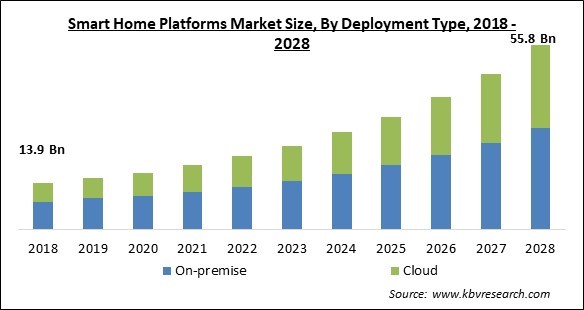

The Global Smart Home Platforms Market size is expected to reach $55.8 billion by 2028, rising at a market growth of 16.6% CAGR during the forecast period.

Smart home platforms, also known as the Internet of Things (IoT) platforms for smart homes, are software applications that link to connected or smart devices and may communicate with them as well as respond to commands, instructions, or events. The primary goal of smart home platforms is to bring all smart devices together as one by ensuring interoperability and regulating them. They not only store and analyze data, but they also handle such smart devices and assure the security of the information they acquire. The usage of a smart home platform simplifies activities involving smart devices in the smart home and aids in user satisfaction.

Any collection of devices, appliances, or systems that link to a common network and can be handled independently and remotely is referred to as smart home technology. A connected home is one in which the house's technology is combined into a single system. The thermostat, audio speakers, lighting, TVs, security cameras, locks, appliances, and more are all integrated into a unified system that can be controlled via a phone or a mobile touch screen device.

A physical hardware unit is the most common and powerful sort of hub. They act as a central communicator, connecting all of the different gadgets to form a single smart home. Each hardware hub comes with its own software that lets users operate many components from a single interface. The hardware hub also keeps the devices connected to the internet so users can monitor and tweak them while the individual is gone. Hardware hubs are equipped with communication radios that allow them to communicate with various devices. If the user is serious about putting together a smart home, the hardware hub is the way to go. If the user is just getting started, software hubs or individual components are a good place to start.

The government's approach has been focused on reducing the impact on people's health, lives, and economies. Technology adoption has been critical in smart cities and around the world in enabling better service delivery and increasing inhabitants' quality of life. The COVID-19 pandemic had a beneficial impact on the industry because these platforms are frequently used by healthcare professionals as well as family members of people who have SARS-CoV-2 to monitor and care for the patient remotely. As investments are made in the development and integration of tools and technology in these platforms that can deliver healthcare solutions centred on voice recognition, a variety of opportunities have arisen for smart home platforms.

The demand of smart home platform is majorly boosted by the reason that it provides better convenience to the consumer, in respect of smart facilities it provides. The ability to integrate all of the house's equipment through a single interface is a huge step forward for technology and home management. In theory, all an individual need to understand, is how to use one app on the smartphone or tablet to access a plethora of functions and gadgets across the home. This reduces the learning curve for new users and makes it simpler to get the features user want for the home. When it comes to accommodating new devices, appliances, and other technology, smart home systems are remarkably adaptable.

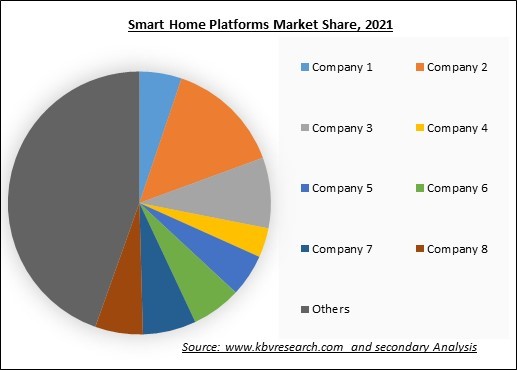

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches.

Home security can arise when the user includes security and surveillance capabilities in the smart home network. There are a lot of alternatives here, but just a few dozen are being investigated right now. House automation systems, for instance, can interconnect motion detectors, surveillance cameras, automated door locks, and other tangible security measures across the home so that users can control them all from a single mobile device before going to bed. A user can also select to receive security warnings on the various devices at different times of the day, and one can watch actions in real-time whether an individual is at home or midway around the world.

An attacker breaks into two systems' communications, interrupts them or spoofs them. Likewise, during a heat wave, an attacker can stop vulnerable HVAC systems, resulting in a disaster for service providers using impacted models. Data generated by unsecured wearable and smart appliances provide cyber attackers with a wealth of specific personal information that can be used for identity theft and fraudulent activities. An attacker takes over control of a device by hijacking it. This is because the attacker does not alter the device's essential functionality, these attacks are difficult to detect. Moreover, one gadget has the potential to infect all smart devices in the home.

Based on Deployment Type, the market is segmented into On-premise and Cloud. The On-premise segment acquired the highest revenue share in the smart home platforms market in 2021. As it will give users with an internal network that can be accessed at any time, regardless of whether or not users have access to the internet. Another reason is lower monthly internet costs that means if the residence does not depend on the internet or cloud-based services, the user may not require to pay for such a fast connection.

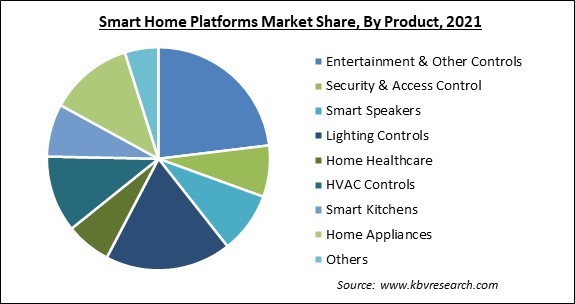

Based on Product, the market is segmented into Entertainment & Other Controls, Security & Access Control, Smart Speakers, Lighting Controls, Home Healthcare, HVAC Controls, Smart Kitchens, Home Appliances, and Others. The Security & Access Control segment garnered a significant revenue share in the smart home platforms market in 2021. Entry to information and information processing systems is restricted by security access controls. When properly implemented, they reduce the chance of information being accessed without proper authorization, as well as the possibility of a home invasion.

Based on Type, the market is segmented into IoT Platform for Smart Appliances, IoT Platform for Security & Surveillance Systems, and IoT Platform for Control & Connectivity Devices. The IoT platform for smart appliances witnessed the highest revenue share in the smart home platforms market in 2021. The IoT platform for smart appliances establishes a link between the platform and the smart appliances, allowing the user to control and accomplish the necessary task. Moreover, consumers are on the lookout for solutions that will assist in the efficient management of energy, therefore the platforms for smart appliances are in great demand and generate significant revenue.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 19.4 Billion |

| Market size forecast in 2028 | USD 55.8 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 16.6% from 2022 to 2028 |

| Number of Pages | 292 |

| Number of Tables | 403 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Market Share Analysis, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Deployment Type, Product, Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America garnered a substantial revenue share in the smart home platform market in 2021. The massive adoption of smart home platforms to access and operate smart home systems is driving market expansion in the region. The United States is the largest country in this area, contributing significantly to the market's revenue generation.

Free Valuable Insights: Global Smart Home Platforms Market size to reach USD 55.8 Billion by 2028

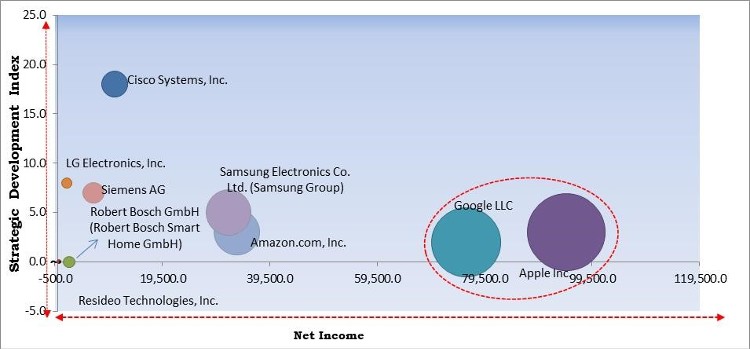

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Apple, Inc. and Google LLC are the forerunners in the Smart Home Platforms Market. Companies such as Amazon.com, Inc. Samsung Electronics Co., Ltd., Cisco Systems, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Apple Inc., Google LLC, Cisco Systems, Inc., Resideo Technologies, Inc., Amazon.com, Inc., LG Electronics, Inc., Samsung Electronics Co. Ltd. (Samsung Group), Siemens AG, Robert Bosch GmbH (Robert Bosch Smart Home GmbH), and General Electric Company.

By Deployment Type

By Product

By Type

By Geography

The smart home platforms market size is projected to reach USD 55.8 billion by 2028.

All home gadgets can easily be managed in one spot, new devices, and appliances are driving the market in coming years, however, Increasing cases of data and identity theft limited the growth of the market.

Apple Inc., Google LLC, Cisco Systems, Inc., Resideo Technologies, Inc., Amazon.com, Inc., LG Electronics, Inc., Samsung Electronics Co. Ltd. (Samsung Group), Siemens AG, Robert Bosch GmbH (Robert Bosch Smart Home GmbH), and General Electric Company.

The expected CAGR of the smart home platforms market is 16.6% from 2022 to 2028.

The Entertainment & Other Controls segment acquired maximum revenue share in the Global Smart Home Platforms Market by Product in 2021, thereby, achieving a market value of $11.2 Billion by 2028.

The Asia Pacific market dominated the Global Smart Home Platforms Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $19,859.5 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.