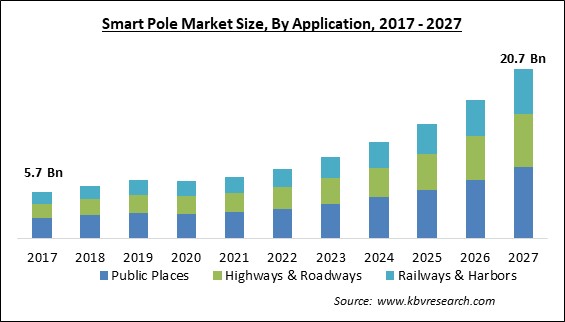

The Global Smart Pole Market size is expected to reach $20.7 billion by 2027, rising at a market growth of 18.6% CAGR during the forecast period.

The word smart is utilized because these smart poles may perform both their primary duty of light distribution as well as other functions like Wi-Fi, Bluetooth, charger points, and a variety of other features. In addition, the smart poles have firmly established themselves as a major component of the developing country's growing "Smart City" strategy.

A smart pole is a fully integrated lighting system that uses real-time systems, data, and sensors to connect information and communication technologies across many parties, such as municipalities, law enforcement, commercial businesses, transportation grids, hospitals, schools, and libraries. Intelligent city management, people flow detection, emergency rescue, car exhaust detection, intelligent schools and hospitals, and bus monitoring are all made possible by the smart pole.

Moreover, smart poles are becoming more popular as a consequence of their multi-functionality, which enables the government and other private sector organizations to readily address urban issues. Smart poles, which are placed utilizing solar-powered energy generation units for their operation, are also in the spotlight, enabling the deployment of smart poles in remote regions such as architectural settings.

A significant factor driving smart pole demand around the world is their ability to contain software controls, electronics, and sensors that can help in sending and receiving data from the pole position to the operator location. Additionally, the smart poles also provide a substantial contribution to the energy-saving parameter as well as improved customer satisfaction. Moreover, as the demand for business automation increases, so does the utilization of the Smart Pole around the world. Smart poles are ingenious poles that can analyse air quality as well as identify and inform authorities about issues such as street flooding. Electric vehicle charging stations could be built into smart poles.

The potential of smart poles to minimize accidents and traffic bottlenecks, the growing demand for energy-efficient streetlights, and expanding government initiatives for the creation of smart cities are all contributing to market expansion. In addition, the need has been fueled by the integration of air quality monitoring systems, security cameras, traffic management systems, wireless sensor networks, and transportation management systems in smart poles. The expanding use of AI and IoT to improve the effectiveness of the system is likely to propel market expansion even faster.

The onset of the COVID-19 pandemic has resulted in a global economic slump. The operations of a number of building and development projects were also disrupted, putting the growth of the smart pole market in jeopardy. For example, in order to stop the spread of the virus, the governments of the United States and China announced a halt to major development and infrastructure projects during the pandemic. However, as global regulations loosen, the market is likely to increase significantly throughout the forecast period. With the recent outbreak of COVID 19, governments in both developed and developing nations are seeing a slowing of infrastructure and building projects, which is impacting the smart pole market growth. The impact of COVID-19, according to the National Highways Authority of India (NHAI) and the National Highways and Infrastructure Development Corp. Ltd (NHIDCL), has resulted in a construction activity ban, as well as a shortage of laborers and construction workers, who are returning to their villages.

Various governments around the world are using smart pole technology to help them construct smart cities. For example, as part of India's Smart Cities Mission, the City of Bhopal inaugurated the first-of-its-kind public-private partnership (PPP)-based smart poles and intelligent streetlights project in August 2019. It intended to erect 400 poles throughout the city to cover the entire region. In addition, the New Delhi Municipal Corporation (NDMC) built 55 energy-saving smart poles in Delhi's Connaught Place to support the Smart City Mission. Air sensors, energy-saving LED lighting, and WiFi connectivity are all included in the poles. These poles' lights can be dimmed automatically to save energy during non-peak traffic hours.

One of the most pressing environmental challenges in metropolitan areas is air quality control. According to the World Health Organization, seven million people die each year as a result of illnesses caused by poor air quality and pollution. Smart poles are crucial in combating urban air pollution because they can monitor a variety of environmental parameters like fine particulate matter concentrations, temperature, and humidity, to offer a comprehensive picture of an area's overall air quality. Additionally, residents can use smart poles to obtain environmental information in order to reduce their exposure to air pollution, and city planners can utilize the data gathered to support decisions that may improve urban air quality.

