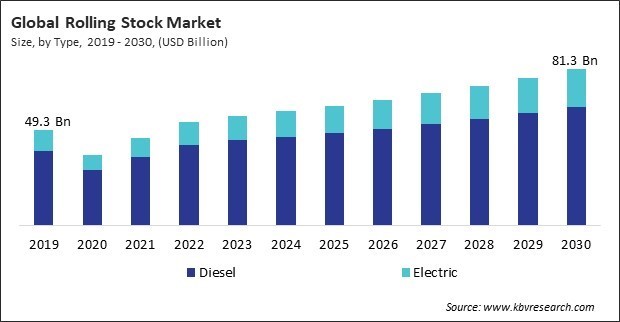

“Global Rolling Stock Market to reach a market value of USD 81.3 Billion by 2030 growing at a CAGR of 5.2%”

The Global Rolling Stock Market size is expected to reach $81.3 billion by 2030, rising at a market growth of 5.2% CAGR during the forecast period.

High-speed rail development is an emerging trend in North America, with discussions and plans for high-speed rail corridors in certain regions. Consequently, North America region captured $13,029.3 million revenue in the market in 2022. The Intermodal transportation, which involves the seamless transfer of commodities between different modes of transportation, is widely used in North America. The extensive freight rail network connects the United States and Canada, facilitating cross-border movement of goods.

The growth of e-commerce has led to a surge in the demand for freight transportation to move goods from distribution centers to fulfillment centers and, ultimately, to end consumers. Rail freight, with its high capacity and efficiency, becomes a preferred mode of transportation, driving the demand for freight the stock. Inland ports benefit from rail connectivity, which acts as hubs for transferring goods between different transportation modes. Additionally, Maintenance services ensure these stock’s proper functioning and longevity. Regular inspections, maintenance, and component replacements increase the life of trains and other rail vehicles, resulting in a more sustainable and cost-effective operation. Providing training programs for maintenance personnel is a vital aspect of aftermarket services. Ensuring maintenance teams are well-trained on the latest technologies and best practices contributes to effective and efficient stock maintenance. Hence, growing maintenance and aftermarket services has been a pivotal factor in driving the growth of the market.

However, the high costs associated with purchasing new stocks may limit the capacity of rail operators to expand their fleets. This limitation can impact the ability to meet the growing demand for passenger services or freight transport, leading to potential service constraints. Rail networks often have aged the stocks that requires replacement for safety, efficiency, and environmental reasons. Private investors may be hesitant to commit to large-scale stocks projects, impacting the overall financing landscape for the market. Modernizing rail networks with new stocks is essential for meeting safety, efficiency, and environmental standards. However, the high capital costs can act as a barrier to implementing modernization initiatives, limiting the overall progress of rail systems. Thus, high initial capital costs can slow down the growth of the market.

Based on type, the market is classified into diesel and electric. In 2022, the diesel segment witnessed the largest revenue share in the market. Diesel-powered stocks are well-suited for providing last-mile connectivity to areas where electrification ends. This is crucial for ensuring a comprehensive and connected rail network, allowing goods and passengers to be transported seamlessly between electrified and non-electrified sections of the rail system. Diesel-powered stock is used for emergency response and maintenance services. Mobile maintenance units and rescue trains, often equipped with diesel engines, can quickly reach locations where immediate assistance is required, ensuring the reliability and safety of the rail network.

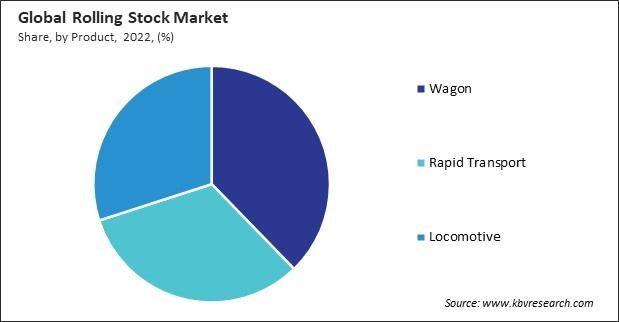

By product, the market is categorized into locomotive, rapid transport, and wagon. The rapid transport segment covered a considerable revenue share in the market in 2022. Rapid transport systems improve connectivity by efficiently linking major cities and regions. This connectivity fosters economic development, facilitates business activities, and strengthens social ties by making it easier for people and goods to move between locations. The introduction of rapid transport systems stimulates urban and regional development along the rail corridors. Improved accessibility to cities and regions served by high-speed rail can increase economic activities, job creation, and infrastructure development.

On the basis of train type, the market is divided into rail freight and passenger rail. In 2022, the rail freight segment dominated the market with maximum revenue share. Rail freight is known for its energy efficiency. Electrically powered freight trains can operate with high energy efficiency, especially by renewable energy sources. Energy-efficient transportation contributes to the overall sustainability of the freight industry. Rail freight is generally considered a safe mode of transportation, with lower accident rates than road transport. The fixed infrastructure, well-defined tracks, and standardized safety protocols contribute to minimizing accidents and incidents.

Free Valuable Insights: Global Rolling Stock Market size to reach USD 81.3 Billion by 2030

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region led the market by generating the highest revenue share. Urbanization and population expansion are pivotal features of the Asia-Pacific region. Rapid urbanization has expanded metro systems and urban transit networks in major cities across the Asia Pacific region. There is a notable shift towards electrification in the market in the Asia Pacific region. The Asia Pacific region is witnessing technological advancements in the stock design and technology innovation.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 53.7 Billion |

| Market size forecast in 2030 | USD 81.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 5.2% from 2023 to 2030 |

| Number of Pages | 213 |

| Number of Tables | 330 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Product, Train Type, Region |

| Country scope |

|

| Companies Included | Alstom SA (Alstom Transport), Kawasaki Heavy Industries, Ltd., Siemens AG (Siemens Mobility), Wabtec Corporation (GE Transportation), Hitachi, Ltd. (Hitachi Rail Systems), CRRC Corporation Limited, Hyundai Motor Company (Hyundai Rotem Company), IHI Corporation (Dai-ichi Life), Mitsubishi Heavy Industries Ltd. (Mitsubishi Power, Ltd.), Trinity Industries, Inc. (TrinityRail) |

By Type

By Product

By Train Type

By Geography

This Market size is expected to reach $81.3 billion by 2030.

Increasing urbanization and population growth are driving the Market in coming years, however, Adverse impact of high initial capital costs restraints the growth of the Market.

Alstom SA (Alstom Transport), Kawasaki Heavy Industries, Ltd., Siemens AG (Siemens Mobility), Wabtec Corporation (GE Transportation), Hitachi, Ltd. (Hitachi Rail Systems), CRRC Corporation Limited, Hyundai Motor Company (Hyundai Rotem Company), IHI Corporation (Dai-ichi Life), Mitsubishi Heavy Industries Ltd. (Mitsubishi Power, Ltd.), Trinity Industries, Inc. (TrinityRail)

The expected CAGR of this Market is 5.2% from 2023 to 2030.

The Wagon segment is leading the Market by Product in 2022; there by, achieving a market value of $29.5 Billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $35.9 Billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges