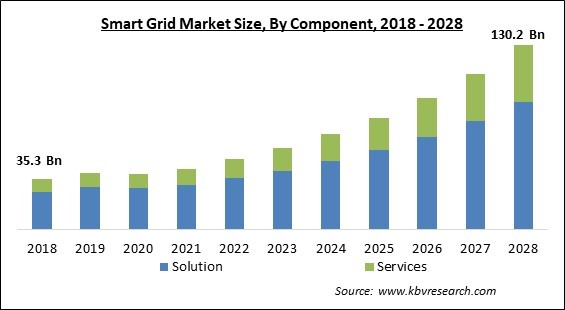

The Global Smart Grid Market size is expected to reach $130.2 billion by 2028, rising at a market growth of 17.4% CAGR during the forecast period.

Smart metering is sometimes seen as the first stage towards developing a smart grid, which is an electrical network or grid that enables a two-way flow of power and data. The expression "the grid" alludes to the electric grid, a system of transmission lines, substations, transformers, and other components that transports energy from a power plant to a building's interior. Similar to the Internet, the Smart Grid will be made up of interconnected controls, computers, automation, and new technologies; but, unlike the Internet, these technologies will be used in conjunction with the electrical grid to adapt digitally to rapidly fluctuating energy demand.

The Smart Grid has many advantages, including more effective energy transmission, quicker restoration of electricity during power outages, cheaper operations and administration expenses for utilities, and eventually lower electricity bills for consumers. Peak demand reduction will also aid in lowering power prices. Larger-scale renewable energy systems' integration, increased security and better customer-owner power generating system integration, particularly systems using renewable energy.

Smart grids transmit information together with power, providing the information we need to control our energy systems. The challenging task for grid operators is to use the information to guarantee that the total power supply and demand are balanced at all times. It calls for continual contact with very volatile energy markets while requesting that producers adjust their output to satisfy demand.

Several businesses and nations experienced economic challenges because of COVID-19. Due to the closure of industrial facility chains, the disruption of supply chain analysis, and the lack of sufficient funding among consumers, several projects have been severely interrupted. Hence, the COVID-19 results have also hindered the expansion of the worldwide smart grid market. Also, because of the worldwide shutdown, manufacturers of cutting-edge hardware components are having a number of problems completing orders on time. Delays in procuring raw materials and other components from suppliers, many of whom are based in China and other Southeast Asian nations, have also been identified as a major influence on the speed of the sector.

The smart grid industry grows as homes and businesses become more dependent on technological gadgets and power. Because it meets customer needs and supplies power when needed. Households, enterprises, communities, and workplaces require dependable and efficient power sources to minimise or eliminate blackouts. Hence, smart grid technologies increase problem detection and network self-healing. Sensors will enable fans to cool just occupied areas. Smart grid's integrated information and communication system is intended to help utilities better integrate and respond on huge amounts of data to improve system dependability, creating attractive smart grid market potential.

Smart grid activities globally will be driven by climate change and renewable energy development. Smart grid technology is also anticipated to assist countries meet carbon emission objectives and boost long-term economic growth. Several nations have net energy metering protocols and equipment, while some are currently studying the technology and its mechanism, which could provide attractive smart grid business potential. In 2021, U.S. electric utilities installed 111 million advanced (smart) metering infrastructure (AMI), 69% of all electric metres. 88% of AMI installations were domestic, and 69% of residential electric metres were AMI. Thus, the support from government drives the smart grid market.

Smart grids generate massive amounts of complicated data. Consumer data, utility use, transmission records, etc. Process it to acquire valuable insights. Smart grid solution suppliers struggle to store and manage data generated by network nodes. Unmanaged data may pose many hazards and make it hard to acquire insights. High-volume data centres and cost-effective analytical solutions are needed by the authorities. Utility companies have the most difficult problem of using previous data and consumption trends to anticipate equipment failure, natural catastrophes, and consumer behaviour.

Based on Component, the Smart Grid Market is divided into Solutions and Services. The Solution segment dominated the market with the largest revenue share in 2021. This area is growing due to lower power rates and the necessity to switch to clean and renewable energy sources. This market is also driven by security and data privacy concerns.

