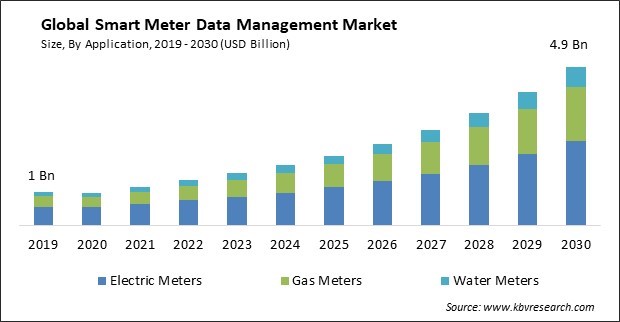

The Global Smart Meter Data Management Market size is expected to reach $4.9 billion by 2030, rising at a market growth of 17.3% CAGR during the forecast period.

The Smart water metering system uses wired and wireless communications technologies, such as the Wi-Fi water meter, to connect LAN or wide area networks, allowing for remote location monitoring and infrastructure repair via leak detection. Therefore, the Water Meters segment generated $178.4 million revenue in the market in 2022. In addition, the smart water metering system can be used in the industrial, residential, and commercial sectors to bill water, energy consumption, and natural gas. Furthermore, across a water utility's supply chain, smart electronic water meters are integrated with advanced water mapping tools and provide trustworthy monitoring solutions.

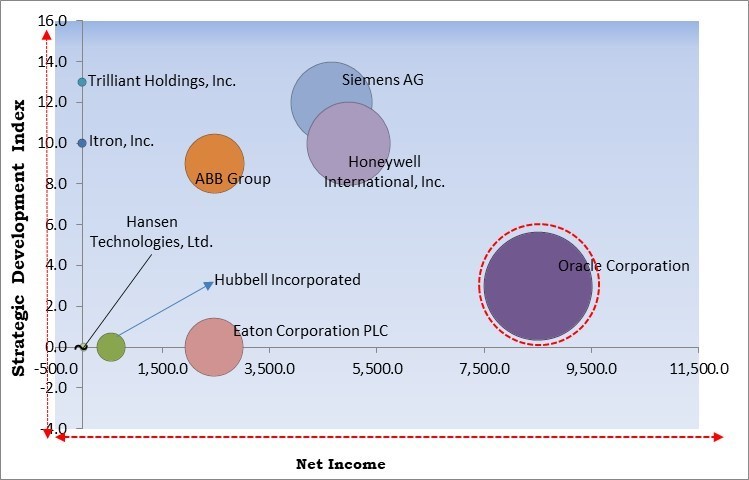

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In November, 2022, Siemens AG came into partnership with SEW, a German manufacturing company. This partnership aimed to enhance the customer and workforce experiences for utility smart meter users and hasten the path to a 100 percent renewable world. Moreover, In August, 2021, Siemens came into a partnership with Tata Power Delhi Distribution Limited, a joint venture between the Government of NCT of Delhi and Tata Power Company Limited. Through this partnership, the companies aimed to deploy Smart Metering Technology for over 200,000 Smart Meters in North Delhi.

Based on the Analysis presented in the KBV Cardinal matrix; Oracle Corporation is the major forerunner in the Market. Companies such as Siemens AG, Honeywell International, Inc. and ABB Group are some of the key innovators in the Market. In September 2023, Siemens AG joined hands with NWG, the holding company for several companies in the water supply, sewerage, and wastewater industries. This collaboration aimed to create, develop, test, and introduce the meter data management SaaS.

The market is fueled by government rules and incentives for smart meter installation. According to the US International Trade Commission, many prominent utilities are cautious of investing in smart meter technology without a government mandate or incentives. This is due to the limited capital expenditure capacity of utilities. Furthermore, utilities are becoming aware of the long-term benefits of installing smart meters, driving investments in the presence of government incentives. As a response, governments around the world have enacted a slew of regulations and mandates to facilitate the deployment of smart meters and smart grids. Hence, these factors are anticipated to fuel the growth of the Market during the forecasting period.

Electric vehicles are in high demand in industrialized countries, particularly in the United States. Chevrolet Volt is a plug-in hybrid car manufactured by General Motors. The Ford Electric Focus is being developed by Ford Motor Company. The Leaf is manufactured by Nissan Motors. All of these large corporations are refocusing their efforts on developing electric and hybrid automobiles. Moreover, numerous small businesses, such as OLA Electric and Ather Energy, are developing specialized plug-in electric vehicles (PEVs). Therefore, these aspects are expected to fuel the further development of the Market over the forecast years.

Smart meter deployment involves several components, including a handheld device, communication network, MDMS, MDA, and other software. Furthermore, services connected to smart meter installations, such as consultancy, maintenance, installation, integration, and upgradation, incur additional costs, impeding the adoption of smart meter data management software significantly. Moreover, many firms' issues with traditional and modern system integrations have predicted market development, particularly among SMEs. Hence, these aspects are set to slow down the growth of the overall Market throughout the forecast period.

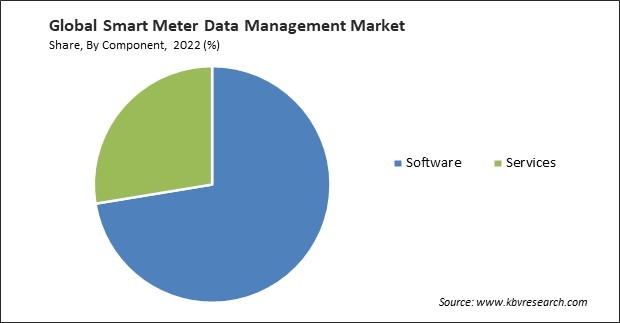

Based on the Component, the Market is bifurcated into Software and Service. In 2021, the Software segment procured the highest revenue share of the Market. This is due to a surge in awareness of energy management software in industrial sectors, which allows for more efficient energy consumption and increased awareness of carbon emission control. Moreover, the growth of the segment would be further driven due to the increased smart meter installation. To ensure exact billing, software is utilised to format, process, and correlate data.

On the basis of Application, the Market is segmented into Electric Meters, Gas Meters, and Water Meters. The Gas Meters segment held a significant revenue share of the Market in 2021. This is because Smart gas meters automatically measure the basic properties of the gas flowing through the pipeline, such as pressure, volume, and temperature. The installation of smart gas meters in industrial, commercial, and residential settings is the next stage in ensuring that everyone has access to gas. There has been no disparity in gas meters, ensuring that the market would continue to grow rapidly in the coming years. Furthermore, an increase in safety concerns and standards has contributed to double-digit growth in the global smart gas meter market in recent years.

Based on the Deployment Mode, the Market is categorized into On-premise and Cloud. In 2021, the On-premise segment collected the largest revenue share of the Market. This is because of the growing investments by large organizations in on-premise platform implementation. Despite the fact that cloud deployment has grown in popularity, on-premise deployment continues to satisfy the needs of a wide range of businesses. Furthermore, the segment's rise is due to associated benefits such as data privacy and security. Because they have complete control over the deployed software, they are able to prevent data breaches. Furthermore, the on-premise solutions are simple to install, and the data saved can be used for future reprocessing.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 1.4 Billion |

| Market size forecast in 2030 | USD 4.9 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 17.3% from 2023 to 2030 |

| Number of Pages | 232 |

| Number of Table | 333 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Component, Deployment Mode, Application, Region |

| Country scope |

|

| Companies Included | Oracle Corporation, Trilliant Holdings, Inc., Itron, Inc., Arad Group, Siemens AG, ABB Group, Honeywell International, Inc., Eaton Corporation PLC, Hubbell Incorporated and Hansen Technologies, Ltd. |

| Growth Drivers |

|

| Restraints |

|

By Region, the Market is analyzed across North America, Europe, APAC, and LAMEA. In 2021, the APAC emerged as the dominating region in the overall market. The growth of the regional market is owed to the availability of next-generation metering infrastructure for ambitious smart grid system installations and an increase in smart meter installation across the region. Furthermore, the increased implementation of smart meters across various industries, such as manufacturing, automotive, and energy & utility, to improve energy consumption and enable proper energy usage during epidemic situations, is propelling the market in this region forward.

Free Valuable Insights: Global Smart Meter Data Management Market size to reach USD 4.9 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Oracle Corporation, Trilliant Holdings, Inc., Itron, Inc., Arad Group, Siemens AG, ABB Group, Honeywell International, Inc., Eaton Corporation PLC, Hubbell Incorporated and Hansen Technologies, Ltd.

By Component

By Application

By Deployment Mode

By Geography

This Market size is expected to reach $4.9 billion by 2030.

Favorable Government measures and investments encouraging grid digitization are driving the Market in coming years, however, Substantial initial investments and maintenance costs restraints the growth of the Market.

Oracle Corporation, Trilliant Holdings, Inc., Itron, Inc., Arad Group, Siemens AG, ABB Group, Honeywell International, Inc., Eaton Corporation PLC, Hubbell Incorporated and Hansen Technologies, Ltd.

The expected CAGR of this Market is 17.3% from 2023 to 2030.

The Electric Meters segment is generating the highest revenue in the Market, By Application in 2022; thereby, achieving a market value of $2.6 billion by 2030.

The Asia Pacific region dominated the Market, By Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $1.8 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.