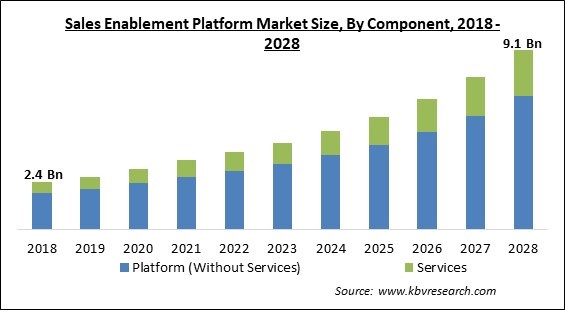

The Global Sales Enablement Platform Market size is expected to reach $9.1 billion by 2028, rising at a market growth of 15.1% CAGR during the forecast period.

By delivering integrated information, instruction, and coaching services for salespeople and front-line sales managers throughout the entire customer's buying experience, sales enablement is a strategic, cross-functional discipline intended to boost sales outcomes and productivity. It is powered by technology.

The adoption of sales enablement platforms all over different sectors to increase their efficiencies in terms of content management, training, sales communication, and training is credited with driving market growth. Businesses have increased their investments in technologies like machine learning and AI.

Digital sales rooms (DSRs) are being established by a number of industry companies to simplify the buyer and seller experience. DSRs offers a centralized location for communication and content connected to the sales cycle. These can be applied to stakeholder collaboration. Additionally, as sectors become more digitalized and linked devices become more widely used, the demand for sales enablement systems has increased.

During the pandemic, the application of AI in sales enablement sped up market expansion. For example, Allego, a player in the sales enablement market, found that nearly 50% of sales representatives said they would like to receive training in AI and virtual selling. Call recordings and AI-based analysis can give managers the knowledge they need to mentor sales representatives.

Vendors of sales enablement platforms have the chance to offer small, medium, and large businesses sales enablement platforms and services to increase their sales efficiency. This will allow businesses to deal with the complexity of configuring sales enablement platforms during the COVID-19 outbreak around the world. The market for sales enablement platforms was positively impacted by the COVID-19 epidemic. Government-imposed laws and travel limitations resulted in business closures, which forced some enterprises to establish a hybrid work environment.

The industry will experience increased demand as a result of the growing use of technology to boost manufacturing sales growth and improve sales operations using better content, strategy, and technology. To engage and cultivate prospects all through the buying process, the sales team uses a method known as "sales enablement" to process data, information, resources, and tools. There are now many deeper sales channels due to the exponential growth of connected devices, which presents prospects for the market for sales enablement platforms. This factor is augmenting the potential of the Sales Enablement Platform market.

Sales enablement is comprised of a variety of tools, procedures, and expertise. Sales training software may consolidate these elements into a single, user-friendly location, allowing the sales representatives to work more efficiently. If a client has a query, the representative may have to go through many sales training frameworks, sales training programs, or staff manuals and handbooks to discover the solution. It consumes a lot of time for the client as well as the representative.

Making ensuring salespeople have the knowledge and tools they need to assist clients and prospects wherever they are is the goal of mobile sales enablement. Since it enables them to satisfy the more demanding modern customer, the majority of sales leaders are aware of their need for such a system. However, a lot of sales managers use mobile sales enablement incorrectly. They make use of whatever tools they have available rather than critically analyzing what their sales team needs and coming up with a plan to meet those requirements. Usually, this entails making an effort to reuse the company's file storage systems. These elements hinder the market's expansion for sales enablement platforms.

Based on Component, the Sales Enablement Platform Market is categorized into Platform (Without Services) and Service. The platform segment led the market with the largest revenue share in 2021 and is predicted to continue its dominance throughout the forecast period. A single platform for managing an organization's sales team is provided by the sales enablement platform. A sales enablement platform is being used by many businesses in a variety of sectors to boost productivity in areas including coaching, training, content management, and sales communication.

Based on organization size, the Sales Enablement Platform Market is categorized into Large Organizations and Small & Medium Organizations. In 2021, the large enterprise segment accounted for the largest revenue share. Large organizations' ability to expand is restricted by issues including underutilization of resources and limitations imposed by legacy systems. Large businesses may find it difficult to test out novel tactics due to a lack of flexibility. Sales reps can reduce the sales cycle and improve their win rates by using a sales enablement tool.

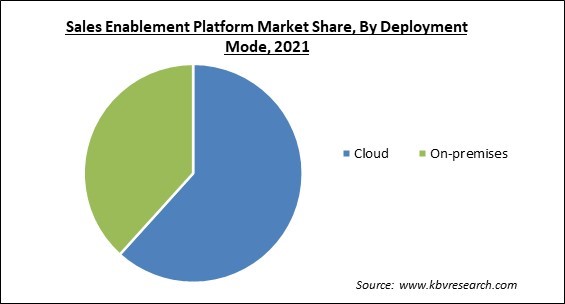

Based on Deployment, the Sales Enablement Platform Market is classified into Cloud and On-Premise based on Deployment. The On-premises sector produced a sizable portion of revenue in 2021. Platforms for on-premises sales enablement are set up and used at the customer's location. Organizations can have extensive control over their data, performance and security owing to these platforms. However, they also demand major time, money, and resource commitments for installation and upkeep.

Based on end use, the Sales Enablement Platform Market is classified into the BFSI, IT & Telecom, Consumer Goods & Retail, Media & Entertainment, Healthcare & Lifesciences, Manufacturing, and Others. During the projection period, the segment for healthcare and life sciences is recording the highest CAGR. Businesses in the life sciences sector must remain at the forefront of the innovation curve since both medical developments and regulatory regulations are constantly evolving. Both their sales activities and their components fall under this. In order to meet regulatory requirements, sales enablement tools are causing a growth in current compliance-approved data.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 3.5 Billion |

| Market size forecast in 2028 | USD 9.1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 15.1% from 2022 to 2028 |

| Number of Pages | 253 |

| Number of Tables | 450 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Deployment Mode, Organization Size, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on geography, the Sales Enablement Platform Market is categorized into North America, Europe, Asia Pacific, and LAMEA. In 2021, North America had the largest revenue share, and it is predicted that it will continue to hold that position throughout the projection period. Market growth is being fueled by the presence of sales enablement companies in the area as well as the expanding use of connected devices. The market in the region is being driven by the introduction of new market participants in the sales enablement sector with an approach toward providing AI-based content management solutions and training sales agents.

Free Valuable Insights: Global Sales Enablement Platform Market size to reach USD 9.1 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include SAP SE, Seismic Software, Inc., Brainshark, Inc. (Bigtincan Holdings), Mindtickle, Inc., Qstream, Inc., Showpad, Inc., Upland Software, Inc., Highspot, Inc., Rallyware, Inc., and Accent Technologies, Inc.

By Component

By Deployment Mode

By Organization Size

By End-use

By Geography

The global Sales Enablement Platform Market size is expected to reach $9.1 billion by 2028.

Using cutting-edge technology to improve sales operations will increase adoption are driving the market in coming years, however, Lack Of Software Expertise restraints the growth of the market.

SAP SE, Seismic Software, Inc., Brainshark, Inc. (Bigtincan Holdings), Mindtickle, Inc., Qstream, Inc., Showpad, Inc., Upland Software, Inc., Highspot, Inc., Rallyware, Inc., and Accent Technologies, Inc.

The Cloud segment acquired maximum revenue share in the Global Sales Enablement Platform Market by Deployment Mode in 2021 thereby, achieving a market value of $6.4 billion by 2028.

The Consumer Goods & Retail segment is leading the Global Sales Enablement Platform Market by End-use in 2021 thereby, achieving a market value of $2.2 billion by 2028.

The North America market dominated the Global Sales Enablement Platform Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $3.1 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.