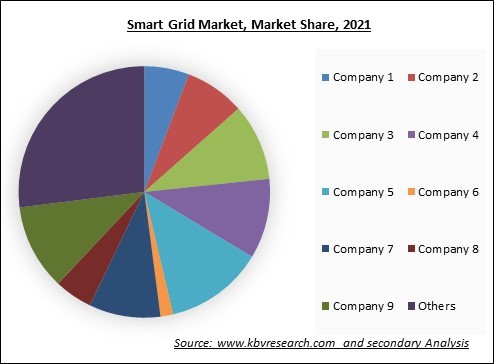

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Based on the solution type, the Smart Grid Market is divided into Smart Grid Distribution Management, Substation Automation, Smart Grid Network Management, Smart Grid Metering Infrastructure, Smart Grid Security, Smart Grid Communications, and Others. The Smart Grid Metering Infrastructure segment registered the substantial revenue share in the market in 2021. AMI reduces operating costs for utilities and improves consumer convenience. By remotely reading metres, connecting/disconnecting service, recognising outages, creating more accurate bills faster, and giving consumers digital access to their consumption information, AMI may drastically cut utility company operational expenses. Countries are investing in advanced metering infrastructure to update the electrical system and decrease T&D losses. This will fuel the AMI market throughout the projection.

Based on application, the Smart Grid Market is divided into Generation, Transmission, Distribution, and Consumption. Distribution segment procured the highest revenue share in the market in 2021. To prevent energy loss, power plants step down and connect to lower voltage distribution lines to feed customers. Substations, feeders, and transformers distribute power. Smart grids intelligently distribute.

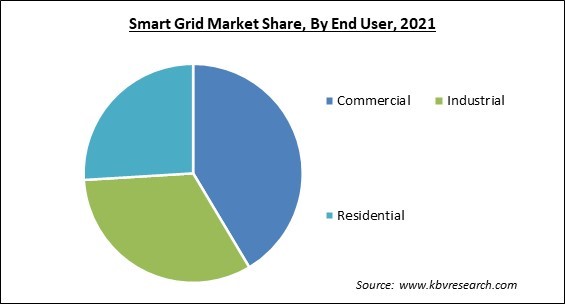

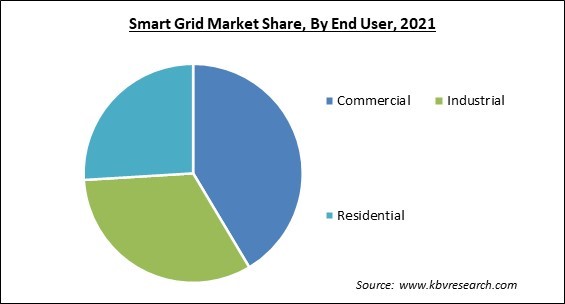

Based on end user, the Smart Grid Market is divided into residential, commercial, and industrial. The residential segment revenue acquired the prominent revenue share in the market in 2021. Smart grids automatically monitor energy flows and adapt to supply and demand. Smart grids with smart metering systems notify consumers and providers of real-time use. Hence, smart infrastructure and smart grids will rise with smart cities projects.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 42.9 Billion |

| Market size forecast in 2028 | USD 130.2 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 17.4% from 2022 to 2028 |

| Number of Pages | 303 |

| Number of Table | 482 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, End User, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on the region, the smart grid market is segmented into North America, Europe, Asia Pacific, and LAMEA. North America led the worldwide smart grid market in 2021. The US and Canadian governments focused more on creating smart grid regulatory frameworks. North America became a market leader in smart grid adoption due to the region's strong economy.

Free Valuable Insights: Global Smart Grid Market size to reach USD 130.2 Billion by 2028

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Cisco Systems Inc. is the forerunner in the Smart Grid Market. Companies such as Schneider Electric, Siemens AG, Oracle Corporation are some of the key innovators in Smart Grid Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include General Electric Company (GE Grid Solutions), Schneider Electric SE, Cisco Systems, Inc., IBM Corporation, Siemens AG, Wipro Limited, Honeywell International, Inc., Oracle Corporation, ABB Group, and Itron, Inc.

By Component

By End User

By Application

By Geography

The global Smart Grid Market size is expected to reach $130.2 billion by 2028.

Supporting Government Regulations are driving the market in coming years, however, Storage and administration of complicated smart grid data restraints the growth of the market.

General Electric Company (GE Grid Solutions), Schneider Electric SE, Cisco Systems, Inc., IBM Corporation, Siemens AG, Wipro Limited, Honeywell International, Inc., Oracle Corporation, ABB Group, and Itron, Inc.

The expected CAGR of the Smart Grid Market is 17.4% from 2022 to 2028.

The Services market has shown the high growth rate of 20% during (2022 - 2028).

The North America market dominated the Global Smart Grid Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $44.1 billion by 2028,.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.