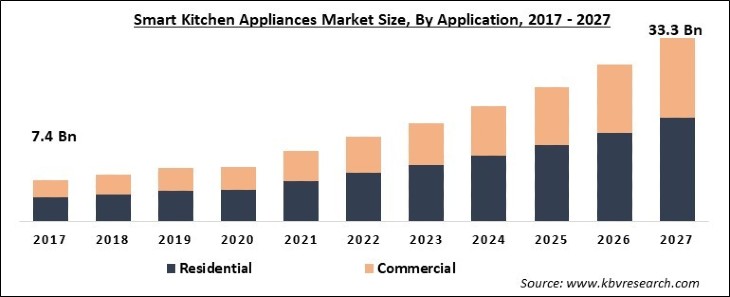

The Global Smart Kitchen Appliances Market size is expected to reach $33.3 billion by 2027, rising at a market growth of 17.3% CAGR during the forecast period. Smart kitchen appliances are manufactured by integrating smart technologies like AI into traditional kitchen appliances. These appliances are developed to improve efficiency, provide more comfort and streamline kitchen tasks. Though, smart kitchen appliances are expensive but they offer a wide range of features and benefits to help a customer in their daily kitchen tasks. By using these appliances, customers can minimize their time in the kitchen and get better outputs along with saving energy.

The smart kitchen appliances market is witnessing a surge in demand due to the shift in living standards and rising interest of the consumers in smart & connected home appliances. In addition, the growing demand for energy-efficient appliances with user-friendly interfaces would also contribute to the growth and demand for smart kitchen appliances in the market. There is increasing popularity of antimicrobial hardware like brasses, coppers, and bronze. The usage of copper-based materials can help in restricting the transmission of viruses and bacteria.

Customers are increasingly demanding the latest smart kitchen appliances due to their features like eco-friendly, energy-efficient, and customer-friendly interface. In addition, the increasing disposable income and rising purchasing power are enabling customers to spend more on these high-end smart kitchen appliances, thereby boosting the growth of the market.

The outbreak of the COVID-19 pandemic has impacted various business verticals including the smart kitchen appliance market. During the initial phase of the pandemic, the sales smart kitchen appliances market has witnessed a decline due to the imposition of various regulations like complete or partial lockdown, travel ban, and the temporary shutdown of manufacturing units. However, at later stages, the smart kitchen appliances market has recorded a surge in demand because most of the people were doing work-from-home and thus, investing more time on making their kitchen smarter and better.

In order to provide smart features to users, there is a need to connect the internet to Smart kitchen appliances. The advanced features and functionalities of these smart kitchen appliances need the support of an internet connection in order to work properly. In the past few years, internet connectivity was a challenge across different regions of the world that had hampered the demand for smart kitchen appliances. Though, the situation has significantly changed with the increasing penetration of the internet.

Smart kitchen appliances are increasingly incorporating various advanced technologies, which are making them more popular across developed and developing nations. In addition, the cost-effectiveness of these smart kitchen appliances is attracting more customers towards its adoption and hence, surging the overall growth of the market. By using smart kitchen appliances, consumers can save fuel, which would reduce the overall environmental impact.

Smartphone and internet users are more prone to misuse that could happen in case personal details like name, home address, date of birth, email address, and credit card credentials are shared and viewed. In addition, smart appliances are majorly managed by the development of the company’s smartphone applications, wherein consumer information is gathered by enterprises via these applications that would further increase the apprehensions among customers related to the privacy of their data.

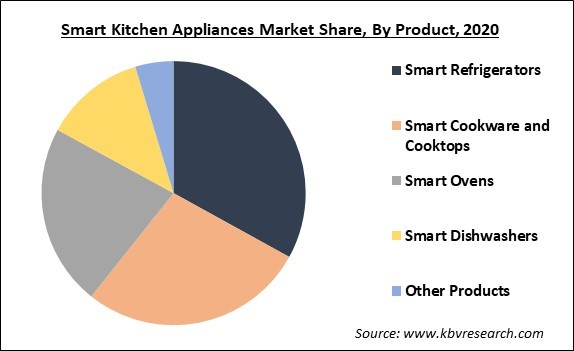

Based on Product, the market is segmented into Smart Refrigerators, Smart Cookware and Cooktops, Smart Ovens, Smart Dishwashers, and Other Products. The smart refrigerators are among the most popular smart kitchen appliances that have amazing features. With these smart refrigerators, customers can look at things inside their refrigerators with their smartphones, which is possible due to technological advancements. In addition, these refrigerators also utilize the integrated touchscreen to modify the temperature, utilize the water dispenser, and many more.

Based on Applications, the market is segmented into Residential and Commercial. The growing travel and tourism sector is creating interest among the customers for trying out different cuisines in cooking, which would contribute to the growth of the smart kitchen appliances market over the forecast period. Several kitchen appliances like refrigerators and ovens could be managed remotely by utilizing voice-activated speakers and smartphone interfaces.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 9.9 Billion |

| Market size forecast in 2027 | USD 33.3 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 17.3% from 2021 to 2027 |

| Number of Pages | 179 |

| Number of Tables | 273 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling, Competitive Landscape |

| Segments covered | Product, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America emerged as the leading region in the market in 2020 by acquiring the highest market share. Factors such as the shifting consumer preferences, expanding the number of smart grid projects, and rising spending power of the customer are responsible for the growth of the regional market. The increasing government incentives for the usage of the energy-efficient appliance are also estimated to propel the growth of the regional market.

Free Valuable Insights: Global Smart Kitchen Appliances Market size to reach USD 33.3 Billion by 2027

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Samsung Electronics Co. Ltd. is the forerunners in the Smart Kitchen Appliances Market. Companies such as Panasonic Corporation, LG Electronics, Koninklijke Philips N.V. are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include BSH Hausgeräte GmbH, Whirlpool Corporation, Miele & Cie. KG, LG Electronics, Inc., Samsung Electronics Co., Ltd. (Samsung Group), Panasonic Corporation, Koninklijke Philips N.V., GE Appliances, a Haier Company, Electrolux AB, and Daewoo Electronics Corporation.

By Product

By Application

By Geography

The global smart kitchen appliances market size is expected to reach $33.3 billion by 2027.

Growing penetration of smartphones and internet are driving the market in coming years, however, Increasing concerns regarding data privacy among customers have limited the growth of the market.

BSH Hausgeräte GmbH, Whirlpool Corporation, Miele & Cie. KG, LG Electronics, Inc., Samsung Electronics Co., Ltd. (Samsung Group), Panasonic Corporation, Koninklijke Philips N.V., GE Appliances, a Haier Company, Electrolux AB, and Daewoo Electronics Corporation

The expected CAGR of the smart kitchen appliances market is 17.3% from 2021 to 2027.

Smart refrigerators accounted for the largest share of the smart kitchen appliances market in 2020.

The North America market dominated the Global Smart Kitchen Appliances Market by Region in 2020. The Europe market is experiencing a CAGR of 16.9% during (2021 - 2027).

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.