Global Retail Core Banking Solution Market Size, Share & Industry Trends Analysis Report By Component, By Deployment Mode (Cloud and On-premise), By Organization Size (Large Enterprises and SMEs), By Application, By Regional Outlook and Forecast, 2022 - 2028

Published Date : 31-Dec-2022 |

Pages: 265 |

Report Format: PDF + Excel |

COVID-19 Impact on the Retail Core Banking Solution Market

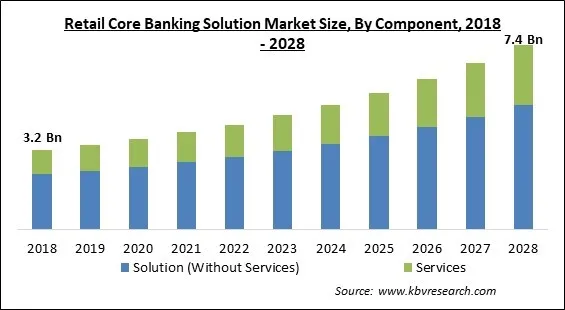

The Global Retail Core Banking Solution Market size is expected to reach $7.4 billion by 2028, rising at a market growth of 9.8% CAGR during the forecast period.

One of the key aspects influencing the market growth is how well the retail core banking solutions help clients manage their finances over a secure channel and provide flexibility in accessing their bank accounts. Additionally, the use of retail core banking solutions gives low-cost funding to banks, aids in their establishment, and maintains an efficient Customer Relationship Management (CRM), which are all predicted to propel market expansion over the course of the projection year. The sector is also growing due to customer mobile and online banking demand.

Banks are under pressure to implement better tactics that may offer their customers straightforward payment options due to the increasing competition from different mobile payment wallets and other Fintech applications, which is expected to drive the market's growth. The competitors in the market are also focusing on new product launches to maintain a competitive edge.

For instance, Temenos AG unveiled its Temenos Transact Data Hub in October 2020. It is a real-time core banking Software-as-a-Service (SaaS) platform. Modern banks must employ the data capabilities Temenos Transact Data Hub provides to fully realize the value of the data housed within the core banking platform. Retailers, technology suppliers, and Fintech start-ups are just a few examples of non-traditional companies that are technology-driven, customer-focused, and nimble.

By concentrating on the most profitable parts of their value chains, such as mobile payments, they harness cutting-edge technologies to provide customers with improved accessibility, higher service, and affordability. Peer-to-peer (P2P) lending was introduced to remove complicated procedures. As a result, these businesses are establishing themselves as strong rivals to conventional banks.

COVID-19 Impact Analysis

To slow the spread of COVID-19, it is advised that most bank employees globally work remotely. The COVID-19 program is also putting customers' long-standing banking habits to the test. Consumers should switch to contactless payment and avoid handling large bills, according to the World Health Organization (WHO). This is because COVID-19 may spread more quickly if it can survive on a note for days. By integrating digital and remote customer transactions, banks can guarantee that ordinary and exceptional operations will be carried out with little trouble. This suggests that the use of IoT in banking will increase over time.

Market Growth Factors

Increase in applications for IoT solutions in banking sector

Due to their many high-throughput and productivity-boosting uses, networked technologies like edge computing and IoT devices are gaining significant popularity on the global market. Additionally, many vendors are producing IoT devices, boosting the penetration of linked devices in the contemporary business environment. Radiofrequency identification (RFID), low-energy Bluetooth, near-field communication (N.F.C.), low-energy wireless, LTE-A, low-energy radio protocols, and Wi-Fi-direct are standard protocols and technologies used by IoT systems.

Growing demand for improved customer experience

IoT impacts banking customer service in various ways. Customers receive timely insights and a personalized experience. Visitors can make an appointment and verify it in their smartphone due to device connectivity. Customers now understand when it is their turn to stand in line rather than wait at the counter. Additionally, the bank maintains a record of each customer's appointments, the services they utilize each time they come in and any questions they may have.

Market Restraining Factors

Rise in the cases of data and security breaches

The biggest barrier to IoT adoption is data protection and security, which is addressed by most of the banking sector. The banking industry is closely regulated by strict compliance with standards and governance since any data breach, or security breach might be fatal. Businesses are feeding increasingly more user and provider data into sophisticated, AI-powered algorithms, creating novel personal data without being aware of how it will affect customers and employees. This subsequently fuels the escalating privacy concerns.

Component Outlook

Based on Component, the Retail Core Banking Solution Market is classified into Solution (without services) and Services. The Services segment registered the significant revenue share in the Retail Core Banking Solution Market. Modern banks need several complex systems to work together to ensure continuous service delivery and reliability. The retail core banking services model ensures that all the systems are managed at once and have outstanding usability, complete functionality, bug fixes, and timely upgrades.

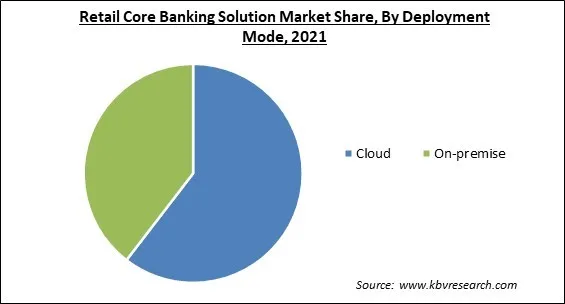

Deployment Mode Outlook

Based on Deployment Mode, the Retail Core Banking Solution Market is classified into Cloud and On-premise. The on-premises segment accounted for the substantial revenue share in the Retail Core Banking Solution Market during 2021. The banking organization favors on-premise solutions because of their many benefits. One of these benefits is total risk reduction because the data is controlled and hosted on private servers.

Organization Size Outlook

Based on Organization size, the Retail Core Banking Solution Market is classified into Large Enterprises and Small & Medium Enterprises. In 2021, the Small and Medium Enterprises segment showcased the considerable revenue share in the market. The segment is anticipated to rise due to S.M.E.s' evolving need to adapt their operations and financing facilities and their growing demand for flexibility. The increasing S.M.E. ecosystem is also accelerating the desire for S.M.E.s to install retail core banking products, which will likely accelerate the segment's growth.

Application Outlook

Based on application, Retail Core Banking Solution Market is divided into Regulatory Compliance, Risk Management, Digital Banking, and Others. In 2021, the regulatory compliance segment acquired the highest revenue share in the market. The dominance might be attributed to the importance of client data protection in the banking industry. Every data breach or internet attack could cause irreversible harm to a business. One advantage of a tailored solution is the capacity to provide extra protection layers.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 3.9 Billion |

| Market size forecast in 2028 | USD 7.4 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9.8% from 2022 to 2028 |

| Number of Pages | 265 |

| Number of Tables | 423 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Deployment Mode, Organization Size, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Regional Outlook

Based on geography, the Retail Core Banking Solution Market is categorized into North America, Europe, Asia Pacific, and LAMEA. North America led the Retail Core Banking Solution Market with the largest revenue share in 2021. Due to significant continuous technological advancements in core banking solutions and acceptance by well-known firms like Canadian Western Bank and HSBC Holdings plc, the dominance is predicted to last over the projection period.

Free Valuable Insights: Global Retail Core Banking Solution Market size to reach USD 7.4 Billion by 2028

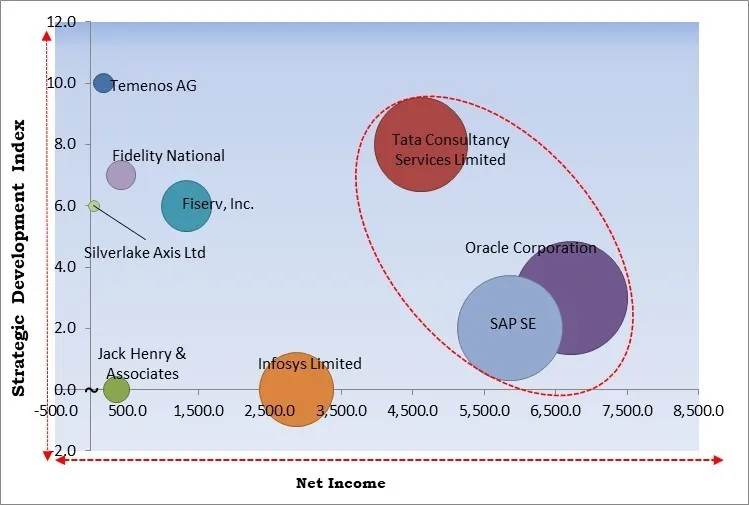

KBV Cardinal Matrix - SRetail Core Banking Solution Market Competition Analysis

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; SAP SE, Oracle Corporation, Tata Consultancy Services Ltd. are the forerunners in the Retail Core Banking Solution Market. Companies such as Infosys Limited, Fiserv, Inc., and Fidelity National Information Services, Inc. are some of the key innovators in Retail Core Banking Solution Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Oracle Corporation, Fiserv, Inc., Temenos AG, Tata Consultancy Services Limited, SAP SE, Infosys Limited, Fidelity National Information Services, Inc. (FIS), Kiya.ai, Jack Henry & Associates, Inc. and Silverlake Axis Ltd.

Strategies deployed in Retail Core Banking Solution Market

» Partnerships, Collaborations and Agreements:

- Aug-2022: Temenos partnered with North International Bank, an Antigua and Barbuda-based bank. Temenos' platform allows NIBank to develop a comprehensive ecosystem of financial services and technology partners.

- Aug-2022: Tata Consultancy Services partnered with Five Star Bank, a US-based provider of banking services. The partnership involves utilizing TCS' Customer Intelligence & Insights (CI&I) analytics platform to compute lending risk and provide personalized customer experiences to Five Star Bank's clients and furnishing Five Star's relationship managers and business customers with appropriate, well-timed insights and alerts.

- Jul-2022: SAP Spain came into partnership with Santander Corporate and Investment Banking (CIB), an investment banking firm. The partnership involves focusing on solutions and services related to enhancing client-to-bank connectivity, and invisible banking. Moreover, this partnership integrates SAP's technology and CIB's products and services, reflecting co-innovation.

- Jul-2022: Silverlake Axis came into partnership with Finastra, a UK-based company primarily into developing payment infrastructure software. The partnership agreement involves, bringing together Silverlake's expertise in understanding complex technical solutioning and Finastra's competence in trade finance to deliver relevant solutions to their clients. Moreover, the partnership involves Silverlake offering Finastra's trade finance solutions to clients in ASEAN.

- Dec-2021: Temenos extended its collaboration agreement with Microsoft, a US-based global technology corporation. The extended agreement aims at fulfilling the growing needs for SaaS and banking services from banks. Moreover, the partnership aligns with both companies' devotion to providing their clients with a road map toward cloud adoption.

- Oct-2021: Tata Consultancy Services (TCS) extended its partnership with the State Bank of India (SBI), an India-based multinational bank. The extended partnership involves TCS continuing to improve and maintain SBI's application estate.

- May-2021: FIS partnered with Abu Dhabi Islamic Bank (ADIB). The partnership involves using FIS' open payment framework to combine ADIB's payment operations, decrease payment processing costs, and comply with dynamic regulatory compliance requirements. Moreover, this partnership aligns with FIS' efforts to develop and invest in digital banking solutions.

- Mar-2021: Fiserv extended its partnership with SDB Bank, a Sri-Lanka-based company primarily into providing banking services. The extended partnership aims at upgrading SDB's teller solutions and banking platform and including features like multi-entity and multicurrency to better serve the needs of its clients.

- Jan-2020: FIS partnered with Union Bank, a US-based chartered savings bank. The partnership aims at delivering a core banking platform to Union Bank and involves using FIS' modern banking platform to jointly design and develop systems to innovate and manage the growing needs of its clients.

» Product Launches and Product Expansions:

- Apr-2022: FIS unveiled Banking-as-a-Service Hub. The hub provides all financial institutions big or small with unbundled fintech solutions. Moreover, the hub enables credit unions, banks, and fintechs to develop payments and a digital banking ecosystem required to provide innovation to consumers and merchants.

- Feb-2022: Temenos unveiled new Temenos Banking Services developed exclusively to meet the distinctive requirements of challenger banks. The new product benefits challenger banks by providing them with reduced costs of ownership, quick innovation, etc.

- Jan-2022: Temenos introduced Buy-Now-Pay-Later banking service. The BNPL service would benefit Temenos' clients particularly banks and fintechs by unlocking new revenue opportunities.

- Oct-2020: Oracle unveiled new cloud services. The new services are intended to support mid-sized banks in the fight against financial crime and money laundering. The new cloud service provides mid-sized banks with the same modern crime detection used by large institutions. The new service features a 360-degree view of events and customers, and the ability to configure and scale to support new services, products, etc.

» Acquisitions and Mergers:

- Apr-2022: Fiserv took over Finxact, a US-based developer of a cloud-based banking platform. The acquisition aims at advancing the capabilities of financial institutions and fintechs to provide digital banking services to their clients.

- Jan-2021: TCS took over Postbank Systems, a Germany-based information technology services company. The acquisition would reinforce and expand TCS' market presence in Germany.

Scope of the Study

Market Segments Covered in the Report:

By Component

- Solution (Without Services)

- Services

By Deployment Mode

- Cloud

- On-premise

By Organization Size

- Large Enterprises

- SMEs

By Application

- Regulatory Compliance

- Risk Management

- Digital Banking

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Oracle Corporation

- Fiserv, Inc.

- Temenos AG

- Tata Consultancy Services Limited

- SAP SE

- Infosys Limited

- Fidelity National Information Services, Inc. (FIS)

- Kiya.ai

- Jack Henry & Associates, Inc.

- Silverlake Axis Ltd

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Retail Core Banking Solution Market, by Component

1.4.2 Global Retail Core Banking Solution Market, by Deployment Mode

1.4.3 Global Retail Core Banking Solution Market, by Organization Size

1.4.4 Global Retail Core Banking Solution Market, by Application

1.4.5 Global Retail Core Banking Solution Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2018-2022)

3.3.2 Key Strategic Move: (Partnerships, Collaborations and Agreements: 2020, Jan – 2022, Aug) Leading Players

Chapter 4. Global Retail Core Banking Solution Market by Component

4.1 Global Solution (Without Services) Market by Region

4.2 Global Services Market by Region

Chapter 5. Global Retail Core Banking Solution Market by Deployment Mode

5.1 Global Cloud Market by Region

5.2 Global On-premise Market by Region

Chapter 6. Global Retail Core Banking Solution Market by Organization Size

6.1 Global Large Enterprises Market by Region

6.2 Global SMEs Market by Region

Chapter 7. Global Retail Core Banking Solution Market by Application

7.1 Global Regulatory Compliance Market by Region

7.2 Global Risk Management Market by Region

7.3 Global Digital Banking Market by Region

7.4 Global Others Market by Region

Chapter 8. Global Retail Core Banking Solution Market by Region

8.1 North America Retail Core Banking Solution Market

8.1.1 North America Retail Core Banking Solution Market by Component

8.1.1.1 North America Solution (Without Services) Market by Country

8.1.1.2 North America Services Market by Country

8.1.2 North America Retail Core Banking Solution Market by Deployment Mode

8.1.2.1 North America Cloud Market by Country

8.1.2.2 North America On-premise Market by Country

8.1.3 North America Retail Core Banking Solution Market by Organization Size

8.1.3.1 North America Large Enterprises Market by Country

8.1.3.2 North America SMEs Market by Country

8.1.4 North America Retail Core Banking Solution Market by Application

8.1.4.1 North America Regulatory Compliance Market by Country

8.1.4.2 North America Risk Management Market by Country

8.1.4.3 North America Digital Banking Market by Country

8.1.4.4 North America Others Market by Country

8.1.5 North America Retail Core Banking Solution Market by Country

8.1.5.1 US Retail Core Banking Solution Market

8.1.5.1.1 US Retail Core Banking Solution Market by Component

8.1.5.1.2 US Retail Core Banking Solution Market by Deployment Mode

8.1.5.1.3 US Retail Core Banking Solution Market by Organization Size

8.1.5.1.4 US Retail Core Banking Solution Market by Application

8.1.5.2 Canada Retail Core Banking Solution Market

8.1.5.2.1 Canada Retail Core Banking Solution Market by Component

8.1.5.2.2 Canada Retail Core Banking Solution Market by Deployment Mode

8.1.5.2.3 Canada Retail Core Banking Solution Market by Organization Size

8.1.5.2.4 Canada Retail Core Banking Solution Market by Application

8.1.5.3 Mexico Retail Core Banking Solution Market

8.1.5.3.1 Mexico Retail Core Banking Solution Market by Component

8.1.5.3.2 Mexico Retail Core Banking Solution Market by Deployment Mode

8.1.5.3.3 Mexico Retail Core Banking Solution Market by Organization Size

8.1.5.3.4 Mexico Retail Core Banking Solution Market by Application

8.1.5.4 Rest of North America Retail Core Banking Solution Market

8.1.5.4.1 Rest of North America Retail Core Banking Solution Market by Component

8.1.5.4.2 Rest of North America Retail Core Banking Solution Market by Deployment Mode

8.1.5.4.3 Rest of North America Retail Core Banking Solution Market by Organization Size

8.1.5.4.4 Rest of North America Retail Core Banking Solution Market by Application

8.2 Europe Retail Core Banking Solution Market

8.2.1 Europe Retail Core Banking Solution Market by Component

8.2.1.1 Europe Solution (Without Services) Market by Country

8.2.1.2 Europe Services Market by Country

8.2.2 Europe Retail Core Banking Solution Market by Deployment Mode

8.2.2.1 Europe Cloud Market by Country

8.2.2.2 Europe On-premise Market by Country

8.2.3 Europe Retail Core Banking Solution Market by Organization Size

8.2.3.1 Europe Large Enterprises Market by Country

8.2.3.2 Europe SMEs Market by Country

8.2.4 Europe Retail Core Banking Solution Market by Application

8.2.4.1 Europe Regulatory Compliance Market by Country

8.2.4.2 Europe Risk Management Market by Country

8.2.4.3 Europe Digital Banking Market by Country

8.2.4.4 Europe Others Market by Country

8.2.5 Europe Retail Core Banking Solution Market by Country

8.2.5.1 Germany Retail Core Banking Solution Market

8.2.5.1.1 Germany Retail Core Banking Solution Market by Component

8.2.5.1.2 Germany Retail Core Banking Solution Market by Deployment Mode

8.2.5.1.3 Germany Retail Core Banking Solution Market by Organization Size

8.2.5.1.4 Germany Retail Core Banking Solution Market by Application

8.2.5.2 UK Retail Core Banking Solution Market

8.2.5.2.1 UK Retail Core Banking Solution Market by Component

8.2.5.2.2 UK Retail Core Banking Solution Market by Deployment Mode

8.2.5.2.3 UK Retail Core Banking Solution Market by Organization Size

8.2.5.2.4 UK Retail Core Banking Solution Market by Application

8.2.5.3 France Retail Core Banking Solution Market

8.2.5.3.1 France Retail Core Banking Solution Market by Component

8.2.5.3.2 France Retail Core Banking Solution Market by Deployment Mode

8.2.5.3.3 France Retail Core Banking Solution Market by Organization Size

8.2.5.3.4 France Retail Core Banking Solution Market by Application

8.2.5.4 Russia Retail Core Banking Solution Market

8.2.5.4.1 Russia Retail Core Banking Solution Market by Component

8.2.5.4.2 Russia Retail Core Banking Solution Market by Deployment Mode

8.2.5.4.3 Russia Retail Core Banking Solution Market by Organization Size

8.2.5.4.4 Russia Retail Core Banking Solution Market by Application

8.2.5.5 Spain Retail Core Banking Solution Market

8.2.5.5.1 Spain Retail Core Banking Solution Market by Component

8.2.5.5.2 Spain Retail Core Banking Solution Market by Deployment Mode

8.2.5.5.3 Spain Retail Core Banking Solution Market by Organization Size

8.2.5.5.4 Spain Retail Core Banking Solution Market by Application

8.2.5.6 Italy Retail Core Banking Solution Market

8.2.5.6.1 Italy Retail Core Banking Solution Market by Component

8.2.5.6.2 Italy Retail Core Banking Solution Market by Deployment Mode

8.2.5.6.3 Italy Retail Core Banking Solution Market by Organization Size

8.2.5.6.4 Italy Retail Core Banking Solution Market by Application

8.2.5.7 Rest of Europe Retail Core Banking Solution Market

8.2.5.7.1 Rest of Europe Retail Core Banking Solution Market by Component

8.2.5.7.2 Rest of Europe Retail Core Banking Solution Market by Deployment Mode

8.2.5.7.3 Rest of Europe Retail Core Banking Solution Market by Organization Size

8.2.5.7.4 Rest of Europe Retail Core Banking Solution Market by Application

8.3 Asia Pacific Retail Core Banking Solution Market

8.3.1 Asia Pacific Retail Core Banking Solution Market by Component

8.3.1.1 Asia Pacific Solution (Without Services) Market by Country

8.3.1.2 Asia Pacific Services Market by Country

8.3.2 Asia Pacific Retail Core Banking Solution Market by Deployment Mode

8.3.2.1 Asia Pacific Cloud Market by Country

8.3.2.2 Asia Pacific On-premise Market by Country

8.3.3 Asia Pacific Retail Core Banking Solution Market by Organization Size

8.3.3.1 Asia Pacific Large Enterprises Market by Country

8.3.3.2 Asia Pacific SMEs Market by Country

8.3.4 Asia Pacific Retail Core Banking Solution Market by Application

8.3.4.1 Asia Pacific Regulatory Compliance Market by Country

8.3.4.2 Asia Pacific Risk Management Market by Country

8.3.4.3 Asia Pacific Digital Banking Market by Country

8.3.4.4 Asia Pacific Others Market by Country

8.3.5 Asia Pacific Retail Core Banking Solution Market by Country

8.3.5.1 China Retail Core Banking Solution Market

8.3.5.1.1 China Retail Core Banking Solution Market by Component

8.3.5.1.2 China Retail Core Banking Solution Market by Deployment Mode

8.3.5.1.3 China Retail Core Banking Solution Market by Organization Size

8.3.5.1.4 China Retail Core Banking Solution Market by Application

8.3.5.2 Japan Retail Core Banking Solution Market

8.3.5.2.1 Japan Retail Core Banking Solution Market by Component

8.3.5.2.2 Japan Retail Core Banking Solution Market by Deployment Mode

8.3.5.2.3 Japan Retail Core Banking Solution Market by Organization Size

