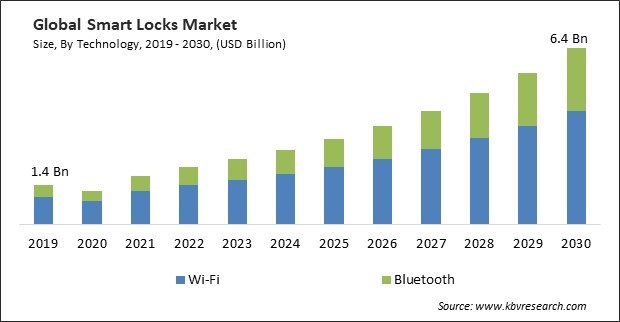

The Global Smart Locks Market size is expected to reach $6.4 billion by 2030, rising at a market growth of 15.2% CAGR during the forecast period. In the year 2022, the market attained a volume of 11,321.2 thousand Units experiencing a growth of 15.1% (2019-2022).

Smart locks integrating with broader smart home ecosystems allow users to create holistic home automation experiences. The versatility of Wi-Fi connectivity enhances the overall user experience, allowing for seamless integration with smart home ecosystems and voice-activated assistants. Consequently, the Wi-Fi segment would account for nearly 60 percent of the total market share by 2030. These locks become part of a comprehensive and interconnected home automation system by connecting with devices such as security cameras, doorbell cameras, lights, thermostats, and voice-activated assistants. Integration with smart home ecosystems enables centralized control through dedicated platforms or mobile apps. Integration with smart home ecosystems have been a pivotal factor in driving the growth of the market.

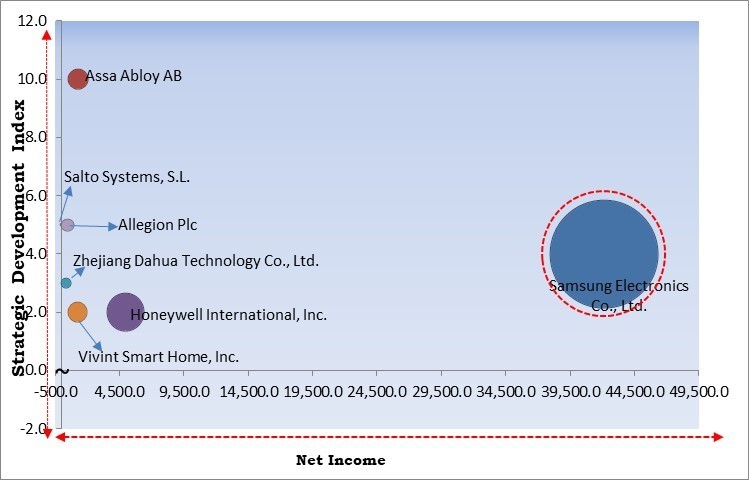

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, in November, 2023, Assa Abloy AB partnered with Aliro, to develop new protocols for improving interoperability between access control readers and different devices. The partnership would deliver a better mobile access experience at the door or place of entry to the customers. Moreover, in May, 2021, Allegion Plc announced a partnership with Hombase, LLC. Under the partnership, Allegion would provide hardware for Homebase’s smart access control solution. The partnership would lead to the creation of industry-leading home security solutions for multifamily residences.

Based on the Analysis presented in the KBV Cardinal matrix; Samsung Electronics Co., Ltd. is the forerunner in the Market. In December, 2022, Samsung Electronics Co., Ltd. teamed up with Zigbang, a Korean real estate services provider. Under the collaboration, the two companies would unveil the SHP-R80 UWB digital key door lock featuring an ultra-wideband chip. Companies such as Honeywell International, Inc., Assa Abloy AB and Vivint Smart Home, Inc. are some of the key innovators in the Market.

Urbanization trends and shifting toward modern lifestyles drive the demand for innovative and technologically advanced solutions. These locks cater to the needs of urban dwellers who seek secure, connected, and convenient access control for their homes and businesses. Urban centers are hubs for technological innovation and early technology adoption. The tech-savvy urban population is more likely to embrace smart home solutions, including these locks, as part of their modern lifestyle. Modern urban living trends include communal living spaces and co-living arrangements. These locks offer flexible access control solutions, allowing residents to manage access permissions for shared spaces and individual living units. The market is expanding significantly due to the expansion of urbanization and modern lifestyles.

Growing awareness and education about the benefits of smart home technologies play a crucial role. Consumers are becoming more informed about the features, installation processes, and potential advantages of these locks, leading to greater adoption. Online platforms that host consumer reviews and testimonials contribute to awareness. Credibility and trust are enhanced through the positive feedback of users who have experienced firsthand the advantages of these locks; these influences other to consider the adoption of such technologies. As a result of the increasing awareness and education, the market is anticipated to increase significantly.

The installation of these locks can be more complex than traditional locks, requiring technical know-how. Consumers uncomfortable with technology or DIY installations may find the process daunting, impacting the adoption rate, especially among older demographics. Complexity increases the likelihood of installation errors, which can compromise the effectiveness and security of smart lock systems. If users struggle to install the devices correctly, it may result in malfunctions, security vulnerabilities, or the need for additional support, negatively impacting the user experience. Thus, complex installation processes can slow down the growth of the market.

Based on technology, the market is classified into Bluetooth and Wi-Fi. The Bluetooth segment acquired a substantial revenue share in the market in 2022. Wi-Fi-Bluetooth provides seamless connectivity between these locks and various devices, primarily smartphones and tablets. The seamless connectivity significantly improves the user experience, which enables homeowners to operate and monitor their locks effortlessly. The simplicity of pairing and maintaining a connection contributes to the growing adoption of Bluetooth-enabled locks. Bluetooth-enabled locks often come with dedicated mobile applications that enable users to manage their locks remotely. The integration of Bluetooth technology enhances the functionality of these mobile apps, contributing to the overall appeal of smart lock systems.

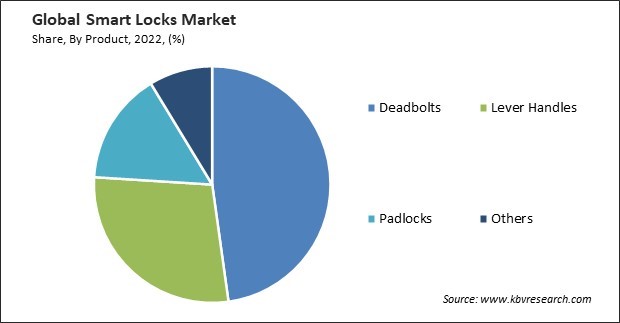

On the basis of product, the market is divided into deadbolts, lever handles, padlocks, and others. The lever handles segment recorded a remarkable revenue share in the market in 2022. The progress in the lever handles segment involves integrating smart lock technology without compromising design and functionality. Smart lever handles offer dual functionality, combining the traditional manual operation of lever handles with the advanced features of these locks. This dual functionality appeals to consumers who appreciate the familiarity of lever handles but seek the added benefits of keyless entry, remote access, and advanced security features provided by smart technology.

By end user, the market is categorized into commercial and residential. The residential segment covered a considerable revenue share in the market in 2022. The locks' seamless and convenient access aligns with modern lifestyles, where residents appreciate the simplicity of entering their homes without fumbling for keys. These locks can contribute to overall energy efficiency in smart homes. Integrating home automation systems allows residents to create energy-saving routines, such as adjusting thermostat settings or turning off lights when the smart lock is engaged. This interconnectedness supports environmentally conscious and energy-efficient living.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 2.1 Billion |

| Market size forecast in 2030 | USD 6.4 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 15.2% from 2023 to 2030 |

| Number of Pages | 304 |

| Number of Table | 672 |

| Quantitative Data | Volume in Thousand Units, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Product, Technology, End User, Region |

| Country scope |

|

| Companies Included | Honeywell International, Inc., Zhejiang Dahua Technology Co., Ltd., Samsung Electronics Co., Ltd. (Samsung Group), Assa Abloy AB, Unikey Technologies Inc., Vivint Smart Home, Inc. (NRG Energy, Inc.), Allegion Plc, HavenLock Inc. and Salto Systems, S.L. |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. The urban population in North America often seeks solutions that enhance security while aligning with contemporary living standards, making these locks a fitting choice.These locks in North America leverage various connectivity options, including Wi-Fi, Bluetooth, and Zigbee. The diverse range of connectivity options ensures compatibility with different devices and home networks, contributing to the region's widespread adoption of these locks.

Free Valuable Insights: Global Smart Locks Market size to reach USD 6.4 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Honeywell International, Inc., Zhejiang Dahua Technology Co., Ltd., Samsung Electronics Co., Ltd. (Samsung Group), Assa Abloy AB, Unikey Technologies Inc., Vivint Smart Home, Inc. (NRG Energy, Inc.), Allegion Plc, HavenLock Inc. and Salto Systems, S.L.

By Technology (Volume, Thousand Units, USD Billion, 2019-2030)

By Product (Volume, Thousand Units, USD Billion, 2019-2030)

By End User (Volume, Thousand Units, USD Billion, 2019-2030)

By Geography (Volume, Thousand Units, USD Billion, 2019-2030)

This Market size is expected to reach $6.4 billion by 2030.

Expansion of urbanization and modern lifestyles are driving the Market in coming years, however, Complex installation processes restraints the growth of the Market.

Honeywell International, Inc., Zhejiang Dahua Technology Co., Ltd., Samsung Electronics Co., Ltd. (Samsung Group), Assa Abloy AB, Unikey Technologies Inc., Vivint Smart Home, Inc. (NRG Energy, Inc.), Allegion Plc, HavenLock Inc. and Salto Systems, S.L.

In the year 2022, the market attained a volume of 11,321.2 thousand Units experiencing a growth of 15.1% (2019-2022).

The Deadbolts segment led the Market by Product in 2022; thereby, achieving a market value of $2.5 Billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $2.2 Billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.