The high cost of technology integration is one of the obstacles to market growth. Due to this, countries grappling with the problem of poor economic conditions still lag behind in the adoption of modern technologies like smart poles. As a result, producers should make smart poles more widely available in order to improve government acceptability. According to a report in The Times of India, the Indore Municipal Corporation plans to build 800 smart poles and 70,000 LED lights across the city, with an estimated cost of US$ 3 billion for the project. When compared to ordinary street lights, the cost of installing smart poles is substantially higher.

Based on Application, the market is segmented into Public Places, Highways & Roadways, and Railways & Harbors. The Highways & Roadways segment collected a significant revenue share of the Smart Pole Market in 2020. This is attributed to the increasing number of smart roads being built around the world. SmartLife poles are being installed on hairpin bends and steep turns in nations like India to prevent accidents on blind turns. In addition, electromagnetic waves and radar sensors are used by these poles to measure vehicle speeds and warn drivers of cars approaching from the opposite direction.

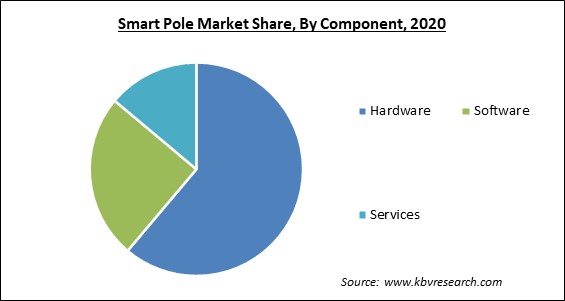

Based on Component, the market is segmented into Hardware, Software, and Services. Based on Hardware Type, the market is segmented into Controller, Lighting Lamp, Pole Bracket & Pole Body, Communication Device, and Others. The Services segment held a promising revenue share of the Smart Pole Market in 2020. Some companies on the market are in charge of establishing smart poles in a facility or city, as well as integrating various technologies. In addition, many utility providers are partnering with private companies to offer smart poles with lamps, traffic management systems, and air quality sensors.

Based on Installation Type, the market is segmented into Retrofit, and New. In 2020, the Retrofit installation segment garnered the maximum revenue share of the Smart Pole Market. This is owing to various governments' smart city projects. Prevailing lights would be replaced with energy-efficient lights, and digital signage, Wi-Fi hotspots, security cameras, and environmental monitoring systems would be installed on existing light poles. The City Council of Essex, for example, stated in October 2021 that it would substitute 10,000 old-style streetlights with LED lights as part of the LED Replacement Program, which would help both inhabitants and the environment. Furthermore, governments choose to refit street poles with sensor technology or upgrade them with IoT applications to save money while gaining the same benefits.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 6.9 Billion |

| Market size forecast in 2027 | USD 20.7 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 18.6% from 2021 to 2027 |

| Number of Pages | 255 |

| Number of Tables | 449 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Application, Installation Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2020, North America emerged as the dominating region in the Smart Pole Market by collecting the maximum revenue share. In addition, the region would exhibit a similar trend even during the forecasting period. The high growth of the regional market is attributed to the increasing deployment of connected lighting in the region. Several communities around the United States have taken steps to deploy AI-powered smart poles that help citizens and business owners in emergency circumstances. For example, the city of Coral Gables in the United States announced in July 2021 that it had installed an AI-powered smart pole from Ekin Spotter, a company that offers advanced data analysis capabilities to help residents and business owners in an emergency and improve traffic management capabilities.

Free Valuable Insights: Global Smart Pole Market size to reach USD 20.7 Billion by 2027

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Eaton Corporation PLC, General Electric (GE) Co., Siemens AG, Signify N.V., Itron, Inc., Wipro Limited, Zumtobel Group AG, Acuity Brands Lighting, Inc., and Hubbell Incorporated.

By Application

By Component

By Installation Type

By Geography

The global smart pole market size is expected to reach $20.7 billion by 2027.

A rise in the number of environmental concerns are driving the market in coming years, however, massive costs may hamper the market growth limited the growth of the market.

Eaton Corporation PLC, General Electric (GE) Co., Siemens AG, Signify N.V., Itron, Inc., Wipro Limited, Zumtobel Group AG, Acuity Brands Lighting, Inc., and Hubbell Incorporated.

The Public Places segment acquired the maximum revenue share in the Global Smart Pole Market by Application in 2020, and would continue to be a dominant market till 2027; thereby, achieving a market value of $8.6 billion by 2027.

The Hardware segment is leading the Global Smart Pole Market by Component in 2020; thereby, achieving a market value of $12.2 billion by 2027.

The North America market dominated the Global Smart Pole Market by Region in 2020, and would continue to be a dominant market till 2027; thereby, achieving a market value of $7.0 billion by 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.