8.3.5.2.4 Japan Retail Core Banking Solution Market by Application

8.3.5.3 India Retail Core Banking Solution Market

8.3.5.3.1 India Retail Core Banking Solution Market by Component

8.3.5.3.2 India Retail Core Banking Solution Market by Deployment Mode

8.3.5.3.3 India Retail Core Banking Solution Market by Organization Size

8.3.5.3.4 India Retail Core Banking Solution Market by Application

8.3.5.4 South Korea Retail Core Banking Solution Market

8.3.5.4.1 South Korea Retail Core Banking Solution Market by Component

8.3.5.4.2 South Korea Retail Core Banking Solution Market by Deployment Mode

8.3.5.4.3 South Korea Retail Core Banking Solution Market by Organization Size

8.3.5.4.4 South Korea Retail Core Banking Solution Market by Application

8.3.5.5 Singapore Retail Core Banking Solution Market

8.3.5.5.1 Singapore Retail Core Banking Solution Market by Component

8.3.5.5.2 Singapore Retail Core Banking Solution Market by Deployment Mode

8.3.5.5.3 Singapore Retail Core Banking Solution Market by Organization Size

8.3.5.5.4 Singapore Retail Core Banking Solution Market by Application

8.3.5.6 Malaysia Retail Core Banking Solution Market

8.3.5.6.1 Malaysia Retail Core Banking Solution Market by Component

8.3.5.6.2 Malaysia Retail Core Banking Solution Market by Deployment Mode

8.3.5.6.3 Malaysia Retail Core Banking Solution Market by Organization Size

8.3.5.6.4 Malaysia Retail Core Banking Solution Market by Application

8.3.5.7 Rest of Asia Pacific Retail Core Banking Solution Market

8.3.5.7.1 Rest of Asia Pacific Retail Core Banking Solution Market by Component

8.3.5.7.2 Rest of Asia Pacific Retail Core Banking Solution Market by Deployment Mode

8.3.5.7.3 Rest of Asia Pacific Retail Core Banking Solution Market by Organization Size

8.3.5.7.4 Rest of Asia Pacific Retail Core Banking Solution Market by Application

8.4 LAMEA Retail Core Banking Solution Market

8.4.1 LAMEA Retail Core Banking Solution Market by Component

8.4.1.1 LAMEA Solution (Without Services) Market by Country

8.4.1.2 LAMEA Services Market by Country

8.4.2 LAMEA Retail Core Banking Solution Market by Deployment Mode

8.4.2.1 LAMEA Cloud Market by Country

8.4.2.2 LAMEA On-premise Market by Country

8.4.3 LAMEA Retail Core Banking Solution Market by Organization Size

8.4.3.1 LAMEA Large Enterprises Market by Country

8.4.3.2 LAMEA SMEs Market by Country

8.4.4 LAMEA Retail Core Banking Solution Market by Application

8.4.4.1 LAMEA Regulatory Compliance Market by Country

8.4.4.2 LAMEA Risk Management Market by Country

8.4.4.3 LAMEA Digital Banking Market by Country

8.4.4.4 LAMEA Others Market by Country

8.4.5 LAMEA Retail Core Banking Solution Market by Country

8.4.5.1 Brazil Retail Core Banking Solution Market

8.4.5.1.1 Brazil Retail Core Banking Solution Market by Component

8.4.5.1.2 Brazil Retail Core Banking Solution Market by Deployment Mode

8.4.5.1.3 Brazil Retail Core Banking Solution Market by Organization Size

8.4.5.1.4 Brazil Retail Core Banking Solution Market by Application

8.4.5.2 Argentina Retail Core Banking Solution Market

8.4.5.2.1 Argentina Retail Core Banking Solution Market by Component

8.4.5.2.2 Argentina Retail Core Banking Solution Market by Deployment Mode

8.4.5.2.3 Argentina Retail Core Banking Solution Market by Organization Size

8.4.5.2.4 Argentina Retail Core Banking Solution Market by Application

8.4.5.3 UAE Retail Core Banking Solution Market

8.4.5.3.1 UAE Retail Core Banking Solution Market by Component

8.4.5.3.2 UAE Retail Core Banking Solution Market by Deployment Mode

8.4.5.3.3 UAE Retail Core Banking Solution Market by Organization Size

8.4.5.3.4 UAE Retail Core Banking Solution Market by Application

8.4.5.4 Saudi Arabia Retail Core Banking Solution Market

8.4.5.4.1 Saudi Arabia Retail Core Banking Solution Market by Component

8.4.5.4.2 Saudi Arabia Retail Core Banking Solution Market by Deployment Mode

8.4.5.4.3 Saudi Arabia Retail Core Banking Solution Market by Organization Size

8.4.5.4.4 Saudi Arabia Retail Core Banking Solution Market by Application

8.4.5.5 South Africa Retail Core Banking Solution Market

8.4.5.5.1 South Africa Retail Core Banking Solution Market by Component

8.4.5.5.2 South Africa Retail Core Banking Solution Market by Deployment Mode

8.4.5.5.3 South Africa Retail Core Banking Solution Market by Organization Size

8.4.5.5.4 South Africa Retail Core Banking Solution Market by Application

8.4.5.6 Nigeria Retail Core Banking Solution Market

8.4.5.6.1 Nigeria Retail Core Banking Solution Market by Component

8.4.5.6.2 Nigeria Retail Core Banking Solution Market by Deployment Mode

8.4.5.6.3 Nigeria Retail Core Banking Solution Market by Organization Size

8.4.5.6.4 Nigeria Retail Core Banking Solution Market by Application

8.4.5.7 Rest of LAMEA Retail Core Banking Solution Market

8.4.5.7.1 Rest of LAMEA Retail Core Banking Solution Market by Component

8.4.5.7.2 Rest of LAMEA Retail Core Banking Solution Market by Deployment Mode

8.4.5.7.3 Rest of LAMEA Retail Core Banking Solution Market by Organization Size

8.4.5.7.4 Rest of LAMEA Retail Core Banking Solution Market by Application

Chapter 9. Company Profiles

9.1 Temenos AG

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Segmental and Regional Analysis

9.1.4 Recent strategies and developments:

9.1.4.1 Partnerships, Collaborations, and Agreements:

9.1.4.2 Product Launches and Product Expansions:

9.1.5 SWOT Analysis

9.2 Fiserv, Inc.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Segmental and Regional Analysis

9.2.4 Recent strategies and developments:

9.2.4.1 Partnerships, Collaborations, and Agreements:

9.2.4.2 Acquisition and Mergers:

9.2.5 SWOT Analysis

9.3 Tata Consultancy Services Ltd.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Segmental and Regional Analysis

9.3.4 Research & Development Expenses

9.3.5 Recent strategies and developments:

9.3.5.1 Partnerships, Collaborations, and Agreements:

9.3.5.2 Acquisition and Mergers:

9.3.6 SWOT Analysis

9.4 Infosys Limited

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Segmental and Regional Analysis

9.4.4 Research & Development Expense

9.4.5 SWOT Analysis

9.5 Oracle Corporation

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Segmental and Regional Analysis

9.5.4 Research & Development Expense

9.5.5 Recent strategies and developments:

9.5.5.1 Product Launches and Product Expansions:

9.5.6 SWOT Analysis

9.6 SAP SE

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Segmental and Regional Analysis

9.6.4 Research & Development Expense

9.6.5 Recent strategies and developments:

9.6.5.1 Partnerships, Collaborations, and Agreements:

9.6.6 SWOT Analysis

9.7 Jack Henry & Associates, Inc.

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Segmental Analysis

9.7.4 Research & Development Expenses

9.8 Fidelity National Information Services, Inc.

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Segmental and Regional Analysis

9.8.4 Recent strategies and developments:

9.8.4.1 Partnerships, Collaborations, and Agreements:

9.8.4.2 Product Launches and Product Expansions:

9.9 Silverlake Axis Ltd.

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Segmental and Regional Analysis

9.9.4 Recent strategies and developments:

9.9.4.1 Partnerships, Collaborations, and Agreements:

9.9.4.2 Acquisition and Mergers:

9.10. Kiya.ai

9.10.1 Company Overview

TABLE 2 Global Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Retail Core Banking Solution Market

TABLE 4 Product Launches And Product Expansions– Retail Core Banking Solution Market

TABLE 5 Acquisition and Mergers– Retail Core Banking Solution Market

TABLE 6 Global Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 7 Global Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 8 Global Solution (Without Services) Market by Region, 2018 - 2021, USD Million

TABLE 9 Global Solution (Without Services) Market by Region, 2022 - 2028, USD Million

TABLE 10 Global Services Market by Region, 2018 - 2021, USD Million

TABLE 11 Global Services Market by Region, 2022 - 2028, USD Million

TABLE 12 Global Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 13 Global Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 14 Global Cloud Market by Region, 2018 - 2021, USD Million

TABLE 15 Global Cloud Market by Region, 2022 - 2028, USD Million

TABLE 16 Global On-premise Market by Region, 2018 - 2021, USD Million

TABLE 17 Global On-premise Market by Region, 2022 - 2028, USD Million

TABLE 18 Global Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 19 Global Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 20 Global Large Enterprises Market by Region, 2018 - 2021, USD Million

TABLE 21 Global Large Enterprises Market by Region, 2022 - 2028, USD Million

TABLE 22 Global SMEs Market by Region, 2018 - 2021, USD Million

TABLE 23 Global SMEs Market by Region, 2022 - 2028, USD Million

TABLE 24 Global Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 25 Global Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 26 Global Regulatory Compliance Market by Region, 2018 - 2021, USD Million

TABLE 27 Global Regulatory Compliance Market by Region, 2022 - 2028, USD Million

TABLE 28 Global Risk Management Market by Region, 2018 - 2021, USD Million

TABLE 29 Global Risk Management Market by Region, 2022 - 2028, USD Million

TABLE 30 Global Digital Banking Market by Region, 2018 - 2021, USD Million

TABLE 31 Global Digital Banking Market by Region, 2022 - 2028, USD Million

TABLE 32 Global Others Market by Region, 2018 - 2021, USD Million

TABLE 33 Global Others Market by Region, 2022 - 2028, USD Million

TABLE 34 Global Retail Core Banking Solution Market by Region, 2018 - 2021, USD Million

TABLE 35 Global Retail Core Banking Solution Market by Region, 2022 - 2028, USD Million

TABLE 36 North America Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 37 North America Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 38 North America Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 39 North America Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 40 North America Solution (Without Services) Market by Country, 2018 - 2021, USD Million

TABLE 41 North America Solution (Without Services) Market by Country, 2022 - 2028, USD Million

TABLE 42 North America Services Market by Country, 2018 - 2021, USD Million

TABLE 43 North America Services Market by Country, 2022 - 2028, USD Million

TABLE 44 North America Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 45 North America Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 46 North America Cloud Market by Country, 2018 - 2021, USD Million

TABLE 47 North America Cloud Market by Country, 2022 - 2028, USD Million

TABLE 48 North America On-premise Market by Country, 2018 - 2021, USD Million

TABLE 49 North America On-premise Market by Country, 2022 - 2028, USD Million

TABLE 50 North America Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 51 North America Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 52 North America Large Enterprises Market by Country, 2018 - 2021, USD Million

TABLE 53 North America Large Enterprises Market by Country, 2022 - 2028, USD Million

TABLE 54 North America SMEs Market by Country, 2018 - 2021, USD Million

TABLE 55 North America SMEs Market by Country, 2022 - 2028, USD Million

TABLE 56 North America Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 57 North America Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 58 North America Regulatory Compliance Market by Country, 2018 - 2021, USD Million

TABLE 59 North America Regulatory Compliance Market by Country, 2022 - 2028, USD Million

TABLE 60 North America Risk Management Market by Country, 2018 - 2021, USD Million

TABLE 61 North America Risk Management Market by Country, 2022 - 2028, USD Million

TABLE 62 North America Digital Banking Market by Country, 2018 - 2021, USD Million

TABLE 63 North America Digital Banking Market by Country, 2022 - 2028, USD Million

TABLE 64 North America Others Market by Country, 2018 - 2021, USD Million

TABLE 65 North America Others Market by Country, 2022 - 2028, USD Million

TABLE 66 North America Retail Core Banking Solution Market by Country, 2018 - 2021, USD Million

TABLE 67 North America Retail Core Banking Solution Market by Country, 2022 - 2028, USD Million

TABLE 68 US Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 69 US Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 70 US Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 71 US Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 72 US Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 73 US Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 74 US Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 75 US Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 76 US Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 77 US Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 78 Canada Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 79 Canada Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 80 Canada Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 81 Canada Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 82 Canada Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 83 Canada Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 84 Canada Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 85 Canada Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 86 Canada Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 87 Canada Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 88 Mexico Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 89 Mexico Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 90 Mexico Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 91 Mexico Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 92 Mexico Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 93 Mexico Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 94 Mexico Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 95 Mexico Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 96 Mexico Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 97 Mexico Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 98 Rest of North America Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 99 Rest of North America Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 100 Rest of North America Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 101 Rest of North America Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 102 Rest of North America Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 103 Rest of North America Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 104 Rest of North America Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 105 Rest of North America Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 106 Rest of North America Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 107 Rest of North America Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 108 Europe Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 109 Europe Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 110 Europe Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 111 Europe Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 112 Europe Solution (Without Services) Market by Country, 2018 - 2021, USD Million

TABLE 113 Europe Solution (Without Services) Market by Country, 2022 - 2028, USD Million

TABLE 114 Europe Services Market by Country, 2018 - 2021, USD Million

TABLE 115 Europe Services Market by Country, 2022 - 2028, USD Million

TABLE 116 Europe Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 117 Europe Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 118 Europe Cloud Market by Country, 2018 - 2021, USD Million

TABLE 119 Europe Cloud Market by Country, 2022 - 2028, USD Million

TABLE 120 Europe On-premise Market by Country, 2018 - 2021, USD Million

TABLE 121 Europe On-premise Market by Country, 2022 - 2028, USD Million

TABLE 122 Europe Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 123 Europe Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 124 Europe Large Enterprises Market by Country, 2018 - 2021, USD Million

TABLE 125 Europe Large Enterprises Market by Country, 2022 - 2028, USD Million

TABLE 126 Europe SMEs Market by Country, 2018 - 2021, USD Million

TABLE 127 Europe SMEs Market by Country, 2022 - 2028, USD Million

TABLE 128 Europe Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 129 Europe Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 130 Europe Regulatory Compliance Market by Country, 2018 - 2021, USD Million

TABLE 131 Europe Regulatory Compliance Market by Country, 2022 - 2028, USD Million

TABLE 132 Europe Risk Management Market by Country, 2018 - 2021, USD Million

TABLE 133 Europe Risk Management Market by Country, 2022 - 2028, USD Million

TABLE 134 Europe Digital Banking Market by Country, 2018 - 2021, USD Million

TABLE 135 Europe Digital Banking Market by Country, 2022 - 2028, USD Million

TABLE 136 Europe Others Market by Country, 2018 - 2021, USD Million

TABLE 137 Europe Others Market by Country, 2022 - 2028, USD Million

TABLE 138 Europe Retail Core Banking Solution Market by Country, 2018 - 2021, USD Million

TABLE 139 Europe Retail Core Banking Solution Market by Country, 2022 - 2028, USD Million

TABLE 140 Germany Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 141 Germany Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 142 Germany Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 143 Germany Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 144 Germany Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 145 Germany Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 146 Germany Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 147 Germany Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 148 Germany Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 149 Germany Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 150 UK Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 151 UK Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 152 UK Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 153 UK Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 154 UK Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 155 UK Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 156 UK Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 157 UK Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 158 UK Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 159 UK Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 160 France Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 161 France Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 162 France Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 163 France Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 164 France Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 165 France Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 166 France Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 167 France Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 168 France Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 169 France Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 170 Russia Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 171 Russia Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 172 Russia Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 173 Russia Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 174 Russia Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 175 Russia Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 176 Russia Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 177 Russia Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 178 Russia Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 179 Russia Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 180 Spain Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 181 Spain Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 182 Spain Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 183 Spain Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 184 Spain Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 185 Spain Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 186 Spain Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 187 Spain Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 188 Spain Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 189 Spain Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 190 Italy Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 191 Italy Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 192 Italy Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 193 Italy Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 194 Italy Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 195 Italy Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 196 Italy Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 197 Italy Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 198 Italy Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 199 Italy Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 200 Rest of Europe Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 201 Rest of Europe Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 202 Rest of Europe Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 203 Rest of Europe Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 204 Rest of Europe Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 205 Rest of Europe Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 206 Rest of Europe Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 207 Rest of Europe Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 208 Rest of Europe Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 209 Rest of Europe Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 210 Asia Pacific Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 211 Asia Pacific Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 212 Asia Pacific Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 213 Asia Pacific Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 214 Asia Pacific Solution (Without Services) Market by Country, 2018 - 2021, USD Million

TABLE 215 Asia Pacific Solution (Without Services) Market by Country, 2022 - 2028, USD Million

TABLE 216 Asia Pacific Services Market by Country, 2018 - 2021, USD Million

TABLE 217 Asia Pacific Services Market by Country, 2022 - 2028, USD Million

TABLE 218 Asia Pacific Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 219 Asia Pacific Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 220 Asia Pacific Cloud Market by Country, 2018 - 2021, USD Million

TABLE 221 Asia Pacific Cloud Market by Country, 2022 - 2028, USD Million

TABLE 222 Asia Pacific On-premise Market by Country, 2018 - 2021, USD Million

TABLE 223 Asia Pacific On-premise Market by Country, 2022 - 2028, USD Million

TABLE 224 Asia Pacific Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 225 Asia Pacific Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 226 Asia Pacific Large Enterprises Market by Country, 2018 - 2021, USD Million

TABLE 227 Asia Pacific Large Enterprises Market by Country, 2022 - 2028, USD Million

TABLE 228 Asia Pacific SMEs Market by Country, 2018 - 2021, USD Million

TABLE 229 Asia Pacific SMEs Market by Country, 2022 - 2028, USD Million

TABLE 230 Asia Pacific Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 231 Asia Pacific Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 232 Asia Pacific Regulatory Compliance Market by Country, 2018 - 2021, USD Million

TABLE 233 Asia Pacific Regulatory Compliance Market by Country, 2022 - 2028, USD Million

TABLE 234 Asia Pacific Risk Management Market by Country, 2018 - 2021, USD Million

TABLE 235 Asia Pacific Risk Management Market by Country, 2022 - 2028, USD Million

TABLE 236 Asia Pacific Digital Banking Market by Country, 2018 - 2021, USD Million

TABLE 237 Asia Pacific Digital Banking Market by Country, 2022 - 2028, USD Million

TABLE 238 Asia Pacific Others Market by Country, 2018 - 2021, USD Million

TABLE 239 Asia Pacific Others Market by Country, 2022 - 2028, USD Million

TABLE 240 Asia Pacific Retail Core Banking Solution Market by Country, 2018 - 2021, USD Million

TABLE 241 Asia Pacific Retail Core Banking Solution Market by Country, 2022 - 2028, USD Million

TABLE 242 China Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 243 China Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 244 China Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 245 China Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 246 China Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 247 China Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 248 China Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 249 China Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 250 China Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 251 China Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 252 Japan Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 253 Japan Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 254 Japan Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 255 Japan Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 256 Japan Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 257 Japan Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 258 Japan Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 259 Japan Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 260 Japan Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 261 Japan Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 262 India Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 263 India Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 264 India Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 265 India Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 266 India Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 267 India Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 268 India Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 269 India Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 270 India Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 271 India Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 272 South Korea Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 273 South Korea Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 274 South Korea Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 275 South Korea Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 276 South Korea Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 277 South Korea Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 278 South Korea Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 279 South Korea Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 280 South Korea Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 281 South Korea Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 282 Singapore Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 283 Singapore Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 284 Singapore Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 285 Singapore Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 286 Singapore Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 287 Singapore Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 288 Singapore Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 289 Singapore Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 290 Singapore Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 291 Singapore Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 292 Malaysia Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 293 Malaysia Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 294 Malaysia Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 295 Malaysia Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 296 Malaysia Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 297 Malaysia Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 298 Malaysia Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 299 Malaysia Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 300 Malaysia Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 301 Malaysia Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 302 Rest of Asia Pacific Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 303 Rest of Asia Pacific Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 304 Rest of Asia Pacific Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 305 Rest of Asia Pacific Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 306 Rest of Asia Pacific Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 307 Rest of Asia Pacific Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 308 Rest of Asia Pacific Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 309 Rest of Asia Pacific Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 310 Rest of Asia Pacific Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 311 Rest of Asia Pacific Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 312 LAMEA Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 313 LAMEA Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 314 LAMEA Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 315 LAMEA Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 316 LAMEA Solution (Without Services) Market by Country, 2018 - 2021, USD Million

TABLE 317 LAMEA Solution (Without Services) Market by Country, 2022 - 2028, USD Million

TABLE 318 LAMEA Services Market by Country, 2018 - 2021, USD Million

TABLE 319 LAMEA Services Market by Country, 2022 - 2028, USD Million

TABLE 320 LAMEA Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 321 LAMEA Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 322 LAMEA Cloud Market by Country, 2018 - 2021, USD Million

TABLE 323 LAMEA Cloud Market by Country, 2022 - 2028, USD Million

TABLE 324 LAMEA On-premise Market by Country, 2018 - 2021, USD Million

TABLE 325 LAMEA On-premise Market by Country, 2022 - 2028, USD Million

TABLE 326 LAMEA Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 327 LAMEA Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 328 LAMEA Large Enterprises Market by Country, 2018 - 2021, USD Million

TABLE 329 LAMEA Large Enterprises Market by Country, 2022 - 2028, USD Million

TABLE 330 LAMEA SMEs Market by Country, 2018 - 2021, USD Million

TABLE 331 LAMEA SMEs Market by Country, 2022 - 2028, USD Million

TABLE 332 LAMEA Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 333 LAMEA Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 334 LAMEA Regulatory Compliance Market by Country, 2018 - 2021, USD Million

TABLE 335 LAMEA Regulatory Compliance Market by Country, 2022 - 2028, USD Million

TABLE 336 LAMEA Risk Management Market by Country, 2018 - 2021, USD Million

TABLE 337 LAMEA Risk Management Market by Country, 2022 - 2028, USD Million

TABLE 338 LAMEA Digital Banking Market by Country, 2018 - 2021, USD Million

TABLE 339 LAMEA Digital Banking Market by Country, 2022 - 2028, USD Million

TABLE 340 LAMEA Others Market by Country, 2018 - 2021, USD Million

TABLE 341 LAMEA Others Market by Country, 2022 - 2028, USD Million

TABLE 342 LAMEA Retail Core Banking Solution Market by Country, 2018 - 2021, USD Million

TABLE 343 LAMEA Retail Core Banking Solution Market by Country, 2022 - 2028, USD Million

TABLE 344 Brazil Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 345 Brazil Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 346 Brazil Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 347 Brazil Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 348 Brazil Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 349 Brazil Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 350 Brazil Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 351 Brazil Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 352 Brazil Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 353 Brazil Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 354 Argentina Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 355 Argentina Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 356 Argentina Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 357 Argentina Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 358 Argentina Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 359 Argentina Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 360 Argentina Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 361 Argentina Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 362 Argentina Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 363 Argentina Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 364 UAE Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 365 UAE Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 366 UAE Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 367 UAE Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 368 UAE Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 369 UAE Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 370 UAE Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 371 UAE Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 372 UAE Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 373 UAE Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 374 Saudi Arabia Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 375 Saudi Arabia Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 376 Saudi Arabia Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 377 Saudi Arabia Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 378 Saudi Arabia Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 379 Saudi Arabia Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 380 Saudi Arabia Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 381 Saudi Arabia Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 382 Saudi Arabia Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 383 Saudi Arabia Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 384 South Africa Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 385 South Africa Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 386 South Africa Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 387 South Africa Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 388 South Africa Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 389 South Africa Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 390 South Africa Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 391 South Africa Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 392 South Africa Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 393 South Africa Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 394 Nigeria Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 395 Nigeria Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 396 Nigeria Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 397 Nigeria Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 398 Nigeria Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 399 Nigeria Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 400 Nigeria Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 401 Nigeria Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 402 Nigeria Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 403 Nigeria Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 404 Rest of LAMEA Retail Core Banking Solution Market, 2018 - 2021, USD Million

TABLE 405 Rest of LAMEA Retail Core Banking Solution Market, 2022 - 2028, USD Million

TABLE 406 Rest of LAMEA Retail Core Banking Solution Market by Component, 2018 - 2021, USD Million

TABLE 407 Rest of LAMEA Retail Core Banking Solution Market by Component, 2022 - 2028, USD Million

TABLE 408 Rest of LAMEA Retail Core Banking Solution Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 409 Rest of LAMEA Retail Core Banking Solution Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 410 Rest of LAMEA Retail Core Banking Solution Market by Organization Size, 2018 - 2021, USD Million

TABLE 411 Rest of LAMEA Retail Core Banking Solution Market by Organization Size, 2022 - 2028, USD Million

TABLE 412 Rest of LAMEA Retail Core Banking Solution Market by Application, 2018 - 2021, USD Million

TABLE 413 Rest of LAMEA Retail Core Banking Solution Market by Application, 2022 - 2028, USD Million

TABLE 414 Key Information – Temenos AG

TABLE 415 Key Information –Fiserv, Inc.

TABLE 416 Key Information – Tata Consultancy Services Ltd.

TABLE 417 Key Information – Infosys Limited

TABLE 418 Key Information – Oracle Corporation

TABLE 419 Key Information – SAP SE

TABLE 420 Key Information – Jack Henry & Associates, Inc.

TABLE 421 Key Information – Fidelity National Information Services, Inc.

TABLE 422 Key Information – SILVERLAKE AXIS LTD.

TABLE 423 Key Information – Infrasoft Technologies Ltd.

List of Figures

FIG 1 Methodology for the research

FIG 2 KBV Cardinal Matrix

FIG 3 Key Leading Strategies: Percentage Distribution (2018-2022)

FIG 4 Key Strategic Move: (Partnerships, Collaborations and Agreements: 2020, Jan – 2022, Aug) Leading Players

FIG 5 Global Retail Core Banking Solution Market share by Component, 2021

FIG 6 Global Retail Core Banking Solution Market share by Component, 2028

FIG 7 Global Retail Core Banking Solution Market by Component, 2018 - 2028, USD Million

FIG 8 Global Retail Core Banking Solution Market share by Deployment Mode, 2021

FIG 9 Global Retail Core Banking Solution Market share by Deployment Mode, 2028

FIG 10 Global Retail Core Banking Solution Market by Deployment Mode, 2018 - 2028, USD Million

FIG 11 Global Retail Core Banking Solution Market share by Organization Size, 2021

FIG 12 Global Retail Core Banking Solution Market share by Organization Size, 2028

FIG 13 Global Retail Core Banking Solution Market by Organization Size, 2018 - 2028, USD Million

FIG 14 Global Retail Core Banking Solution Market share by Application, 2021

FIG 15 Global Retail Core Banking Solution Market share by Application, 2028

FIG 16 Global Retail Core Banking Solution Market by Application, 2018 - 2028, USD Million

FIG 17 Global Retail Core Banking Solution Market share by Region, 2021

FIG 18 Global Retail Core Banking Solution Market share by Region, 2028

FIG 19 Global Retail Core Banking Solution Market by Region, 2018 - 2028, USD Million

FIG 20 Recent strategies and developments: Temenos AG

FIG 21 SWOT Analysis: Temenos AG

FIG 22 SWOT Analysis: Fiserv, Inc.

FIG 23 Recent strategies and developments: Tata Consultancy Services Ltd.

FIG 24 SWOT Analysis: Tata Consultancy Services Ltd.

FIG 25 SWOT Analysis: Infosys Limited

FIG 26 SWOT analysis: Oracle Corporation

FIG 27 SWOT Analysis: SAP SE

FIG 28 Recent strategies and developments: Fidelity National Information Services, Inc.