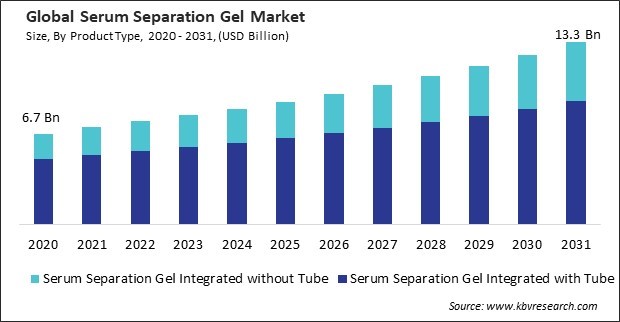

“Global Serum Separation Gel Market to reach a market value of USD 13.3 Billion by 2031 growing at a CAGR of 6.7%”

The Global Serum Separation Gel Market size is expected to reach $13.3 billion by 2031, rising at a market growth of 6.7% CAGR during the forecast period.

North America has a significant aging population, with a growing number of older adults experiencing age-related chronic conditions and comorbidities. There is an increasing emphasis on preventive healthcare and early disease detection in North America, driven by efforts to reduce healthcare costs, improve patient outcomes, and promote population health. Therefore, the North America region generated $2,756.6 million revenue in 2023. The region’s advanced healthcare system fosters the adoption of innovative medical technologies, including serum separation gel, to support diagnostic testing, biomedical research, and therapeutic development.

Higher healthcare spending improves access to advanced healthcare services, including diagnostic testing and specialized medical treatments. Serum separation gel is essential for obtaining serum samples used in diagnostic tests for various diseases and health conditions. Increased access to healthcare services drives the demand for serum separation gel products in clinical settings. Therefore, the market is expanding significantly due to the integration of healthcare expenditure.

Additionally, Veterinary medicine has seen significant advancements in recent years, including improved diagnostic technologies and treatment modalities. As veterinary practices adopt advanced diagnostic techniques such as immunoassays, molecular diagnostics, and point-of-care testing, the demand for high-quality serum samples obtained with serum separation gel increases. Serum separation gel ensures the integrity and stability of serum samples, enabling accurate and reliable test results in veterinary diagnostics. Thus, because of the expansion of veterinary diagnostics, the market is anticipated to increase significantly.

However, the high cost of serum separation gel products, including blood collection tubes containing the gel, can impose a significant financial burden on healthcare facilities, particularly in resource-limited settings or underfunded healthcare systems. Procuring serum separation gel products at high prices may strain budgets allocated for laboratory supplies, diagnostics, and healthcare services, limiting access to essential testing capabilities. Therefore, high-cost constraints are a significant challenge that hampers the growth of market.

Serological tests requiring serum samples experienced a notable upsurge in demand due to the aftermath of the pandemic. Serum separation gel is critical in blood collection tubes for obtaining high-quality serum samples for COVID-19 testing and other diagnostic assays. The heightened demand for diagnostic testing during the pandemic contributed to increased sales of serum separation gel. Thus, the COVID-19 pandemic had a positive impact on the serum separation gel market.

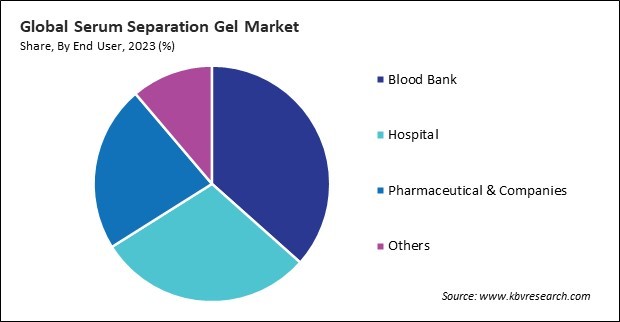

Based on end user, the market is classified into blood bank, hospital, pharmaceutical companies, and others. In 2023, the blood bank segment witnessed 36.6% revenue share in the market. Blood banks routinely perform various blood tests to ensure the safety and compatibility of donated blood products. Serum separation gel is used to obtain high-quality serum samples from donated whole blood, allowing for the screening of infectious diseases, blood typing, antibody testing, and other pre-transfusion testing procedures. The efficient separation of serum using serum separation gel ensures accurate and reliable test results, contributing to the safety of blood transfusions.

By product type, the market is categorized into serum separation gel integrated without tube and serum separation gel integrated with tube. The serum separation gel integrated without tube segment covered a 28.9% revenue share in the market in 2023. Serum separation gel is widely used in clinical laboratories for diagnostic testing. It enables the separation of serum from whole blood samples, allowing for the analysis of various biomarkers, enzymes, hormones, and other analytes in the serum.

Free Valuable Insights: Global Serum Separation Gel Market size to reach USD 13.3 billion by 2031

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific region acquired a 29.3% revenue share in the market. An increasing amount of people in the Asia Pacific region are suffering from chronic illnesses like diabetes, heart disease, and cancer. Urbanization, aging populations, and lifestyle changes are some of the causes contributing to this trend. The Asia Pacific region has a growing awareness of preventive healthcare and early disease detection.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 8 Billion |

| Market size forecast in 2031 | USD 13.3 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 6.7% from 2024 to 2031 |

| Number of Pages | 205 |

| Number of Tables | 260 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Product Type, End User, Region |

| Country scope |

|

| Companies Included | Becton, Dickinson, and Company, F. Hoffmann-La Roche Ltd., Abbott Laboratories, Agilent Technologies, Inc., Siemens Healthineers AG (Siemens AG), Bio-Rad Laboratories, Inc., Danaher Corporation, Sysmex Corporation, Charles River Laboratories International, Inc., QuidelOrtho Corporation |

By Product Type

By End User

By Geography

This Market size is expected to reach $13.3 billion by 2031.

Integration of Healthcare Expenditure are driving the Market in coming years, however, High-Cost Constraints of Serum Separation Gel restraints the growth of the Market.

Becton, Dickinson, and Company, F. Hoffmann-La Roche Ltd., Abbott Laboratories, Agilent Technologies, Inc., Siemens Healthineers AG (Siemens AG), Bio-Rad Laboratories, Inc., Danaher Corporation, Sysmex Corporation, Charles River Laboratories International, Inc., QuidelOrtho Corporation

The expected CAGR of this Market is 6.7% from 2024 to 2031.

The Serum Separation Gel Integrated with Tube segment is leading the Market by Product Type in 2023 thereby, achieving a market value of $9 billion by 2031.

The North America region dominated the Market by Region in 2023 and would continue to be a dominant market till 2031; thereby, achieving a market value of $4.3 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges