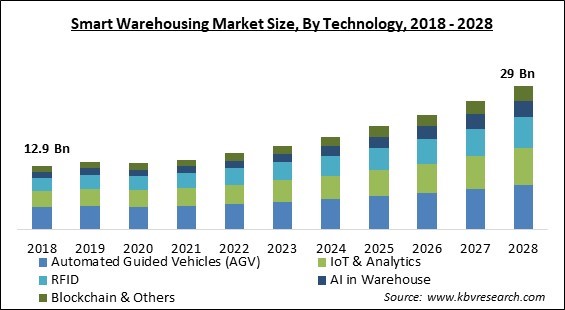

The Global Smart Warehousing Market size is expected to reach $29 billion by 2028, rising at a market growth of 11.2% CAGR during the forecast period.

A smart warehouse is a large structure used for the storage of manufactured items and raw materials. Machines & computers are used in smart warehouse technology to undertake typical warehouse tasks that were previously performed by humans. Receiving and recognizing orders, storing products, counting products, transferring orders to the relevant location, and recalling where orders are all accomplished in smart warehouses. All of these tasks are carried out with no or little errors, due to the use of various technologies like AGV, RFID, IoT, & analytics. The increased usage of modern technologies is a major element driving the market for smart warehousing forward.

In addition, a significant number of smart warehouses is moving toward automation of nearly all operations involved in getting goods from suppliers to customers. As a result, significant increases in the adoption of automation in warehouses throughout the world are expected to expand sales potential in the smart warehousing market in coming years. The introduction of multi-channel distribution networks, as well as the globalization & dynamic nature of supply chain networks around the world, are expected to drive growth in the smart warehousing industry.

Big Data and analytics, Artificial Intelligence, autonomous robotics, augmented reality, as well as the internet of things, are all part of the Industry 4.0 revolution that is revolutionizing modern-day warehouse operations. Moreover, the rising popularity of e-commerce along with the development of digitization is moving the smart warehousing industry forward. Many suppliers throughout the world are incorporating cutting-edge technologies like bar code scanning software, automated guided vehicles, and radio frequency identification technology to improve and speed up supply chain networks while reducing errors. The use of these technologies in warehousing is critical for the development of the market.

The COVID-19 pandemic caused a severe impact on numerous industries all over the world. Government across various countries imposed lockdown in order to stop the containment of the novel coronavirus. Under these lockdowns, the supply of several goods and services were hampered. Global supply chains have been disrupted by the COVID-19 pandemic, which has outpaced & affected both supply and demand at a faster rate. COVID-19, on the other hand, can also have a long-term impact on the smart warehouse market. As the coronavirus spreads around the world, a transit delay in one region of the world might have a considerable effect on the rest of the world, prompting shutdowns owing to warehouse closures or supplies that are delayed or missing.

The warehouse is an important part of the whole supply chain. Order picking, inventory management, & asset tracking are all labour-intensive operations in the warehouse that can impair overall productivity. As a result, using mobile-based technologies and applications to streamline the entire warehouse process can boost operational efficiencies and enhance the bottom line. Warehouse workers & logistics partners now have access to a multitude of tools and materials due to the widespread use of mobile devices such as smartphones and tablets. The functionality that would benefit warehouse managers to manage the complete warehouse process efficiently includes scanning inventory with barcode scanning apps, viewing the accurate location of a shipment on a map, pulling up detailed shipping information & receiving data, as well as generating reports in less time.

Warehouse 4.0 brings together digital and physical systems to create better-linked experiences that will affect the entire warehouse process, from product design and planning to supply chain and production. Warehouses are shifting to a voice-based plus screen-directed inventory picking & restocking process to reduce the time that is spent on the training of new employees. Multi-modal picking, which combines picking with screen-directed picking via mobile devices, is being implemented by businesses. In addition, to build a strong warehouse automation system, IoT, big data & data science, wearable, AR, low-cost sensors, computer vision AI, robots, and high-level computers can be integrated.

