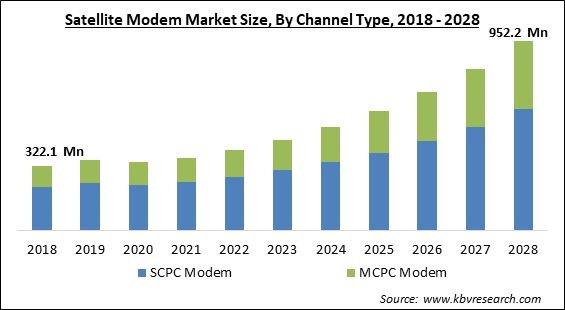

The Global Satellite Modem Market size is expected to reach $952.2 million by 2028, rising at a market growth of 15.5% CAGR during the forecast period.

A satellite modem or sat modem is a modem that uses a communications satellite as a relay to establish data transfers. The primary purpose of a satellite modem is to convert an input stream of bits to a radio wave and vice versa. Some devices that have simply a demodulator (and no modulator, allowing data to be downloaded solely via satellite) are also known as "satellite modems." These gadgets are used to access the Internet through satellite (in this case uploaded data is transferred through a conventional PSTN modem or an ADSL modem). It takes more than a satellite modem to establish a channel of communication.

Additionally, satellite antennae and frequency converters are required for the establishment of a satellite link. Data to be communicated are transmitted to modems from data terminal equipment. The intermediate frequency (IF) output of the modem is typically 50-200 MHz; however, the signal is occasionally modulated straight to the L band.

In the majority of instances, the frequency must be transformed with an upconverter before amplification and transmission. Depending on the modulation technique employed, a modulated signal is a sequence of symbols, or forms of data conveyed by a corresponding signal state, such as a bit or a few bits.

Recovering a symbol clock (synchronizing a local symbol clock generator with a distant one) is one of the most essential responsibilities of a demodulator. Similarly, a signal received from a satellite is initially down-converted, followed by demodulation by a modem, and finally handled by data terminal equipment. The LNB is typically supplied with 13 or 18 V DC through the solution providers by the modem.

The COVID-19 pandemic has had a substantial influence on the expansion of this sector. During the pandemic, the demand for this market was greatly bolstered by the increase in demand for satellite communication solutions across several industries. In addition, the worldwide telecommunications industry has begun deploying satellite modem solutions, which is anticipated to boost the expansion of the satellite modem market study post-pandemic.

Numerous end-user sectors, including those in the maritime, oil and gas, transport, communications, and education, among others, have increased their need for real-time and high-speed communication, which has led to an increase in the demand for sophisticated high-speed satellite modems. Users are now able to send massive quantities of data effectively due to the satellite modem industry's ongoing advancements. The speed and data connectivity rates that are also available onshore are not available to offshore teams.

A lot of businesses in this industry have suggested or are putting into practice plans to create satellite constellations, while CubeSats and other tiny spacecraft are also gaining popularity. The rising popularity of GPS is a key factor in the expansion of LEO and MEO satellites. It is now a crucial component of the satellite communications system. To supply GPS, a large number of MEO satellites are deployed into orbit. More MEO satellites will be required as the demand for GPS connection rises. For effective signal transmission, this will lead to a necessity for several satellite modems to be placed throughout base stations. The massive launches of the satellites surge the growth of the satellite modem market.

For the majority of enterprises installing IoT systems and, more recently, 5G networks, which include numerous connected devices across networks, platforms, and devices, security is the most important technical challenge. IoT growth implies a bad actor might potentially control a vast network of linked devices if just one unencrypted device or the communication between them isn't safeguarded. Every step of the data transmission process must be secured, not only the devices themselves. The satellite-space industry is now under threat from network hacking and cyberattacks, which is creating an increasing challenge to satellite operators.

Based on the Channel Type, the Satellite Modem Market is segmented into SCPC Modem and MCPC Modem. The MCPC modem segment witnessed a significant revenue share in the satellite modem market in 2021. It is due to the unmatched channel efficiency provided by these modems, which is a fundamental necessity for high-data-traffic applications such as mobile communication, the Internet, and wireless broadband.

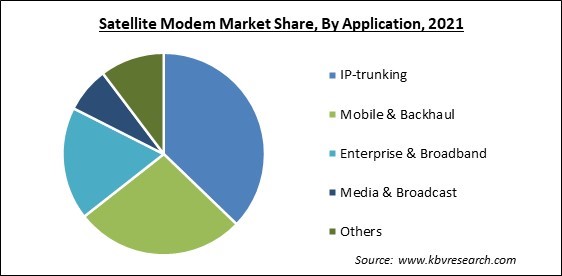

By Application, the Satellite Modem Market is classified into Mobile & Backhaul, IP-trunking, Enterprise & Broadband, Media & Broadcast, and Others. The IP-trucking segment garnered the highest revenue share in the satellite modem market in 2021. It is because IP-trunking offers a huge array of advantages, including unlimited employee mobility, dependable phone service, and a robust end-to-end unified communications network that improves data security while also enhancing communication system quality.

On the basis of Technology, the Satellite Modem Market is divided into VSAT, Satcom-on-the-move, Satcom-on-the-pause, and Others. The VSAT segment recorded a substantial revenue share in the satellite modem market in 2021. It is because VSATs are used to transmit either narrowband or broadband data. VSATs are also utilized for mobile, transportable (using phased array antennas), or mobile marine communications.

Based on the End User, the Satellite Modem Market is bifurcated into Telecommunications, Marine, Military & Defense, Transportation & Logistics, Oil & Gas, and Others. The military & defense segment acquired the largest revenue share in the satellite modem market in 2021. It is due to the information collection, situational awareness, and border patrol are just a few of the numerous military and defense applications for satellite communication. In recent years, the volume of data, voice, and video exchanged between headquarters and remote locations has expanded significantly.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 363.4 Million |

| Market size forecast in 2028 | USD 952.2 Million |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 15.5% from 2022 to 2028 |

| Number of Pages | 289 |

| Number of Tables | 493 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Channel Type, Application, Technology, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the Satellite Modem Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured a promising revenue share in the satellite modem market in 2021. This market will be driven by the increasing demand for complicated industrial applications using metals such as steel. China continues to be the largest market for satellite modems and is expected to maintain its dominating position during the projection period. Investments in the growth of glass production and government backing for steel production are anticipated to create enormous prospects for the market.

Free Valuable Insights: Global Satellite Modem Market size to reach USD 952.2 Million by 2028

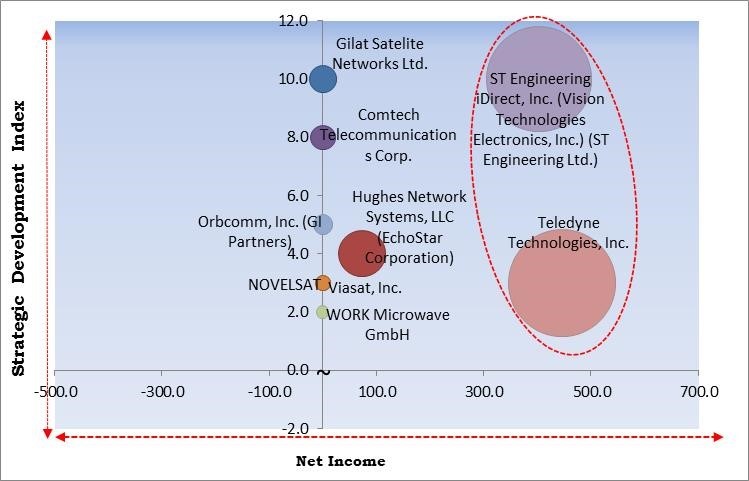

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; ST Engineering iDirect, Inc. (Vision Technologies Electronics, Inc.) (ST Engineering Ltd.) and Teledyne Technologies, Inc. are the forerunners in the Satellite Modem Market. Companies such as Gilat Satelite Networks Ltd., Comtech Telecommunications Corp., Orbcomm, Inc. (GI Partners) are some of the key innovators in Satellite Modem Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Comtech Telecommunications Corp., Datum System, Gilat Satelite Networks Ltd., Hughes Network Systems, LLC (EchoStar Corporation), Orbcomm, Inc. (GI Partners), NOVELSAT, ST Engineering iDirect, Inc. (Vision Technologies Electronics, Inc.), Teledyne Technologies, Inc., Viasat, Inc. and WORK Microwave GmbH.

By Channel Type

By Application

By Technology

By End User

By Geography

The global Satellite Modem Market size is expected to reach $952.2 million by 2028.

Data Connectivity at High Speeds Is Becoming More Important are driving the market in coming years, however, Satcom Equipment's Susceptibility to Cyberattacks restraints the growth of the market.

Comtech Telecommunications Corp., Datum System, Gilat Satelite Networks Ltd., Hughes Network Systems, LLC (EchoStar Corporation), Orbcomm, Inc. (GI Partners), NOVELSAT, ST Engineering iDirect, Inc. (Vision Technologies Electronics, Inc.), Teledyne Technologies, Inc., Viasat, Inc. and WORK Microwave GmbH.

The SCPC Modem market is generating high revenue in the Global Satellite Modem Market by Channel Type in 2021; thereby, achieving a market value of $607 million by 2028.

The Satcom-on-the-move market is leading the Global Satellite Modem Market by Technology in 2021; thereby, achieving a market value of $398.3 million by 2028.

The North America market dominated the Global Satellite Modem Market by Region in 2021; thereby, achieving a market value of $362.8 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.