The Global Smart Buildings Market size is expected to reach $131.5 billion by 2027, rising at a market growth of 10.6% CAGR during the forecast period.

A smart building is a concept where the infrastructure, security systems, lighting, ventilation, heating, and air conditioning systems, among several other things, are all automated. A smart building employs technology to make it more efficient, sustainable, safe, and cost-effective. The IoT and connected sensor environment is growing, and smart building systems are crucial part of it.

Large housing complex are driving substantial implementations of the solution and services within residential area. Commercial architecture includes retail spaces, office spaces, and other commercial complexes, along with government structures. Moreover, industrial buildings are included as a part of commercial division.

The growing demand for lower energy consumption and the massive growth of energy usage led to the rising number of enterprise buildings that has forced the development of innovative techniques to reduce and optimize building energy usage. Because of the growing demand in energy conservation and savings, building energy management systems (BEMS) have grown in popularity. The energy needs of a building can be monitored and controlled using a building energy management system.

Smaller buildings require a system that can provide data on historical billing analysis, incentive availability, and educational, behavioral, and retrofit suggestions, whereas larger buildings require predictive analytics, advanced building, continuous optimization and building optimization, autoDR, demand response, automated building control, and enterprise integration. BEMS is crucial to addressing these requirements.

BEMS solutions for moderate buildings are also obtainable from companies. Provide Trouble ticket administration, retro and ongoing commissioning, Energy monitoring, NOC availability, maintenance, retrofit programmer proposals and AMI data analysis. Moreover, government initiatives such as the European Union's Energy Performance of Buildings Directive (EPBD) and the United States' Commercial Building Initiative (CBI) are urging governments and companies to increase their efforts to reduce energy consumption and greenhouse gas emissions at the community level.

The reopening of corporate buildings for in-office work following the pandemic is projected to increase the demand for smart technology that ensures a safe atmosphere. After a lockdown, commercial office facility managers and corporate tenants should provide a safe workplace. As a result, smart technologies are anticipated to be used to handle cleanings and sanitizing, proper workplace ventilation, temperature measurement devices, smart entrance control, and space management for complete distance. This will very certainly increase the market for smart building systems. Moreover, the smart technology could play an important role in the near future for monitoring staff activity as well as from avoiding virus spread. Intelligent technology can provide real-time data as it engages with systems and people.

With increased building efficiency, improved tenant connections, and additional revenue generation opportunities, the Internet of Things (IoT) has a massive effect on the Commercial Real Estate (CRE) market. BMS can manage all building management services using a single infrastructure with no manual intervention. Internet-of-things building management systems are used for various objectives, including maintaining and repairing building systems, lowering energy consumption, and reducing building administration costs. At the building level, property owners use data gathered from external sensors, such as indoor environmental quality and space use, to adjust air conditioning and heating. Real-time lighting system helps to conserve and improve the inside atmosphere for its intended function.

Smart buildings play a significant role in smart cities, even though the growth of smart buildings and smart cities are not mutually exclusive. Buildings with sensor networks can track sustainability initiatives, monitor power and water usage in live time, and connect with other smart city elements. Governments across the world are funneling millions into smart city projects, which would boost smart building adoption in different regions of the world. As a result, the expansion of the smart buildings market is projected to be supported by an increase in smart city efforts by various governments. During the COVID-19 pandemic, Transportation for Greater Manchester (TfGM) and Vivacity Labs introduced a range of AI-controlled smart traffic junctions in November 2020 to enhance safety and reduce congestion in the city.

With IoT and current smart building technologies to perform together, there appears to be a lot of interaction among standard enterprises, city governments, organizations, and other stakeholders. This collaboration in the development of smart cities is critical to realizing the full potential of these technologies. Property and tenant management, along with facility management, each has its range of requirements & operating systems. Since these technologies are often built to connect with other systems, accessing data from building systems can be problematic. On the other hand, the increasing cyberattack is a major hindrance to market expansion. Each building system and equipment is connected to intelligent technology.

Based on Component, the market is segmented into Solution and Services (Professional and Managed). The solutions segment acquired the largest revenue share in the Smart Buildings Market in 2020. RegTech solutions can help financial institutions automate anti-money laundering activities, streamline and automate KYC data collection methods, detect and analyze key rules and related changes over time, and more. These solutions assist businesses in meeting real-time regulations and compliance needs, improving customer experience, managing risk, and making appropriate recommendations. Using third-party RegTech services can help companies save money on regulatory compliance.

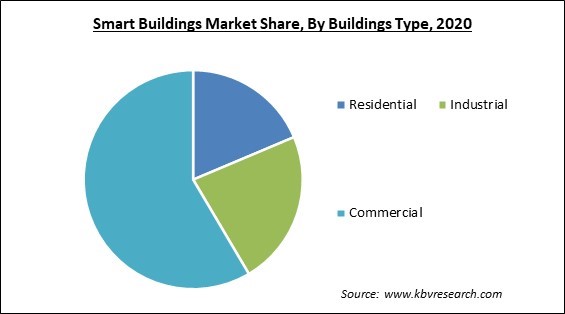

Based on Building Type, the market is segmented into Residential, Industrial, Commercial. The residential market registered a significant revenue share of the Smart Buildings Market in 2020. Increasing demands for the HVAC monitoring, smart door & locking system, along with smart meters, can propel the growth of the intelligent building demand in residential applications. Residential market is expected to witness rapid adoption of smart building technologies to control smart maintenance, energy consumption, safety and security, and other factors.

Based on Component, the market is segmented into Solution and Services. The solution segment is divided into Safety & Security Management (Access Control System, Video Surveillance System, Fire & Life Safety System), Building Infrastructure Management (Parking Management System, Smart Water Management System, Elevator & Escalator Management System), Energy Management (HVAC Control System and Lighting Management System), Network Management and Integrated Workplace Management System.

Safety & Security Management segment acquired the highest revenue share in the market in 2020. Advanced building operation services, security systems, surveillance systems, and smart workspace solutions are in high demand in commercial buildings. It's further divided into three categories: access control, video surveillance, and safety.

Based on Services Type, the market is segmented into Implementation, Consulting, and Support & Maintenance. Support services assist with the implementation of smart building solutions. Vendors give ongoing maintenance and support to upgrade solutions in order to improve smart building management and performance. After implementation, these suppliers conduct solution diagnoses on a regular basis to make tailored technological adjustments and process enhancements for performance optimization.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 69.5 Billion |

| Market size forecast in 2027 | USD 131.5 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 10.6% from 2021 to 2027 |

| Number of Pages | 414 |

| Number of Tables | 713 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Buildings Type, Component, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America dominated the smart buildings market by generating the largest revenue share in 2020. The United States and Canada are major contributors to regional technology development; since US organizations are making significant investments in smart building metrics including building system integration and building controls in order to leverage energy and system storage and deliver safer, smarter, and more sustainable buildings. Similarly, the Canadian government is working hard to assist the country's commitment to environmental and resource protection by rendering federal facilities more energy-efficient and lowering greenhouse gas emissions, resulting in the creation of smart buildings.

Free Valuable Insights: Global Smart Buildings Market size to reach USD 131.5 Billion by 2027

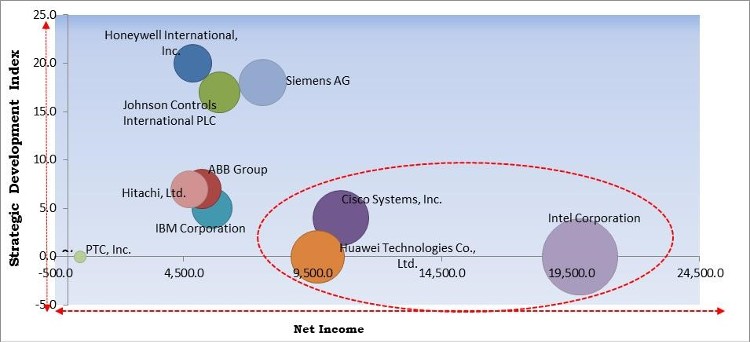

The major strategies followed by the market participants are Partnership. Based on the Analysis presented in the Cardinal matrix; Cisco Systems, Inc., Huawei Technologies Co., Ltd. and Intel Corporation are the forerunners in the Smart Buildings Market. Companies such as Honeywell International Inc., Siemens AG and Johnson Controls International PLC are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Cisco Systems, Inc., IBM Corporation, Honeywell International, Inc., ABB Group, Siemens AG, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Intel Corporation, Hitachi, Ltd., Johnson Controls International PLC, and PTC, Inc.

By Buildings Type

By Component

By Geography

The global smart buildings market size is expected to reach $131.5 billion by 2027.

Growing trends in Smart City projects are driving the market in coming years, however, absence of teamwork among the standard bodies along with the rising cyberattacks limited the growth of the market.

Cisco Systems, Inc., IBM Corporation, Honeywell International, Inc., ABB Group, Siemens AG, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Intel Corporation, Hitachi, Ltd., Johnson Controls International PLC, and PTC, Inc.

The expected CAGR of the smart buildings market is 10.6% from 2021 to 2027.

The Commercial segment acquired the maximum revenue share in the Global Smart Buildings Market by Buildings Type in 2020; thereby, achieving a market value of $75.8 billion by 2027.

The North America market dominated the Global Smart Buildings Market by Region in 2020, and would continue to be a dominant market till 2027; thereby, achieving a market value of $47.3 billion by 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.