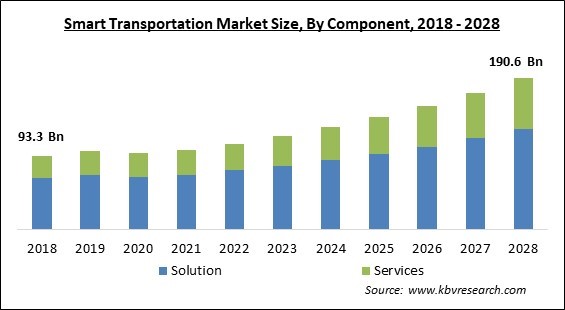

The Global Smart Transportation Market size is expected to reach $190.6 billion by 2028, rising at a market growth of 9.9% CAGR during the forecast period.

Smart transportation IoT solutions, along with smart city solutions, enable government organizations and their partners to improve community resources and transportation for everyone, resulting in a safer, more efficient transportation infrastructure in cities. In addition, smart transportation IoT solutions provide real-time visibility and reliable data, allowing city transportation authorities and companies to enhance efficiency while also creating smarter, greener cities for their residents. Smart transportation is defined as the vertical application of IoT capabilities in transportation systems and hence refers to the integrated use of current technologies and management tactics. These technologies are targeted at delivering cutting-edge services in the areas of transportation and traffic management. It allows consumers to be better informed and to use transportation networks in a safer and more efficient manner.

The most important factors for the growth and development of the Smart transportation system industry are government laws and initiatives. Governments all over the world, particularly in the United States, Europe, Russia, China, and Brazil, are legislating the installation of factory-fitted telematics and safety systems in vehicles as a result of rise in the road safety concerns and auto thefts.

Rapid urbanization has resulted from the world's rising population, causing a slew of issues such as traffic congestion and road safety concerns. The need to provide a long-term solution to these issues is gaining popularity around the world. Smart transportation is becoming a reality due to cloud-based technology and advancements in vehicle-to-vehicle (V2V) and vehicle-to-grid infrastructure (V2I). As the world's population continues to rise, a growing number of cities are finding it difficult to accommodate both residents and visitors. Congested streets and higher pollution have an influence on city people’s health and well-being.

The COVID-19 pandemic wreaked havoc on all markets and dealt a serious blow to the transportation industry. The transportation business has suffered a significant loss as a result of most governments adopting isolation policies. Governments in many regions declared complete lockdown and temporary industry shutdowns, resulting in border restrictions that hampered the movement of transportation and logistics services. Toll and fare collections have been discontinued in nations like China and the United States. For cars conveying emergency supplies and vital personnel, China is likewise introducing a no-stop, no-check, toll-free regime. With an increase in demand for proper traffic management systems and increased transportation infrastructure amenities for passenger safety, industry players have embraced creative methods to increase growth potential in the worldwide smart transportation market.

One such essential feature is smart transportation, which attempts to deliver innovative services connected to various forms of transportation and traffic control systems. It makes transportation easier and faster by utilizing Smart systems like sensing technologies, wireless communications, real-time data, and computing technologies. This saves time in transportation solutions such as traffic management and ticket management systems. Furthermore, fleet operators are progressively adopting novel information and communication technology (ICT) applications like fiber optics, a global positioning system (GPS), and the Internet of Things (IoT), among others, due to their significant benefits.

To accomplish economic growth, social development, and decreased environmental losses, effective transportation systems are required for national prosperity. In Asia, more than half of the world's urban population lives in cities, with some nations, such as India and China, having more than a billion people living in cities alone. According to the Chinese Ministry of Infrastructure Development, a contemporary national comprehensive transportation network that is fast, cost-effective, green, Smart, advanced, and reliable is scheduled to be mostly finished by 2035. Furthermore, to meet the European Union's (EU) aim of a 37.5 percent reduction in emissions by 2030, the French government is relying on electric and hydrogen vehicles and aircraft.

Smart transportation systems are made up of a variety of components, such as different technologies, hardware, and software, all of which are available from a variety of vendors. As a result, there is a lack of standardization and uniformity in the solutions, which causes compatibility problems. Moreover, different countries and regions have distinct communication and network standards and protocols, which makes it difficult for vendors to sell their products worldwide. For example, in the European region, rules are inconsistent or non-existent when it comes to collecting and analyzing data flow. To facilitate the global adoption of traffic management technologies, a uniform protocol for communication and workflow for traffic management systems is required.

Based on Component, the market is segmented into Solution (Traffic Management System, Parking Management & Guidance System, Ticketing Management System, and Integrated Supervision System) and Services (Business, Professional, and Cloud Services). The Services segment held a significant revenue share of the Smart Transportation Market in 2021. In a competitive market, unplanned downtime and application failure can result in a customer's trust being lost. To boost the agility, compatibility, and availability of smart transportation solutions, industry players are cooperating with support and maintenance service providers. The rapidly changing dynamics of the marketplace are prompting businesses to choose support and maintenance services in order to provide their clients with superior transportation solutions.

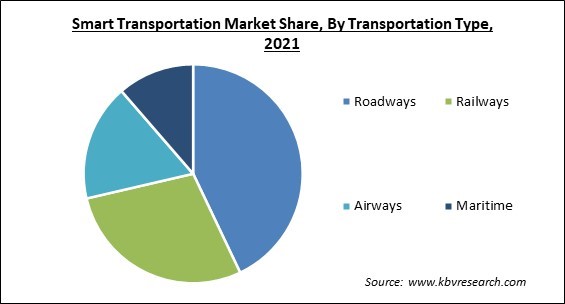

Based on Transportation Type, the market is segmented into Roadways, Railways, Airways, and Maritime. The Roadways segment held the maximum revenue share of the Smart Transportation Market in 2021. This is because of the technology's capacity to reduce traffic congestion and increase road safety by effectively monitoring and managing vehicular traffic. Reduced crash rates and increased road safety for drivers, passengers, and pedestrians are two primary driving factors for smart transportation systems on highways. Highways are increasingly being outfitted with modern radar and in-pavement warning lights that alert approaching motorists. The Department of Transportation (DOT) is churning out new ways to relieve traffic congestion on roads, such as ramp metering.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 100.2 Billion |

| Market size forecast in 2028 | USD 190.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9.9% from 2022 to 2028 |

| Number of Pages | 275 |

| Number of Tables | 453 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Transportation Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, the Asia-Pacific garnered the maximum revenue share of the Smart Transportation Market. This is because of the increased use of new technologies, rising investments in digital transformation, and rising GDP in APAC countries. Australia, Singapore, China, Hong Kong, Korea, and India are among the region's most promising economies, with each promising to spend heavily on technological transformation. Because the competition in this region is fragmented, smart transportation solution providers are trying to expand their operations to include the majority of the countries in the region. The smart transportation market is predicted to grow at the fastest rate throughout the forecast period due to untapped prospective markets, increasing penetration of modern technologies, increasing freight usage in many industries, economic advancements, and government restrictions.

Free Valuable Insights: Global Smart Transportation Market size to reach USD 190.6 Billion by 2028

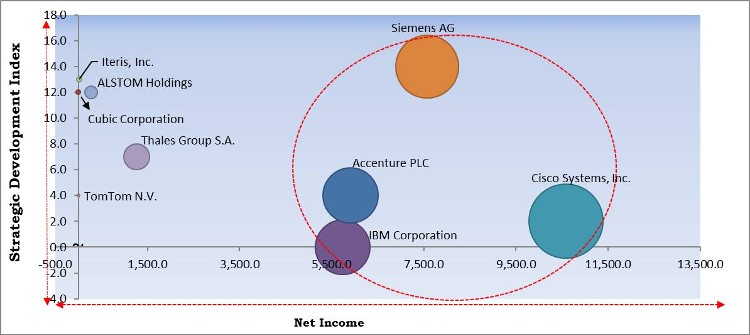

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; IBM Corporation, Cisco Systems, Inc., Accenture PLC and Siemens AG are the forerunners in the Smart Transportation Market. Companies such as Cubic Corporation, ALSTOM Holdings and Iteris, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Cisco Systems, Inc., Accenture PLC, Cubic Corporation, ALSTOM Holdings, Siemens AG, Thales Group S.A., TomTom N.V., MSR-Traffic GmbH (MSR-Group GmbH), and Iteris, Inc.

Dec-2021: Iteris launched Vantage Fusion, a hybrid traffic detection system. This launch aimed to allow real-world vehicle-to-everything applications as well as advanced intersection visualization for smarter, safer, and more sustainable roadways.

By Component

By Transportation Type

By Geography

The global smart transportation market size is expected to reach $190.6 billion by 2028.

High need for the consistent flow of traffic and time-efficiency are increasing are driving the market in coming years, however, absence of centralized and uniform technology growth of the market.

IBM Corporation, Cisco Systems, Inc., Accenture PLC, Cubic Corporation, ALSTOM Holdings, Siemens AG, Thales Group S.A., TomTom N.V., MSR-Traffic GmbH (MSR-Group GmbH), and Iteris, Inc.

Yes, With an increase in demand for proper traffic management systems and increased transportation infrastructure amenities for passenger safety, industry players have embraced creative methods to increase growth potential in the worldwide smart transportation market.

The Solution segment acquired maximum revenue share in the Global Smart Transportation Market by Component in 2021; thereby, achieving a market value of $126.2 billion by 2028.

The Europe market dominated the Global Smart Transportation Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $67.6 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.