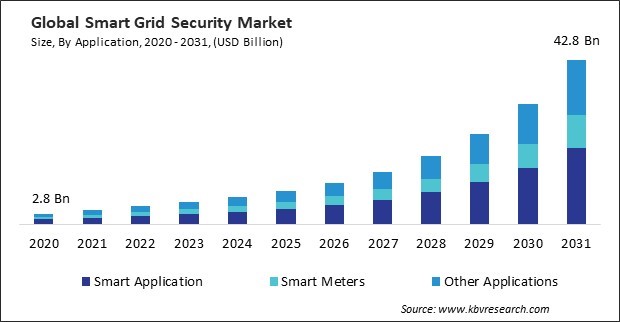

“Global Smart Grid Security Market to reach a market value of 42.8 Billion by 2031 growing at a CAGR of 29.1%”

The Global Smart Grid Security Market size is expected to reach $42.8 billion by 2031, rising at a market growth of 29.1% CAGR during the forecast period.

The Government’s "Smart Grid 2030" strategy aims to integrate smart technologies across its energy grid to enhance efficiency and sustainability. In response to rising cybersecurity concerns, the South Korean Government has introduced new guidelines for protecting critical energy infrastructure, ensuring that smart grid technologies are secure. With an emphasis on building a resilient and secure grid, South Korea is investing heavily in smart grid technologies and the necessary security frameworks to support their deployment. Thus, the Asia Pacific region acquired 27% revenue share in the market 2023.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In May, 2024, Honeywell announced the partnership with Weatherford, a leading global energy service, to create an advanced emissions management solution for the energy sector. This partnership aims to combine Honeywell's emissions management suite with Weatherford's Cygnet SCADA platform, enabling effective monitoring, reporting, and reduction of greenhouse gas emissions and other hazardous gases.

Additionally, In December, 2023, Schneider Electric teamed up with Hailo Technologies, a supplier of artificial intelligence (AI) chip technology, to merge Hailo’s Hailo-8 AI processors into Schneider's devices. This collaboration would enhance industrial automation systems by using Hailo's low-power, high-accuracy processors for real-time data analysis at the edge, boosting system intelligence and efficiency.

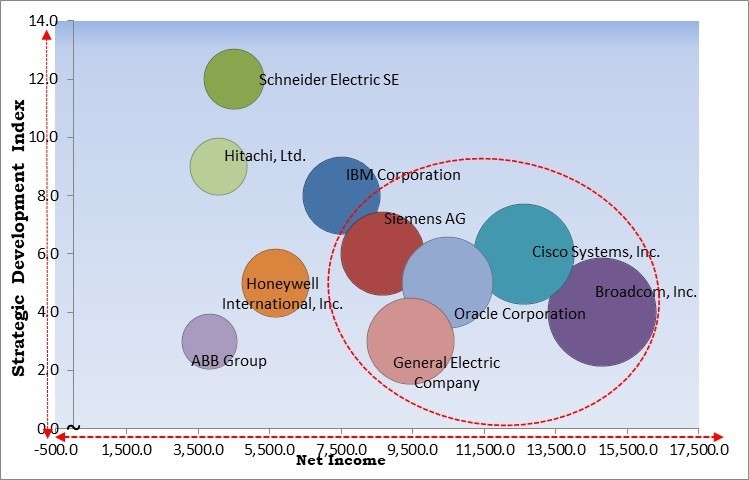

Based on the Analysis presented in the KBV Cardinal matrix; Broadcom, Inc., Cisco Systems, Inc., Oracle Corporation, General Electric Company and Siemens AG are the forerunners in the Smart Grid Security Market. In June, 2024, Cisco Systems, Inc. announced a partnership with WALLIX, an access management solutions provider, to enhance industrial cybersecurity, integrating WALLIX’s PAM4OT OT. Security and Cisco Cyber Vision solutions. This partnership provides centralized, secure access management for OT environments, ensuring compliance and asset protection. Companies such as IBM Corporation, Schneider Electric SE and Honeywell International, Inc. are some of the key innovators in Smart Grid Security Market.

Though the attack was thwarted, it highlighted the potential risks smart grid systems face as they integrate more connected devices. This incident underscored Israel's need to strengthen its cybersecurity frameworks around critical infrastructure, leading to increased investments in securing its smart grids against potential future threats.

Additionally, the Government’s “Cyber Defense Methodologies for Energy Infrastructure” mandates proactive monitoring, threat intelligence sharing, and real-time incident response capabilities. Therefore, these regulatory frameworks worldwide compel energy providers to adopt rigorous security measures, thus driving the demand for advanced smart grid security solutions.

Securing each of these connected devices with proper encryption, authentication, and threat-detection capabilities is both resource-intensive and expensive. Utility companies must often deploy cybersecurity measures across thousands of devices, requiring significant capital investment. Hence, high implementation costs remain a key factor impeding the rapid growth of smart grid security solutions.

