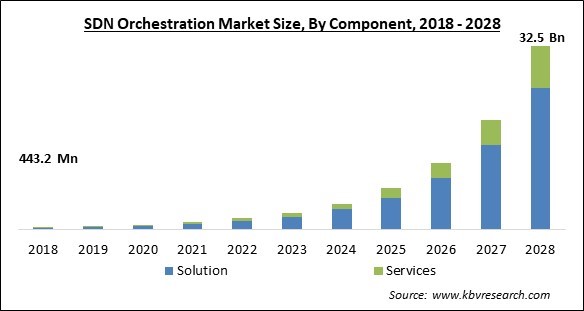

The Global SDN Orchestration Market size is expected to reach $32.5 billion by 2028, rising at a market growth of 58.8% CAGR during the forecast period.

The capacity to create automatic behaviors in a network to coordinate the necessary networking hardware and software pieces in order to enable applications and services is known as software-defined networking (SDN) orchestration, also known as SDN orchestration or SDN policy orchestration. SDN orchestration can begin with customer service orders, which may be the result of manual chores or client-driven behaviors like placing an order for services online. The service would then be provided by the application or service using SDN orchestration technology. Setting up server-based virtualization, virtual network layers, or security services like an encrypted tunnel may be necessary for this.

Many different types of commercial or open source software, frequently created using standard APIs that may connect to popular networking technologies, can be found on SDN orchestration platforms. Anuta Networks, CENX, Cisco Systems, Big Switch, Cyan, Overture Networks, Nuage Networks, and UBIqube are a few businesses that provide or provide SDN orchestration technologies. Software actions are frequently coordinated with an SDN Controller, which can be created using open source software like OpenDaylight, as part of SDN orchestration. In the event of traffic congestion, malfunctioning equipment, or security issues, the controller may also be programmed to make choices regarding the network automatically.

Monitoring the network and automating connectivity is the most crucial component of SDN orchestration. It is regarded as one of the SDN networks' most promising growth areas as a result. For instance, international service providers are looking for software that incorporates orchestration, fulfillment, control, assurance, performance, usage, security, analytics, and policy of enterprise networking services based on public and interoperable standards. The introduction of new SDN orchestration tools, in the opinion of many service providers and cloud operators, would necessitate an update of operation support systems to be interoperable with more open and interoperable SDN technologies.

The COVID-19 pandemic caused significant damage to the worldwide economy. Several businesses all over the world were demolished. However, the outbreak positively impacted the SDN orchestration market. The COVID-19 outbreak is helping the market for SDN orchestration grow since SDN technologies are assisting businesses in meeting the high capacity demands of mobile traffic. Internet traffic has grown by a significant rate over the past year. As a result, in a variety of applications, service providers including mobile and fixed-line are investing significantly in SDN and network function virtualization.

Because there is no practical way to combine different components, traditional service distribution based on OSS and BSS tends to remain isolated. It is likely that connecting them would require specialized software, which is rarely practicable. Interoperability between service components will be enabled via standardized APIs, removing obstacles to networking. Systems in the cloud and on-premises will operate in harmony, and reliance on particular hardware resources would be diminished or removed. What used to require a number of loosely connected networks can now be combined into a single network with any necessary subnetworks.

Scaling-up and scaling-down is automated via SDN. Engineers now have the operational capability to swiftly and seamlessly normalize traffic across a large space owing to this capability and the added visibility it delivers. SDN offers a wide range of advantages. It is essential to know what it can achieve for the business. SDN orchestration offers optimized management and smart design to the business. Moreover, SDN is an ideal option if the customer is searching for a strategy to increase the network's performance while reducing costs.

Every device connected to a network fills up space. The quantity of virtualized resources affects how quickly devices and networks communicate. More virtualized resources can be added if more speed is required. Currently, virtualizing resources may cause a sizable degree of latency. Additionally, an essential component of networking for conducting its operations is maintenance. It requires effective and frequent maintenance, which if lacking, makes managing the real devices challenging, particularly while growing up a network. For SDN, there are no established security protocols.

Based on the Component, the SDN Orchestration Market is segmented into Solution and Service (Integration & Implementation, and Training & Consulting). In 2021, the solution segment acquired the largest revenue share of the SDN orchestration market. The growth of this segment can be attributed to the increased emphasis of businesses on handling heavy network traffic, giving customers a real-time view of different infrastructure components, and preventing system outages.

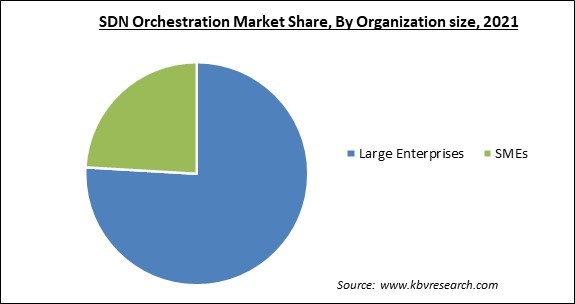

On the basis of Organization Size, the SDN Orchestration Market is bifurcated into Large Enterprises and Small & Medium-sized Enterprises (SMEs). In 2021, the large enterprises segment procured the biggest revenue share of the SDN orchestration market. The rapidly rising growth of this segment is owing to the fact that SDN orchestration solutions and services significantly streamline workflows across these organizations. Large enterprises typically handle a significant number of customers. Manually operating SDN can become very challenging as well as require a lot of time and cost.

By the Vertical, the SDN Orchestration Market is segregated into BFSI, IT & Telecom, Government & defense, Manufacturing, Healthcare, and Others. In 2021, the manufacturing segment witnessed a significant revenue share of the SDN orchestration market. The increasing growth of the segment is owing to the surging number of technological advancements in the manufacturing industry. There is a number of technological advancements that have been introduced to the manufacturing software, which are allowing manufacturers to considerably reduce the burden.

By the End-user, the SDN Orchestration Market is divided into Cloud Service Providers and Telecom Service Providers. In 2021, the telecom service providers segment acquired a substantial revenue share of the SDN orchestration market. The rising demand from telecom service providers for SDN orchestration solutions is majorly propelling the growth of this segment of the market. SDN Orchestration is useful for telecom service providers in many different contexts. For instance, they can use it to more effectively monitor their networks or to rapidly and easily roll out new services.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.4 Billion |

| Market size forecast in 2028 | USD 32.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 58.8% from 2022 to 2028 |

| Number of Pages | 250 |

| Number of Tables | 440 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Vertical, Organization size, End Use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-Wise, the SDN Orchestration Market is analyzed across North America1, Europe, Asia-pacific, and LAMEA. In 2021, North America accounted for the largest revenue share of the SDN orchestration market. The region is anticipated to maintain its supremacy. These businesses have created cutting-edge SDN orchestration technologies that have been widely used by service providers all over the region and are actively engaging in R&D efforts. Because more telecom service providers in nations like China, India, and Japan, among others, are utilizing cloud services, the regional market is estimated to witness several robust growth prospects.

Free Valuable Insights: Global SDN Orchestration Market size to reach USD 32.5 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Cisco Systems, Inc., Hewlett-Packard enterprise company, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Nokia Corporation, Ciena Corporation, Juniper Networks, Inc., NEC Corporation, Qualitest Group, Anuta Networks International LLC, and Zymr, Inc.

By Component

By Vertical

By Organization size

By End Use

By Geography

The SDN Orchestration Market size is projected to reach USD 32.5 billion by 2028.

Increased Flexibility And Reliability are driving the market in coming years, however, Latency And Maintenance Issues restraints the growth of the market.

Cisco Systems, Inc., Hewlett-Packard enterprise company, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Nokia Corporation, Ciena Corporation, Juniper Networks, Inc., NEC Corporation, Qualitest Group, Anuta Networks International LLC, and Zymr, Inc.

The IT & Telecom segment acquired maximum revenue share in the Global SDN Orchestration Market by Vertical in 2021 thereby, achieving a market value of $11.6 billion by 2028.

The Cloud Service Providers segment is leading the Global SDN Orchestration Market by End Use in 2021 thereby, achieving a market value of $19.3 billion by 2028.

The North America market dominated the Global SDN Orchestration Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $12.5 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.