The Global Smart Hospitality Market size is expected to reach $58.3 billion by 2028, rising at a market growth of 28.4% CAGR during the forecast period.

Smart hospitality is a new technology, which is utilized in hotels and other accommodation locations to use internet-connected equipment that can interact or communicate with each other. It is similar to the internet of things, or IoT, which allows extremely common appliances or equipment in hotels to send and receive data and make intelligent decisions. Benefits of smart hospitality technologies include improved guest safety with alarming and mobilization, high-speed Wi-Fi, guest voicemail & wake-up, operator & visitor reservation solutions, increased staff mobility, and operator & guest voicemail & wake-up.

One of the major forces behind the expansion of India's services sector is the tourism and hospitality sector. Given the country's extensive natural beauty, diverse environment, and rich cultural as well as historical legacy, tourism in India has a lot of promise. India, like many other countries, depends heavily on tourism for its foreign exchange. According to the Indian Brand Equity Foundation, foreign exchange earnings increased at a CAGR of 7% from 2016 to 2019 but declined in 2020 as a result of the COVID-19 pandemic.

Additionally, by knowing that a Facebook user lists their marital status, Google can more precisely tailor advertisements for that user on its search engine. In order to make hotel visitors feel satisfied and special, this specific data can also be used to offer them a service that is personalized to their needs. An IoT platform may remember a visitor's varied comfort preferences and then automatically set the room's lighting, temperature, window coverings, and TV channels for their subsequent stay. To make the visitor feel unique, the TV may even welcome and greet them by name when they enter the room.

The poor economic effects from COVID-19 have compelled several individuals to adopt a work-from-home lifestyle. Government-imposed lockdowns forced businesses operating in the hospitality sector, including those working in hotels, resorts, restaurants, spas, and casinos, to temporarily shut down their operations. For a brief period of time, travel and tourism restrictions prompted the hospitality industry to close its doors. In addition, international arrivals decreased by a significant rate due to travel restrictions. As a result, the hospitality industry has seen a loss in revenue and numerous hotels, fast-food restaurants, and spas have closed permanently.

With new digital tools and platforms, hotel owners are continually looking for methods to streamline the guest experience. Operators may be able to completely transform their offers with cutting-edge in-room and cross-facility services due to 5G. Through the provision of the fundamental framework for tying together wireless devices, applications, and people, 5G has the ability to propel digital transformation in the hospitality sector. Hotel owners should be able to communicate with their customers more effectively and learn more about their journeys owing to 5G technology.

Hoteliers can create a long-lasting, value-driven connection with every guest and increase the likelihood that they will leave a good review by providing a more individualized travel experience. Organizing a unique visitor experience boosts brand reputation and customer loyalty in addition to generating income. New smart hospitality solutions give hoteliers access to data-backed insights and behavior that can be used to create a 360-degree perspective of every visitor and improve their experience through better customer care.

The deployment of complex and advanced hospitality systems, like Property Management Systems (PMS), Guest Experience Management Systems, etc. is expensive, whether they are installed physically or online. Budget restrictions can make it difficult for any hotel to install a smart hospitality solution because the hospitality industry is still recovering from a pandemic-related financial loss of enormous proportions. The majority of hotels that used smart hospitality technologies found that maintaining them was also very expensive. The cost of deployment is primarily based on the complexities and advancements of the system or service.

On the basis of Offering, the Smart Hospitality Market is segmented into Solution and Services. In 2021, the services segment acquired a significant revenue share of the smart hospitality market. The expansion of smart hospitality services in the market is being driven by the increase in the number of smart hotels, which is fueling services and software used for integration, management, and training.

Based on Solution Type, the market is segmented into Property Management System, Guest Experience Management System, Integrated Security Management, Facility Management Software, Network Management Software, and Point of Sale Software. In the solution segment, the Guest Experience Management Systems segment recorded a substantial revenue share of the market. The adoption of smart hospitality solutions will be driven by the rising demand to optimize customer service operations and build a strong brand. Moreover, nowadays, the major focus of hotels along with other hospitality facilities is to enhance their customer experience.

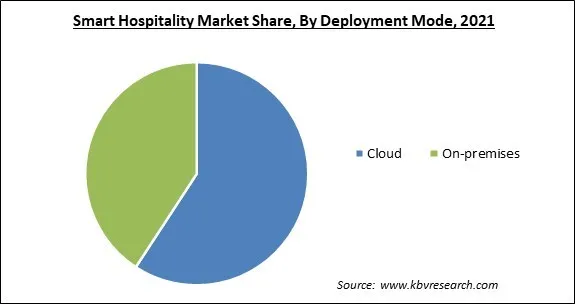

Based on Deployment Mode, the Smart Hospitality Market is bifurcated into Cloud and On-premises. In 2021, the cloud segment procured the biggest revenue share of the smart hospitality market. Modern hotels are deploying cloud-based solutions that are adaptable to the shifting business and market dynamics. The market would be driven by the demand for a better guest experience, improved cost optimization, as well as universal access to hoteliers from any remote place. Moreover, the cloud is one of the safest and most secure online storage for data and information related to the privacy of the consumer.

By End-User, the Smart Hospitality Market is segregated into Hotel, Cruise, Luxury Yatches, and Others. In 2021, the hotels segment witnessed the highest revenue share of the smart hospitality market. The growth of the segment is being driven by the demand to create smart guest experiences through smart hospitality services and solutions in the hotels. The market will also be driven by the rising level of living, the abundance of five-star hotels, and a substantial improvement in guest service.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 11.6 Billion |

| Market size forecast in 2028 | USD 58.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 28.4% from 2022 to 2028 |

| Number of Pages | 292 |

| Number of Tables | 463 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Offering, Deployment Mode, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the Smart Hospitality Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Europe accounted for the largest revenue share of the smart hospitality market. The presence of a major domestic cloud provider, openness to new technology, and relatively robust internet infrastructure have all helped the smart hospitality business in expanding. The demand for Internet of Things (IoT) products is rising across Europe. Leading European IoT adoption includes the countries of Germany, France, Italy, the United Kingdom, Spain, and the Netherlands.

Free Valuable Insights: Global Smart Hospitality Market size to reach USD 58.3 Billion by 2028

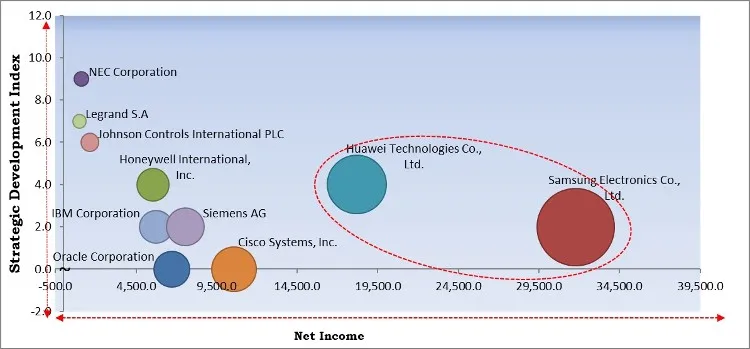

The major strategies followed by the market participants are Partnership. Based on the Analysis presented in the Cardinal matrix; Huawei Technologies Co., Ltd. and Samsung Electronics Co., Ltd. is the forerunners in the Smart Hospitality Market. Companies such as NEC Corporation, Honeywell International, Inc., and Johnson Controls International PLC are some of the key innovators in Smart Hospitality Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include NEC Corporation, Huawei Technologies Co., Ltd., Oracle Corporation, Samsung Electronics Co., Ltd., IBM Corporation, Cisco Systems, Inc., Siemens AG, Johnson Controls International PLC, Honeywell International, Inc. and Legrand S.A.

By Offering

By Deployment Mode

By End User

By Geography

The global Smart Hospitality Market size is expected to reach $58.3 billion by 2028.

Rising penetration of 5G in the hospitality sector are driving the market in coming years, however, High cost of deployment, maintenance, and training restraints the growth of the market.

NEC Corporation, Huawei Technologies Co., Ltd., Oracle Corporation, Samsung Electronics Co., Ltd., IBM Corporation, Cisco Systems, Inc., Siemens AG, Johnson Controls International PLC, Honeywell International, Inc. and Legrand S.A.

The Solution market acquired the maximum share in the Global Smart Hospitality Market by Offering in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $35.9 billion by 2028.

The Cruise market has high growth rate of 30.4% during (2022 - 2028).

The Europe market dominated the Global Smart Hospitality Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $20 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.