Global Retail Logistics Market Size, Share & Industry Trends Analysis Report By Type, By Solution, By Mode of Transport (Roadways, Railways, Waterways and Airways), By Regional Outlook, Strategy, Challenges and Forecast, 2021 - 2027

Published Date : 28-Feb-2022 |

Pages: 229 |

Formats: PDF |

COVID-19 Impact on the Retail Logistics Market

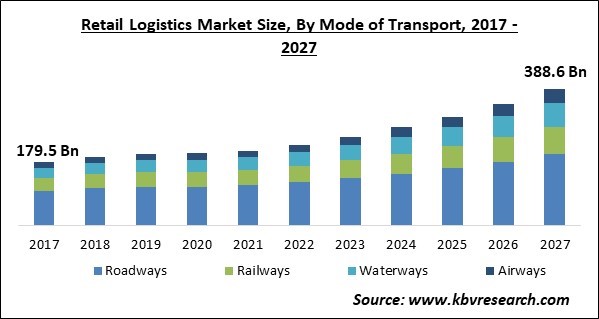

The Global Retail Logistics Market size is expected to reach $388.6 billion by 2027, rising at a market growth of 10.5% CAGR during the forecast period.

The systematic process of controlling and ensuring the flow of goods from the source of supply to the buyer is known as retail logistics. A vast range of products is sold by manufacturers, wholesalers, and distributors. This necessitates the systematic planning of diverse commodities' movement till they are delivered to the buyer or consumer. Through effective logistics and added value, retail logistics guarantees that everything is in place to provide superior delivery and service at reduced costs.

Companies can get profit from a wide range of features and benefits provided by logistics software. Orders are received from all sales channels, fulfilled, and tracking, invoicing, returns, and interaction with shipping firms are all possible with this platform. Inventory management is responsible for tracking each manufactured item from the time it enters the supply chain. This feature allows companies to make decisions about where to stock and store products.

Multimodal transportation is becoming more popular as a result of various advantages, including fewer customs restrictions, faster freight processing, and lower per-vehicle expenses. One of the main market trends is the increasing usage of different modes of transportation, which includes the use of ships, trucks, planes, and railcars.

Combining these multimodal modes of transportation can assist reduce inventory expenses while also keeping merchandise costs under control. Multimodal transportation also aids businesses in efficiently transporting goods during outbound logistics while lowering transportation expenses.

COVID-19 Impact Analysis

The ongoing COVID-19 pandemic has wreaked havoc on the global economy in three ways: by hampering profitability, hurting production and demand directly, and depleting financial reserves and cash flows. The COVID-19 pandemic has an equal impact on retail logistics companies. Due to the labor shortage and supply chain problems in the early stages of the pandemic (Q1 and Q2), the industry faced a slight setback. Later, as consumers preferred internet shopping over in-store, the rise in online orders put a burden on retail logistics companies' transportation and logistical services.

Currently, businesses have already begun to try to get back to normal, but they are confronting numerous obstacles on both consumer and operational level. Meeting client expectations in terms of process optimization, growing security concerns about connected networks, increased connectivity challenges, and a drop in industrial and retailing operations are just a few of them.

Market Growth Factors:

Increase in the integration of drone & smart glasses in transportation vehicles

The integration of drones and smart glasses into the transportation vehicles has enhanced pliability and delivery speed, which would positively impact on the growth of the retail logistics market over the projection period. In both urban and rural settings, self-driving vehicles, autonomous vehicles, and trucks are capable of maintaining high reasonableness and same-day delivery.

Increasing Advanced Technology Integration

Artificial intelligence, Blockchain, machine learning, and other modern technologies are expected to be widely implemented in the retail sector. Improved data management, tailored experiences, predictive analysis, and real-time support are all benefits of AI. Other AI applications, such as chatbots, virtual assistants, and others, help retailers stay in touch with their customers. This boosts company profitability by updating customers about promotions and sales.

Marketing Restraining Factor:

Change in Customer Behaviour following the COVID-19 pandemic

After being under complete lockdown for over three months, the retail industry is finding it difficult to get back on track. Retail, like other customer-driven industries, hinges on client behavior and engagement, and it's having trouble keeping up with lockdown-induced changes in customer behavior. Along with declining revenues, retail is suffering from a data shortage.

Type Outlook

On the basis of Type, the Retail Logistics Market is bifurcated into Conventional Retail Logistics and E-Commerce Retail Logistics. The E-Commerce Retail Logistics held a significant revenue share of the Retail logistics market in 2020. The growth is mostly attributable to the global spread of the coronavirus pandemic, which resulted in a surge in sales for e-commerce outlets. In addition, rising internet penetration, combined with benefits such as quick and free returns/exchanges, fast delivery, lower shipping costs, and a plethora of product alternatives, are all contributing to the growth of the segment.

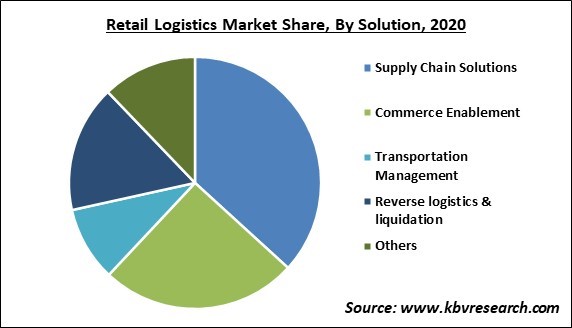

Solution Outlook

Based on the Solution, the Retail Logistics Market is segregated into Commerce Enablement, Supply Chain Solutions, Reverse logistics & liquidation, Transportation Management, and Others. In 2020, the supply chain solutions segment had the highest revenue share, and this dominance is likely to continue during the forecast period. On-time delivery is enabled by the supply chain, which also improves omnichannel operations, personalizes kitting and order fulfillment, and efficiently processes customer returns.

Mode of Transport Outlook

By Mode of Transport, the Retail Logistics Market is segmented into Railways, Airways, Roadways, and Waterways. In 2020, the roadways segment collected the highest revenue share of the overall Retail Logistics Market. The large percentage is due to the increased need for roadway vehicles for long-distance retail product transportation, particularly in domestic regions. It also has a large carrying capacity, making it a better choice. Moreover, a number of government measures encourage sector growth.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 205.3 Billion |

| Market size forecast in 2027 | USD 388.6 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 10.5% from 2021 to 2027 |

| Number of Pages | 229 |

| Number of Tables | 374 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Solution, Mode of Transport, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Regional Outlook

Based on the Region, the Retail Logistics Market is analysed across North America, Europe, APAC, and LAMEA. In 2020, the Asia Pacific dominated the Retail Logistics Market with the highest revenue share. Due to the significant expansion of e-commerce and the availability of a huge consumer base for retail products, the area is expected to maintain its dominance during the projection period. India, Japan, China, and Australia are among the top ten item exporters, accounting for a significant share of worldwide retail e-commerce sales. As a result, the region's e-commerce industry's outstanding development prospects are the key drivers of regional market expansion.

Free Valuable Insights: Global Retail Logistics Market size to reach USD 388.6 Billion by 2027

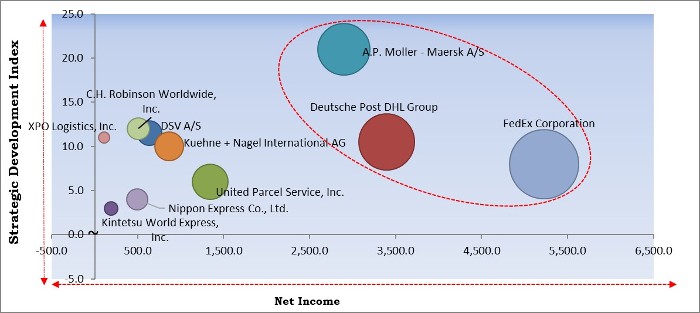

KBV Cardinal Matrix - Retail Logistics Market Competition Analysis

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; A.P. Moller - Maersk A/S, FedEx Corporation and Deutsche Post DHL Group are the forerunners in the Retail Logistics Market. Companies such as Kuehne + Nagel International AG, United Parcel Service, Inc., DSV A/S are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Kintetsu World Express, Inc. (APL Logistics Ltd.) (Kintetsu Group Holdings Co., Ltd.), A.P. Moller - Maersk A/S, DSV A/S, Deutsche Post DHL Group, FedEx Corporation, Kuehne + Nagel International AG, Nippon Express Co., Ltd., XPO Logistics, Inc., United Parcel Service, Inc., and C.H. Robinson Worldwide, Inc.

Recent Strategies Deployed in Retail Logistics Market

» Partnerships, Collaborations and Agreements:

- Dec-2021: A.P. Moller - Maersk signed a long-term strategic partnership with Li & Fung, the world's leading supply chain solutions partner for consumer brands and retailers, and its affiliates. This partnership would allow the two companies to use their respective resources and worldwide networks to develop a wide range of end-to-end global supply chain services.

- Nov-2021: DSV extended its logistics agreement with New Balance, an American sports footwear and apparel brand. Following this, DSV tripled the volume stored and distributed for New Balance in EMEA. The new setup is designed to ensure a high capacity as well as a flexible shuttle system for storage and retrieval, allowing the millions of extra pieces of merchandise that DSV will be managing for New Balance to be efficiently distributed from the warehouse to all parts of Europe.

- Oct-2021: C.H. Robinson joined hands with SPS Commerce, the world’s leading retail network. The collaboration would assist omnichannel retail businesses to navigate a busy holiday season and challenging supply chain conditions. Moreover, the collaboration would make the shipping process simpler, affordable, and rapid by connecting SPS Commerce Fulfillment's Carrier Service LTL directly into Robinson’s Navisphere platform, which provides access to the biggest less-than-truckload (LTL) network in North America and competitive rates for more than 95,000 retail suppliers.

- Sep-2021: FedEx entered into a multi-year partnership with Salesforce, an American cloud-based software company. The partnership would combine Salesforce Commerce Cloud and Salesforce Order Management with innovative capabilities from FedEx and ShopRunner, its e-commerce platform and subsidiary. Through this integration, the two companies would offer the speed, control, and economies they require to assist them in surpassing those expectations.

- Jul-2021: FedEx Express, a division of FedEx Corp. signed equity and commercial agreements with Delhivery, a leading logistics, and supply chain services company in India. Following the agreement, the two companies would leverage each other's expertise in exploring India's global trade potential.

- Jan-2021: C.H. Robinson formed a partnership with SAS, a world-renowned data analytics company. The partnership would redefine the way worldwide supply chains work as they get extremely complicated. Moreover, the partnership would mitigate the issue by developing a new kind of solution, an end-to-end supply chain solution that integrates inventory and demand signal data with real-time transportation data.

- Jun-2021: United Parcel Service formed a partnership with ParcelHub, a multi-carrier shipping and eCommerce customer services solution. Following this, UPS would expand its retail presence in Malaysia to capture and fulfill the regional increasing e-commerce and logistics demands.

- Dec-2020: XPO Logistics entered into a partnership with La Palette Rouge (LPR), the leading provider of pooled pallets in the fast-moving consumer goods (FMCG) and retail sectors in Europe. Following this, XPO’s would expand their agreement with LPR, a division of Euro Pool Group, to two decades.

» Acquisitions and Mergers:

- Dec-2021: Maersk signed an agreement for the acquisition of to acquire LF Logistics, a Hong Kong-based contract logistics company. Through this acquisition, the company would become empowered to enhance its critical capabilities in APAC to accelerate long-term growth for customers.

- Sep-2021: A.P. Moller – Maersk took over HUUB, a Portuguese cloud-based logistics start-up, specialized in technology solutions for B2C warehousing for the fashion industry. Following the acquisition, Maersk would leverage the advanced capabilities and talent of HUUB to significantly expedite its omnichannel offerings

- Sep-2021: United Parcel Service took over Roadie, a same-day delivery startup, looking to speed service and expand into atypical parcels such as oversized packages and perishable goods. Following this, Roadie would run under its name as a separate company, and packages won’t cross over between the startup and UPS’s conventional network.

- Aug-2021: A.P. Moller-Maersk completed the acquisition of Salt Lake City-based Visible Supply Chain Management, a business-to-consumer (B2C) logistics company focused on parcel delivery and fulfillment services. The acquisition would integrate the operating models and value proposition of Visible SCM and B2C Europe to allow their customers to constantly create their e-commerce offering, hence increasing the scope and potential of the strategic partnerships.

- Aug-2021: DSV acquired Global Integrated Logistics (GIL), the freight forwarding and contract logistics division of Agility Logistics. The acquisition of GIL’s warehousing capacity would be a robust inclusion to the DSV Solutions division, which manages contract logistics services for a range of industries including automotive.

- May-2021: C.H. Robinson took over Combinex Holding (Combinex), one of the fastest-growing forwarders in the Benelux region, specializing in transport services for dry, fresh, and frozen goods. Following the acquisition, the company would bolster its current presence in Europe, specifically our presence in Western Europe.

- May-2021: Kuehne+Nagel took over Apex International Corporation, one of Asia’s leading freight forwarders. Through this acquisition, the two companies would provide their customer with an excellent value proposition in the competitive Asian logistics industry, particularly in e-commerce fulfillment, hi-tech and e-mobility.

- Dec-2020: FedEx Corp. acquired ShopRunner, the e-commerce platform that directly connects brands and merchants with online shoppers. Following this acquisition, ShopRunner’s capabilities would support and expand the FedEx e-commerce offering and develop an increased value for brands, merchants, and consumers.

- Sep-2020: NIPPON EXPRESS acquired the complete equity interests of MD Logistics and MD Express through the subsidiary, Nippon Express USA. Following this, the company got domestic logistics functions in the United States, which accounts for about 40% of global pharmaceutical demand and is the biggest consumer goods market in the world.

- Apr-2020: A.P. Moller - Maersk took over Performance Team, US-based warehousing, and distribution company. The acquisition would expand the capabilities of the company as an integrated container logistics company, providing end-to-end supply chain solutions to its customers.

- Mar-2020: C.H. Robinson took over Prime Distribution Services, a leading provider of retail consolidation and value-added warehouse services in North America. Following the acquisition, Prime would get the retail consolidation business and brings additional scale, capabilities, and expertise of C.H. Robinson.

» Product Launches and Product Expansions:

- Jun-2021: DHL introduced Supplier Direct Fulfillment. Through this, the company aimed to allow the retailers to enhance their online presence by increasing their range of large items like furniture, beds, and kitchens, without investing in additional stockholding. With this new service, retailers can provide consumers with a similar home delivery proposition for additional ranges from other suppliers as they do for their own stock, enabling a streamlined brand experience.

- Jan-2021: APL Logistics introduced Logistics SuperSuite Plus (LSS+), the new version of APL Logistics’ visibility and reporting platform. In addition, LSS+ is a dynamic redesign of the SeeChange and Logistics SuperSuite (LSS) solutions, that covers data management, and visibility. The "+" denotes the addition of additional functionality that we anticipate will be important in the supply chain's future.

- Aug-2020: Maersk rolled out Maersk Flow, a digital platform that provides customers and their partners with everything they need to take control of their supply chain, from the factory to the market. Moreover, the solution allows transparency in critical supply chain processes and facilitates the planned execution of the flow of goods and documents.

- Jun-2020: DSV introduced e-Commerce Solutions, a wide range of e-commerce services for shippers that serve end customers directly. Moreover, the new service combines a standardized warehousing procedure, off-the-shelf automation concepts, IT integration, and implementation.

- Apr-2020: Kuehne + Nagel introduced eShipAsia, an online logistics platform allowing Intra-Asia shippers to enhance every shipment on the basis of the route, transit time, and cost instantly. Through eShipAsia, shippers are connected to 20 countries, and can immediately compare sailing schedules and rates between 2,220 port pairs, 7,500 service loops, and 54 underlying carriers.

» Geographical Expansions:

- Feb-2021: DHL expanded its geographical footprint by establishing a drive-up, mobile pop-up retail store in Woodbridge, Virginia. The new store is situated at the Potomac Mills shopping center and would offer a drive-up window for a safe, easy-to-use shipping option for customers.

- May-2020: DSV expanded its geographical footprint by establishing a new contract logistics facility in Edison, New Jersey. In addition, the latest 10,000 square meter distribution center would provide various logistics services. Moreover, these two DSV units would support the company’s present network of 26 locations in the USA.

Scope of the Study

Market Segments Covered in the Report:

By Type

- Conventional Retail Logistics and

- E-Commerce Retail Logistics

By Solution

- Supply Chain Solutions

- Commerce Enablement

- Transportation Management

- Reverse logistics & liquidation and

- Others

By Mode of Transport

- Roadways

- Railways

- Waterways and

- Airways

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Kintetsu World Express, Inc. (APL Logistics Ltd.) (Kintetsu Group Holdings Co., Ltd.)

- A.P. Moller - Maersk A/S

- DSV A/S

- Deutsche Post DHL Group

- FedEx Corporation

- Kuehne + Nagel International AG

- Nippon Express Co., Ltd.

- XPO Logistics, Inc.

- United Parcel Service, Inc.

- C.H. Robinson Worldwide, Inc.

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Retail Logistics Market, by Type

1.4.2 Global Retail Logistics Market, by Solution

1.4.3 Global Retail Logistics Market, by Mode of Transport

1.4.4 Global Retail Logistics Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.2.4 Geographical Expansions

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2017-2021)

3.3.2 Key Strategic Move: (Acquisition & Mergers: 2018, May – 2021, Dec) Leading Players

Chapter 4. Global Retail Logistics Market by Type

4.1 Global Conventional Retail Logistics Market by Region

4.2 Global E-Commerce Retail Logistics Market by Region

Chapter 5. Global Retail Logistics Market by Solution

5.1 Global Supply Chain Solutions Market by Region

5.2 Global Commerce Enablement Market by Region

5.3 Global Transportation Management Market by Region

5.4 Global Reverse logistics & liquidation Market by Region

5.5 Global Other Solutions Market by Region

Chapter 6. Global Retail Logistics Market by Mode of Transport

6.1 Global Roadways Market by Region

6.2 Global Railways Market by Region

6.3 Global Waterways Market by Region

6.4 Global Airways Market by Region

Chapter 7. Global Retail Logistics Market by Region

7.1 North America Retail Logistics Market

7.1.1 North America Retail Logistics Market by Type

7.1.1.1 North America Conventional Retail Logistics Market by Country

7.1.1.2 North America E-Commerce Retail Logistics Market by Country

7.1.2 North America Retail Logistics Market by Solution

7.1.2.1 North America Supply Chain Solutions Market by Country

7.1.2.2 North America Commerce Enablement Market by Country

7.1.2.3 North America Transportation Management Market by Country

7.1.2.4 North America Reverse logistics & liquidation Market by Country

7.1.2.5 North America Other Solutions Market by Country

7.1.3 North America Retail Logistics Market by Mode of Transport

7.1.3.1 North America Roadways Market by Country

7.1.3.2 North America Railways Market by Country

7.1.3.3 North America Waterways Market by Country

7.1.3.4 North America Airways Market by Country

7.1.4 North America Retail Logistics Market by Country

7.1.4.1 US Retail Logistics Market

7.1.4.1.1 US Retail Logistics Market by Type

7.1.4.1.2 US Retail Logistics Market by Solution

7.1.4.1.3 US Retail Logistics Market by Mode of Transport

7.1.4.2 Canada Retail Logistics Market

7.1.4.2.1 Canada Retail Logistics Market by Type

7.1.4.2.2 Canada Retail Logistics Market by Solution

7.1.4.2.3 Canada Retail Logistics Market by Mode of Transport

7.1.4.3 Mexico Retail Logistics Market

7.1.4.3.1 Mexico Retail Logistics Market by Type

7.1.4.3.2 Mexico Retail Logistics Market by Solution

7.1.4.3.3 Mexico Retail Logistics Market by Mode of Transport

7.1.4.4 Rest of North America Retail Logistics Market

7.1.4.4.1 Rest of North America Retail Logistics Market by Type

7.1.4.4.2 Rest of North America Retail Logistics Market by Solution

7.1.4.4.3 Rest of North America Retail Logistics Market by Mode of Transport

7.2 Europe Retail Logistics Market

7.2.1 Europe Retail Logistics Market by Type

7.2.1.1 Europe Conventional Retail Logistics Market by Country

7.2.1.2 Europe E-Commerce Retail Logistics Market by Country

7.2.2 Europe Retail Logistics Market by Solution

7.2.2.1 Europe Supply Chain Solutions Market by Country

7.2.2.2 Europe Commerce Enablement Market by Country

7.2.2.3 Europe Transportation Management Market by Country

7.2.2.4 Europe Reverse logistics & liquidation Market by Country

7.2.2.5 Europe Other Solutions Market by Country

7.2.3 Europe Retail Logistics Market by Mode of Transport

7.2.3.1 Europe Roadways Market by Country

7.2.3.2 Europe Railways Market by Country

7.2.3.3 Europe Waterways Market by Country

7.2.3.4 Europe Airways Market by Country

7.2.4 Europe Retail Logistics Market by Country

7.2.4.1 Germany Retail Logistics Market

7.2.4.1.1 Germany Retail Logistics Market by Type

7.2.4.1.2 Germany Retail Logistics Market by Solution

7.2.4.1.3 Germany Retail Logistics Market by Mode of Transport

7.2.4.2 UK Retail Logistics Market

7.2.4.2.1 UK Retail Logistics Market by Type

7.2.4.2.2 UK Retail Logistics Market by Solution

7.2.4.2.3 UK Retail Logistics Market by Mode of Transport

7.2.4.3 France Retail Logistics Market

7.2.4.3.1 France Retail Logistics Market by Type

7.2.4.3.2 France Retail Logistics Market by Solution

7.2.4.3.3 France Retail Logistics Market by Mode of Transport

7.2.4.4 Russia Retail Logistics Market

7.2.4.4.1 Russia Retail Logistics Market by Type

7.2.4.4.2 Russia Retail Logistics Market by Solution

7.2.4.4.3 Russia Retail Logistics Market by Mode of Transport

7.2.4.5 Spain Retail Logistics Market

7.2.4.5.1 Spain Retail Logistics Market by Type

7.2.4.5.2 Spain Retail Logistics Market by Solution

7.2.4.5.3 Spain Retail Logistics Market by Mode of Transport

7.2.4.6 Italy Retail Logistics Market

7.2.4.6.1 Italy Retail Logistics Market by Type

7.2.4.6.2 Italy Retail Logistics Market by Solution

7.2.4.6.3 Italy Retail Logistics Market by Mode of Transport

7.2.4.7 Rest of Europe Retail Logistics Market

7.2.4.7.1 Rest of Europe Retail Logistics Market by Type

7.2.4.7.2 Rest of Europe Retail Logistics Market by Solution

7.2.4.7.3 Rest of Europe Retail Logistics Market by Mode of Transport

7.3 Asia Pacific Retail Logistics Market

7.3.1 Asia Pacific Retail Logistics Market by Type

7.3.1.1 Asia Pacific Conventional Retail Logistics Market by Country

7.3.1.2 Asia Pacific E-Commerce Retail Logistics Market by Country

7.3.2 Asia Pacific Retail Logistics Market by Solution

7.3.2.1 Asia Pacific Supply Chain Solutions Market by Country

7.3.2.2 Asia Pacific Commerce Enablement Market by Country

7.3.2.3 Asia Pacific Transportation Management Market by Country

7.3.2.4 Asia Pacific Reverse logistics & liquidation Market by Country

7.3.2.5 Asia Pacific Other Solutions Market by Country

7.3.3 Asia Pacific Retail Logistics Market by Mode of Transport

7.3.3.1 Asia Pacific Roadways Market by Country

7.3.3.2 Asia Pacific Railways Market by Country

7.3.3.3 Asia Pacific Waterways Market by Country

7.3.3.4 Asia Pacific Airways Market by Country

7.3.4 Asia Pacific Retail Logistics Market by Country

7.3.4.1 China Retail Logistics Market

7.3.4.1.1 China Retail Logistics Market by Type

7.3.4.1.2 China Retail Logistics Market by Solution

7.3.4.1.3 China Retail Logistics Market by Mode of Transport

7.3.4.2 Japan Retail Logistics Market

7.3.4.2.1 Japan Retail Logistics Market by Type

7.3.4.2.2 Japan Retail Logistics Market by Solution

7.3.4.2.3 Japan Retail Logistics Market by Mode of Transport

7.3.4.3 India Retail Logistics Market

7.3.4.3.1 India Retail Logistics Market by Type

7.3.4.3.2 India Retail Logistics Market by Solution

7.3.4.3.3 India Retail Logistics Market by Mode of Transport

7.3.4.4 South Korea Retail Logistics Market

7.3.4.4.1 South Korea Retail Logistics Market by Type

7.3.4.4.2 South Korea Retail Logistics Market by Solution

7.3.4.4.3 South Korea Retail Logistics Market by Mode of Transport

7.3.4.5 Singapore Retail Logistics Market

7.3.4.5.1 Singapore Retail Logistics Market by Type

7.3.4.5.2 Singapore Retail Logistics Market by Solution

7.3.4.5.3 Singapore Retail Logistics Market by Mode of Transport

7.3.4.6 Malaysia Retail Logistics Market

7.3.4.6.1 Malaysia Retail Logistics Market by Type

7.3.4.6.2 Malaysia Retail Logistics Market by Solution

7.3.4.6.3 Malaysia Retail Logistics Market by Mode of Transport

7.3.4.7 Rest of Asia Pacific Retail Logistics Market

7.3.4.7.1 Rest of Asia Pacific Retail Logistics Market by Type

7.3.4.7.2 Rest of Asia Pacific Retail Logistics Market by Solution

7.3.4.7.3 Rest of Asia Pacific Retail Logistics Market by Mode of Transport

7.4 LAMEA Retail Logistics Market

7.4.1 LAMEA Retail Logistics Market by Type

7.4.1.1 LAMEA Conventional Retail Logistics Market by Country

7.4.1.2 LAMEA E-Commerce Retail Logistics Market by Country

7.4.2 LAMEA Retail Logistics Market by Solution

7.4.2.1 LAMEA Supply Chain Solutions Market by Country

7.4.2.2 LAMEA Commerce Enablement Market by Country

7.4.2.3 LAMEA Transportation Management Market by Country

7.4.2.4 LAMEA Reverse logistics & liquidation Market by Country

7.4.2.5 LAMEA Other Solutions Market by Country

7.4.3 LAMEA Retail Logistics Market by Mode of Transport

7.4.3.1 LAMEA Roadways Market by Country

7.4.3.2 LAMEA Railways Market by Country

7.4.3.3 LAMEA Waterways Market by Country

7.4.3.4 LAMEA Airways Market by Country

7.4.4 LAMEA Retail Logistics Market by Country

7.4.4.1 Brazil Retail Logistics Market

7.4.4.1.1 Brazil Retail Logistics Market by Type

7.4.4.1.2 Brazil Retail Logistics Market by Solution

7.4.4.1.3 Brazil Retail Logistics Market by Mode of Transport

7.4.4.2 Argentina Retail Logistics Market

7.4.4.2.1 Argentina Retail Logistics Market by Type

7.4.4.2.2 Argentina Retail Logistics Market by Solution

7.4.4.2.3 Argentina Retail Logistics Market by Mode of Transport

7.4.4.3 UAE Retail Logistics Market

7.4.4.3.1 UAE Retail Logistics Market by Type

7.4.4.3.2 UAE Retail Logistics Market by Solution

7.4.4.3.3 UAE Retail Logistics Market by Mode of Transport

7.4.4.4 Saudi Arabia Retail Logistics Market

7.4.4.4.1 Saudi Arabia Retail Logistics Market by Type

7.4.4.4.2 Saudi Arabia Retail Logistics Market by Solution

7.4.4.4.3 Saudi Arabia Retail Logistics Market by Mode of Transport

7.4.4.5 South Africa Retail Logistics Market

7.4.4.5.1 South Africa Retail Logistics Market by Type

7.4.4.5.2 South Africa Retail Logistics Market by Solution

7.4.4.5.3 South Africa Retail Logistics Market by Mode of Transport

7.4.4.6 Nigeria Retail Logistics Market

7.4.4.6.1 Nigeria Retail Logistics Market by Type

7.4.4.6.2 Nigeria Retail Logistics Market by Solution

7.4.4.6.3 Nigeria Retail Logistics Market by Mode of Transport

7.4.4.7 Rest of LAMEA Retail Logistics Market

7.4.4.7.1 Rest of LAMEA Retail Logistics Market by Type

7.4.4.7.2 Rest of LAMEA Retail Logistics Market by Solution

7.4.4.7.3 Rest of LAMEA Retail Logistics Market by Mode of Transport

Chapter 8. Company Profiles

8.1 Kintetsu World Express, Inc. (APL Logistics Ltd.) (Kintetsu Group Holdings Co., Ltd.)

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Segmental Analysis

8.1.4 Recent strategies and developments:

8.1.4.1 Product Launches and Product Expansions:

8.2 A.P. Moller - Maersk A/S

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Recent strategies and developments:

8.2.4.1 Partnerships, Collaborations, and Agreements:

8.2.4.2 Product Launches and Product Expansions:

8.2.4.3 Acquisition and Mergers:

8.3 DSV A/S

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Recent strategies and developments:

8.3.4.1 Partnerships, Collaborations, and Agreements:

8.3.4.2 Product Launches and Product Expansions:

8.3.4.3 Acquisition and Mergers:

8.3.4.4 Geographical Expansions:

8.4 Deutsche Post DHL Group

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Segmental and Regional Analysis

8.4.4 Recent strategies and developments:

8.4.4.1 Product Launches and Product Expansions:

8.4.4.2 Acquisition and Mergers:

8.4.4.3 Geographical Expansions:

8.5 FedEx Corporation

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Segmental and Regional Analysis

8.5.4 Recent strategies and developments:

8.5.4.1 Partnerships, Collaborations, and Agreements:

8.5.4.2 Acquisition and Mergers:

8.6 Kuehne + Nagel International AG

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Segmental and Regional Analysis

8.6.4 Recent strategies and developments:

8.6.4.1 Product Launches and Product Expansions:

8.6.4.2 Acquisition and Mergers:

8.7 Nippon Express Co., Ltd.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Segmental and Regional Analysis

8.7.4 Recent strategies and developments:

8.7.4.1 Acquisition and Mergers:

8.8 XPO Logistics, Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Regional & Segmental Analysis

8.8.4 Recent strategies and developments:

8.8.4.1 Partnerships, Collaborations, and Agreements:

8.8.4.2 Product Launches and Product Expansions:

8.9 United Parcel Service, Inc.

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Segmental and Regional Analysis

8.9.4 Recent strategies and developments:

8.9.4.1 Partnerships, Collaborations, and Agreements:

8.9.4.2 Acquisition and Mergers:

8.1 C.H. Robinson Worldwide, Inc.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Regional & Segmental Analysis

8.10.4 Recent strategies and developments:

8.10.4.1 Partnerships, Collaborations, and Agreements:

8.10.4.2 Acquisitions and Mergers:

TABLE 2 Global Retail Logistics Market, 2021 - 2027, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Retail Logistics Market

TABLE 4 Product Launches And Product Expansions– Retail Logistics Market

TABLE 5 Acquisition and Mergers– Retail Logistics Market

TABLE 6 Geographical Expansions– Retail Logistics Market

TABLE 7 Global Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 8 Global Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 9 Global Conventional Retail Logistics Market by Region, 2017 - 2020, USD Million

TABLE 10 Global Conventional Retail Logistics Market by Region, 2021 - 2027, USD Million

TABLE 11 Global E-Commerce Retail Logistics Market by Region, 2017 - 2020, USD Million

TABLE 12 Global E-Commerce Retail Logistics Market by Region, 2021 - 2027, USD Million

TABLE 13 Global Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 14 Global Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 15 Global Supply Chain Solutions Market by Region, 2017 - 2020, USD Million

TABLE 16 Global Supply Chain Solutions Market by Region, 2021 - 2027, USD Million

TABLE 17 Global Commerce Enablement Market by Region, 2017 - 2020, USD Million

TABLE 18 Global Commerce Enablement Market by Region, 2021 - 2027, USD Million

TABLE 19 Global Transportation Management Market by Region, 2017 - 2020, USD Million

TABLE 20 Global Transportation Management Market by Region, 2021 - 2027, USD Million

TABLE 21 Global Reverse logistics & liquidation Market by Region, 2017 - 2020, USD Million

TABLE 22 Global Reverse logistics & liquidation Market by Region, 2021 - 2027, USD Million

TABLE 23 Global Other Solutions Market by Region, 2017 - 2020, USD Million

TABLE 24 Global Other Solutions Market by Region, 2021 - 2027, USD Million

TABLE 25 Global Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 26 Global Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 27 Global Roadways Market by Region, 2017 - 2020, USD Million

TABLE 28 Global Roadways Market by Region, 2021 - 2027, USD Million

TABLE 29 Global Railways Market by Region, 2017 - 2020, USD Million

TABLE 30 Global Railways Market by Region, 2021 - 2027, USD Million

TABLE 31 Global Waterways Market by Region, 2017 - 2020, USD Million

TABLE 32 Global Waterways Market by Region, 2021 - 2027, USD Million

TABLE 33 Global Airways Market by Region, 2017 - 2020, USD Million

TABLE 34 Global Airways Market by Region, 2021 - 2027, USD Million

TABLE 35 Global Retail Logistics Market by Region, 2017 - 2020, USD Million

TABLE 36 Global Retail Logistics Market by Region, 2021 - 2027, USD Million

TABLE 37 North America Retail Logistics Market, 2017 - 2020, USD Million

TABLE 38 North America Retail Logistics Market, 2021 - 2027, USD Million

TABLE 39 North America Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 40 North America Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 41 North America Conventional Retail Logistics Market by Country, 2017 - 2020, USD Million

TABLE 42 North America Conventional Retail Logistics Market by Country, 2021 - 2027, USD Million

TABLE 43 North America E-Commerce Retail Logistics Market by Country, 2017 - 2020, USD Million

TABLE 44 North America E-Commerce Retail Logistics Market by Country, 2021 - 2027, USD Million

TABLE 45 North America Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 46 North America Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 47 North America Supply Chain Solutions Market by Country, 2017 - 2020, USD Million

TABLE 48 North America Supply Chain Solutions Market by Country, 2021 - 2027, USD Million

TABLE 49 North America Commerce Enablement Market by Country, 2017 - 2020, USD Million

TABLE 50 North America Commerce Enablement Market by Country, 2021 - 2027, USD Million

TABLE 51 North America Transportation Management Market by Country, 2017 - 2020, USD Million

TABLE 52 North America Transportation Management Market by Country, 2021 - 2027, USD Million

TABLE 53 North America Reverse logistics & liquidation Market by Country, 2017 - 2020, USD Million

TABLE 54 North America Reverse logistics & liquidation Market by Country, 2021 - 2027, USD Million

TABLE 55 North America Other Solutions Market by Country, 2017 - 2020, USD Million

TABLE 56 North America Other Solutions Market by Country, 2021 - 2027, USD Million

TABLE 57 North America Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 58 North America Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 59 North America Roadways Market by Country, 2017 - 2020, USD Million

TABLE 60 North America Roadways Market by Country, 2021 - 2027, USD Million

TABLE 61 North America Railways Market by Country, 2017 - 2020, USD Million

TABLE 62 North America Railways Market by Country, 2021 - 2027, USD Million

TABLE 63 North America Waterways Market by Country, 2017 - 2020, USD Million

TABLE 64 North America Waterways Market by Country, 2021 - 2027, USD Million

TABLE 65 North America Airways Market by Country, 2017 - 2020, USD Million

TABLE 66 North America Airways Market by Country, 2021 - 2027, USD Million

TABLE 67 North America Retail Logistics Market by Country, 2017 - 2020, USD Million

TABLE 68 North America Retail Logistics Market by Country, 2021 - 2027, USD Million

TABLE 69 US Retail Logistics Market, 2017 - 2020, USD Million

TABLE 70 US Retail Logistics Market, 2021 - 2027, USD Million

TABLE 71 US Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 72 US Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 73 US Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 74 US Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 75 US Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 76 US Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 77 Canada Retail Logistics Market, 2017 - 2020, USD Million

TABLE 78 Canada Retail Logistics Market, 2021 - 2027, USD Million

TABLE 79 Canada Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 80 Canada Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 81 Canada Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 82 Canada Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 83 Canada Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 84 Canada Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 85 Mexico Retail Logistics Market, 2017 - 2020, USD Million

TABLE 86 Mexico Retail Logistics Market, 2021 - 2027, USD Million

TABLE 87 Mexico Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 88 Mexico Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 89 Mexico Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 90 Mexico Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 91 Mexico Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 92 Mexico Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 93 Rest of North America Retail Logistics Market, 2017 - 2020, USD Million

TABLE 94 Rest of North America Retail Logistics Market, 2021 - 2027, USD Million

TABLE 95 Rest of North America Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 96 Rest of North America Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 97 Rest of North America Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 98 Rest of North America Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 99 Rest of North America Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 100 Rest of North America Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 101 Europe Retail Logistics Market, 2017 - 2020, USD Million

TABLE 102 Europe Retail Logistics Market, 2021 - 2027, USD Million

TABLE 103 Europe Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 104 Europe Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 105 Europe Conventional Retail Logistics Market by Country, 2017 - 2020, USD Million

TABLE 106 Europe Conventional Retail Logistics Market by Country, 2021 - 2027, USD Million

TABLE 107 Europe E-Commerce Retail Logistics Market by Country, 2017 - 2020, USD Million

TABLE 108 Europe E-Commerce Retail Logistics Market by Country, 2021 - 2027, USD Million

TABLE 109 Europe Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 110 Europe Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 111 Europe Supply Chain Solutions Market by Country, 2017 - 2020, USD Million

TABLE 112 Europe Supply Chain Solutions Market by Country, 2021 - 2027, USD Million

TABLE 113 Europe Commerce Enablement Market by Country, 2017 - 2020, USD Million

TABLE 114 Europe Commerce Enablement Market by Country, 2021 - 2027, USD Million

TABLE 115 Europe Transportation Management Market by Country, 2017 - 2020, USD Million

TABLE 116 Europe Transportation Management Market by Country, 2021 - 2027, USD Million

TABLE 117 Europe Reverse logistics & liquidation Market by Country, 2017 - 2020, USD Million

TABLE 118 Europe Reverse logistics & liquidation Market by Country, 2021 - 2027, USD Million

TABLE 119 Europe Other Solutions Market by Country, 2017 - 2020, USD Million

TABLE 120 Europe Other Solutions Market by Country, 2021 - 2027, USD Million

TABLE 121 Europe Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 122 Europe Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 123 Europe Roadways Market by Country, 2017 - 2020, USD Million

TABLE 124 Europe Roadways Market by Country, 2021 - 2027, USD Million

TABLE 125 Europe Railways Market by Country, 2017 - 2020, USD Million

TABLE 126 Europe Railways Market by Country, 2021 - 2027, USD Million

TABLE 127 Europe Waterways Market by Country, 2017 - 2020, USD Million

TABLE 128 Europe Waterways Market by Country, 2021 - 2027, USD Million

TABLE 129 Europe Airways Market by Country, 2017 - 2020, USD Million

TABLE 130 Europe Airways Market by Country, 2021 - 2027, USD Million

TABLE 131 Europe Retail Logistics Market by Country, 2017 - 2020, USD Million

TABLE 132 Europe Retail Logistics Market by Country, 2021 - 2027, USD Million

TABLE 133 Germany Retail Logistics Market, 2017 - 2020, USD Million

TABLE 134 Germany Retail Logistics Market, 2021 - 2027, USD Million

TABLE 135 Germany Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 136 Germany Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 137 Germany Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 138 Germany Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 139 Germany Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 140 Germany Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 141 UK Retail Logistics Market, 2017 - 2020, USD Million

TABLE 142 UK Retail Logistics Market, 2021 - 2027, USD Million

TABLE 143 UK Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 144 UK Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 145 UK Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 146 UK Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 147 UK Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 148 UK Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 149 France Retail Logistics Market, 2017 - 2020, USD Million

TABLE 150 France Retail Logistics Market, 2021 - 2027, USD Million

TABLE 151 France Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 152 France Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 153 France Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 154 France Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 155 France Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 156 France Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 157 Russia Retail Logistics Market, 2017 - 2020, USD Million

TABLE 158 Russia Retail Logistics Market, 2021 - 2027, USD Million

TABLE 159 Russia Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 160 Russia Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 161 Russia Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 162 Russia Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 163 Russia Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 164 Russia Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 165 Spain Retail Logistics Market, 2017 - 2020, USD Million

TABLE 166 Spain Retail Logistics Market, 2021 - 2027, USD Million

TABLE 167 Spain Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 168 Spain Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 169 Spain Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 170 Spain Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 171 Spain Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 172 Spain Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 173 Italy Retail Logistics Market, 2017 - 2020, USD Million

TABLE 174 Italy Retail Logistics Market, 2021 - 2027, USD Million

TABLE 175 Italy Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 176 Italy Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 177 Italy Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 178 Italy Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 179 Italy Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 180 Italy Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 181 Rest of Europe Retail Logistics Market, 2017 - 2020, USD Million

TABLE 182 Rest of Europe Retail Logistics Market, 2021 - 2027, USD Million

TABLE 183 Rest of Europe Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 184 Rest of Europe Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 185 Rest of Europe Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 186 Rest of Europe Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 187 Rest of Europe Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 188 Rest of Europe Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 189 Asia Pacific Retail Logistics Market, 2017 - 2020, USD Million

TABLE 190 Asia Pacific Retail Logistics Market, 2021 - 2027, USD Million

TABLE 191 Asia Pacific Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 192 Asia Pacific Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 193 Asia Pacific Conventional Retail Logistics Market by Country, 2017 - 2020, USD Million

TABLE 194 Asia Pacific Conventional Retail Logistics Market by Country, 2021 - 2027, USD Million

TABLE 195 Asia Pacific E-Commerce Retail Logistics Market by Country, 2017 - 2020, USD Million

TABLE 196 Asia Pacific E-Commerce Retail Logistics Market by Country, 2021 - 2027, USD Million

TABLE 197 Asia Pacific Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 198 Asia Pacific Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 199 Asia Pacific Supply Chain Solutions Market by Country, 2017 - 2020, USD Million

TABLE 200 Asia Pacific Supply Chain Solutions Market by Country, 2021 - 2027, USD Million

TABLE 201 Asia Pacific Commerce Enablement Market by Country, 2017 - 2020, USD Million

TABLE 202 Asia Pacific Commerce Enablement Market by Country, 2021 - 2027, USD Million

TABLE 203 Asia Pacific Transportation Management Market by Country, 2017 - 2020, USD Million

TABLE 204 Asia Pacific Transportation Management Market by Country, 2021 - 2027, USD Million

TABLE 205 Asia Pacific Reverse logistics & liquidation Market by Country, 2017 - 2020, USD Million

TABLE 206 Asia Pacific Reverse logistics & liquidation Market by Country, 2021 - 2027, USD Million

TABLE 207 Asia Pacific Other Solutions Market by Country, 2017 - 2020, USD Million

TABLE 208 Asia Pacific Other Solutions Market by Country, 2021 - 2027, USD Million

TABLE 209 Asia Pacific Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 210 Asia Pacific Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 211 Asia Pacific Roadways Market by Country, 2017 - 2020, USD Million

TABLE 212 Asia Pacific Roadways Market by Country, 2021 - 2027, USD Million

TABLE 213 Asia Pacific Railways Market by Country, 2017 - 2020, USD Million

TABLE 214 Asia Pacific Railways Market by Country, 2021 - 2027, USD Million

TABLE 215 Asia Pacific Waterways Market by Country, 2017 - 2020, USD Million

TABLE 216 Asia Pacific Waterways Market by Country, 2021 - 2027, USD Million

TABLE 217 Asia Pacific Airways Market by Country, 2017 - 2020, USD Million

TABLE 218 Asia Pacific Airways Market by Country, 2021 - 2027, USD Million

TABLE 219 Asia Pacific Retail Logistics Market by Country, 2017 - 2020, USD Million

TABLE 220 Asia Pacific Retail Logistics Market by Country, 2021 - 2027, USD Million

TABLE 221 China Retail Logistics Market, 2017 - 2020, USD Million

TABLE 222 China Retail Logistics Market, 2021 - 2027, USD Million

TABLE 223 China Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 224 China Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 225 China Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 226 China Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 227 China Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 228 China Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 229 Japan Retail Logistics Market, 2017 - 2020, USD Million

TABLE 230 Japan Retail Logistics Market, 2021 - 2027, USD Million

TABLE 231 Japan Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 232 Japan Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 233 Japan Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 234 Japan Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 235 Japan Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 236 Japan Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 237 India Retail Logistics Market, 2017 - 2020, USD Million

TABLE 238 India Retail Logistics Market, 2021 - 2027, USD Million

TABLE 239 India Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 240 India Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 241 India Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 242 India Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 243 India Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 244 India Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 245 South Korea Retail Logistics Market, 2017 - 2020, USD Million

TABLE 246 South Korea Retail Logistics Market, 2021 - 2027, USD Million

TABLE 247 South Korea Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 248 South Korea Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 249 South Korea Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 250 South Korea Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 251 South Korea Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 252 South Korea Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 253 Singapore Retail Logistics Market, 2017 - 2020, USD Million

TABLE 254 Singapore Retail Logistics Market, 2021 - 2027, USD Million

TABLE 255 Singapore Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 256 Singapore Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 257 Singapore Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 258 Singapore Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 259 Singapore Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 260 Singapore Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 261 Malaysia Retail Logistics Market, 2017 - 2020, USD Million

TABLE 262 Malaysia Retail Logistics Market, 2021 - 2027, USD Million

TABLE 263 Malaysia Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 264 Malaysia Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 265 Malaysia Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 266 Malaysia Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 267 Malaysia Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 268 Malaysia Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 269 Rest of Asia Pacific Retail Logistics Market, 2017 - 2020, USD Million

TABLE 270 Rest of Asia Pacific Retail Logistics Market, 2021 - 2027, USD Million

TABLE 271 Rest of Asia Pacific Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 272 Rest of Asia Pacific Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 273 Rest of Asia Pacific Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 274 Rest of Asia Pacific Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 275 Rest of Asia Pacific Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 276 Rest of Asia Pacific Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 277 LAMEA Retail Logistics Market, 2017 - 2020, USD Million

TABLE 278 LAMEA Retail Logistics Market, 2021 - 2027, USD Million

TABLE 279 LAMEA Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 280 LAMEA Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 281 LAMEA Conventional Retail Logistics Market by Country, 2017 - 2020, USD Million

TABLE 282 LAMEA Conventional Retail Logistics Market by Country, 2021 - 2027, USD Million

TABLE 283 LAMEA E-Commerce Retail Logistics Market by Country, 2017 - 2020, USD Million

TABLE 284 LAMEA E-Commerce Retail Logistics Market by Country, 2021 - 2027, USD Million

TABLE 285 LAMEA Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 286 LAMEA Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 287 LAMEA Supply Chain Solutions Market by Country, 2017 - 2020, USD Million

TABLE 288 LAMEA Supply Chain Solutions Market by Country, 2021 - 2027, USD Million

TABLE 289 LAMEA Commerce Enablement Market by Country, 2017 - 2020, USD Million

TABLE 290 LAMEA Commerce Enablement Market by Country, 2021 - 2027, USD Million

TABLE 291 LAMEA Transportation Management Market by Country, 2017 - 2020, USD Million

TABLE 292 LAMEA Transportation Management Market by Country, 2021 - 2027, USD Million

TABLE 293 LAMEA Reverse logistics & liquidation Market by Country, 2017 - 2020, USD Million

TABLE 294 LAMEA Reverse logistics & liquidation Market by Country, 2021 - 2027, USD Million

TABLE 295 LAMEA Other Solutions Market by Country, 2017 - 2020, USD Million

TABLE 296 LAMEA Other Solutions Market by Country, 2021 - 2027, USD Million

TABLE 297 LAMEA Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 298 LAMEA Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 299 LAMEA Roadways Market by Country, 2017 - 2020, USD Million

TABLE 300 LAMEA Roadways Market by Country, 2021 - 2027, USD Million

TABLE 301 LAMEA Railways Market by Country, 2017 - 2020, USD Million

TABLE 302 LAMEA Railways Market by Country, 2021 - 2027, USD Million

TABLE 303 LAMEA Waterways Market by Country, 2017 - 2020, USD Million

TABLE 304 LAMEA Waterways Market by Country, 2021 - 2027, USD Million

TABLE 305 LAMEA Airways Market by Country, 2017 - 2020, USD Million

TABLE 306 LAMEA Airways Market by Country, 2021 - 2027, USD Million

TABLE 307 LAMEA Retail Logistics Market by Country, 2017 - 2020, USD Million

TABLE 308 LAMEA Retail Logistics Market by Country, 2021 - 2027, USD Million

TABLE 309 Brazil Retail Logistics Market, 2017 - 2020, USD Million

TABLE 310 Brazil Retail Logistics Market, 2021 - 2027, USD Million

TABLE 311 Brazil Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 312 Brazil Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 313 Brazil Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 314 Brazil Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 315 Brazil Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 316 Brazil Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 317 Argentina Retail Logistics Market, 2017 - 2020, USD Million

TABLE 318 Argentina Retail Logistics Market, 2021 - 2027, USD Million

TABLE 319 Argentina Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 320 Argentina Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 321 Argentina Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 322 Argentina Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 323 Argentina Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 324 Argentina Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 325 UAE Retail Logistics Market, 2017 - 2020, USD Million

TABLE 326 UAE Retail Logistics Market, 2021 - 2027, USD Million

TABLE 327 UAE Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 328 UAE Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 329 UAE Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 330 UAE Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 331 UAE Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 332 UAE Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 333 Saudi Arabia Retail Logistics Market, 2017 - 2020, USD Million

TABLE 334 Saudi Arabia Retail Logistics Market, 2021 - 2027, USD Million

TABLE 335 Saudi Arabia Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 336 Saudi Arabia Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 337 Saudi Arabia Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 338 Saudi Arabia Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 339 Saudi Arabia Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 340 Saudi Arabia Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 341 South Africa Retail Logistics Market, 2017 - 2020, USD Million

TABLE 342 South Africa Retail Logistics Market, 2021 - 2027, USD Million

TABLE 343 South Africa Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 344 South Africa Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 345 South Africa Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 346 South Africa Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 347 South Africa Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 348 South Africa Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 349 Nigeria Retail Logistics Market, 2017 - 2020, USD Million

TABLE 350 Nigeria Retail Logistics Market, 2021 - 2027, USD Million

TABLE 351 Nigeria Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 352 Nigeria Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 353 Nigeria Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 354 Nigeria Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 355 Nigeria Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 356 Nigeria Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 357 Rest of LAMEA Retail Logistics Market, 2017 - 2020, USD Million

TABLE 358 Rest of LAMEA Retail Logistics Market, 2021 - 2027, USD Million

TABLE 359 Rest of LAMEA Retail Logistics Market by Type, 2017 - 2020, USD Million

TABLE 360 Rest of LAMEA Retail Logistics Market by Type, 2021 - 2027, USD Million

TABLE 361 Rest of LAMEA Retail Logistics Market by Solution, 2017 - 2020, USD Million

TABLE 362 Rest of LAMEA Retail Logistics Market by Solution, 2021 - 2027, USD Million

TABLE 363 Rest of LAMEA Retail Logistics Market by Mode of Transport, 2017 - 2020, USD Million

TABLE 364 Rest of LAMEA Retail Logistics Market by Mode of Transport, 2021 - 2027, USD Million

TABLE 365 Key Information – Kintetsu World Express, Inc.

TABLE 366 Key Information – A.P. Moller - Maersk A/S

TABLE 367 Key Information – DSV A/S

TABLE 368 Key Information – Deutsche Post DHL Group

TABLE 369 Key Information – FedEx Corporation

TABLE 370 Key Information – Kuehne + Nagel International AG

TABLE 371 Key Information – Nippon Express co., ltd.

TABLE 372 Key information – XPO Logistics, Inc.

TABLE 373 Key Information – United Parcel Service, Inc.

TABLE 374 Key information – C.H. Robinson Worldwide, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 KBV Cardinal Matrix

FIG 3 Key Leading Strategies: Percentage Distribution (2017-2021)

FIG 4 Key Strategic Move: (Acquisition & mergers: 2018, May – 2021, Dec) Leading Players

FIG 5 Recent strategies and developments: A.P. Moller - Maersk A/S

FIG 6 Recent strategies and developments: DSV A/S

FIG 7 Recent strategies and developments: Deutsche Post DHL Group

FIG 8 Recent strategies and developments: FedEx Corporation

FIG 9 Recent strategies and developments: Kuehne + Nagel International AG

FIG 10 Recent strategies and developments: XPO Logistics, Inc.

FIG 11 Recent strategies and developments: United Parcel Service

FIG 12 Recent strategies and developments: C.H. Robinson Worldwide, Inc.