Several small-scale businesses do not have their own warehouses due to the fact that these organizations stock lesser goods in contrast to large organizations. Due to the lower income of small-scale businesses, multiple organizations cannot afford to invest in smart warehousing solutions. Small-scale business owners fail to understand the advantages of smart warehousing solutions due to a hesitation to upgrade existing systems and constrained growth plans. Furthermore, considerable investments and high upfront costs associated with the adoption of smart warehousing systems are also a barrier in the adoption of smart warehousing solutions across various small and medium-sized organizations.

Based on Deployment Mode, the market is segmented into On-premises and Cloud. The cloud-based solutions segment garnered a significant revenue share in the smart warehousing market in 2021. The increasing growth of the segment is due to the rising adoption of cloud-based solutions among both SMEs & Large enterprises, because of new functionalities that are deployed in customized form as per the business requirement, which results in higher customer satisfaction. Furthermore, such solutions provide several advantages, including the capacity to grow their applications, flexibility, and ease of maintenance. As a result, large enterprises and SMEs are increasingly adopting cloud-based solutions.

Based on Technology, the market is segmented into Automated Guided Vehicles (AGV), IoT & Analytics, RFID, AI in Warehouse, Blockchain & Others. The Automated Guided Vehicles (AGV) segment registered the highest revenue share in the smart warehousing market in 2021. For activities that would normally be managed by forklifts, conveyor systems, or manual carts, automated guided vehicle systems are utilized to move huge amounts of cargo in a repeated manner. AGVs are employed in a wide range of situations. They are frequently utilized to transport raw commodities including plastic, metal, rubber, and paper. AGVs can, for instance, the transfer of raw materials from receiving to the warehouse or deliver goods to production lines directly. AGVs seamlessly deliver raw materials without the need for human interaction, making sure that production processes are never lacking the materials they require.

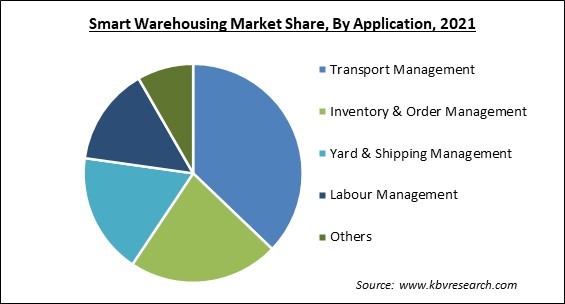

Based on Application, the market is segmented into Transport Management, Inventory & Order Management, Yard & Shipping Management, Labour Management, and Others. The Inventory and Order Management segment garnered a substantial revenue share in the smart warehousing in 2021. Order management is the capacity to efficiently manage each customer's order from receipt to fulfillment. The goal of efficient order processing is to ensure that consumers receive correct products they bought in good condition. Orders cna be delivered through offline or online methods, and warehouses must manage them efficiently to ensure seamless order fulfillment and a better customer experience. To keep track of order status, warehouse managers employ manual logbooks, physical ledgers, or order management systems. Knowing where an order is in the fulfillment process and where it is in the order assists in simplifying the entire process & lowering errors. It's normal for managers to become overloaded by the number of orders coming in, especially with warehouses growing in size as well as the increased frequency & complexity of online sales with e-commerce enterprises experiencing a spike in consumer orders in recent years.

Based on Component, the market is segmented into Hardware, Solution (Warehouse Management Systems and Warehouse Control Systems & Others), and Services. The Hardware segment acquired the highest revenue share in the smart warehousing market in 2021. This growth can be attributed to the growing popularity of smartphone devices across multiple verticals, which can quickly deploy inventory management systems & automated picking tools to manage the inventory process and lower total labour costs. Vendors are developing smart warehousing hardware in response to a growth in consumer demand for IoT, sensors, & AI technologies to enhance warehouse operations.

Based on Organization Size, the market is segmented into Large Enterprises and Small & Medium Enterprises (SMEs). The Small and Medium enterprises procured a substantial revenue share in the smart warehousing market in 2021. Due to the increasing requirement to improve business operations, reach new consumers, stay competitive, and minimize expenditures, small and medium-sized enterprises are widely adopting smart warehousing solutions and services. In addition, the adoption of smart warehousing services & solutions among SMEs would be driven by the focus of various industry verticals on adopting cutting-edge solutions & processes at a lesser cost.

Based on Vertical, the market is segmented into Transportation & Logistics, Retail & Consumer Goods, Automotive, Government, Healthcare & Life Sciences, Manufacturing, Mining, Food & Beverages, and Others. The Transportation and Logistics segment acquired the highest revenue share in the smart warehousing market in 2021. Maintaining inventory accuracy is one of the most crucial advantages of smart warehousing. From a centralized system, the inventory keeper can keep track the inventory flow in real-time and manage numerous warehouse operations. A user can get accurate information and deliver solutions over the supply chain & logistics network by leveraging the accessibility of smart warehousing solutions. These robots are capable of assisting human workers in a variety of warehouse tasks. They are capable of doing difficult operations such as pickup & installation while letting personnel remain in their current work location. Co-bots can run indefinitely while reducing labour-intensive logistics tasks. Hence the growth of this segment is being driven due to this.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 14.1 Billion |

| Market size forecast in 2028 | USD 29 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 11.2% from 2022 to 2028 |

| Number of Pages | 454 |

| Number of Tables | 783 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Deployment Mode, Technology, Organization Size, Application, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, Asia-Pacific held a significant revenue share of the smart warehousing market. The growth of the regional market is rising due to a significant surge in the technology adoption over all the industries to improve customer experience & productivity. Moreover, the demand for automated warehouse processes for enhanced productivity, efficiency, and accuracy, smart warehousing hardware, solutions, and services is also growing across the region. The smart warehouse technologies that have been introduced enable flexibility and increase staff potential.

Free Valuable Insights: Global Smart Warehousing Market size to reach USD 29 Billion by 2028

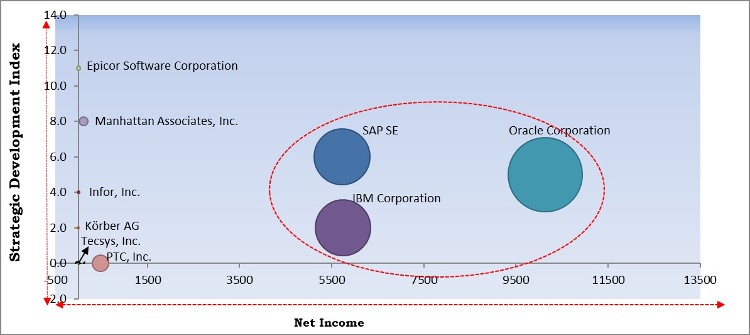

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; IBM Corporation, Oracle Corporation, SAP SE are the forerunners in the Smart Warehousing Market. Companies such as Epicor Software Corporation, Manhattan Associates, Inc. and Infor, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Oracle Corporation, SAP SE, Infor, Inc., Softeon, Körber AG, Manhattan Associates, Inc., PTC, Inc., Tecsys, Inc., and Epicor Software Corporation.

By Deployment Mode

By Technology

By Application

By Component

By Organization Size

By Vertical

By Geography

The smart warehousing market size is projected to reach USD 29 billion by 2028.

The rising focus on warehouse 4.0 for a more efficient & safer warehouse are increasing are driving the market in coming years, however, lesser penetration of smart warehousing across small-scale businesses growth of the market.

IBM Corporation, Oracle Corporation, SAP SE, Infor, Inc., Softeon, Körber AG, Manhattan Associates, Inc., PTC, Inc., Tecsys, Inc., and Epicor Software Corporation.

The expected CAGR of the smart warehousing market is 11.2% from 2022 to 2028.

The On-premises segment dominated the Global Smart Warehousing Market by Deployment Mode in 2021, thereby, achieving a market value of $16.4 billion by 2028.

The North America is the fastest growing region in Global Smart Warehousing Market by Region in 2021, and would continue to be a dominant market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.