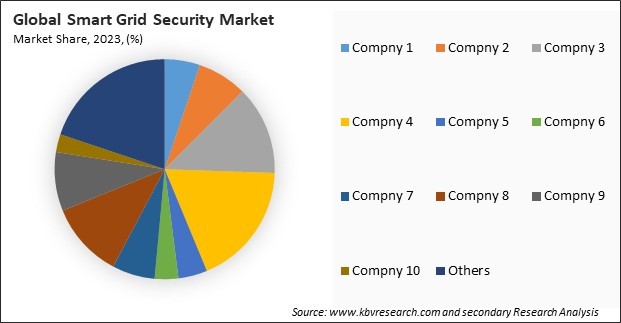

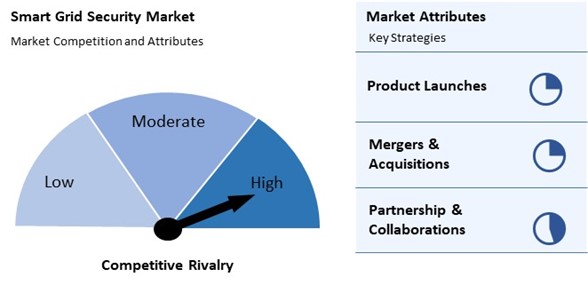

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are and Partnerships & Collaborations.

By application, the market is divided into smart meters, smart application, and others. The smart application segment garnered 48% revenue share in the market in 2023. Smart applications include software platforms that manage various grid operations, such as energy distribution, demand response, and grid automation.

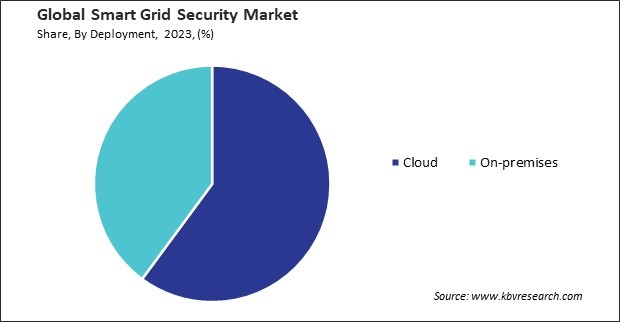

Based on deployment, the market is segmented into cloud and on-premises. The on-premises segment acquired 40% revenue share in the market in 2023. On-premises deployments provide utilities with direct oversight of their cybersecurity systems, allowing them to tailor their infrastructure to meet specific regulatory requirements or operational needs.

On the basis of enterprise size, the market is segmented into large enterprises and SMEs. The SMEs segment procured 33% revenue share in the market in 2023. Many SMEs are adopting smart grid solutions to optimize their operations and improve energy efficiency. However, this digitalization also exposes them to cyber risks, which encourages these companies to invest in scalable and affordable security solutions.

On the basis of services, the market is bifurcated into professional services and managed services. The professional services segment acquired 63% revenue share in the market in 2023. This segment includes services like consulting, implementation, integration, and training provided by experts who assist utility companies in designing and deploying robust security solutions for their smart grid infrastructure.

Free Valuable Insights: Global Smart Grid Security Market size to reach USD 42.8 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 36% revenue share in the market in 2023. This dominance can be attributed to the advanced healthcare infrastructure, high adoption rate of new technologies, and significant investments in healthcare IT solutions in North America. The presence of major market players and the growing demand for efficient and integrated healthcare systems further drive the revenue share in this region.

The Market is characterized by intense competition among various players, driven by the increasing need for cybersecurity solutions in energy infrastructure. Key attributes influencing the market include the integration of advanced technologies like AI and machine learning for threat detection, regulatory compliance, and the demand for real-time monitoring systems. Additionally, the rise in cyber threats and the need for resilience against attacks are prompting investments in security solutions, fostering innovation and collaboration within the industry.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 6 Billion |

| Market size forecast in 2031 | USD 42.8 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 29.1% from 2024 to 2031 |

| Number of Pages | 320 |

| Tables | 513 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Services, Deployment, Application, Enterprise Size, Security Type, Region |

| Country scope |

|

| Companies Included | Broadcom, Inc., Cisco Systems, Inc., IBM Corporation, Siemens AG, Oracle Corporation, Honeywell International, Inc., ABB Group, General Electric Company, Schneider Electric SE and Hitachi, Ltd. |

By Services

By Deployment

By Application

By Enterprise Size

By Security Type

By Geography

This Market size is expected to reach $42.8 billion by 2031.

Rising cybersecurity threats across the world are driving the Market in coming years, however, High implementation costs of smart grids restraints the growth of the Market.

Broadcom, Inc., Cisco Systems, Inc., IBM Corporation, Siemens AG, Oracle Corporation, Honeywell International, Inc., ABB Group, General Electric Company, Schneider Electric SE and Hitachi, Ltd.

The expected CAGR of this Market is 29.1% from 2024 to 2031.

The Cloud market is leading the Market by Deployment in 2023, thereby, achieving a market value of $26.4 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $14.9 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges