting rooms, interactions with store employees, the acceptance of cash purchases, and in-store product testing, were put to the ultimate test during the COVID-19 pandemic and the ensuing social isolation. As a result, radio-frequency identification (RFID) tags are now a key component of automated in-store checkout systems. RFID tags are very small metal strips that transmit data about the object they are attached to using radio waves, as their name suggests. RFID tags substantially accelerate the automatic checkout procedure because they can be automatically scanned simultaneously and store more data than barcode labels.

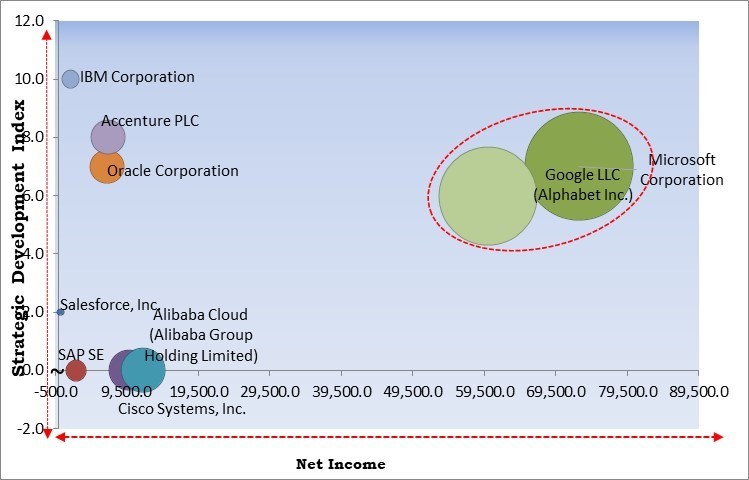

The major strategies followed by the market participants are Product Launches as the key developmental strategy in order to keep pace with the changing demands of end users. For instance, In January, 2023, Google Cloud launched four latest and updated AI tools which are: A personalized search and browsing experience for e-commerce sites, An AI-driven product recommendation system, A tool that uses machine learning to arrange products on websites, and An AI-powered solution for checking in-store shelves. The update aims to offer customers a smoother online shopping experience and support retailers with in-store inventory management. Additionally, In January, 2021, Microsoft Unveiled Microsoft Cloud for Retail, in another sign of the largest cloud providers targeting specific industries and sectors. This launch would aim to help brands create what Microsoft calls 'intelligent retail'. Furthermore, Microsoft would utilize digital solutions to help better known customers to employees in the latest ways, provide an agile and resilient supply chain, and help retail businesses.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation and Google LLC (Alphabet Inc.) are the forerunners in the Market. In September, 2022, Microsoft partnered with Infosys to enable businesses to swiftly redefine customer experiences, amplify systems with cloud and data and renew processes. Companies such as IBM Corporation, Oracle Corporation and Accenture PLC are some of the key innovators in the Market.

Multi-cloud systems are being used by retailers for data analytics. Retailers gather a ton of information from various sources, such as social media, in-store transactions, and internet purchases. Retailers can ensure they have access to the resources and tools they need to efficiently manage their supply chain by utilizing a variety of cloud providers. A shop, for instance, may use one cloud provider for logistics management or another for inventory management. Retailers may gain a competitive advantage, boost their scalability, flexibility, and agility, reduce expenses, and strengthen their security posture using multi-cloud setups.

The demand for a smooth and customized purchasing experience drives the adoption of new retail strategies. Retailers are implementing new technologies to gather and analyze consumer data to better understand their buying habits and preferences. This information can be used to make personalized recommendations and increase customer engagement. Utilizing technology like augmented reality, artificial intelligence, big data analytics, machine learning, and virtual reality, among others, falls under this category. These aspects are predicted to support the growth of the market.

One of the main challenges to the widespread use of cloud computing systems in the retail sector is the integration of cloud technologies with legacy systems. Over time, many retailers have invested in legacy systems, which often handle crucial tasks like ordering, payment, and inventory management. Integrating traditional systems with cloud-based systems can be difficult, but it is necessary to allow businesses to use cloud computing while keeping their current systems in place. Compared to recent cloud-based systems, legacy systems are often created using antiquated technologies. These challenges while integrating cloud-based and legacy systems may hamper the market growth.

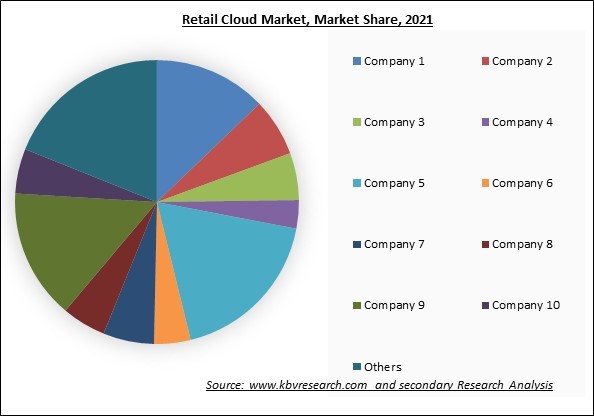

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Based on component, the market is segmented into solutions and services. In 2022, the solutions segment dominated the market with the maximum revenue share. Retail cloud solutions connect online and offline interactions to provide more customized, insight-driven consumer journeys. Moreover, retail cloud solutions offer maximum scalability and high availability for every channel. These advantages of retail cloud solutions encourage greater uptake, which will fuel market expansion in this segment.

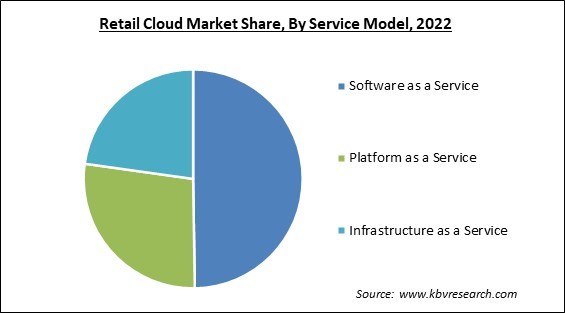

By services model, the market is categorized into SaaS, PaaS, and IaaS. The IaaS segment recorded a remarkable revenue share in the market in 2022. Because of the growing need to reduce IT complexity, hire trained staff to manage IT infrastructures, and reduce data center deployment costs, IaaS is becoming more and more in demand. Both the expanding use of hybrid cloud platforms and the demand for commercial storage and security solutions, have been responsible for the market’s expansion in this segment.

Based on solution type, the market is divided into supply chain management, customer management, workforce management, merchandising, reporting & analytics, data security, omni-channel, and others. In 2022, the supply chain management segment held the highest revenue share in the market. Since most of the industry's major players are implementing cloud-based technology to revolutionize their supply chains with unparalleled visibility and data-driven insights, the retail sector is predicted to experience tremendous growth.

On the basis of deployment model, the market is classified into public cloud, private cloud and hybrid cloud. In 2022, the hybrid cloud segment garnered a significant revenue share in the market. The ability to connect different retail apps and workloads across public & private cloud infrastructures makes hybrid cloud a more popular choice among retailers. Supply chain management, customer relationship management, inventory management, and e-commerce are some of the important retail tasks retailers employ hybrid cloud to serve.

Based on organizational size, the market is fragmented into large enterprises and SMEs. In 2022, the large enterprises segment held the highest revenue share in the market. Large businesses must continuously innovate to thrive in the very competitive retail sector. Large businesses can shave costs, improve customer experience, and streamline processes by implementing retail cloud solutions. Because they have the infrastructure and resources to adopt and operate retail cloud solutions, large businesses may more easily use the advantages of the technology.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 39.7 Billion |

| Market size forecast in 2029 | USD 133 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 19.2% from 2023 to 2029 |

| Number of Pages | 337 |

| Number of Table | 563 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Organization Size, Service Model, Deployment Model, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analysed across North America, Europe, Asia Pacific and LAMEA. In 2022, the North America region led the retail cloud market by generating the highest revenue share. The booming retail industry and rising demand for cloud-based retail solutions are the main causes of consistent revenue growth. Additionally, businesses are reorienting themselves to offer their clients a personalized in-store shopping experience, which is anticipated to drive the market's revenue growth in the region.

Free Valuable Insights: Global Retail Cloud Market size to reach USD 133 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Alibaba Cloud (Alibaba Group Holding Limited), Cisco Systems, Inc., Salesforce, Inc., SAP SE, IBM Corporation, Oracle Corporation, Accenture PLC, Amazon Web Services, Inc (Amazon.com, Inc.), Microsoft Corporation and Google LLC (Alphabet Inc.)

By Organization Size

By Service Model

By Component

By Deployment Model

By Geography

The Market size is projected to reach USD 133 billion by 2029.

Grown acceptance of multi-cloud architecture are driving the Market in coming years, however, Incorporation of cloud-based systems with legacy systems restraints the growth of the Market.

Alibaba Cloud (Alibaba Group Holding Limited), Cisco Systems, Inc., Salesforce, Inc., SAP SE, IBM Corporation, Oracle Corporation, Accenture PLC, Amazon Web Services, Inc (Amazon.com, Inc.), Microsoft Corporation and Google LLC (Alphabet Inc.)

The Software as a Service segment is leading the Market by Service Model in 2022 thereby, achieving a market value of $64.5 billion by 2029.

The Public Cloud segment is generating the highest revenue share in the Market by Deployment Model in 2022 thereby, achieving a market value of $61.6 billion by 2029.

The North America market dominated the Market by Region in 2022 and would continue to be a dominant market till 2029; thereby, achieving a market value of $45.5 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.